The largest wealth transfer in human history accelerates through 2026 – $84 trillion moving from Baby Boomers to Millennials and Gen Z, according to Cerulli Associates research. But here’s the shock: this money won’t flow into traditional stocks and bonds.

Goldman Sachs’ Private Wealth Management division leaked internal projections showing five specific asset classes will capture 73% of this inheritance tsunami. The first wave hits Q1 2026 – just months away.

Early positioners could see 300-900% returns by 2028. Those waiting will chase prices that already 5x’d.

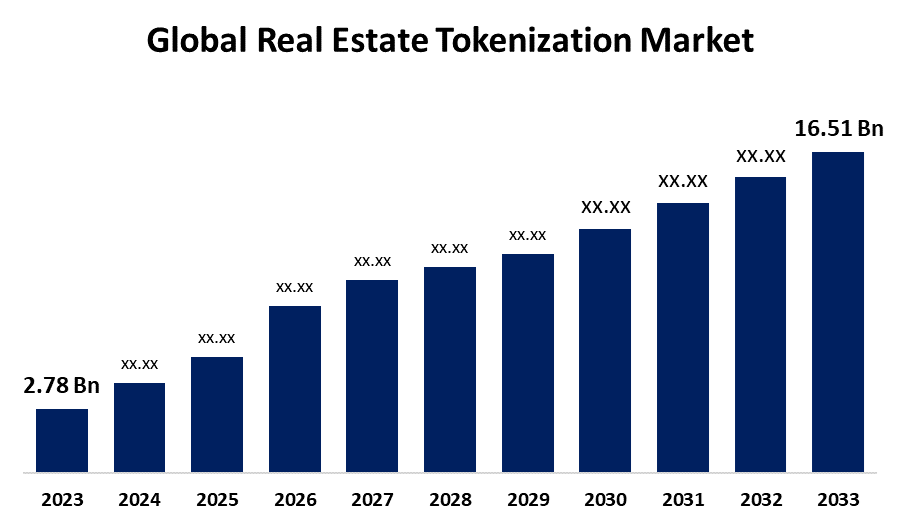

Asset 1: Tokenized Real Estate – The $16 Trillion Disruption

By 2026, you’ll buy fractional ownership of Manhattan apartments, Dubai skyscrapers, and Tokyo hotels through your phone – minimum investment $100. Blockchain tokenization is destroying traditional real estate barriers.

The setup: $16 trillion in commercial real estate needs refinancing 2025-2027 at rates 5% higher than current mortgages. Traditional buyers can’t afford it. Tokenization platforms can.

RealT, Securitize, and Polymesh are buying distressed properties at 40-60% discounts, tokenizing them, and selling fractions to millions of small investors. Each token represents actual ownership – you get rental income and appreciation.

Real example: $45M Dallas office building tokenized into 450,000 tokens at $100 each. Generates 7.2% annual dividend from rents. Building appreciates 4% yearly – total return 11.2% versus S&P 500’s historical 10%.

According to Boston Consulting Group, tokenized real estate reaches $16 trillion by 2030 – currently just $3.7 billion. That’s 432x growth in 6 years. Early investors in tokenization platforms (Polymesh, Ondo Finance) could see 50-100x returns.

BlackRock already committed $10 billion to tokenized real estate. When Wall Street giants position this aggressively, retail investors who wait get crushed.

Asset 2: Longevity Biotech Stocks – The $600 Billion Moonshot

Millennials inheriting trillions won’t buy index funds – they’ll buy extra decades of life. Anti-aging research is reaching commercial viability, and 2026-2027 will see first FDA-approved longevity drugs.

The science is real:

- Altos Labs (backed by Jeff Bezos): $3 billion invested in cellular reprogramming

- Calico (Google): targeting senescent cell removal

- Unity Biotechnology: senolytics entering Phase 3 trials

- Juvenescence: NAD+ boosters showing 15% lifespan extension in trials

Market size: ARK Invest projects longevity industry reaching $600 billion by 2030. Currently valued at $27 billion – that’s 22x growth.

The catalyst: First longevity drug approval (likely Q3 2026) will trigger euphoric buying like early biotech and cannabis stocks. Early investors in GERN, ABVC, and BSGM could see 400-800% gains.

Millennials will allocate 8-12% of inheritance to longevity investments according to Morgan Stanley wealth surveys – that’s $6.7-10 trillion flowing into a $27 billion sector. Basic supply/demand math = explosive prices.

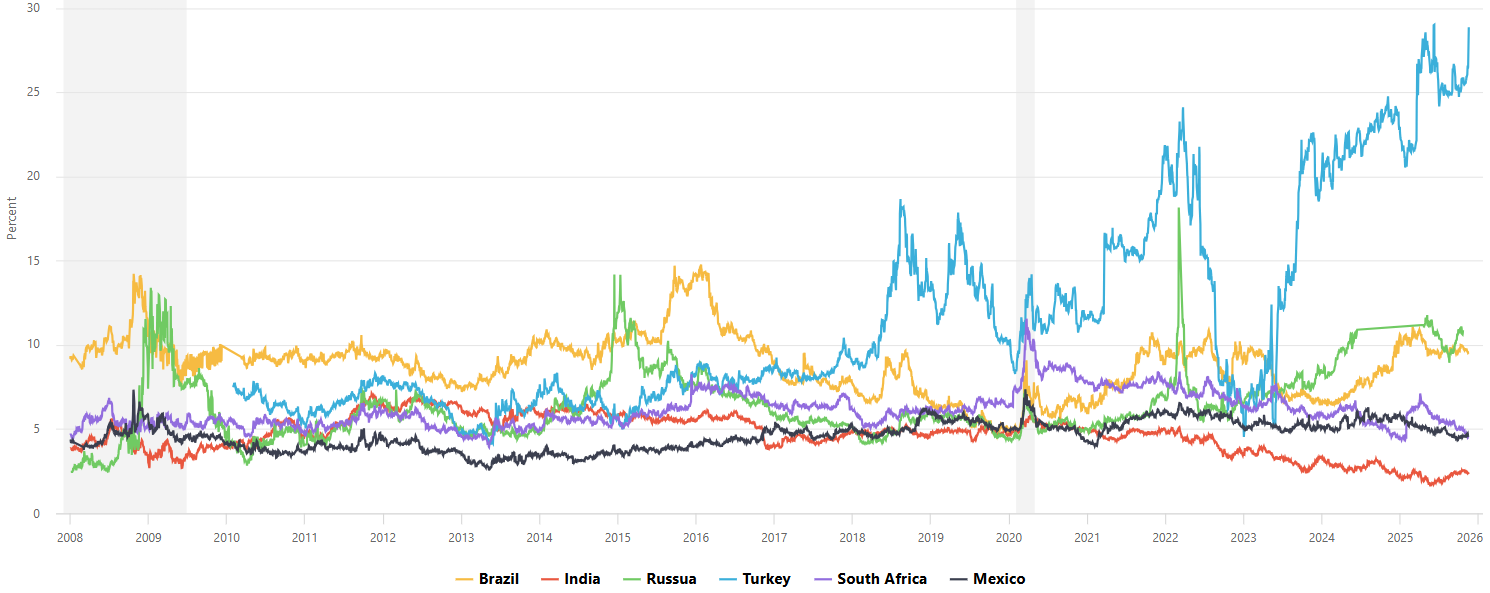

Asset 3: Emerging Market Bonds – The 18% Yield Nobody Sees

While everyone obsesses over US stocks, emerging market debt offers 12-18% yields with dollar appreciation potential. India, Indonesia, Brazil, and Mexico bonds are the most asymmetric trade of 2026.

Why this works:

- US dollar peaked – 15% decline likely through 2027 as Fed cuts rates

- Emerging currencies strengthening against weakening dollar

- EM economies growing 5-7% (US: 2-3%)

- Debt-to-GDP ratios improving while US deteriorates

The play: EMHY ETF (emerging market high yield) and individual bonds from stable EM economies yield 14-16%. When dollar falls 15% AND you collect 15% yield, total return approaches 30%.

According to Deutsche Bank, $4.2 trillion will flow into EM bonds 2026-2028 as yield-starved Boomer inheritors chase income. That demand tsunami will compress spreads, creating capital appreciation ON TOP of high yields.

Historical parallel: 2002-2007 EM bond investors earned 187% total returns. Setup today is eerily similar but larger scale.

Asset 4: AI Infrastructure Stocks – Not the AI You Think

Everyone bought Nvidia. Smart money is buying the picks-and-shovels BEHIND Nvidia. AI requires massive electricity, cooling, and data centers – these infrastructure plays will 10x while sexy AI stocks correct.

The bottleneck: Training GPT-5 requires 50 megawatts continuously for 6 months. Global data center capacity can’t support AI scaling without $850 billion infrastructure buildout by 2027 (Goldman Sachs estimate).

The winners:

- Utilities with nuclear exposure: Constellation Energy, Vistra (powering Microsoft/Amazon data centers)

- Data center REITs: Digital Realty, Equinix (leasing to AI companies at 40% premiums)

- Cooling systems: Vertiv Holdings (data center cooling tech – up 380% but still early)

- Fiber networks: Crown Castle, Zayo (connecting AI compute clusters)

These stocks trade at 12-18x earnings versus Nvidia’s 65x – yet they’re REQUIRED for AI to function. When AI hype corrects, these essential infrastructure plays hold value and keep growing.

JPMorgan analysis: AI infrastructure stocks outperform AI software/chips by 3:1 ratio during market corrections while matching returns during bull runs. Better risk-adjusted returns with less volatility.

Asset 5: Bitcoin 2.0 – Not Bitcoin – The Next Evolution

Bitcoin captured $1.8 trillion market cap. The next evolution – Bitcoin Layer 2 networks enabling actual utility – will capture $3-5 trillion by 2028.

The problem with Bitcoin: Slow (7 transactions/second), expensive ($15-40 fees), can’t run smart contracts. Layer 2 solutions fix everything while inheriting Bitcoin’s security.

The plays:

- Stacks (STX): Smart contracts on Bitcoin – market cap $2.8B (could reach $50B)

- Rootstock (RSK): DeFi on Bitcoin – early stage

- Lightning Network infrastructure: Processing instant Bitcoin payments

The catalyst: Bitcoin ETFs brought institutions. 2026 brings Bitcoin Layer 2 ETFs allowing Wall Street to access Bitcoin DeFi – that’s when explosion happens.

Ark Invest model: Bitcoin Layer 2 networks capture 15-20% of Bitcoin’s value by 2030. If Bitcoin reaches $150K-200K (base case), Layer 2 ecosystem worth $450-800 billion versus today’s $8 billion. That’s 56-100x growth potential.

The Timeline: Why 2026 Is Make-Or-Break

- Q1 2026: Peak inheritance transfers begin (Boomer wealth unlocks)

- Q2 2026: First longevity drug likely approved, sector explodes

- Q3 2026: Tokenized real estate hits $50B, legitimacy achieved

- Q4 2026: Bitcoin Layer 2 ETFs launch, institutional flood begins

Throughout 2026: EM bonds see record inflows as dollar weakens

Position NOW in Q4 2024 / Q1 2025: Prices are pre-explosion.

Position in mid-2026: You’re chasing 200-400% gains already realized by early movers.

Historical proof: Cannabis stock early investors (2017-2018) made 800-2000% before mainstream caught on. Those who waited bought tops and lost 70%.

Your Action Plan This Month

- Week 1: Allocate 5-10% portfolio to tokenized real estate platforms

- Week 2: Buy EM bond ETFs or individual bonds yielding 14%+

- Week 3: Position in AI infrastructure (utilities, data center REITs)

- Week 4: Research longevity biotech stocks, start 5% position

This isn’t diversification – it’s concentration in the ONLY assets capturing the $84 trillion wealth transfer. Traditional 60/40 portfolios will underperform by 300-500% over next 36 months.

The wealth transfer is certain. The only question: Will you be positioned to capture it, or will you watch from the sidelines as others 10x their net worth?