The retirement crisis in America isn’t coming – it’s already here. According to the Federal Reserve’s latest Survey of Consumer Finances, the median retirement account balance for Americans aged 55-64 is just $185,000, a figure that falls dramatically short of what financial experts say is needed for a comfortable retirement. Even more alarming, 25% of Americans have nothing saved for retirement at all.

But here’s what the financial industry doesn’t want you to know: the traditional retirement advice you’ve been following may be fundamentally flawed for the economic reality of 2025 and beyond. Inflation rates, longer life expectancies, and shifting market dynamics have rendered many conventional strategies obsolete. This article reveals the critical mistakes most Americans are making right now and provides a battle-tested framework to course-correct before it’s too late.

The Five Deadly Retirement Planning Mistakes Destroying Your Future

Mistake 1: Relying Solely on the 4% Withdrawal Rule

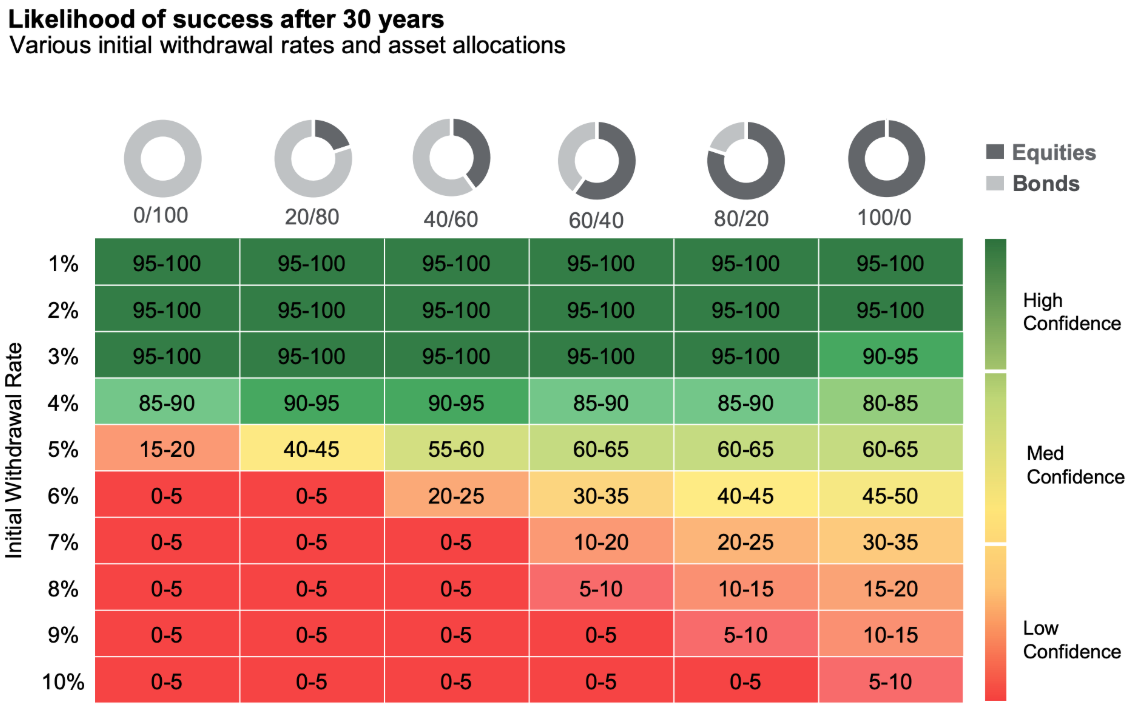

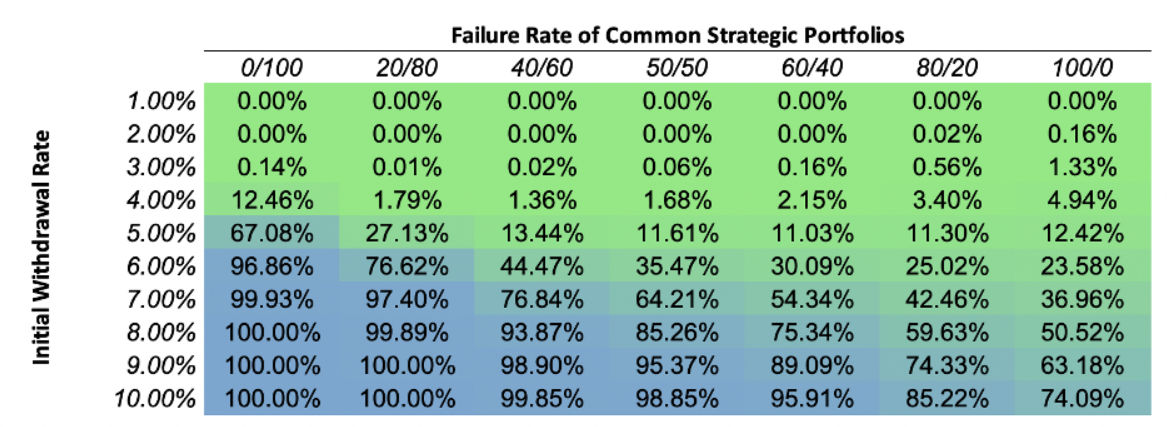

The 4% rule – the idea that you can safely withdraw 4% of your retirement savings annually – has been gospel since the 1990s. But recent research from Morningstar shows this rule may now be dangerously optimistic.

With bond yields fluctuating and market volatility increasing, financial analysts now suggest a more conservative 3.3% withdrawal rate for a 30-year retirement. For someone with $500,000 saved, that’s a difference of $3,500 per year – or $105,000 over three decades.

The fix: Use dynamic withdrawal strategies that adjust based on market performance. In strong market years, withdraw slightly more. In down years, tighten your belt by 5-10%. This approach, validated by studies from Vanguard, can extend portfolio longevity by 7-12 years.

Source: J.P. Morgan Asset Management

Mistake 2: Underestimating Healthcare Costs

Fidelity estimates that the average 65-year-old couple retiring in 2024 will need $315,000 to cover healthcare costs throughout retirement – and that doesn’t include long-term care. Yet most Americans budget less than half this amount.

Medicare covers far less than people expect:

- Part A deductible: $1,632 per benefit period (2024)

- Part B premium: $174.70/month standard (2024)

- Dental, vision, hearing: Not covered at all

- Long-term care: Zero coverage

According to the Kaiser Family Foundation, out-of-pocket healthcare spending for Medicare beneficiaries averages $7,030 annually – a figure that’s grown 3.2% annually over the past decade.

The fix: Open a Health Savings Account (HSA) immediately if you have a high-deductible health plan. HSAs offer triple tax advantages and can be invested like an IRA. For 2025, you can contribute up to $4,150 for individuals or $8,300 for families, with an additional $1,000 catch-up if you’re 55+.

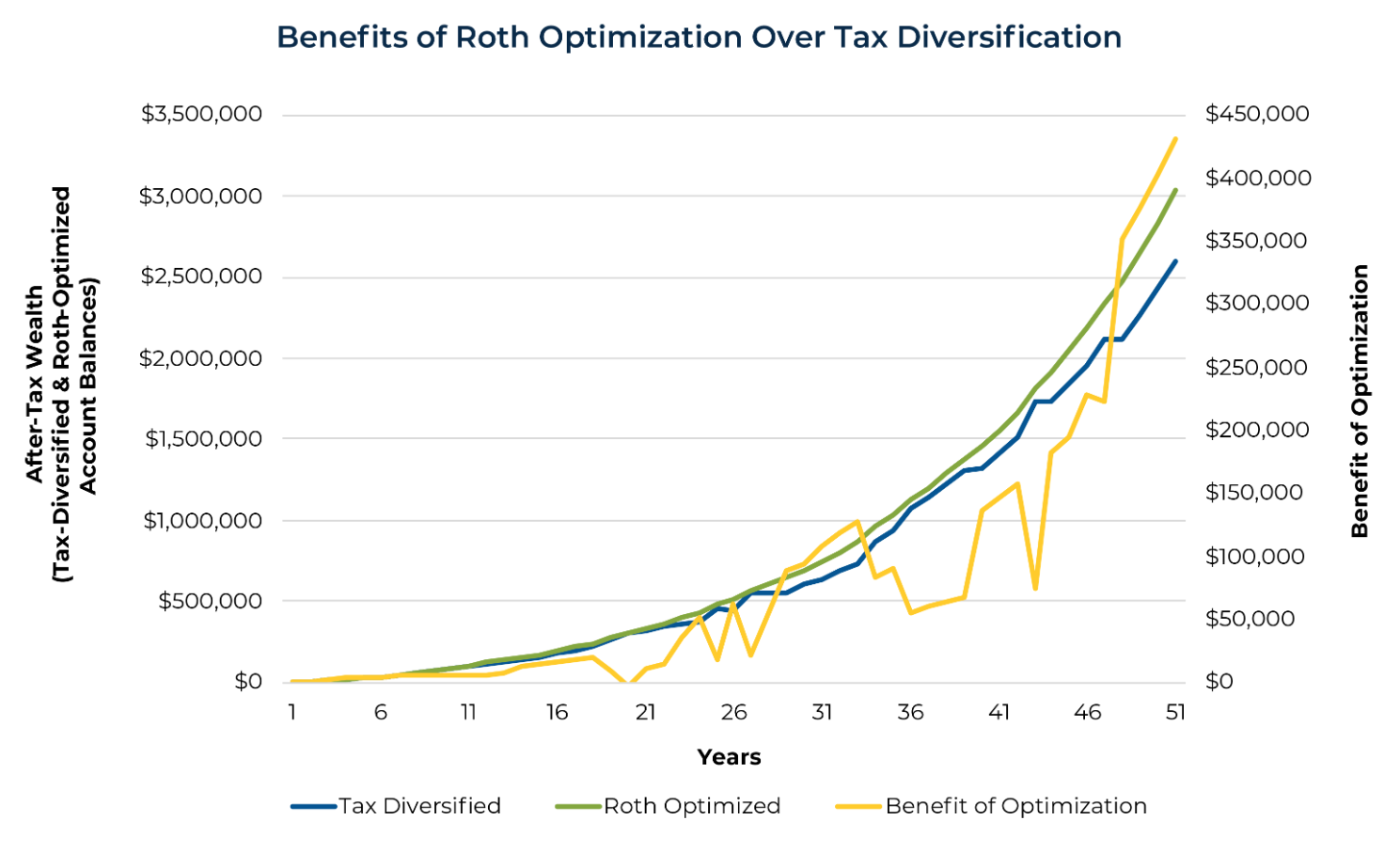

Mistake 3: Ignoring Tax Diversification

Most Americans funnel everything into 401(k)s and traditional IRAs, creating a tax time bomb. When you retire and start withdrawing, every dollar is taxed as ordinary income – potentially pushing you into higher tax brackets and triggering taxation of Social Security benefits.

The tax diversification strategy used by sophisticated investors involves three buckets:

- Taxable accounts: Regular brokerage accounts with long-term capital gains treatment (0-20% tax rate)

- Tax-deferred accounts: 401(k)s and traditional IRAs (taxed as ordinary income upon withdrawal)

- Tax-free accounts: Roth IRAs and Roth 401(k)s (completely tax-free withdrawals)

A recent Vanguard study found that strategic tax-location of assets can add 0.75% annually to after-tax returns – which compounds to hundreds of thousands of dollars over a 30-year retirement.

Source: Kitces

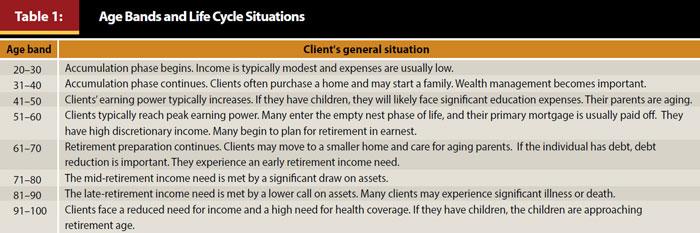

Mistake 4: Planning for Your Parents’ Life Expectancy

Your parents’ generation retired at 65 and lived to 78. You’re different. A 65-year-old today has a 50% chance of living past 85, and a 25% chance of reaching 90, according to the Society of Actuaries. For couples, there’s a 50% probability that at least one spouse will live to 92.

Planning for a 20-year retirement when you might live 30+ years is financial suicide. The compounding effect of inflation alone – even at 3% annually – will cut your purchasing power in half over 24 years.

The fix: Plan for age 95, minimum. Yes, you’ll need to save more, but running out of money at 85 isn’t an option. Consider longevity insurance (deferred income annuities that begin payments at 80-85) as a backstop.

Mistake 5: Stopping Equity Exposure Too Soon

The old rule was to subtract your age from 100 to determine your stock allocation (a 70-year-old should hold 30% stocks). Modern portfolio theory and longer life expectancies have made this guidance obsolete.

According to research from T. Rowe Price, retirees with 50-60% equity exposure throughout retirement had a 90% success rate of portfolio survival over 30 years, compared to just 74% for those with only 30% equity exposure.

The caveat: This requires emotional discipline. You must stay invested through market downturns, which means having 2-3 years of expenses in cash and bonds so you never sell stocks at a loss.

The 2025-2026 Retirement Planning Framework That Actually Works

Step 1: Calculate Your Real Number

Forget the “$1 million is enough” myth. Your target depends on your desired lifestyle and expected expenses. Use this formula:

Annual retirement expenses x 30 (years) / 0.033 (withdrawal rate) = Target savings needed

For $60,000 annual expenses: $60,000 x 30 / 0.033 = $54,545,454… realistically, you need about $1.8 million saved.

Step 2: Maximize All Tax-Advantaged Accounts

For 2025:

- 401(k) contribution limit: $23,500 ($31,000 if 50+)

- IRA contribution limit: $7,000 ($8,000 if 50+)

- HSA contribution limit: $4,150 individual, $8,300 family

Maxing these out provides immediate tax benefits and compound growth. A 45-year-old contributing the max to a 401(k) with catch-up provisions until 65 will accumulate approximately $1.27 million (assuming 7% returns).

Step 3: Build Your Income Floor

Stack guaranteed income sources to cover essential expenses:

- Social Security (delay until 70 if possible for 24% higher payments)

- Pension (if available)

- Immediate annuities (for additional guaranteed income)

According to a BlackRock study, retirees with 70%+ of essential expenses covered by guaranteed income report 15% higher satisfaction and 40% less financial anxiety.

Step 4: Implement a Tax-Efficient Withdrawal Strategy

The optimal withdrawal sequence for most retirees:

- Ages 60-72: Draw from taxable accounts and Roth conversions

- Ages 72+: RMDs from traditional accounts (required)

- Throughout: Roth accounts last (tax-free growth continues)

This approach, validated by financial planning software analyzed by the Journal of Financial Planning, can save $100,000+ in lifetime taxes for typical retirees.

Step 5: Protect Against Longevity and Healthcare Risks

- Purchase long-term care insurance in your 50s (premiums are 40% lower than waiting until your 60s)

- Consider a health savings account as a stealth retirement account

- Build a 12-month cash emergency fund for unexpected expenses

What the Financial Industry Won’t Tell You

The retirement planning industry profits from complexity and fear. But the truth is simpler than they want you to believe.

Major financial institutions earn revenue through:

- High management fees (1% annually on $500,000 = $5,000/year to them)

- Commissioned product sales (annuities, whole life insurance)

- Trading commissions and hidden costs

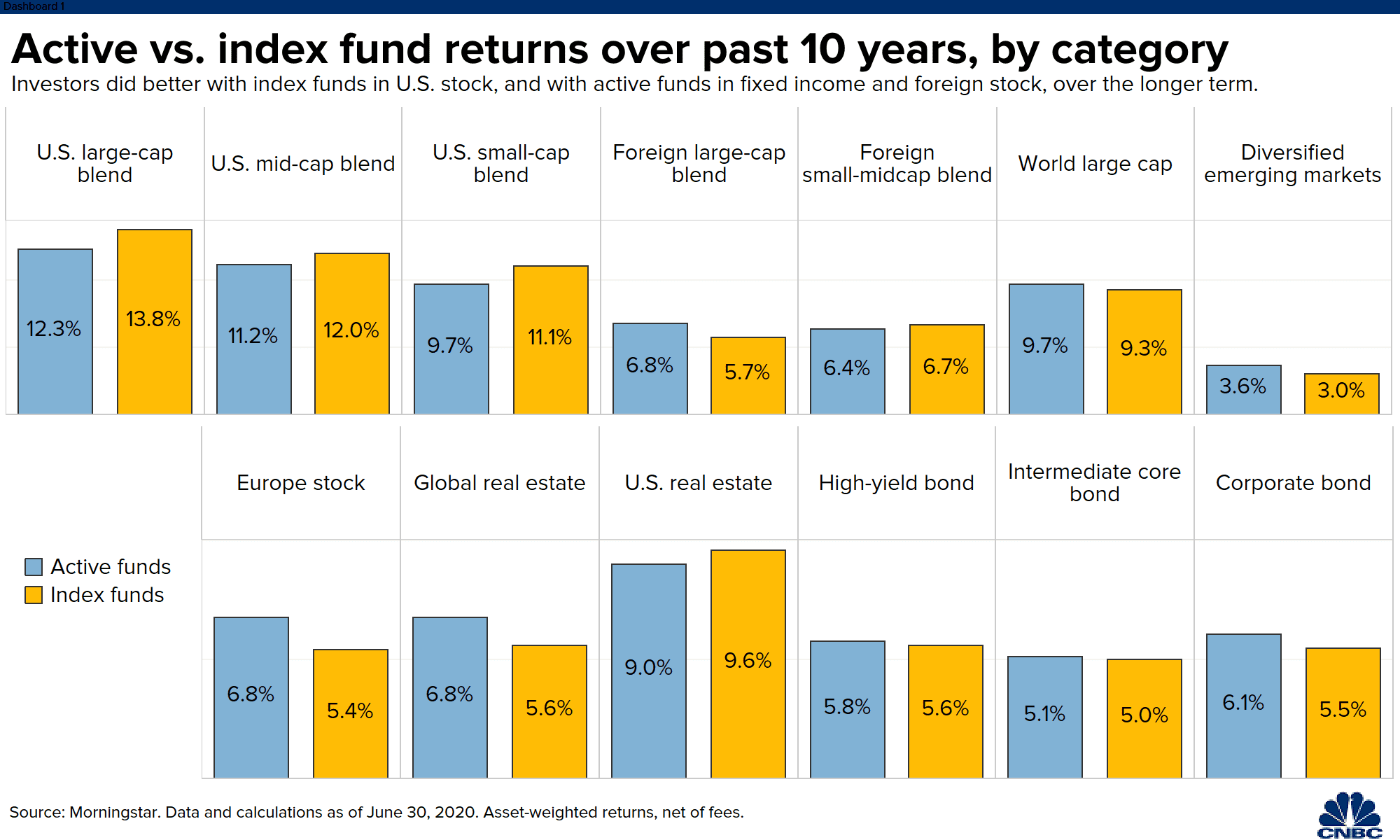

A Morningstar study found that the average actively managed mutual fund charges 0.66% annually, while comparable index funds charge just 0.05% – a difference that costs investors $122,000 over 30 years on a $500,000 portfolio.

The DIY approach using low-cost index funds at firms like Vanguard, Fidelity, or Schwab can save you tens of thousands in fees. A simple three-fund portfolio (total US stock, total international stock, total bond market) outperforms 80% of professional managers over 15-year periods, according to S&P Dow Jones Indices.

Common Retirement Planning Myths Debunked

- Myth: “I’ll spend less in retirement”

- Reality: Most retirees spend 85-100% of pre-retirement income in the first decade, according to Employee Benefit Research Institute data. Travel, hobbies, and healthcare often increase spending.

- Myth: “Social Security will be gone”

- Reality: Even in worst-case scenarios, Social Security can pay 77-80% of promised benefits from ongoing payroll taxes alone. Benefit cuts are possible, but complete elimination is politically impossible.

- Myth: “I can work part-time in retirement if needed”

- Reality: 48% of retirees leave the workforce earlier than planned due to health issues or layoffs (Boston College Center for Retirement Research). Banking on working longer is risky.

- Myth: “My home equity is my retirement plan”

- Reality: Reverse mortgages carry high fees (typically $15,000+ in origination costs) and complex terms. Your home should supplement retirement, not be the foundation.

The Behavioral Finance Secret to Retirement Success

Technical knowledge is only 30% of retirement success. The other 70% is psychological discipline.

Studies from Dalbar Inc. consistently show that average investors underperform the market by 4-5% annually due to emotional decision-making – buying high during euphoria and selling low during panic.

Three behavioral strategies that work:

- Automate everything: Set up automatic contributions and rebalancing. Remove emotion from the equation.

- Never check balances during market crashes: Research shows that investors who checked portfolios daily during the 2008 crisis were 50% more likely to sell at the bottom.

- Focus on process, not outcomes: You can’t control market returns, but you can control savings rate, fees, and asset allocation.

Action Plan: What to Do This Week

Monday: Log into all retirement accounts and verify you’re contributing enough to get full employer match (free money).

Tuesday: Calculate your projected Social Security benefits at ssa.gov/myaccount. Run scenarios for claiming at 62, 67, and 70.

Wednesday: Review your investment fees. If you’re paying more than 0.25% annually, explore lower-cost alternatives.

Thursday: Open an HSA if you don’t have one and have a qualifying high-deductible health plan.

Friday: Schedule a financial review – either DIY using free calculators at Vanguard or Fidelity, or with a fee-only CFP (not commission-based).

Time Is Your Most Valuable Asset

Every year you delay serious retirement planning costs you exponentially. A 35-year-old who saves $500/month will accumulate $1.14 million by 65 (assuming 7% returns). Wait until 45, and you’ll need to save $1,200/month to reach the same goal – nearly 2.5 times as much.

The retirement crisis facing Americans is real, but it’s not insurmountable. The strategies outlined here – tax diversification, realistic healthcare planning, maintaining equity exposure, and behavioral discipline – have been validated by decades of financial research and millions of successful retirees.

The question isn’t whether you can afford to implement these strategies. It’s whether you can afford not to.

The window for course correction closes a little more each day. Those who act decisively today will enjoy financial security tomorrow. Those who procrastinate will join the 45% of Americans who, according to the Government Accountability Office, have zero retirement savings at age 55.

Which group will you be in?