Proof of Work vs. Proof of Stake: Why It Matters for Investors

By Thomas Wright

Senior Financial Analyst | 12+ Years Wall Street Experience

- Last Updated: December 8, 2025

- Data Verified: December 7, 2025

- Reading Time: 14 minutes

In September 2022, Ethereum switched from Proof of Work to Proof of Stake. This was called “The Merge.”

I watched institutional investors lose their minds trying to understand what this meant for their multi-million dollar ETH positions. Was it more valuable now? Less valuable? Different risk profile?

Most crypto “explainers” talk about PoW vs. PoS in terms of technology and environmental impact. That’s fine for computer science students.

But you’re an investor. You want to know: How does this affect my money?

After managing portfolios through The Merge and analyzing both consensus mechanisms for years, here’s what actually matters:

- Which one generates better returns?

- Which has lower risk?

- How does each affect inflation and token supply?

- What are the regulatory implications?

- Where should you allocate capital?

This isn’t a technical deep-dive. This is an investor’s guide to understanding why the consensus mechanism matters to your portfolio returns.

Full disclosure: I hold both PoW assets (Bitcoin) and PoS assets (Ethereum, Solana, Cardano). This article contains affiliate links – see our disclosure policy for details.

The Core Question: What Problem Are They Solving?

Before we compare PoW and PoS, understand the fundamental problem blockchain networks face:

How do you get thousands of strangers to agree on the truth without a central authority?

In traditional finance:

- Banks verify transactions (they’re the authority)

- Visa processes payments (central ledger)

- The Fed controls money supply (central issuer)

In crypto, there’s no central authority. So how do you prevent:

- Someone spending the same Bitcoin twice (double-spending)?

- Bad actors corrupting the transaction history?

- Disagreement about which transactions are valid?

You need a consensus mechanism – a system where the network collectively agrees on truth.

Both PoW and PoS solve this problem. They just use completely different approaches.

The approach determines: cost, speed, security, token economics, and your investment returns.

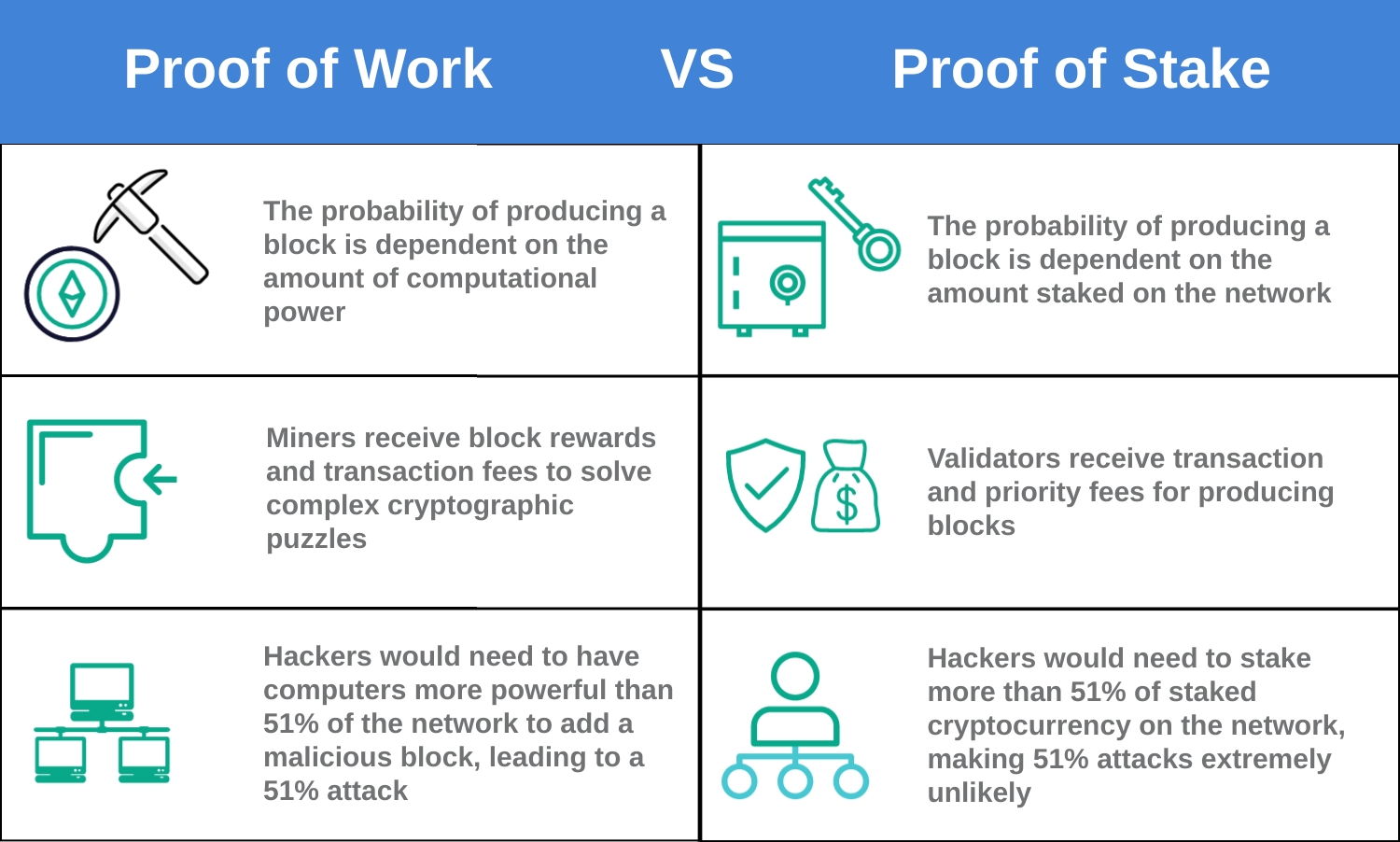

Proof of Work (PoW): Security Through Energy

How It Works (Simplified)

The concept: To add transactions to the blockchain, you must solve an extremely difficult math puzzle. Solving it requires massive computational power (and electricity).

The process:

- Miners compete to solve the puzzle

- First one to solve it gets to add the next block of transactions

- Winner receives newly minted coins + transaction fees as reward

- Other miners verify the solution (easy to verify, hard to solve)

- Process repeats every 10 minutes (Bitcoin) or faster for other chains

Why this works:

Attacking the network requires controlling 51% of computing power. That would cost billions in hardware and electricity – far more than you’d gain from attacking.

It’s economically irrational to attack because the attack itself is more expensive than the potential reward.

Key characteristics:

- Energy intensive: Bitcoin mining uses ~150 TWh per year (roughly equivalent to Argentina)

- Hardware intensive: Requires specialized ASIC miners ($3,000-$12,000 each)

- Decentralized: Anyone can participate (though mining pools dominate)

- Proven: 16 years of Bitcoin operation with no successful 51% attacks

Major PoW Blockchains

Bitcoin (BTC):

- The original, launched 2009

- Most secure PoW network by far

- ~$1.2 trillion market cap (Dec 2025)

Litecoin (LTC):

- “Silver to Bitcoin’s gold”

- Faster blocks (2.5 min vs. 10 min)

- Less hash power = less secure

Dogecoin (DOGE):

- Originally a joke, now legitimately used

- Merge-mined with Litecoin

- High inflation (5 billion new DOGE per year)

Monero (XMR):

- Privacy-focused PoW

- ASIC-resistant (can mine with regular computers)

- Niche but dedicated use case

Ethereum Classic (ETC):

- Original Ethereum chain after the DAO hack split

- Much smaller than Ethereum, higher 51% attack risk

Proof of Stake (PoS): Security Through Financial Commitment

How It Works (Simplified)

The concept: To validate transactions, you must “stake” (lock up) a large amount of the cryptocurrency. If you behave dishonestly, you lose your stake.

The process:

- Validators lock up coins (32 ETH for Ethereum, varies by chain)

- Network randomly selects validators to propose new blocks

- Other validators verify and vote on the proposed block

- Honest validators earn rewards (new coins + fees)

- Dishonest validators get “slashed” (lose their staked coins)

Why this works:

Attacking the network requires owning 51% of all staked coins. If you own that much, attacking would crash the coin price – destroying the value of your own holdings.

It’s economically irrational because you’d be attacking your own wealth.

Key characteristics:

- Energy efficient: 99.95% less energy than PoW (Ethereum’s reduction)

- No hardware needed: Just the coins themselves

- Passive income: Stakers earn 4-15% APY depending on network

- Barrier to entry: Need significant capital (32 ETH = ~$80,000)

Major PoS Blockchains

Ethereum (ETH):

- Switched to PoS in September 2022 (“The Merge”)

- ~$450 billion market cap (Dec 2025)

- 4-5% staking rewards

Cardano (ADA):

- Built as PoS from day one

- Academic research-driven approach

- 5% staking rewards

Solana (SOL):

- High-performance PoS chain

- 1,000+ transactions per second

- 7% staking rewards

Polkadot (DOT):

- Multi-chain PoS platform

- 10-14% staking rewards

- More complex staking mechanism

Avalanche (AVAX):

- Fast PoS consensus

- 8-11% staking rewards

- Growing DeFi ecosystem

If you want to stake these coins, here’s where to do it safely with the best returns.

The Investment Comparison: What Actually Matters

Forget the environmental debates. Let’s talk returns, risks, and portfolio allocation.

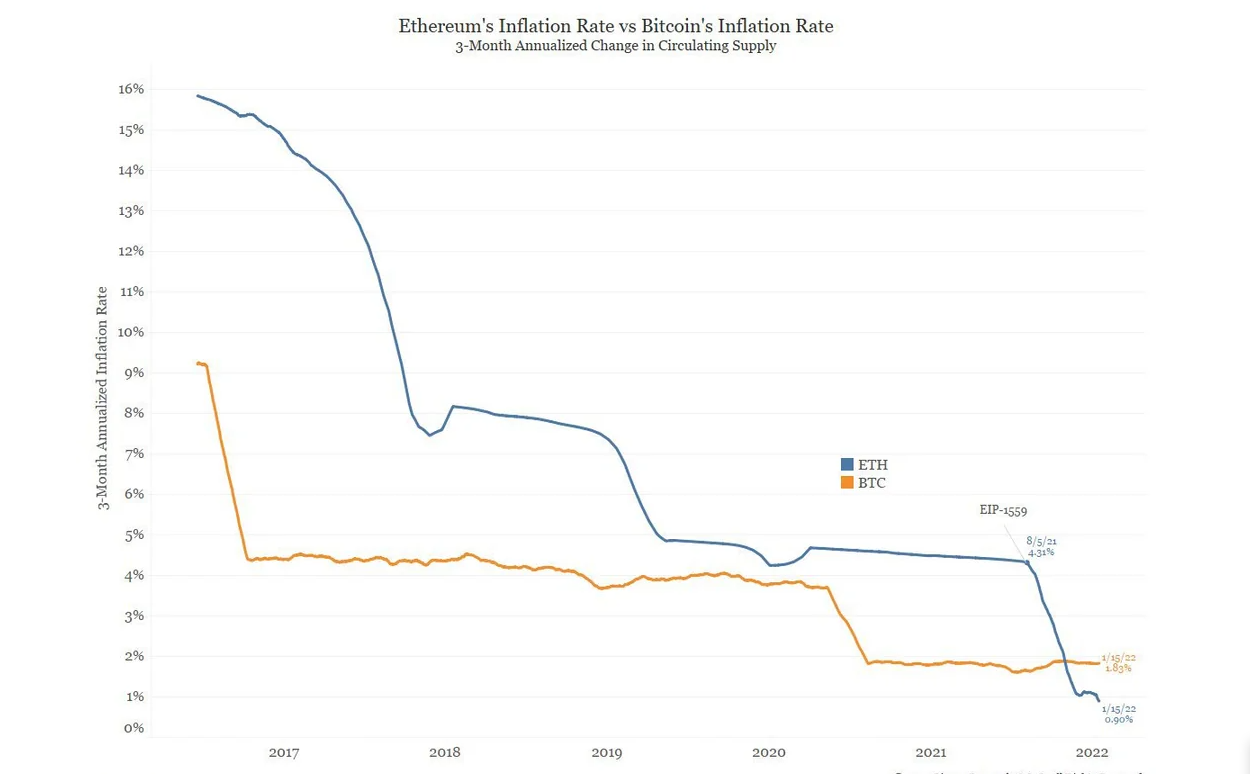

Factor 1: Token Supply and Inflation

PoW (Bitcoin example):

- Fixed supply: 21 million BTC, ever

- Halving events: Mining rewards cut in half every 4 years

- Current inflation: ~1.7% per year (as of 2025)

- Future inflation: Approaches 0% by 2140

Investment thesis: Scarce, deflationary asset. As fewer coins are produced, assuming constant or growing demand, price should increase.

This is why Bitcoin is compared to gold – fixed supply creates scarcity value.

PoS (Ethereum example):

- No hard cap: Unlimited total supply (but controlled)

- Issuance: ~0.5% new ETH per year to stakers

- Burn mechanism: Transaction fees are destroyed (since EIP-1559)

- Net result: Often deflationary (-0.2% to -0.5% depending on network usage)

Investment thesis: Low inflation, potentially deflationary during high usage. Less “digital gold” narrative, more “productive asset” yielding returns.

Which is better?

PoW is better if: You want the purest scarcity model. Bitcoin’s fixed 21M is easier to explain to traditional investors.

PoS is better if: You want yield on your holdings. Ethereum stakers earn 4-5% APY passively, Bitcoin holders earn 0%.

My allocation: 60% Bitcoin, 30% Ethereum, 10% other PoS. I want the scarcity of PoW but also the yield from PoS.

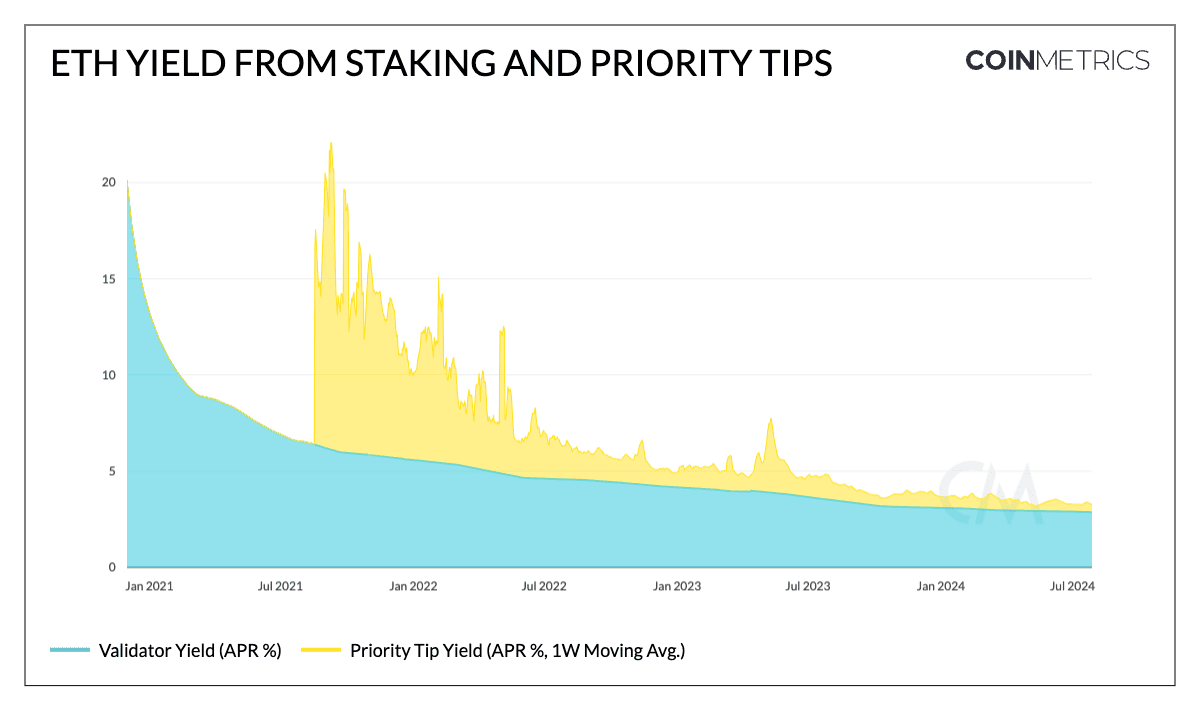

Factor 2: Returns and Yield

PoW returns come from:

- Price appreciation only

- You hold and hope value increases

PoS returns come from:

- Price appreciation

- Staking rewards (4-15% APY)

- Compounding if you reinvest rewards

Real example from my portfolio:

Bitcoin (2020-2025):

- Bought at $10,000 average

- Sold none, held entire time

- Current value: ~$95,000 (850% gain)

- No yield earned

Ethereum (2020-2025):

- Bought at $400 average

- Staked starting Sept 2022

- Current value: ~$2,500 (525% gain)

- Earned 12 ETH in staking rewards (~$30,000)

- Total return: 600%+ including yield

Ethereum underperformed Bitcoin in price action but the staking rewards closed the gap significantly.

The math for long-term holders:

If you hold for 10 years:

- PoW: Your return is purely price appreciation

- PoS: Your return is price appreciation + 4-15% compounded annually

Even if PoS coins appreciate slightly less, the yield makes up for it.

Learn more about staking mechanics here – not all staking is equal.

source: coinmetrics

Factor 3: Risk Profile

PoW risks:

Centralization of mining:

- 4-5 major mining pools control 51%+ of Bitcoin hash power

- They could theoretically collude (though economically irrational)

- Geographic concentration (China had 65% until 2021, now US has ~40%)

Energy costs:

- Miners can be forced to shut down during energy crises

- Regulatory pressure on energy consumption

Hardware obsolescence:

- ASIC miners become outdated every 2-3 years

- Mining profitability fluctuates with difficulty and price

PoS risks:

Wealth concentration:

- Largest stakers earn the most rewards

- “Rich get richer” dynamic over time

- Top 10 validators can have outsized influence

Slashing risk:

- If your validator misbehaves (even accidentally), you lose staked coins

- Running your own validator requires technical expertise

Smart contract risk:

- PoS consensus often involves more complex code

- More attack surface than simple PoW

Regulatory risk:

- Some argue PoS tokens resemble securities (staking = earning “dividends”)

- SEC has been ambiguous but concerning

My assessment:

Both are secure for top-tier assets (Bitcoin, Ethereum). Smaller PoW chains get 51% attacked regularly (Ethereum Classic, Bitcoin Gold). Smaller PoS chains have been exploited via validator manipulation.

Stick to the top 2-3 in each category. Don’t chase 50% staking yields on random PoS chains – that’s how you get rugged.

Factor 4: Transaction Speed and Costs

PoW characteristics:

- Slow: Bitcoin processes ~7 transactions per second

- Expensive during congestion: $5-50 per transaction

- Finality: Takes 6 confirmations (60 minutes) for full security

PoS characteristics:

- Fast: Ethereum does ~30 TPS, Solana does 1,000+ TPS

- Cheaper: Ethereum post-Merge: $1-5 per transaction, Solana: $0.0001

- Finality: Ethereum: 15 minutes, Solana: seconds

Why investors care:

If you’re actively trading or using DeFi, PoS chains are vastly superior. Lower fees mean more of your capital working, not paying miners.

If you’re buying and holding for years, speed doesn’t matter.

I hold Bitcoin for long-term wealth storage. I use Ethereum/Solana for active trading and DeFi activities.

Factor 5: Regulatory Treatment

The SEC’s current stance (as of Dec 2025):

Bitcoin (PoW): Definitively classified as a commodity, not a security. The SEC chair has stated this explicitly.

Result: Lower regulatory risk. ETFs approved. Institutional adoption growing.

Ethereum (PoS): Ambiguous. Some SEC officials have hinted PoS tokens might be securities because staking resembles “investment contracts.”

Result: Higher regulatory uncertainty. No clear exemption like Bitcoin.

Why this matters:

If the SEC classifies PoS tokens as securities:

- Exchanges might delist them (for US customers)

- Staking platforms could face enforcement

- Tax treatment could change

- Institutional adoption would slow

I’m not saying it will happen. But it’s a risk Bitcoin doesn’t have.

My hedge: Keep majority allocation in Bitcoin (regulatory clarity), smaller positions in PoS assets (higher risk but higher yield).

Environmental Debate: Does It Matter for Returns?

Let’s address the elephant in the room: PoW uses massive energy. PoS doesn’t.

The criticism:

Bitcoin mining uses more electricity than entire countries. This is unsustainable and morally wrong.

The counter-argument:

- 60%+ of Bitcoin mining uses renewable energy (hydroelectric, solar)

- Miners seek the cheapest energy (often excess/wasted energy)

- Gold mining uses far more energy and causes physical environmental damage

- Banking system (buildings, servers, transportation) uses more energy than Bitcoin

My take as an investor:

Environmental impact affects perception, which affects adoption, which affects price.

Negative ESG perception hurts Bitcoin with:

- Institutional investors with ESG mandates (many can’t touch Bitcoin)

- Retail investors who prioritize sustainability

- Regulators looking for reasons to restrict crypto

This is why Ethereum’s switch to PoS was strategically brilliant.

Post-Merge, Ethereum’s energy usage dropped 99.95%. This:

- Opened doors to ESG-focused investors

- Reduced regulatory attack surface

- Improved public perception

Investment impact:

Did The Merge cause Ethereum to outperform Bitcoin? No. Bitcoin is still up more since Sept 2022.

But did it prevent Ethereum from underperforming worse due to ESG concerns? Probably.

Environmental criticism is a headwind for PoW coins. Not fatal, but real.

The Tax Implications (Often Overlooked)

PoW Mining:

If you mine Bitcoin, the rewards are ordinary income at fair market value when received.

Example:

- You mine 0.1 BTC when BTC = $40,000

- You report $4,000 ordinary income (taxed like your salary)

- Your cost basis in that 0.1 BTC is $4,000

- When you sell later, you pay capital gains on the difference

PoS Staking:

Same treatment. Staking rewards are ordinary income when received.

Example:

- You stake ETH and earn 0.5 ETH in rewards when ETH = $2,000

- You report $1,000 ordinary income

- Cost basis in that 0.5 ETH is $1,000

- Later sale is subject to capital gains

The problem:

Both get taxed twice – once as income when received, once as capital gains when sold.

But PoS is worse for small holders because rewards accrue constantly. You might earn $50 per month in staking rewards, owing income tax on $600/year, even if you never sold anything.

If the coin crashes before you sell, you owe tax on income you “made” but never realized in cash.

My recommendation:

Use crypto tax software that tracks staking automatically. Manually calculating hundreds of small staking deposits is a nightmare.

Also, consider the tax burden when choosing staking platforms. Higher yield isn’t better if taxes eat 30-40% of it.

Full breakdown of crypto taxes here

Which Should You Invest In?

The binary choice is wrong.

You don’t choose PoW OR PoS. You allocate to both based on goals.

My Framework:

Allocate to PoW (Bitcoin) if you want:

- Maximum scarcity (fixed 21M supply)

- Lowest regulatory risk (commodity classification)

- “Digital gold” narrative

- No staking complexity

- 16-year proven security track record

Allocate to PoS (Ethereum, Solana, etc.) if you want:

- Passive income (4-15% staking yields)

- Lower transaction fees for active use

- Faster transaction finality

- Better ESG profile

- Exposure to smart contract platforms and DeFi

My Personal Allocation (As of Dec 2025):

- 60% Bitcoin (PoW): Core holding, long-term wealth storage

- 30% Ethereum (PoS): Staked for yield, used for DeFi

- 7% Other PoS (Solana, Avalanche): Higher risk/reward plays

- 3% Cash/Stablecoins: Dry powder for opportunities

Rationale:

Bitcoin is my anchor. It’s the most decentralized, most secure, most widely recognized crypto asset. If only one survives long-term, it’s BTC.

Ethereum gives me yield and utility. I can stake it, use it in DeFi, and benefit from the broader smart contract ecosystem.

Smaller PoS positions are higher risk but offer 8-12% staking yields and exposure to faster, cheaper networks.

What I don’t do:

- Chase 50%+ APY on random PoS chains (those are ponzis)

- Ignore PoW entirely because of environmental concerns

- Go all-in on PoS for the yield (regulatory risk too high)

- Invest in PoW coins other than Bitcoin (they’re mostly dead)

Common Misconceptions Debunked

Myth 1: “PoS is less secure than PoW”

Reality: Both are secure when implemented correctly on large networks.

Bitcoin’s security comes from billions in hardware and electricity costs. Ethereum’s security comes from tens of billions in staked ETH.

Both make attacks economically irrational.

Smaller networks of both types are vulnerable (Ethereum Classic gets 51% attacked, small PoS chains get validator collusion).

Security scales with network size, not consensus mechanism.

Myth 2: “PoW is outdated technology”

Reality: PoW is simpler, more battle-tested, and arguably more decentralized.

The simplicity is a feature. Fewer things can go wrong. Bitcoin’s code has barely changed in 16 years because it works.

PoS is more complex (validators, slashing, delegation). Complexity creates attack surface.

“Outdated” implies something better replaced it. That’s arguable.

Myth 3: “PoS will make you rich from staking rewards”

Reality: 4-7% APY is nice but not life-changing.

If you stake $10,000 ETH at 5% APY, you earn $500 per year. After taxes (~30%), that’s $350.

It’s meaningful over decades, but it’s not “passive income for retirement” unless you have mid-six-figures staked.

Also, if the price crashes 50%, your 5% yield doesn’t save you.

Staking rewards are a bonus, not the primary investment thesis.

Myth 4: “Ethereum switching to PoS crashed its value”

False: ETH is up ~40% since The Merge (Sept 2022 – Dec 2025).

The merge was successfully executed. No major bugs. No security issues. Staking works as designed.

Price is driven by macro conditions, not consensus mechanism.

Myth 5: “Bitcoin will switch to PoS eventually”

Never happening. Bitcoin’s culture is extremely conservative. The community rejected far smaller changes.

Switching Bitcoin to PoS would require near-unanimous consensus. Won’t happen.

If you want PoS benefits, buy PoS coins. Bitcoin will be PoW forever.

How to Actually Profit From This Knowledge

Knowing the difference between PoW and PoS is useless unless it changes your investment decisions.

Strategy 1: The Barbell Approach (What I Use)

60% Bitcoin (PoW): Conservative, scarce, proven

30% Ethereum (PoS): Moderate risk, yields income

10% Speculative PoS: Higher risk/reward (Solana, others)

This gives you:

- Stability from Bitcoin

- Income from staking

- Upside from faster PoS chains

Strategy 2: The Conservative Approach (For Beginners)

80% Bitcoin

20% Ethereum (staked)

Simple. Low maintenance. You get the blue chips of both worlds.

Buy on a reputable exchange, stake ETH through their platform (4-5% APY), and hold long-term.

Strategy 3: The Yield Maximizer (Advanced)

40% Ethereum (staked)

40% Diversified PoS (Solana, Cardano, Polkadot)

20% Bitcoin

This sacrifices Bitcoin’s scarcity for higher yields (8-12% blended).

Risk: More regulatory risk, more smart contract risk, more price volatility.

Only do this if you:

- Understand staking mechanics

- Can stomach 70% drawdowns

- Have proper wallet security

Strategy 4: The Bitcoin Maximalist (Valid Strategy)

100% Bitcoin

Ignore everything else. PoS is untested. Ethereum is centralized. Only Bitcoin matters.

Why this works:

Bitcoin has outperformed almost everything over 5+ year timeframes. Keeping it simple avoids:

- Staking complexity

- Additional tax reporting

- Smart contract risks

- Regulatory uncertainty with PoS

Why I don’t do it:

I want income from my crypto. 4% ETH staking yields compound nicely over decades.

But if you prefer maximum simplicity and scarcity, Bitcoin-only is rational.

The Regulatory Endgame – My Prediction

Bitcoin (PoW): Will remain classified as a commodity. Faces no serious existential regulatory threat. May face environmental regulations (carbon taxes on mining), but won’t be banned.

Ethereum (PoS): 60% chance of staying in regulatory gray zone. 30% chance of being classified as a security (forcing exchanges to delist or register). 10% chance of getting explicit commodity classification like Bitcoin.

Other PoS coins: Highest regulatory risk. Many will be labeled securities. Smaller PoS chains may face enforcement actions.

What this means for your portfolio:

Keep the majority in Bitcoin (lowest regulatory risk). Allocate less to PoS assets, with heavier weighting to Ethereum (most likely to survive regulatory scrutiny) and less to smaller PoS chains.

Don’t go all-in on high-yield PoS chains that might get classified as unregistered securities.

FAQ: Your Questions Answered

Q: Can Bitcoin be 51% attacked?

Theoretically yes, but the cost is prohibitive. You’d need to control more hash power than the current network (~500 exahashes/second).

Cost estimate: $20+ billion in hardware, plus ongoing electricity costs of $100M+ per month.

Even if you succeeded, you’d crash Bitcoin’s price, making your attack unprofitable.

It’s never happened in 16 years and becomes exponentially harder as the network grows.

Q: What happens to PoW miners when all Bitcoin is mined (2140)?

They’ll earn transaction fees only (no block rewards). If Bitcoin is widely used, fees could sustain mining. If not, security decreases.

This is 115 years away. Not an immediate concern.

Q: Can I mine Bitcoin at home?

Not profitably. Mining is dominated by industrial operations with cheap electricity (<$0.03/kWh) and latest ASICs.

Your home electricity (~$0.12/kWh) makes mining a guaranteed loss.

Better to just buy Bitcoin.

Q: Is staking safe?

On reputable platforms, like these, with established PoS networks (Ethereum, Solana), yes, it’s relatively safe.

Risks:

- Slashing (lose staked coins if validator misbehaves)

- Platform risk (if using custodial staking)

- Smart contract bugs (rare on major chains)

Never stake on unknown platforms promising 50%+ APY. That’s a scam.

Q: Do I need 32 ETH to stake Ethereum?

To run your own validator, yes. But you can stake any amount through:

- Centralized exchanges (Coinbase, Kraken)

- Staking pools (Lido, Rocket Pool)

- Staking platforms

These aggregate smaller amounts and run validators on your behalf.

Q: Why doesn’t every blockchain use PoS if it’s so much better?

PoS is more complex. PoW is simpler and more battle-tested.

Bitcoin won’t switch because its community values simplicity and proven security over efficiency.

New blockchains choose PoS because they want speed/low costs and didn’t exist during the PoW era.

The Bottom Line

PoW vs. PoS isn’t about which is “better.” It’s about tradeoffs.

PoW (Bitcoin):

- Scarce, proven, simple

- High energy use, no yield

- Lowest regulatory risk

- Best for long-term wealth storage

PoS (Ethereum, others):

- Efficient, yields income, faster

- More complex, regulatory uncertainty

- Best for income generation and active use

My recommendation:

Own both. Allocate based on your goals.

Want maximum scarcity and security? Favor Bitcoin.

Want yield and utility? Favor PoS assets.

Want both? Do 60/30/10 like me (60% BTC, 30% ETH, 10% other).

The consensus mechanism matters, but it’s not the only thing that matters. Team, adoption, network effects, use cases – all of these drive value.

Don’t overthink it. Buy quality assets, hold long-term, ignore the noise.

Important Disclaimers

Affiliate Disclosure

This article contains affiliate links to cryptocurrency exchanges and staking platforms. We may earn a commission if you sign up through these links at no additional cost to you.

Read our full disclosure policy

Financial Risk Warning

Cryptocurrency investments carry substantial risk including total loss of capital. Both PoW and PoS assets are highly volatile.

This article is NOT:

- Financial advice or investment recommendation

- A guarantee of returns from staking

- Legal or regulatory guidance

You should:

- Never invest more than you can afford to lose

- Understand the technology before investing

- Consult with licensed professionals

- Stay informed about changing regulations

The author holds positions in both PoW (Bitcoin) and PoS (Ethereum, Solana) assets. Past performance does not indicate future results.