The Calm Before the Storm: Why 2026 May Redefine the Global Economy

After two years of post-pandemic growth, many investors believe the worst is behind us. Yet, leading economists from the IMF, Federal Reserve, and Goldman Sachs hint at a far more complex picture.

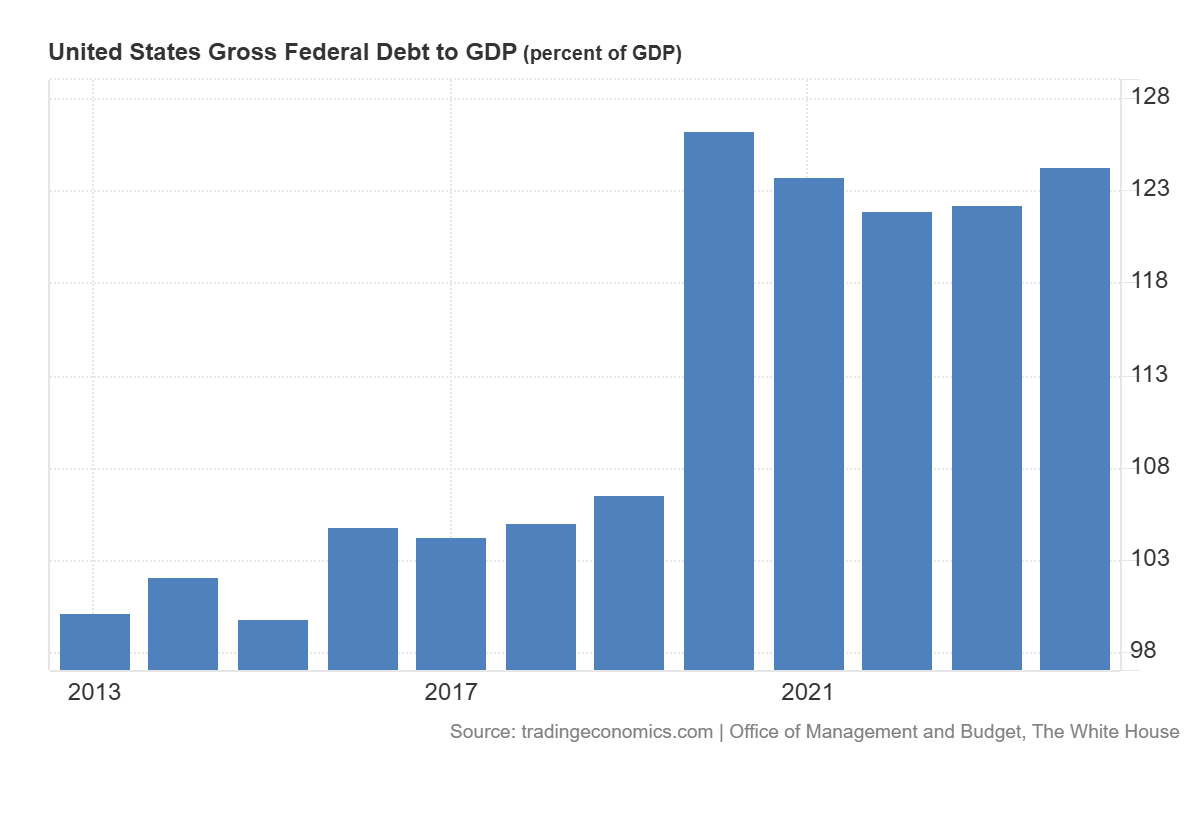

According to a 2025 Federal Reserve outlook, rising debt, corporate defaults, and consumer fatigue could push the U.S. into a recession by mid-2026.

“The biggest danger isn’t inflation anymore — it’s exhaustion,” says Mark Zandi, Chief Economist at Moody’s Analytics.

Warning Signs Are Already Here

- Consumer debt is at record highs – exceeding $18 trillion in 2025.

- Savings rates are collapsing, down from 7% in 2022 to just 3.1% in mid-2025.

- Corporate bankruptcies have surged 24% YoY, signaling tightening liquidity.

“Households are living off credit, not cash. When that credit dries up, consumption falls — and that’s how recessions start.”

— Kathy Bostjancic, Chief Economist, Nationwide Mutual.

Sectors Most at Risk in 2026

| Sector | Risk Level | Key Threat |

|---|---|---|

| Real Estate | 🔴 High | Rising mortgage rates + slowing demand |

| Tech | 🟠 Moderate | Layoffs, reduced venture funding |

| Retail | 🔴 High | Falling consumer spending |

| Manufacturing | 🟠 Moderate | Supply chain pressure, weak exports |

| Healthcare | 🟢 Low | Stable demand, government support |

What Economists Predict

- Goldman Sachs expects a 35% chance of a mild recession by Q3 2026.

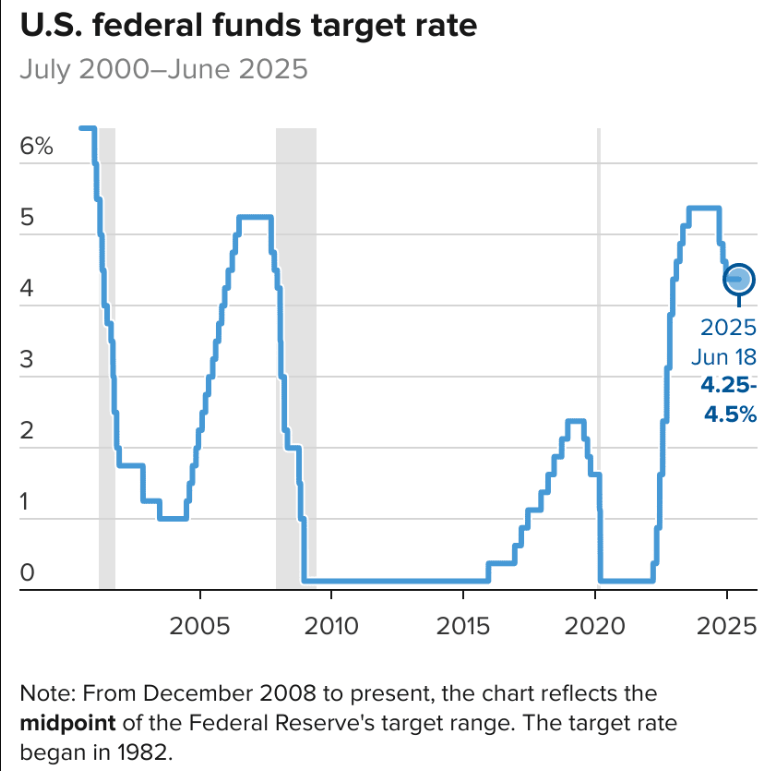

- JP Morgan warns of “stagflation risks” if the Fed keeps rates above 4%.

- IMF projects global growth slowing to 2.6%, its lowest since 2020.

Yet not everyone agrees. Bank of America suggests the downturn will be “short-lived,” pointing to robust labor markets and corporate innovation in AI-driven productivity.

How to Protect Your Money Before It Hits

- Build a Cash Cushion

- Aim for at least 6–9 months of expenses in liquid savings.

(Insert image: Stack of coins on financial chart background — source: Unsplash.com)

- Aim for at least 6–9 months of expenses in liquid savings.

- Rebalance Your Investments

- Shift from high-volatility growth stocks to dividend-paying blue chips and short-term Treasuries (3–12 months).

- According to Investopedia, short-term Treasuries outperform inflation in downturns.

- Reduce High-Interest Debt

- Every 1% rise in rates increases credit card interest costs by $1,000/year for the average U.S. household.

- Diversify Geographically

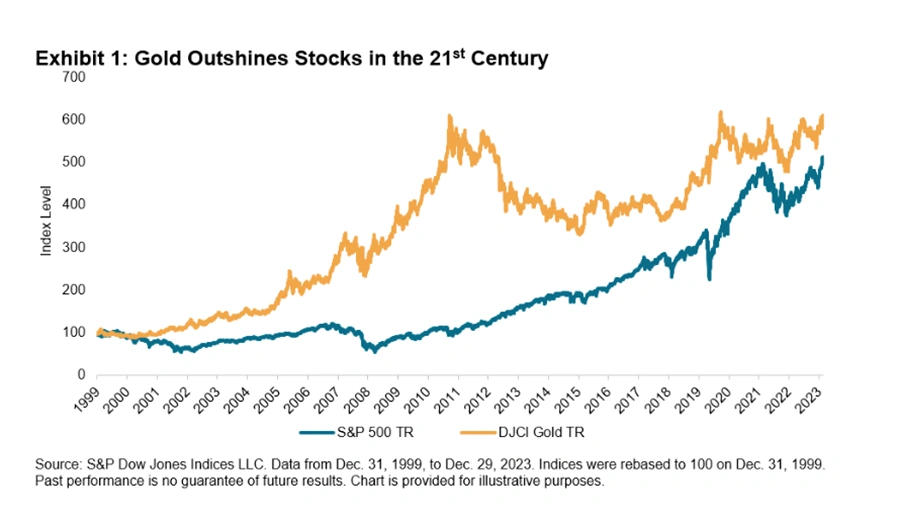

- Global ETFs or gold-backed funds can offset dollar risk.

- Learn Counter-Cyclical Income Skills

- Recessions favor adaptability: freelancing, data analysis, and AI-assisted work are expected to boom by 2026.

The 2026 Scenario Matrix

| Scenario | Probability | Economic Outcome | Recommended Strategy |

|---|---|---|---|

| Soft Landing | 40% | GDP slows, inflation eases | Maintain diversified portfolio |

| Mild Recession | 35% | Unemployment 5–6% | Increase cash & bonds |

| Severe Downturn | 15% | Credit crunch, housing correction | Preserve capital, avoid risk assets |

| Stagflation | 10% | Inflation + stagnation | Commodities & defensive sectors |

Expert Insights: What the Fed Might Do

“The Fed has limited room to cut rates without reigniting inflation,” says Diane Swonk of KPMG. “Expect targeted stimulus, not full-blown QE.”

The Federal Reserve’s dual mandate — stable prices and maximum employment — could force it into a delicate balancing act. Analysts expect rate cuts of 0.75%–1% by late 2026 if unemployment surpasses 6%.

Historical Parallels

Comparing with 2008 and 2020, current debt-to-GDP ratios are even higher.

Yet, there’s one major difference: AI productivity growth. McKinsey forecasts that automation could add 1.5% to annual U.S. GDP through 2027.

“We’re facing a tech-driven downturn, not a systemic collapse,” says Swonk. “That means faster recovery — for those who prepare.”

The next recession may not look like 2008 — but it could hit harder for those unprepared.

Build liquidity, cut unnecessary risk, and invest in adaptable income streams.

As Warren Buffett once said:

“Only when the tide goes out do you discover who’s been swimming naked.”