Stop Losing Money – Why Your First Crypto Exchange Choice Matters

The cryptocurrency market is complex, but buying your first Bitcoin shouldn’t be.

Most beginners in the US make a critical mistake: choosing the easiest, most advertised platform without looking at the long-term costs. A difference of just 1% in fees can cost you thousands of dollars over your first year of investing.

Worse, choosing an exchange with weak security can wipe out your entire portfolio overnight.

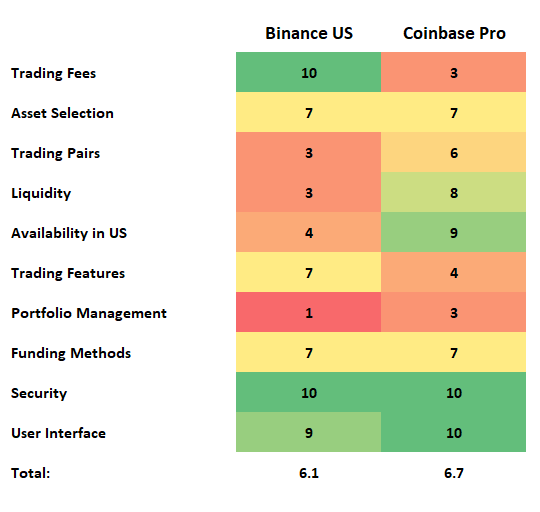

As seasoned financial analysts, we’ve dissected the top US-regulated crypto exchanges. We ranked them based on a beginner’s needs: security, ease of use, regulatory compliance, and most importantly, low fees.

This guide cuts through the noise. We show you the 7 best platforms to get started and which one is the absolute cheapest and safest choice for your first $1,000 investment.

The 7 Best Crypto Exchanges for US Beginners: Quick Comparison

We selected these platforms based on US regulatory status, liquidity, and verified security measures. Fees listed reflect the standard taker fee for trades under $10,000.

| Exchange | Best For | Spot Trading Fee (Taker) | Ease of Use | US Regulatory Status | Affiliate Link Action |

| Coinbase | Easiest Interface | 0.60% (Pro: 0.40%) | 5/5 | Excellent | Open Coinbase Account |

| Kraken | Low Fees & Security | 0.26% (Pro: 0.10%) | 4/5 | Strong | Trade with Kraken |

| Binance.US | Asset Selection | 0.60% (Lower with BNB) | 3/5 | Fair | Explore Binance.US |

| Gemini | High Security/Insurance | Up to 1.49% (High) | 4/5 | Excellent | Check Gemini Fees |

| Crypto.com | Mobile/Credit Card Use | 0.40% | 4/5 | Moderate | Sign Up for Crypto.com |

| eToro | Social/Copy Trading | 1.00% (Spread fees) | 5/5 | Excellent | Start Copy Trading |

| Uphold | Multi-Asset Bridge | 0.90% (Includes Spread) | 3/5 | Fair | View Uphold Platform |

Detailed Analysis: Top 3 Exchanges for Beginners

These three platforms represent the safest and most balanced entry points for any new US investor.

1. Coinbase: The Easiest Entry Point

Coinbase is the most trusted and regulated gateway to crypto in the US. They prioritize compliance and simplicity, making them the default choice for first-time buyers.

- Pros:

- Regulatory Status: Publicly traded (NASDAQ: COIN). Highest trust level.

- Interface: Unbeatable ease of use. Buying Bitcoin is as simple as ordering on Amazon.

- Insurance: Holds extensive crime insurance.

- Cons:

- Fees: Standard purchasing fees (2.0% ACH, 3.99% Card) are high. Crucial Tip: Use Coinbase Advanced (formerly Coinbase Pro) for much lower fees (0.40% or less).

- Verdict: If safety and simplicity are your primary concerns, start here. But ensure you switch to the “Advanced” trading interface immediately to avoid paying crippling fees.

Don’t pay the high standard fees. Sign up now and learn to use the “Advanced” interface.

Open Coinbase Account & Access Lower Fees

2. Kraken: The Low-Fee Security Champion

Kraken is frequently praised by security experts for its rigorous cold storage policies and long history without a major security breach. It’s the perfect step-up once you understand the basics.

- Pros:

- Lowest Fees: Taker fees start at 0.26% and go down fast for higher volumes. Significantly cheaper than Coinbase’s standard rate.

- Security: Excellent cold storage practices and proof-of-reserves audits.

- Staking: Offers competitive on-platform staking rewards. (Internal Linking to M6) If you want to put your assets to work, check out our guide on the Best Crypto Staking Platforms to maximize your passive income.

- Cons:

- Interface: Slightly less intuitive than Coinbase for absolute beginners; the platform is clearly designed for traders.

- Verdict: Highly recommended for the beginner who is serious about security and wants to maximize their portfolio growth by minimizing costs.

Ready to save on fees? Kraken offers a professional, safe environment for less.

Trade with Kraken – Start Saving on Fees

3. Binance.US: Best for Asset Variety

Binance.US is the US-regulated arm of the global Binance exchange. It offers the widest range of tradable assets among major US platforms.

- Pros:

- Asset Selection: Deep liquidity and a vast number of coins available to trade.

- BNB Discounts: If you hold Binance Coin (BNB), you get automatic fee discounts.

- Cons:

- Regulatory Hurdles: Has faced significant scrutiny from US regulators, making its long-term future slightly less certain than Coinbase or Kraken.

- Complexity: The platform is overwhelming for brand new users.

- Verdict: A great secondary exchange once you are comfortable and want to explore smaller-cap coins not listed elsewhere. It should not be your first choice due to the regulatory cloud and complex interface.

How to Choose Your First Crypto Exchange – The 3 Non-Negotiables

Choosing the right platform is simple if you prioritize these factors:

1. Security & Regulation (The Lifeboat)

In crypto, if an exchange goes bankrupt or is hacked, your funds are usually gone.

- US Compliance: Look for exchanges registered with FinCEN (Financial Crimes Enforcement Network). Publicly traded companies (like Coinbase) are held to the highest standard.

- Cold Storage: The exchange must hold the vast majority of customer assets offline in “cold storage.” This is the single biggest safety measure.

2. Fees (The Wealth Destroyer)

Beginners are often hit with two types of high fees:

- Credit/Debit Card Purchase Fees: These are usually 3.5% to 4.5%. AVOID THEM.

- Spread Fees: Hidden costs where the exchange marks up the price.

- Solution: Always use ACH bank transfers (free or low-cost) and use the exchange’s “Advanced/Pro” trading interface to access maker/taker fees (typically under 0.5%).

3. Ease of Use (The Time Saver)

A complex interface can lead to expensive mistakes, like accidentally buying at the market rate instead of setting a limit order.

- Good UI: Coinbase and eToro are top-tier here.

- Complexity: Kraken and Binance.US require a sharper learning curve, but the reward is lower fees.

Beginner Strategy: Don’t Trade, Accumulate

The best thing a beginner can do is adopt a long-term accumulation strategy. This means buying a fixed amount of Bitcoin or Ethereum regularly, regardless of the price. This strategy is called Dollar-Cost Averaging (DCA).

(E20) Learn how to implement this slow, reliable strategy in our comprehensive guide: A Guide to Dollar-Cost Averaging (DCA) into Bitcoin. DCA is proven to outperform attempts at market timing.

Ready to start accumulating? Choose an exchange with low fees and a secure track record.

Compare and Sign Up with the Top 3 Exchanges

The Best Choice for Your First Trade

Choosing the right exchange is your first and most important investment decision.

For pure simplicity and regulatory trust, Coinbase is the safest starting line. However, if you are prepared to handle a slightly steeper learning curve to save significantly on fees, Kraken offers a superior long-term fee structure.

(M5) Ultimately, the best choice depends on your trading volume. For a detailed breakdown of which platform wins the fee battle at your specific investment level, view our full fee comparison guide.

Start smart. Start safe. Start now.

Financial Disclaimer

This content is for informational and educational purposes only and does not constitute financial or investment advice. Cryptocurrencies are highly volatile and carry a significant risk of loss. Always consult with a qualified financial professional before making investment decisions. Past performance is not indicative of future results.

Pingback: How to Set Up MetaMask Wallet Correctly: Complete Security