Best Crypto Staking & Earn Platforms 2025: Maximize Your APY Safely

The Primary Risk: The highest APY often comes with the highest risk of platform collapse. Custodial risk is your greatest enemy.

Safest (Low APY): Staking directly on regulated exchanges like Kraken or Coinbase offers the highest peace of mind.

Best Non-Custodial Yield (High Risk/Reward): Using Decentralized Finance (DeFi) platforms like Aave or Compound requires self-custody (Ledger/Trezor).

ACTION: For most US investors, starting with Kraken’s highly liquid staking program offers the best entry point for passive income.

Don’t Let Your Crypto Sit Idle: The Power of Passive Income

If your cryptocurrency is simply sitting in a spot wallet on an exchange, you are missing out on one of the greatest advantages of digital assets: the ability to generate yield. In traditional finance, earning 5% interest is considered excellent; in crypto, double-digit APY is often possible.

However, the collapse of multi-billion dollar firms like Celsius and BlockFi proved a harsh lesson: high yield demands high risk.

As analysts, we guide you away from speculative schemes and toward platforms that prioritize transparency, liquidity, and compliance, allowing you to maximize returns without risking a total loss.

Quick Comparison: Safest Yield Platforms (Custodial vs. Non-Custodial)

| Platform | Type | Best For | Max APY (Approx.) | Custodial Risk |

| 1. Kraken Staking | Centralized Exchange | Exchange-Based Staking | 4% – 12% | Low (Regulated Exchange) |

| 2. Coinbase Staking | Centralized Exchange | Easiest to Use | 3% – 5% | Low (Publicly Traded) |

| 3. Nexo | Centralized Lending | High APY on Fiat/Stablecoins | 8% – 10% | High (Lending Counterparty) |

| 4. Aave (DeFi) | Decentralized (DEX) | Non-Custodial Yield | Variable (3% – 15%) | Smart Contract Risk |

| 5. Crypto.com Earn | Centralized Exchange | Variety of Locked Terms | 1% – 8% | Medium (Higher Counterparty Risk) |

1. Kraken Staking: Secure and Liquid Staking

Kraken offers one of the most trusted staking programs in the industry. Staking is the process of locking up coins (like ETH, SOL, ADA) to help secure a blockchain, and in return, you earn rewards.

- Key Advantage: Unlike many platforms, Kraken offers high liquidity on some staked assets, meaning you might be able to unstake and trade quickly if needed.

- Highest APY: You can earn up to 12% on popular assets like Polkadot (DOT).

- Safety: Being a highly regulated, top-tier exchange, Kraken is the safest choice for beginners entering the staking world.

- Make your crypto work for you. Start earning up to 12% APY with Kraken’s trusted staking program.

Start Staking on Kraken Pro

2. Coinbase Staking: Simplicity is the Key

Coinbase makes staking easy. If you hold Ethereum, you can stake it directly through the Coinbase app with a few taps. While their fees (often taking 25% of your rewards) are higher than Kraken, the simplicity is unmatched for absolute beginners.

- Easiest On-Ramp: The absolute smoothest way for a US user to convert fiat to staking rewards.

- Safety: Backed by the reputation of a NASDAQ-listed company.

3. Nexo: A Leading Centralized Lender

Nexo is one of the oldest and most resilient crypto lending platforms. They offer high APY on stablecoins (like USDC/USDT) and fiat currencies.

- High Stablecoin Yield: Nexo often provides the best rates for stablecoins, making it ideal for risk-averse investors looking for dollar-pegged returns.

- Risks: Nexo uses customer funds for institutional lending, creating counterparty risk. Understand their insurance and collateral policies fully.

- Maximize stablecoin returns. Earn top APY on your cash and stablecoins with Nexo.

Open Nexo Account and Start Earning

4. Aave and Compound: The DeFi Yield Giants

For maximum decentralization and non-custodial yield, you must turn to DeFi protocols like Aave and Compound. You lend your crypto directly to the protocol via a smart contract, cutting out the middleman.

- Non-Custodial: You control your funds at all times (via your Ledger/Trezor).

- Risk: Smart Contract Risk. If the code is exploited, your funds could be lost.

To access these platforms safely, you need a hardware wallet. Review our guide on Best No-KYC Crypto Exchanges for details on accessing DeFi.

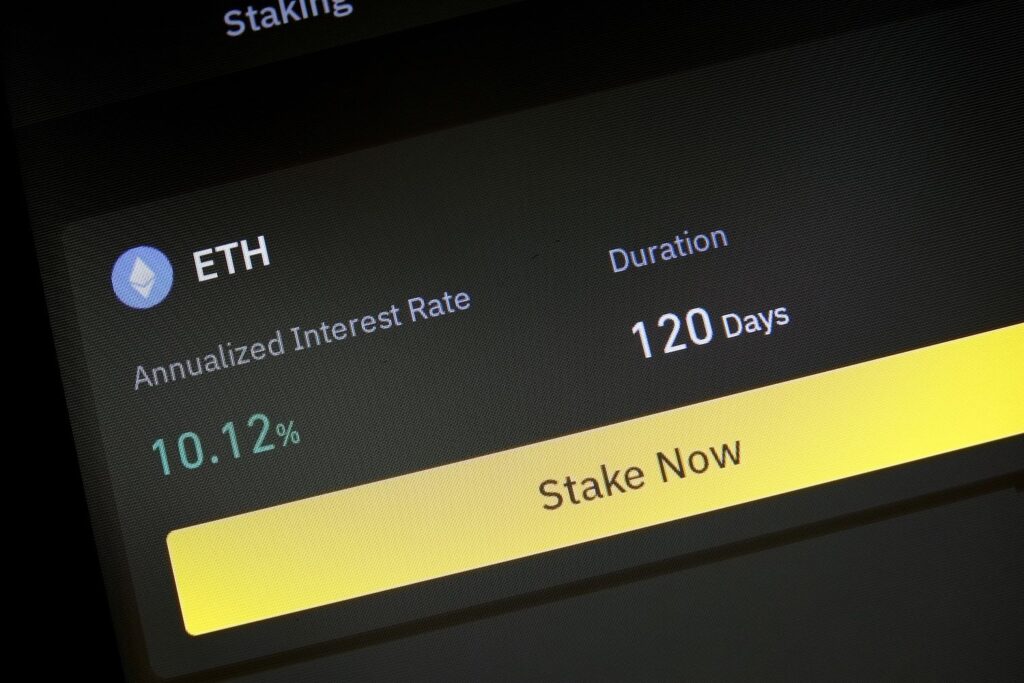

5. Crypto.com Earn: Variety with Term Locks

Crypto.com offers an “Earn” feature with various lock-up periods (1 month, 3 months, flexible). The longer you lock your funds, the higher the APY.

- Flexibility: Great for managing liquidity.

- Bonus: Users who stake CRO (Crypto.com’s native token) receive boosted APY rates.

Mitigating the Risks of Yield Hunting

The failures of 2022 taught us two lessons:

Custodial Risk vs. Non-Custodial Risk

- Custodial (Exchanges/Lenders): You risk the company going bankrupt. (e.g., Celsius, BlockFi).

- Non-Custodial (DeFi): You risk the smart contract being hacked. (e.g., Aave, Compound).

- Solution: Diversify your risk across multiple low-risk platforms and never risk more than you can afford to lose.

Proof of Reserves (PoR)

Always check if a centralized platform publishes Proof of Reserves. Kraken is a leader in this, providing regular audits that verify they actually hold the crypto they claim to. This is crucial for trust.

(E12) Learn how to protect your assets in our guide: The Ultimate Crypto Security Checklist.

Start Earning Smart, Not Hard

Passive income from crypto is a powerful tool for wealth creation, but it must be approached with a professional, risk-mitigating mindset.

For beginners, Kraken Staking is the safest bridge between security and high yield. If you are already highly diversified and want aggressive stablecoin APY, Nexo is the top choice.

Don’t let inflation erode your capital. Put your crypto to work today.

Start Earning Passive Income Securely:

-

For Trusted Staking: Kraken Pro

-

For High Stablecoin APY: Nexo

-

For Easiest DeFi Access: Ledger Nano X

Financial Disclaimer

This content is for informational and educational purposes only and does not constitute financial or investment advice. Crypto lending/staking involves high risk, including the potential loss of principal. Assets lent or staked are generally NOT FDIC-insured. Always understand the risks before committing funds.