Crypto in 2026: Which Coins Will Survive the Next Market Cycle?

The crypto market is evolving fast — and not every coin will make it to 2026. With regulatory pressure, new technology, institutional adoption, and shifting investor behavior, the next cycle will be a survival test. The hype coins will die. Utility-driven ecosystems will dominate.

This article breaks down which cryptos are most likely to survive and grow by 2026, based on fundamentals, adoption, utility, and institutional support – and which ones are doomed to vanish.

Why 2026 Will Be a Turning Point for Crypto

Several macro events will reshape the crypto landscape by 2026:

- Institutional crypto ETFs expanding beyond Bitcoin & Ethereum

- Global regulation frameworks becoming standardized

- Mass adoption of tokenized real-world assets (RWA)

- AI-integrated blockchain ecosystems gaining traction

- CBDCs rising, pushing private crypto to evolve or die

According to Coinbase Institutional, over 52% of institutional investors plan to increase crypto exposure by 2026.

Bitcoin (BTC): The Safe Haven & Digital Reserve Asset

Bitcoin remains the most likely long-term survivor.

Why BTC survives 2026:

- Institutional adoption growing (BlackRock, Fidelity ETFs)

- Scarcity + halving cycles supporting long-term value

- Seen as digital gold & inflation hedge

BTC may not deliver the highest % gains, but it remains the most secure long-term hold.

Ethereum (ETH): The Settlement Layer of Web3

Ethereum won’t just survive – it will dominate.

Strength factors:

- Largest developer ecosystem

- Smart contracts standard

- Real-world asset tokenization built mostly on ETH

- Staking economy ensures network security & yield

According to Consensys, 71% of Web3 projects still build on Ethereum or L2s.

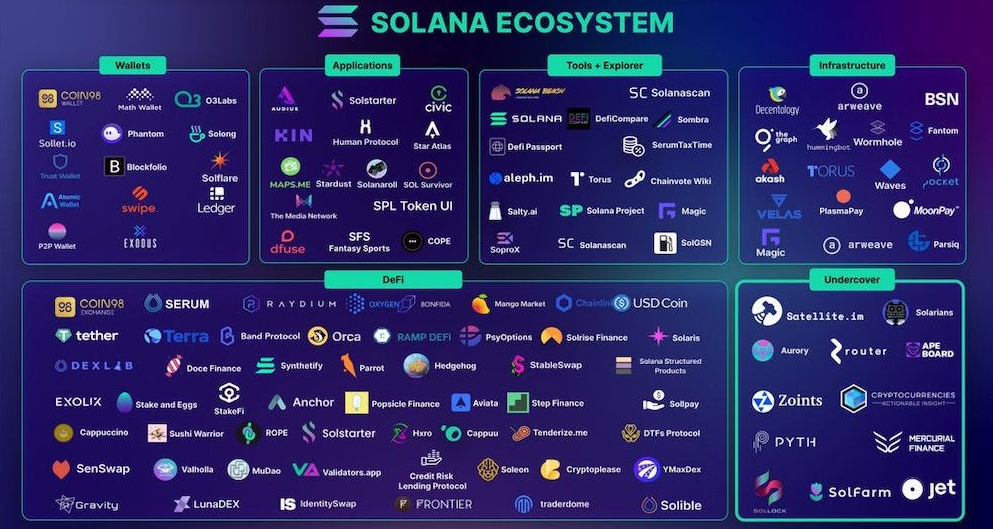

Solana (SOL): High-Speed Winner With Institutional Momentum

Solana’s comeback story is one of the biggest in crypto. Despite outages in 2022–2023, Solana has become a top choice for scalable apps, consumer crypto, and AI integrations.

Why SOL survives:

- Fast transactions & low fees

- Major ecosystem growth

- Backing from top funds & retail adoption

Solana is the “Apple of crypto” — a controlled, optimized ecosystem.

XRP & Institutional Banking Coins

Coins connected to banking and cross-border payments will thrive as regulation matures.

Top survivors in this category:

- XRP — banking rails + CBDC partnerships

- XLM — remittance + financial inclusion

- Link (Chainlink) — oracle standard for RWA tokenization

Once regulators finalize rules by 2025, banking-approved crypto will gain massive institutional inflow.

AI & DePIN Tokens Will Explode — But Only 5–10% Survive

The fastest-growing sector heading into 2026:

- AI + Blockchain

- Decentralized physical infrastructure networks (DePIN)

- RWA tokenization

- Gaming + metaverse revival (but selective)

Likely winners:

| Sector | Coins That Will Survive |

|---|---|

| AI | FET / ASI, RNDR, AGIX |

| DePIN | HNT, AKT, IOTX |

| RWA | ONDO, LINK, MKR |

| Gaming | IMX, PYR (selectively) |

Around 90% of AI-themed coins will die because they were hype with no tech behind them.

Coins That Will Not Survive 2026

Expect failure in:

- Meme coins without utility

- Projects with no revenue model

- Tokens still relying on hype vs product

- Forks and copy-paste L1s

By 2026, the market matures. Users won’t buy hype — they’ll buy value and utility.

How to Build a “Survive-2026” Crypto Portfolio

A future-proof allocation example (not financial advice):

- 40% BTC + ETH — core

- 30% SOL / LINK / RWAs

- 20% AI + DePIN

- 10% Venture high-risk future picks

Rule: Own coins with a purpose, not coins with a mascot.

The 2026 crypto landscape will filter out weak projects. Survivors will be those delivering real-world value, mass adoption, and institutional integration.

Crypto will not disappear — it will evolve.