Bitcoin has shattered expectations in 2024, climbing past $89,000 and leaving traditional analysts scrambling to revise their predictions. But this isn’t just another crypto hype cycle driven by retail FOMO and Twitter influencers. Something fundamentally different is happening in the digital asset space, and the implications for investors could be massive.

According to data from CoinGecko and Bloomberg, Bitcoin’s market capitalization now exceeds $1.75 trillion, surpassing the market cap of silver and approaching that of Google. More importantly, institutional ownership of Bitcoin has increased by 340% since 2022, with names like BlackRock, Fidelity, and Franklin Templeton leading the charge through spot Bitcoin ETFs.

This article cuts through the noise to reveal what’s really driving this unprecedented rally, which warning signs investors must watch, and what the next 18 months could bring based on on-chain data, macroeconomic trends, and institutional flow analysis.

What Makes the 2024-2025 Bitcoin Rally Fundamentally Different

The Institutional Tsunami That Changed Everything

January 2024 marked a watershed moment: the SEC approved spot Bitcoin ETFs after a decade of rejections. Within the first 10 months, these ETFs accumulated over $25 billion in net inflows, according to Bloomberg Intelligence data.

The BlackRock iShares Bitcoin Trust (IBIT) alone attracted $20 billion in assets under management, making it one of the most successful ETF launches in history. For context, it took gold ETFs five years to reach the inflows Bitcoin ETFs achieved in 10 months.

Why does this matter? Institutional money moves differently than retail:

- Longer time horizons: Pension funds and endowments invest for decades, not days

- Massive capital pools: CalPERS alone manages $440 billion in assets

- Legitimacy effect: When Wisconsin’s state pension adds Bitcoin exposure, it signals mainstream acceptance

- Permanent bid: Unlike retail traders who panic sell, institutions rebalance and dollar-cost average

According to a recent report from Fidelity Digital Assets, 71% of institutional investors now view digital assets as an appealing addition to portfolios, up from just 36% in 2020.

The Halving Effect Meets Supply Shock

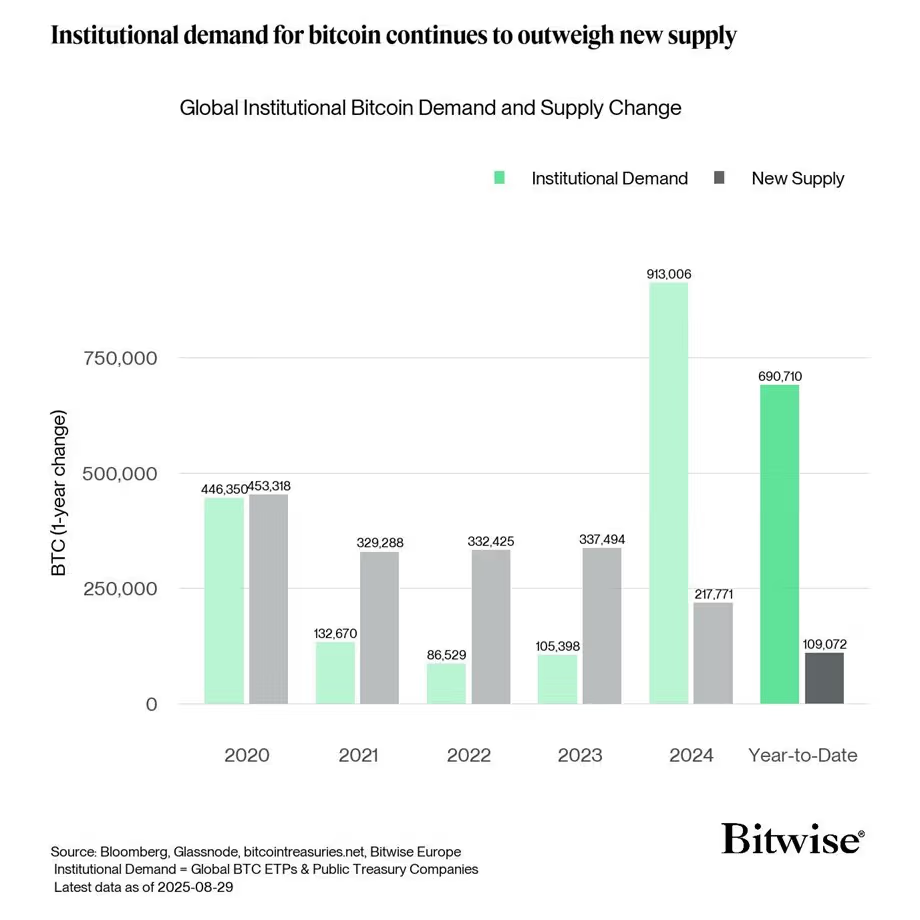

Bitcoin’s fourth halving occurred in April 2024, cutting miner rewards from 6.25 BTC to 3.125 BTC per block. This reduced new Bitcoin supply to just 450 BTC per day, or roughly $40 million at current prices.

Compare this to demand: spot Bitcoin ETFs alone have been accumulating 5,000-7,000 BTC daily during strong inflow periods. The math is simple and brutal for anyone trying to short Bitcoin.

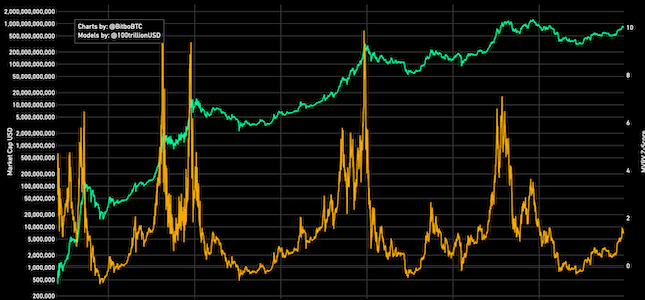

Historical pattern analysis from Glassnode shows that Bitcoin typically reaches cycle peaks 12-18 months after halving events:

- 2012 halving: Peak came November 2013 (+9,000%)

- 2016 halving: Peak came December 2017 (+2,900%)

- 2020 halving: Peak came November 2021 (+650%)

If this pattern holds, the current cycle could peak somewhere between October 2025 and April 2026.

However, there’s a critical difference: previous cycles lacked institutional ETF demand. This could extend the rally or create a higher baseline price floor when the eventual correction arrives.

Macro Conditions Are Finally Aligned

Unlike 2021’s retail-driven mania, today’s rally is supported by favorable macroeconomic conditions:

Federal Reserve policy shift: With inflation trending toward the 2% target, the Fed has begun cutting interest rates. Bitcoin historically performs well in rate-cutting cycles, as lower yields make non-yielding assets like Bitcoin relatively more attractive.

Dollar weakness concerns: With US debt approaching $36 trillion and deficit spending continuing, concerns about long-term dollar debasement are driving investors toward scarce assets. Bitcoin’s fixed supply of 21 million coins provides programmatic scarcity that no fiat currency can match.

Geopolitical uncertainty: According to State Street Global Advisors research, Bitcoin has increasingly traded as a “chaos hedge” during geopolitical flare-ups, similar to gold but with better portability and divisibility.

The On-Chain Data That Has Analysts Excited

Blockchain transparency provides real-time insight into Bitcoin holder behavior that’s impossible with traditional assets. Current on-chain metrics paint a bullish picture:

Exchange Balances Hit Multi-Year Lows

Bitcoin held on exchanges has dropped to 2.3 million BTC, the lowest level since 2018, according to Glassnode data. When Bitcoin moves off exchanges into cold storage, it signals long-term holding conviction and reduces available supply for sellers.

Long-Term Holder Supply Surges

Addresses holding Bitcoin for 155+ days (considered long-term holders) now control 75% of circulating supply, per CryptoQuant analysis. These “strong hands” rarely sell during corrections, providing price support.

Realized Profit/Loss Ratio Remains Healthy

Unlike the euphoric peaks of 2017 and 2021 where massive profit-taking preceded crashes, current realized profit ratios suggest the market isn’t overheated. Most holders remain in profit but aren’t rushing to sell, a sign of market maturity.

MVRV Z-Score Shows Room to Run

The MVRV (Market Value to Realized Value) Z-Score, which measures whether Bitcoin is over or undervalued relative to its “fair value,” currently sits at 2.1. Historical tops occur around 7+, suggesting significant upside potential remains before traditional warning signals flash red.

What Could Derail the Rally: The Risk Factors Nobody’s Talking About

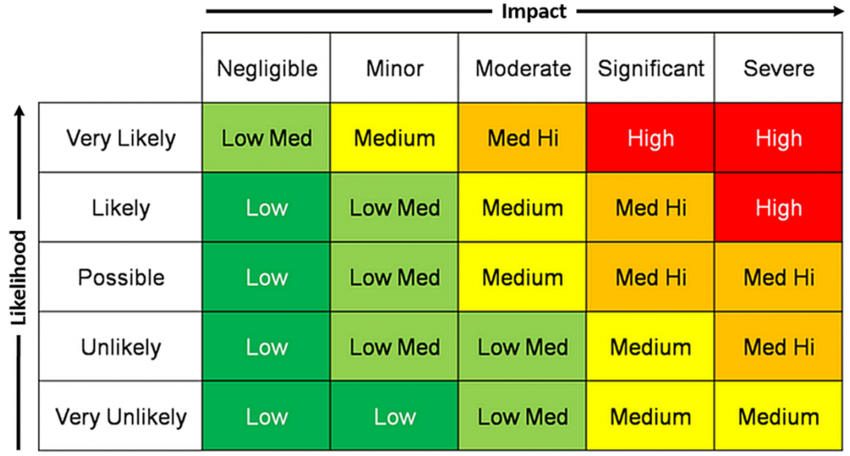

The Tether Time Bomb

Tether (USDT), the largest stablecoin with $120+ billion market cap, remains controversial. Despite attestation reports from BDO Italia, questions persist about the quality of reserves and regulatory compliance. A Tether collapse would trigger massive crypto market disruption, potentially worse than the FTX implosion.

Risk assessment: Medium probability but extreme impact. Diversifying into USDC (Circle) or USDT alternatives reduces exposure.

Regulatory Whiplash

While the US has moved toward Bitcoin acceptance via ETFs, regulatory clarity remains elusive for the broader crypto ecosystem. The SEC continues enforcement actions against altcoins and exchanges, creating uncertainty.

European Union’s MiCA regulations take full effect in 2025, requiring strict compliance from crypto firms. How this plays out could influence global regulatory approaches.

Quantum Computing Threat

Though currently distant, advances in quantum computing pose a theoretical threat to Bitcoin’s cryptographic security. Bitcoin’s elliptic curve cryptography could potentially be vulnerable to sufficiently powerful quantum computers, estimated to emerge in the 2030s according to IBM and Google research.

The Bitcoin development community is aware and working on quantum-resistant upgrades, but implementation would require network consensus and coordination.

The Mt. Gox Distribution

Approximately 140,000 BTC from the 2014 Mt. Gox hack are being distributed to creditors throughout 2024-2025. While many creditors are long-term holders, some selling pressure is inevitable as people who bought Bitcoin at $500 suddenly have windfalls worth millions.

Expert Price Predictions for 2025-2026 (And Why Most Are Wrong)

The Bull Case: $150,000 – $200,000

Cathie Wood (ARK Invest): Maintains a $150,000 base case for 2025, with a bull scenario of $600,000+ by 2030. Her model assumes continued institutional adoption and Bitcoin capturing 5% of global monetary base.

Standard Chartered Bank: Projects $200,000 by end of 2025, citing ETF inflows, halving supply shock, and potential Fed rate cuts as catalysts.

Fundstrat’s Tom Lee: Targets $180,000 for 2025, based on stock-to-flow model adjustments and institutional demand curves.

The Bear Case: $45,000 – $60,000

JPMorgan analysts: Suggest Bitcoin is overvalued relative to gold on a volatility-adjusted basis, predicting a retracement to $60,000 if risk appetite wanes.

Peter Schiff (gold advocate): Continues predicting Bitcoin collapse to $20,000 or lower, though his track record on Bitcoin has been consistently wrong since 2013.

The Realistic Middle Ground

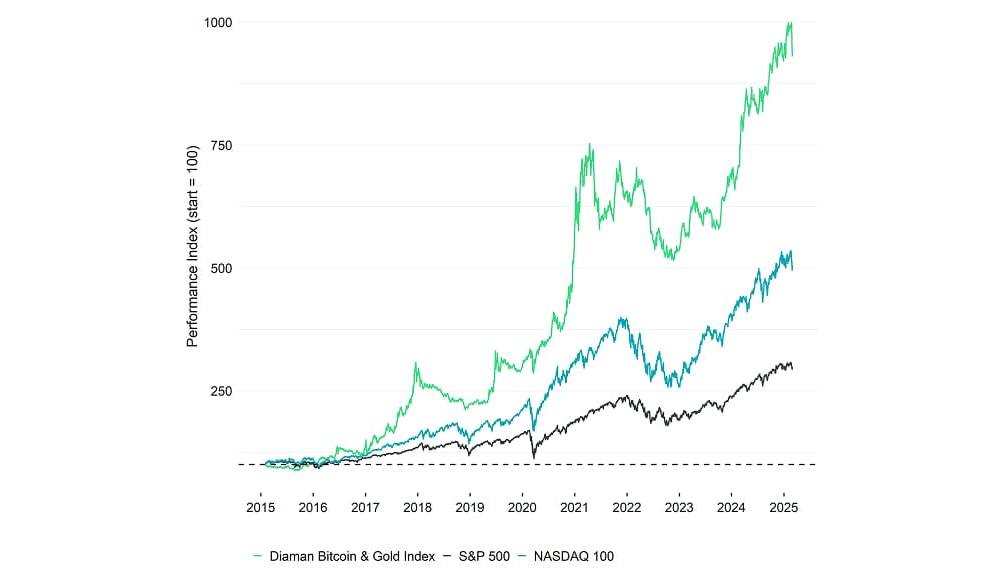

Most credible analysts cluster around $100,000 – $130,000 for Q2 2025, with significant uncertainty beyond that point. Historical cycle analysis suggests diminishing returns with each halving cycle, meaning a 500% gain from cycle lows (like previous cycles) is less likely than 200-300% gains.

The critical factor: Whether institutional buying sustains through a potential correction. If ETFs continue accumulating during dips, price floors should hold higher than previous cycles.

How to Position Your Portfolio for the Next Phase

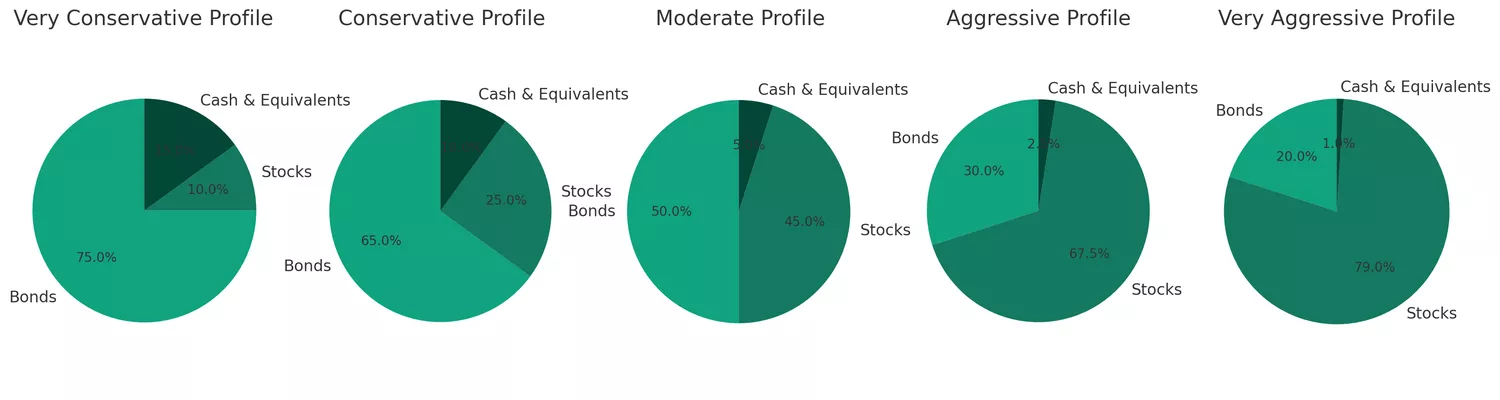

For Conservative Investors (1-3% Bitcoin Allocation)

Strategy: Dollar-cost average through major platforms with lowest fees. Coinbase, Kraken, and Swan Bitcoin offer automated recurring purchases.

Risk management: Only allocate capital you won’t need for 5+ years. Bitcoin remains volatile, with 30-50% corrections common even in bull markets.

Tax considerations: Hold for 12+ months to qualify for long-term capital gains rates (0-20% vs 10-37% for short-term).

For Moderate Investors (5-10% Bitcoin Allocation)

Strategy: Core position in Bitcoin (70-80% of crypto allocation), with selective exposure to Ethereum and high-quality altcoins.

Rebalancing discipline: When Bitcoin reaches new all-time highs, take 10-20% profits and rebalance into bonds or cash. Research from Grayscale shows that quarterly rebalancing improves risk-adjusted returns by 15-25% in crypto portfolios.

Security essentials: Move holdings to hardware wallets (Ledger, Trezor) once you exceed $10,000. Exchange hacks remain a real risk despite improvements.

For Aggressive Investors (15%+ Allocation)

Strategy: Layer in leveraged positions through regulated futures (CME Bitcoin futures) or options strategies, but never risk more than 3-5% of portfolio on leveraged positions.

Advanced tactics:

- Sell covered calls on portion of holdings to generate income during consolidation

- Use cash-secured puts to accumulate more Bitcoin at lower prices during corrections

- Consider Bitcoin mining stocks (MARA, RIOT, CLSK) for leveraged exposure

Warning: According to a Bitwise study, 95% of altcoins eventually fail and go to zero. Stick with top 10 market cap projects if diversifying beyond Bitcoin.

The Regulatory Wild Card: What Washington Might Do

The outcome of the 2024 US presidential election will significantly influence crypto regulation. Both major parties have softened their stances on crypto, recognizing its importance to younger voters and innovation.

Potential regulatory developments through 2026:

- Stablecoin legislation: Bipartisan support exists for regulatory framework, likely passing in 2025

- Market structure clarity: SEC may finally define which tokens are securities vs commodities

- Banking access: Clearer guidance allowing banks to custody crypto assets

- Tax reform: Possible exemption for small transactions (under $200) to enable daily use

According to a recent Coinbase survey, 56% of Americans now believe crypto should be regulated similarly to traditional securities, suggesting mainstream acceptance is accelerating.

Beyond Bitcoin: The Altcoin Landscape

While Bitcoin dominates headlines, Ethereum’s transition to proof-of-stake and the growth of layer-2 scaling solutions (Arbitrum, Optimism, Base) have created new investment opportunities.

Ethereum (ETH): Spot ETFs launched in July 2024, though with less fanfare than Bitcoin. ETH serves as the foundation for DeFi, NFTs, and tokenization – giving it different value drivers than Bitcoin.

Solana (SOL): Emerged as Ethereum’s main competitor with higher throughput and lower fees. However, network outages remain a concern.

The 90/10 rule: For most investors, 90% of crypto allocation should be Bitcoin and Ethereum, with only 10% in speculative altcoins. Data from Messari shows that a simple BTC/ETH 70/30 portfolio outperformed 85% of complex altcoin portfolios over the past 5 years with dramatically lower volatility.

The Bottom Line: Measured Optimism With Eyes Wide Open

Bitcoin’s current rally is built on stronger fundamentals than any previous cycle. Institutional adoption, supply dynamics, and improving regulatory clarity provide genuine tailwinds that weren’t present in 2017 or 2021.

However, euphoria remains the enemy. When your Uber driver starts giving Bitcoin price predictions, when mainstream media publishes “get rich quick” crypto stories, when altcoins with no use case 10x in days – these are signals that the cycle is nearing exhaustion.

Smart investors will:

- Maintain disciplined position sizing (no more than you can afford to lose completely)

- Take profits systematically on the way up

- Keep 6-12 months emergency fund outside of crypto

- Never invest based on social media hype or fear of missing out

- Understand this is a high-risk, high-reward asset class unsuitable for everyone

The question isn’t whether Bitcoin will reach $100,000 – current trajectory suggests it will. The question is whether you have the emotional discipline to hold through 20% corrections, the wisdom to take profits near cycle peaks, and the patience to wait through the inevitable bear market that follows.

Bitcoin has created more millionaires than almost any asset in history. It has also devastated investors who bought at tops and panic-sold at bottoms. Your success will be determined not by Bitcoin’s price, but by your own behavior.

The next 18 months will be thrilling, terrifying, and potentially life-changing. Make sure you’re positioned appropriately for your personal situation, risk tolerance, and financial goals.