The wealth gap in America isn’t about luck – it’s about knowledge. According to the Federal Reserve’s 2024 Survey of Consumer Finances, the median net worth of the top 10% is $1.9 million, while the bottom 50% averages just $12,000. That’s a 158x difference.

But here’s what financial advisors rarely admit: wealthy people don’t have secret investment strategies or insider information. They simply follow seven core principles that compound over decades into substantial wealth.

This article reveals exactly what millionaires do differently with their money, backed by research from Fidelity Investments, Vanguard, and academic studies tracking wealth accumulation patterns.

Money Move 1: They Pay Themselves First (Not Last)

Average Americans save what’s left after expenses. Millionaires save first, then spend what’s left.

The difference is massive. According to research from T. Rowe Price, households that automate savings into investment accounts before seeing the money accumulate 2.3x more wealth over 20 years than those who manually save leftover funds.

The 50/30/20 rule wealthy people actually use:

- 50% needs (housing, food, utilities)

- 30% investments (not wants – investments)

- 20% wants (discretionary spending)

Most financial advice reverses the 30% and 20%, suggesting 30% for wants and 20% for savings. This keeps people perpetually middle class.

Action step: Set up automatic transfer of 20-30% of income to investment accounts on payday. Adjust lifestyle to remaining 70-80%.

Money Move 2: They Buy Assets, Not Liabilities

Poor people buy things that lose value. Rich people buy things that gain value.

According to data from Wealth-X, millionaires allocate 60-70% of net worth to appreciating assets:

- Stocks and index funds (average 10% annual return)

- Real estate (average 8% annual appreciation plus rental income)

- Business ownership (unlimited upside potential)

- Retirement accounts (tax-advantaged compound growth)

Middle-class spending patterns by contrast:

- New cars (lose 20% value immediately, 60% over 5 years)

- Luxury goods (designer clothes, watches, bags – zero investment value)

- Expensive vacations (memories but no financial return)

- Oversized homes (maintenance costs exceed appreciation)

This doesn’t mean never enjoying life. It means wealthy people ensure appreciating assets grow faster than depreciating purchases. They buy the luxury car after investment portfolios generate enough passive income to cover it.

The 10x rule: Before buying any depreciating asset over $1,000, own 10x that amount in appreciating assets. Want a $50,000 car? Have $500,000 invested first.

Money Move 3: They Understand Tax Optimization (Not Tax Evasion)

The wealthy pay lower effective tax rates than high-income workers – legally. Warren Buffett famously noted his secretary paid a higher tax rate than him.

How they do it:

Capital gains vs ordinary income: Long-term capital gains (assets held 12+ months) are taxed at 0-20%, while ordinary income tops out at 37%. Millionaires structure compensation as equity rather than salary whenever possible.

Tax-deferred growth: Maxing 401(k)s ($23,500 for 2025, $31,000 if 50+) and IRAs ($7,000, $8,000 if 50+) reduces current taxes while money grows tax-free for decades.

Strategic Roth conversions: Converting traditional IRA money to Roth during low-income years (layoffs, sabbaticals, early retirement) locks in lower tax rates permanently.

Real estate tax benefits: Depreciation deductions, 1031 exchanges, and mortgage interest deductions create substantial tax shields.

According to analysis from the Tax Policy Center, households earning $500,000+ who optimize taxes save $47,000 annually on average compared to those who don’t use these strategies.

Action step: Consult a CPA (not just tax preparer) to develop multi-year tax strategy. Cost: $500-2,000 annually. Savings: $5,000-50,000+ annually.

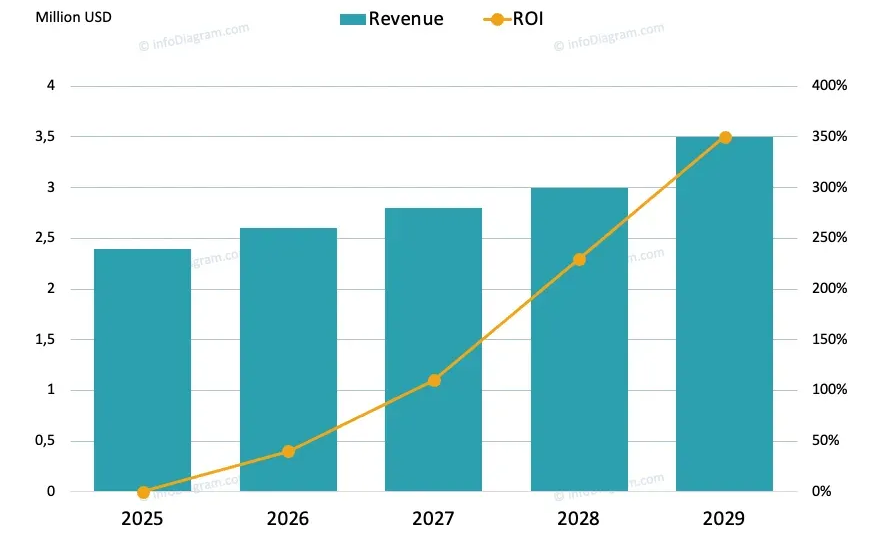

Money Move 4: They Leverage Compound Interest Aggressively

Einstein allegedly called compound interest “the eighth wonder of the world.” Millionaires understand this deeply. Average people underestimate it completely.

The power of starting early:

A 25-year-old investing $500 monthly at 10% average return reaches $3.2 million by age 65 (total contributions: $240,000).

A 35-year-old making identical contributions reaches $1.1 million (total contributions: $180,000).

Waiting 10 years costs $2.1 million despite contributing $60,000 less. That’s the power of compound interest.

According to Vanguard research, time in market beats timing the market in 92% of historical scenarios. Starting early with consistent contributions outperforms waiting for “perfect” entry points.

The millionaire approach:

- Start investing immediately, even with small amounts

- Never stop contributions, even during market downturns

- Increase contributions with every raise or bonus

- Let money compound for 20-40 years without touching it

Action step: If you don’t have investment accounts, open Vanguard/Fidelity/Schwab account this week. Start with $100-500 monthly into total market index fund. Increase 5% annually.

Money Move 5: They Focus on Income Growth, Not Just Savings

You cannot save your way to wealth on average income. Millionaires obsessively focus on increasing earning power.

Average household income: $74,580 (US Census Bureau)

Average millionaire household income: $295,000+ (Ramsey Solutions study)

The math is simple: Saving 20% of $75,000 = $15,000 annually. Saving 20% of $250,000 = $50,000 annually. The higher earner accumulates wealth 3.3x faster.

How millionaires increase income:

Career advancement: Strategic job changes every 2-4 years typically yield 15-25% raises, compared to 3-5% annual raises staying put.

Skill development: Investing 5-10% of income in skills training increases earning potential 20-40% according to LinkedIn data.

Side businesses: 65% of millionaires have three or more income streams (salary, rental income, side business, investments).

Negotiation: Studies from Harvard show people who negotiate job offers earn $500,000+ more over their careers than those who accept first offers.

Action step: Set goal to increase income 30% within 24 months through combination of job advancement, negotiation, skill development, or side income.

Money Move 6: They Avoid Consumer Debt Like the Plague

Average American household carries $103,358 in debt (including mortgages), according to Experian data. This includes:

- Credit cards: $6,501 average balance

- Auto loans: $20,987 average

- Student loans: $37,338 average

Millionaires use debt strategically for appreciating assets (mortgages on rental properties) while avoiding consumer debt completely.

The true cost of consumer debt:

$6,500 credit card balance at 22% APR (average rate) costs $1,430 annually in interest alone. That’s $1,430 that could compound to $150,000+ over 30 years if invested instead.

Auto loans averaging $20,987 at 7% for 5 years cost $3,750 in interest – plus the vehicle depreciates 60%. Double financial hit.

Millionaire approach to debt:

- Pay cash for depreciating assets (cars, electronics, furniture)

- Use mortgages only for primary residence and investment properties

- Pay off credit cards in full monthly (using rewards strategically)

- Avoid student loans through community college + state schools, or pursue high-ROI degrees only

List all consumer debts. Attack highest interest rate first (avalanche method) or smallest balance first (snowball method for psychological wins). Redirect interest savings to investments once debt-free.

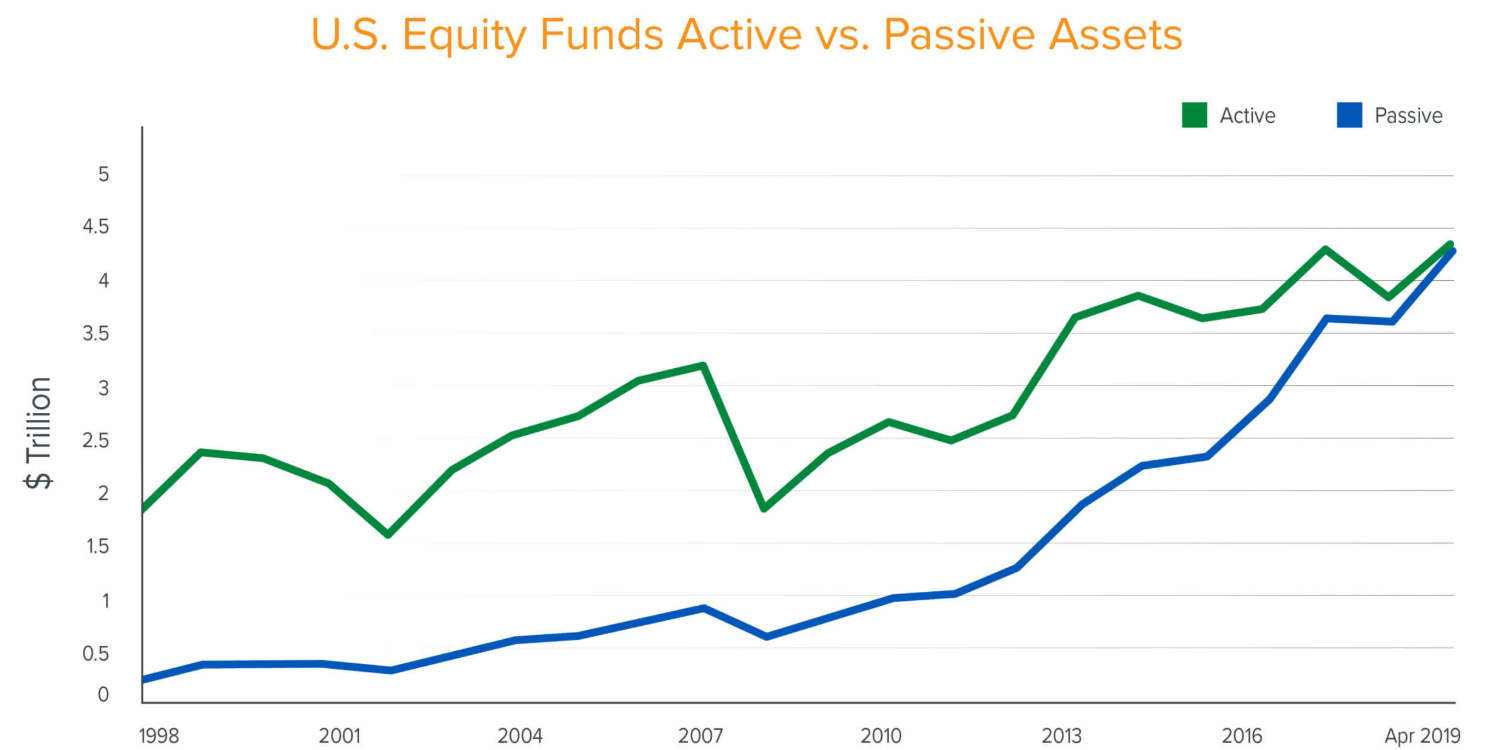

Money Move 7: They Think Long-Term (10-30 Years, Not 10-30 Days)

Poor people make decisions based on immediate gratification. Wealthy people delay gratification for exponentially better outcomes.

The famous Stanford marshmallow experiment showed children who delayed eating one marshmallow to receive two later had significantly better life outcomes decades later – including higher net worth.

Research from Fidelity analyzing 1.2 million investor accounts found:

- Best performing accounts: Belonged to people who forgot they had them (buy and hold)

- Worst performing accounts: Belonged to active traders making frequent changes

Millionaires make long-term decisions:

- Choosing careers with 20-year earning trajectory over quick money

- Investing in broad market index funds held 30+ years

- Building businesses requiring 5-10 years to reach peak value

- Acquiring rental properties held 20-30 years for maximum appreciation

- Maxing retirement accounts despite 40+ year wait to access funds

The average investor achieves 3.7% annual returns while the S&P 500 averages 10% because they panic sell during downturns and chase performance during bubbles.

Write down 10-year and 30-year financial goals. Make decisions based on these timelines, not weekly market movements or annual performance.

The Millionaire Mindset Shift

Becoming wealthy requires changing how you think about money fundamentally:

- From: “I can’t afford it”

- To: “How can I afford it?” (through income growth and investment)

- From: “I deserve this purchase because I work hard”

- To: “I deserve financial freedom, which requires short-term sacrifice”

- From: “Rich people are lucky or unethical”

- To: “Wealthy people follow proven principles I can learn”

- From: “I’ll start investing when I have more money”

- To: “I’ll have more money because I start investing now”

- From: “Budgets are restrictive and depressing”

- To: “Budgets are permission to spend on what matters after investing”

Your 90-Day Wealth Building Action Plan

Month 1: Foundation

- Track every dollar spent for 30 days (reveals spending leaks)

- Open investment account if you don’t have one

- Set up automatic investment transfer (even $100 monthly)

- Pull credit report and start improving score

Month 2: Optimization

- Increase investment contributions by 2-5%

- Negotiate one bill (insurance, phone, internet) to reduce costs

- Research higher-paying job opportunities in your field

- Read one personal finance book (suggestions: “The Simple Path to Wealth,” “The Millionaire Next Door”)

Month 3: Acceleration

- Apply for 5-10 higher-paying positions or ask for raise

- Launch side income stream (freelancing, consulting, e-commerce)

- Eliminate one major expense or pay off one debt

- Review and adjust strategy based on progress

Repeat quarterly while increasing targets.

Wealth Is a System, Not an Event

Nobody becomes a millionaire from one lucky investment or big break. Lottery winners and inheritance recipients often lose money within years because they lack wealth-building systems.

According to research tracking millionaires, 79% are self-made – meaning they built wealth through consistent application of these seven principles over 20-30 years.

The path is simple but not easy:

- Pay yourself first through automatic investing

- Buy appreciating assets, avoid depreciating purchases

- Optimize taxes legally and aggressively

- Let compound interest work for decades

- Focus on increasing income consistently

- Avoid consumer debt completely

- Think and act long-term despite short-term temptations

Start today. Not tomorrow. Not next month. Not after your next raise.

A 25-year-old implementing these strategies can realistically accumulate $2-5 million by retirement. A 35-year-old can still reach $1-3 million. A 45-year-old can build $500,000-1.5 million.

But only if you start now.

The millionaires of 2050 are making their first investment today. Will you be one of them?