Why Smart Americans Are Switching to Usage Based Insurance in 2026 and Saving Over $1,400 per Year

Insurance in the US has entered a new era. Rising premiums, inflation and economic pressure in 2025 pushed Americans to search for cheaper and more fair alternatives. In 2026, one trend dominates the insurance market: Usage Based Insurance (UBI). It is becoming the number one choice for drivers, homeowners and even renters who want to pay only for what they actually use.

According to Forbes Advisor, the average auto insurance premium increased by 24 percent in 2024 and continued rising through 2025 due to inflation and increased repair costs.

UBI flips the traditional insurance model upside down. Instead of paying a fixed price, consumers pay based on their actual behavior and usage, often saving from 20 to 45 percent on premiums.

What Is Usage Based Insurance and Why Is It Exploding in 2026

Usage Based Insurance (also called Pay Per Mile or Pay How You Drive) uses telematics to monitor driving habits through a mobile app, plugged in car device or built in vehicle system. Consumers pay based on how safely and how often they drive.

How It Works

- You install an insurer app or a small OBD-2 device into your car

- The system tracks driving data and mileage

- Your premium is calculated based on your usage and driving behavior

Top tracked factors:

- Mileage

- Speed and braking patterns

- Driving time (day or night)

- Traffic frequency

- Distracted driving score (phone usage)

In a survey by Statista, 62 percent of US drivers aged 21 to 35 said they would switch to a usage based auto policy if it saved them at least 15 percent.

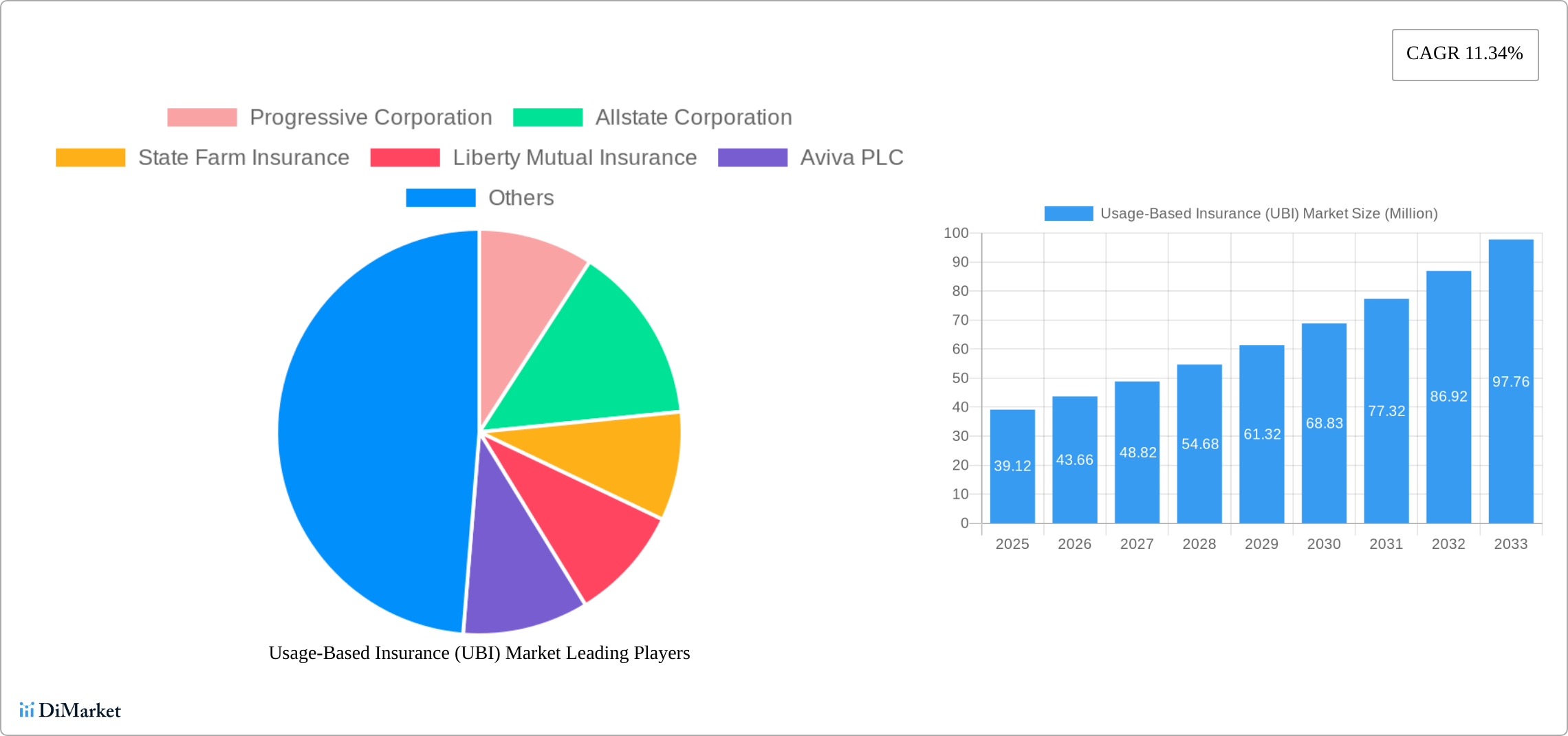

source: DiMarket

Real Savings: How Much Can You Actually Save in 2026

UBI is especially beneficial for people who drive less, work remotely or drive safely. Here is what average Americans are saving:

| Driver Type | Annual Savings |

|---|---|

| Remote worker | $900 to $1,400 |

| Safe driver | $600 to $1,200 |

| Student with low mileage | $450 to $800 |

| Retired driver | $700 to $1,000 |

Why Insurers Love It Too

UBI does not only benefit consumers. Insurance companies also win because:

- Lower risks from safe drivers

- More accurate pricing

- Less fraud and exaggerated claims

The Psychology Behind the Switch

People like to feel in control, especially over money. UBI gives customers:

- Transparency

- Customization

- Personalized pricing

- Immediate feedback on driving score

This makes insurance feel less like a mandatory tax and more like a smart financial choice.

Top UBI Providers in the US in 2026

If readers want to switch, these are the most competitive insurers offering UBI in 2026:

| Insurance Provider | Program Name | Highlight |

|---|---|---|

| Progressive | Snapshot | Good driver rewards |

| Allstate | Drivewise | Cashback for safe driving |

| Nationwide | SmartRide | Up to 40 percent discount |

| Liberty Mutual | RightTrack | Personalized premium |

| Metromile | Pay Per Mile | Best for low mileage drivers |

The Downsides You Should Know Before Switching

Although UBI is trending, it is not for everyone.

Potential drawbacks:

- Privacy concerns due to tracking

- Higher premiums for risky driving scores

- Not suitable for long distance daily drivers

- Some insurers raise prices if data looks risky

A 2025 report by Consumer Reports (https://www.consumerreports.org/) highlighted that 31 percent of drivers did not fully understand what data insurers collect before signing up.

Tip: Always read data privacy policy before joining a UBI program.

The Future of Insurance: Personalized and AI Driven

By 2027, insurance will use AI to create fully personalized policies not only for auto but also for health, home and cyber insurance. AI will analyze lifestyle and risk to generate a dynamic premium that updates monthly.

Key future trends:

- AI risk scoring for all insurance categories

- Bundled UBI policies for auto plus home

- Rewards for low risk lifestyle

- Discounts for safe digital habits