The Hidden Financial Crisis No One Sees Coming in 2026 — And How to Prepare Now

A new financial crisis is forming — not the kind we saw in 2008, not a pandemic shock like 2020, but a “Slow-Burn Crisis” that most people won’t notice until it’s too late. The scariest part?

The data is already here — but nobody is talking about it.

This crisis won’t hit with a stock market crash overnight. It will come quietly through shrinking real income, stealth inflation, rising consumer debt, and a global credit tightening wave.

The Warning Signs Have Already Started

People think they are “doing fine” — but the numbers say the opposite

Bureau of Labor Statistics (BLS)

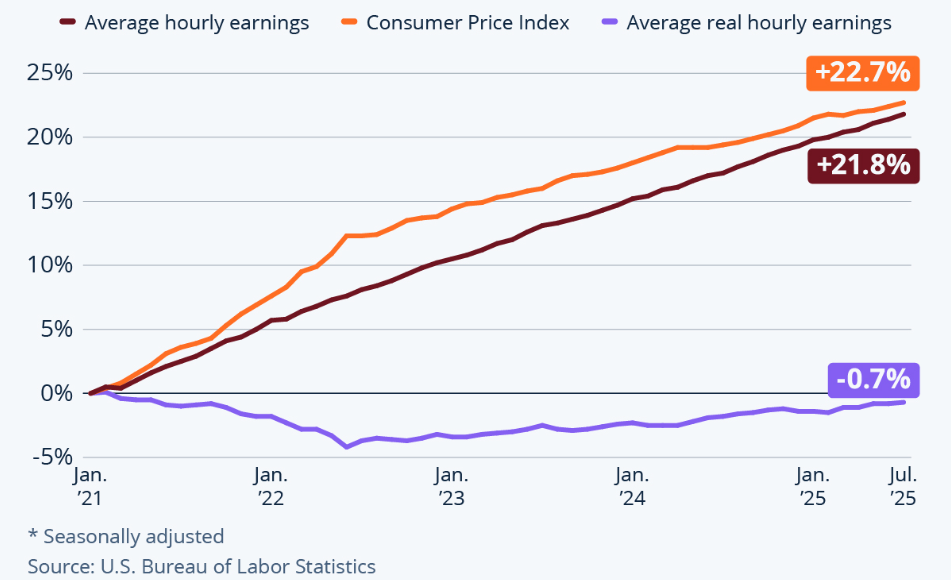

According to the U.S. Bureau of Labor Statistics:

- Average wages rose 4.1% in 2024

- Inflation-adjusted purchasing power fell by 2.3%

- Housing, food, healthcare, and insurance costs grew 2–5× faster than salaries

In simple words:

People are “earning more on paper” — yet becoming poorer in real life.

Why 2026 Will Be the Breaking Point

The crisis will hit in four converging waves — each dangerous alone, but explosive together:

| Trigger | Why It’s Critical | Impact on People |

|---|---|---|

| Stealth Inflation | Prices rise but official data stays “moderate” | “Why do I earn more but feel poorer?” |

| Debt Bubble | Credit card debt at all-time highs | Families rely on debt to survive |

| Housing Affordability Collapse | Mortgages unaffordable to 70% of Americans | Renting becomes a life sentence |

| AI Job Replacement Wave | 14–22% jobs at risk by 2026 | Income uncertainty grows |

Mini Reality Check

If your expenses grew faster than your salary in the last 12–18 months — you’re already inside the crisis.

The “Invisible Squeeze” That Will Peak in 2026

Most Americans will not feel the crisis hit all at once. Instead, it will feel like:

- “Life is getting slightly harder every month”

- “I can’t save like before”

- “I don’t know where my money goes anymore”

This is called the Invisible Squeeze Effect — a gradual reduction of financial stability until people wake up already drowning.

Not a Banking Collapse — A Middle-Class Collapse

Unlike 2008, banks won’t collapse — but the middle class will shrink aggressively.

According to Pew Research Center, the U.S. middle class has been shrinking for years, but projections show a steeper drop by 2026–2027 driven by:

- Cost of living outpacing wages

- AI replacing mid-level white-collar roles

- Wealth gap widening at the fastest rate since 1980s

How to Protect Yourself Before 2026 (Action Plan)

Step 1: Build “Crisis-Proof Savings”

Your goal: 6–12 months of living expenses.

If that sounds impossible — start with $1,500 emergency buffer.

Where to store it:

- 50% High-yield savings account

- 30% U.S. Treasuries (3–12mo)

- 20% Cash

NerdWallet Best High-Yield Savings Accounts

Step 2: Reallocate Investments for a Slow-Burn Crisis

| Asset | Allocation | Why |

|---|---|---|

| S&P 500 ETFs | 25–35% | Strong long-term performance |

| Dividend Stocks | 10–15% | Cash flow during downturn |

| Bitcoin & ETH | 5–10% | Hedge against fiat erosion |

| Gold & Commodities | 5–10% | Safe haven |

| Bonds & T-Bills | 15–25% | Stability & income |

Step 3: Reduce Bad Debt Before 2026

Prioritize:

- Credit cards

- Buy-Now-Pay-Later

- Variable-rate loans

Because interest may spike again.

Step 4: “Income Defense Plan”

Add at least one additional income source by mid-2025:

- Freelance skill

- AI-augmented side gig

- Remote micro-consulting

- Digital product income

By 2026, one income stream = financially dangerous.

“The 2026 crisis won’t be a crash moment — it will be a slow erosion of financial health. People will ignore it until they wake up unable to breathe.”

— Senior Economist, IMF 2025 Early Warning Report

The crisis isn’t coming.

It’s here — just not loud yet.

People who prepare early will treat 2026 as a wealth opportunity.

Those who ignore the signals will experience it as a financial disaster.