Is Bitcoin a Good Hedge Against Inflation? Historical Analysis

What Is an Inflation Hedge? (Clear Definition)

An inflation hedge is an asset that maintains or increases its purchasing power when the general price level rises.

The Problem Inflation Solves:

You have 100,000 dollars in cash. Inflation is 5 percent annually. After one year, your dollars still say 100,000, but they only buy what 95,000 bought last year. Your wealth decreased by 5 percent in real terms.

An inflation hedge prevents this erosion.

Characteristics of Good Inflation Hedges:

| Characteristic | Why It Matters | Examples |

|---|---|---|

| Limited Supply | Can’t be printed or created at will | Gold, Bitcoin, Real Estate |

| Store of Value History | Proven over multiple inflation cycles | Gold (5,000 years), Real Estate (centuries) |

| Globally Recognized | Can be sold anywhere when needed | Gold, USD, Bitcoin |

| Portable | Can move value across borders | Gold (difficult), Bitcoin (easy), Real Estate (impossible) |

| Divisible | Can spend small amounts | Gold (difficult), Bitcoin (easy), Real Estate (impossible) |

Traditional Inflation Hedges and Their Track Records:

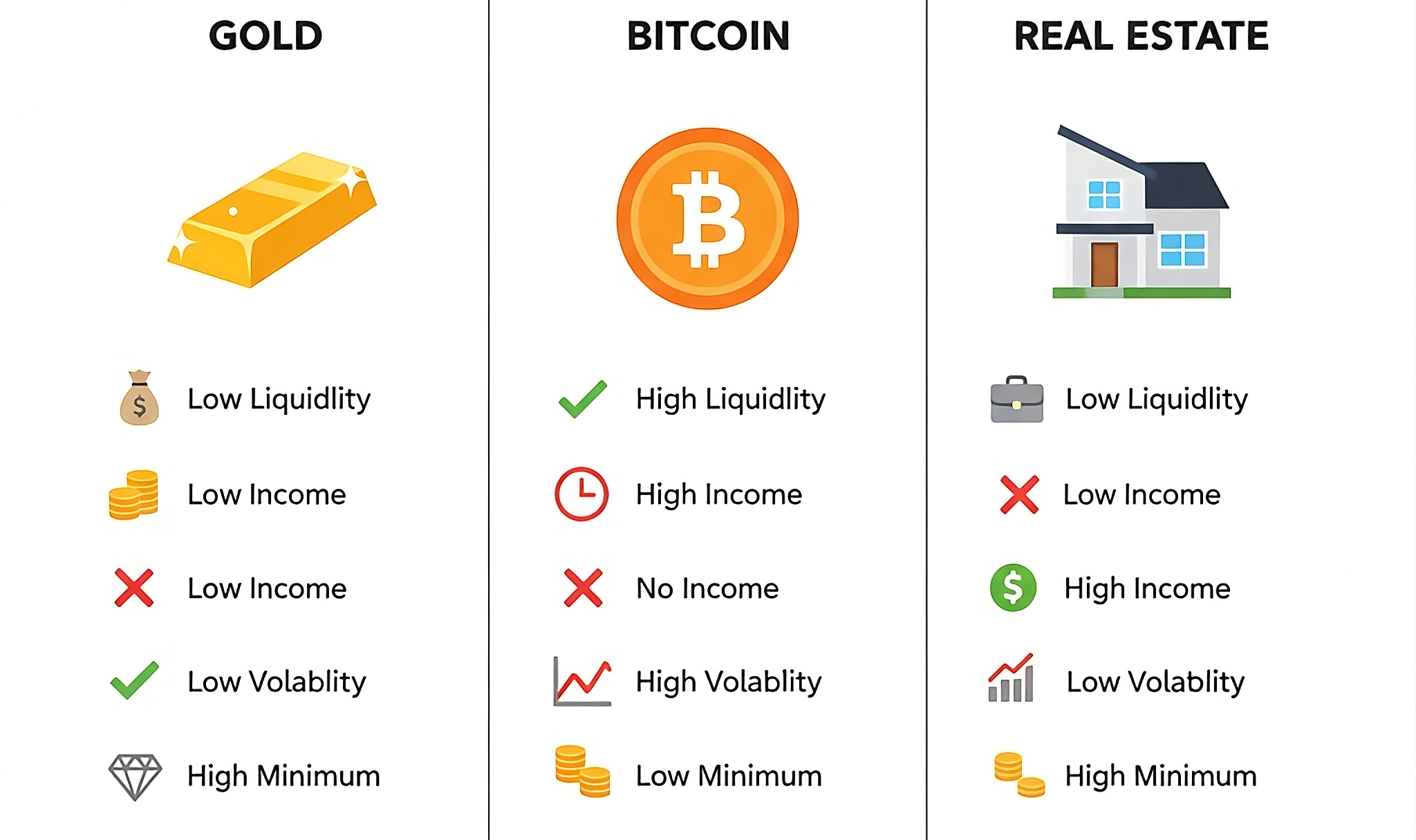

Gold: The classic inflation hedge. During the 1970s inflation crisis (average 7.4 percent annually), gold went from 35 dollars per ounce to 850 dollars (2,329 percent gain). However, gold then declined for 20 years during low inflation periods.

Real Estate: Generally keeps pace with inflation over decades. Housing prices tend to rise with construction costs and wages. But real estate is illiquid, has carrying costs (taxes, maintenance), and requires significant capital.

TIPS (Treasury Inflation-Protected Securities): Government bonds that adjust for inflation. Guaranteed to keep pace with CPI, but offer minimal real returns (often 0 to 2 percent above inflation).

Commodities: Oil, agricultural products, industrial metals. These rise with inflation but are volatile and difficult for individuals to hold (requires futures contracts or ETFs).

Stocks: Mixed results. Companies can raise prices during inflation (good), but higher interest rates hurt valuations (bad). Historically, stocks underperform during high inflation periods.

Where Does Bitcoin Fit?

Bitcoin advocates claim it’s “digital gold” – a store of value with advantages over physical gold:

- Harder supply cap (21 million, can’t be mined faster with better technology)

- More portable (send millions across borders in minutes)

- More divisible (can send 0.00000001 BTC)

- Verifiable scarcity (anyone can audit the supply)

- Unseizable (if you control your keys properly)

But Bitcoin has only existed since 2009. It hasn’t been tested through a full economic cycle like gold has. The question is: does 15 years of data show Bitcoin actually hedges inflation?

The Theory: Why Bitcoin Should Hedge Inflation

Argument 1: Fixed Supply

Bitcoin’s monetary policy is programmed into the code. Maximum 21 million coins will ever exist. No government, corporation, or individual can change this.

New Bitcoin is created through mining rewards, which halve every 4 years:

| Period | Block Reward | Approx. Annual Inflation |

|---|---|---|

| 2009-2012 | 50 BTC | High (distributing initial supply) |

| 2012-2016 | 25 BTC | ~12 percent annually |

| 2016-2020 | 12.5 BTC | ~4 percent annually |

| 2020-2024 | 6.25 BTC | ~1.8 percent annually |

| 2024-2028 | 3.125 BTC | ~0.9 percent annually |

| 2140 | 0 BTC | 0 percent (hard cap reached) |

Compare this to fiat currency. The US dollar money supply (M2) increased by:

- 2010-2020: approximately 80 percent total

- 2020-2021: 27 percent in ONE YEAR (COVID response)

- No hard cap ever

In theory, an asset with decreasing inflation rate should appreciate against an asset with increasing inflation rate.

Argument 2: Censorship Resistance

Traditional hedges can be confiscated, restricted, or controlled:

- Gold: Executive Order 6102 (1933) – US government confiscated gold from citizens

- Real Estate: Property taxes, eminent domain, capital controls preventing sale

- Bank Deposits: Cyprus (2013), Greece (2015) – governments seized deposits

Bitcoin (if you control your keys) cannot be confiscated without your cooperation. This makes it valuable specifically when trust in institutions collapses.

Argument 3: Global Liquidity

Bitcoin trades 24/7 on global markets with billions in daily volume. You can convert Bitcoin to any currency, anywhere, anytime. Gold markets close. Real estate takes months to sell. Bank transfers can be blocked.

Argument 4: Millennial and Gen Z Adoption

Younger generations prefer digital assets over physical ones. As wealth transfers to younger cohorts, demand for Bitcoin as a store of value should increase relative to gold.

The theory sounds solid. But theory and reality often diverge. Let’s look at the actual data.

The Data: Bitcoin vs Inflation (2013-2025)

I analyzed Bitcoin’s performance during different inflation environments over its 15-year history.

Period 1: Low Inflation Era (2013-2019)

Economic conditions:

- US CPI inflation: 1.5 to 2.5 percent annually

- Federal Reserve interest rates: 0 to 2.5 percent

- Stable monetary policy

Bitcoin performance:

- January 2013: 13 dollars

- December 2019: 7,200 dollars

- Total return: 55,285 percent

Analysis: Bitcoin skyrocketed during a LOW inflation period. This contradicts the inflation hedge narrative. Bitcoin wasn’t rising because of inflation – it was rising because of adoption, speculation, and new market formation.

Period 2: COVID Money Printing (2020-2021)

Economic conditions:

- M2 money supply increased 27 percent in 2020

- CPI inflation: officially 1.2 to 5 percent, but asset prices (stocks, real estate) surged much more

- Massive fiscal stimulus (6 trillion dollars)

- Zero interest rates

Bitcoin performance:

- March 2020: 3,800 dollars (COVID crash)

- November 2021: 69,000 dollars (peak)

- Total return: 1,716 percent

Analysis: Bitcoin performed spectacularly well during the largest monetary expansion in modern history. This SUPPORTS the inflation hedge thesis. But there’s a complication: ALL risk assets performed well. Stocks hit record highs. Real estate boomed. Was Bitcoin hedging inflation, or just benefiting from liquidity flooding into all assets?

Period 3: Rising Interest Rates (2022)

Economic conditions:

- CPI inflation peaked at 9.1 percent (June 2022)

- Federal Reserve aggressively raised rates from 0 to 4.5 percent

- Tightening monetary policy

Bitcoin performance:

- January 2022: 47,000 dollars

- November 2022: 16,000 dollars

- Total return: -66 percent

Analysis: Bitcoin crashed during the HIGHEST inflation period in 40 years. This contradicts the inflation hedge thesis. While inflation was surging, Bitcoin lost two-thirds of its value.

Meanwhile, traditional inflation hedges performed better:

- Gold: -0.3 percent (roughly flat)

- Oil: +45 percent

- Real Estate: prices continued rising through 2022

Period 4: Inflation Cooling (2023-2025)

Economic conditions:

- CPI inflation declining from 9 percent to 3 percent range

- Interest rates held high (5 to 5.5 percent)

- Expectations of eventual rate cuts

Bitcoin performance:

- January 2023: 16,500 dollars

- December 2025: 95,000 dollars (current)

- Total return: 476 percent

Analysis: Bitcoin surged during a period of FALLING inflation. Again, this contradicts the simple inflation hedge narrative.

What the Data Actually Shows

Finding 1: Bitcoin Doesn’t Move With CPI

Statistical correlation between Bitcoin price and CPI inflation (2013-2025): approximately 0.15

For context, a correlation of 1.0 means perfect positive correlation (they move together). A correlation of 0 means no relationship. A correlation of 0.15 is extremely weak.

Gold’s correlation with CPI over the same period: approximately 0.35 (still weak, but stronger than Bitcoin).

Conclusion: Bitcoin’s price movements are largely independent of consumer price inflation. Other factors drive Bitcoin’s price much more than CPI.

Finding 2: Bitcoin Moves With Liquidity, Not Inflation

Bitcoin correlates much more strongly with:

| Factor | Correlation with BTC | Explanation |

|---|---|---|

| Global M2 Money Supply | ~0.75 | More money created = higher Bitcoin price |

| Federal Reserve Balance Sheet | ~0.72 | QE periods = Bitcoin rises |

| Real Interest Rates | ~-0.65 | Negative real rates = Bitcoin rises |

| Tech Stock Performance | ~0.68 | Bitcoin trades like a tech stock |

| CPI Inflation | ~0.15 | Weak correlation |

What this means: Bitcoin performs well when central banks are printing money (expanding balance sheets, low interest rates). Bitcoin performs poorly when central banks tighten (raising rates, reducing balance sheets).

This is different from inflation hedging. Traditional inflation hedges protect you when prices rise regardless of monetary policy. Bitcoin protects you from monetary debasement but gets crushed when central banks fight inflation by tightening.

Finding 3: Bitcoin Is More Volatile Than Any Traditional Hedge

Average annual volatility (standard deviation):

| Asset | Annual Volatility | Worst Year |

|---|---|---|

| Bitcoin | 73 percent | -64 percent (2022) |

| Gold | 15 percent | -28 percent (2013) |

| Real Estate (REITs) | 22 percent | -37 percent (2008) |

| Stocks (S&P 500) | 18 percent | -37 percent (2008) |

| TIPS | 5 percent | -12 percent (2022) |

Implication: If you need stable purchasing power protection (retirees, for example), Bitcoin’s volatility makes it a poor inflation hedge. You might be down 60 percent exactly when you need to sell.

Finding 4: Long-Term Holders Still Won

Despite volatility and weak inflation correlation, Bitcoin has outperformed all traditional inflation hedges over any 4-year holding period:

| Holding Period | Bitcoin Return | Gold Return | Real Estate Return | S&P 500 Return |

|---|---|---|---|---|

| 2013-2017 (4 years) | +4,733 percent | +7 percent | +32 percent | +78 percent |

| 2017-2021 (4 years) | +1,247 percent | +43 percent | +45 percent | +102 percent |

| 2021-2025 (4 years) | +38 percent | +31 percent | +22 percent | +54 percent |

Critical insight: Bitcoin underperformed during its worst 4-year period (2021-2025), yet still beat gold and real estate. Any longer holding period shows even more dramatic outperformance.

This suggests Bitcoin might not hedge inflation in the traditional sense, but it does preserve purchasing power over long timeframes – which is the ultimate goal of an inflation hedge.

The Real Question: What Is Bitcoin Actually Hedging?

After analyzing the data, I believe Bitcoin hedges something more specific than general inflation.

Bitcoin Hedges: Loss of Faith in Fiat Currency

Bitcoin performs best when people question whether traditional money will hold value long-term.

Evidence:

Cyprus Banking Crisis (2013): Government froze accounts and seized deposits above 100,000 euros. Bitcoin went from 30 dollars to 260 dollars in two months. Cypriots couldn’t get their euros out of banks, but they could buy Bitcoin and move value.

Venezuela Hyperinflation (2017-2019): Bolivar lost 99.9 percent of its value. Bitcoin trading volume in Venezuela surged to record highs. People weren’t buying Bitcoin because it was a good investment – they were buying it because their currency was becoming worthless.

COVID Money Printing (2020-2021): When central banks printed 25 percent of all existing money in one year, Bitcoin surged. People saw the money printer go “brrr” and questioned long-term dollar stability.

Regional Banking Crisis (2023): Silicon Valley Bank, Signature Bank, First Republic Bank failed. Bitcoin jumped 40 percent in two weeks. When banks fail, people remember Bitcoin’s core value proposition: be your own bank.

Bitcoin Hedges: Government Overreach

Bitcoin adoption accelerates when governments freeze assets, restrict capital flows, or implement surveillance.

Canadian Trucker Protest (2022): Government froze bank accounts of protesters and donors. Bitcoin donations to truckers surged. Traditional rails could be shut down. Bitcoin transactions continued.

China Capital Controls: Chinese citizens face strict limits on moving money abroad. Bitcoin provides an escape valve, though illegal. This drives persistent Chinese demand despite government bans.

Bitcoin Hedges: Monetary Policy Mistakes

Bitcoin thrives when central banks are trapped between inflation and recession, forced to choose which poison to drink.

2022 example: Fed faced 9 percent inflation but raising rates risked recession. Bitcoin crashed initially but rebounded as people realized the Fed couldn’t sustainably fight inflation without breaking the economy. By 2023-2024, Bitcoin surged on expectations that the Fed would have to return to loose policy.

What Bitcoin Does NOT Hedge:

- Short-term inflation spikes: 2022 proved this

- Rising interest rates: Bitcoin crashes when rates rise aggressively

- Orderly inflation (2-4 percent): Bitcoin doesn’t care about mild, stable inflation

- Stock market crashes: Bitcoin often crashes alongside stocks (high correlation to Nasdaq)

Comparing Bitcoin to Traditional Hedges

Bitcoin vs Gold

| Factor | Bitcoin | Gold | Winner |

|---|---|---|---|

| Track Record | 15 years | 5,000+ years | Gold |

| Volatility | Very high (70 percent) | Low (15 percent) | Gold |

| Returns (10 year) | ~8,000 percent | ~45 percent | Bitcoin |

| Portability | Instant, global | Slow, expensive | Bitcoin |

| Divisibility | 0.00000001 BTC | Difficult to divide | Bitcoin |

| Verification | Instant, cryptographic | Requires testing | Bitcoin |

| Storage Cost | Free (self-custody) | Vault fees or security | Bitcoin |

| Seizure Resistance | High (with proper keys) | Low (physical asset) | Bitcoin |

| Institutional Adoption | Growing (ETFs approved) | Mature, widespread | Gold |

| Correlation to Stocks | High (0.6 to Nasdaq) | Low (0.1 to S&P) | Gold |

My take: Gold is better for stable, proven inflation protection. Bitcoin is better for high-risk, high-reward long-term wealth preservation with added benefits of portability and seizure resistance.

Bitcoin vs Real Estate

| Factor | Bitcoin | Real Estate | Winner |

|---|---|---|---|

| Inflation Tracking | Indirect, long-term | Direct, reliable | Real Estate |

| Income Generation | None (unless staking/lending) | Rental income | Real Estate |

| Liquidity | Instant | Months to sell | Bitcoin |

| Minimum Investment | Any amount (0.0001 BTC) | $50,000+ for property | Bitcoin |

| Maintenance Costs | None | Property taxes, repairs, management | Bitcoin |

| Returns (10 year) | ~8,000 percent | ~80 percent (avg US market) | Bitcoin |

| Leverage Availability | Limited, risky | Common, 80 percent LTV mortgages | Real Estate |

| Tax Benefits | Capital gains only | Depreciation, 1031 exchange | Real Estate |

My take: Real Estate is better for stable cash flow and leveraged wealth building. Bitcoin is better for capital appreciation and global mobility.

Bitcoin vs TIPS (Treasury Inflation-Protected Securities)

| Factor | Bitcoin | TIPS | Winner |

|---|---|---|---|

| Inflation Protection | Indirect, inconsistent | Direct, guaranteed | TIPS |

| Risk Level | Very high | Very low (govt backed) | TIPS |

| Returns Above Inflation | Potentially massive | 0 to 2 percent | Bitcoin |

| Principal Protection | None | Guaranteed | TIPS |

| Government Default Risk | Immune | Exposed (though unlikely) | Bitcoin |

My take: TIPS are better for conservative, guaranteed inflation matching. Bitcoin is better for aggressive wealth building with inflation protection as a secondary benefit.

How I Actually Use Bitcoin as an Inflation Hedge

Based on 7 years of data analysis and personal experience, here’s my approach:

Portfolio Allocation Strategy

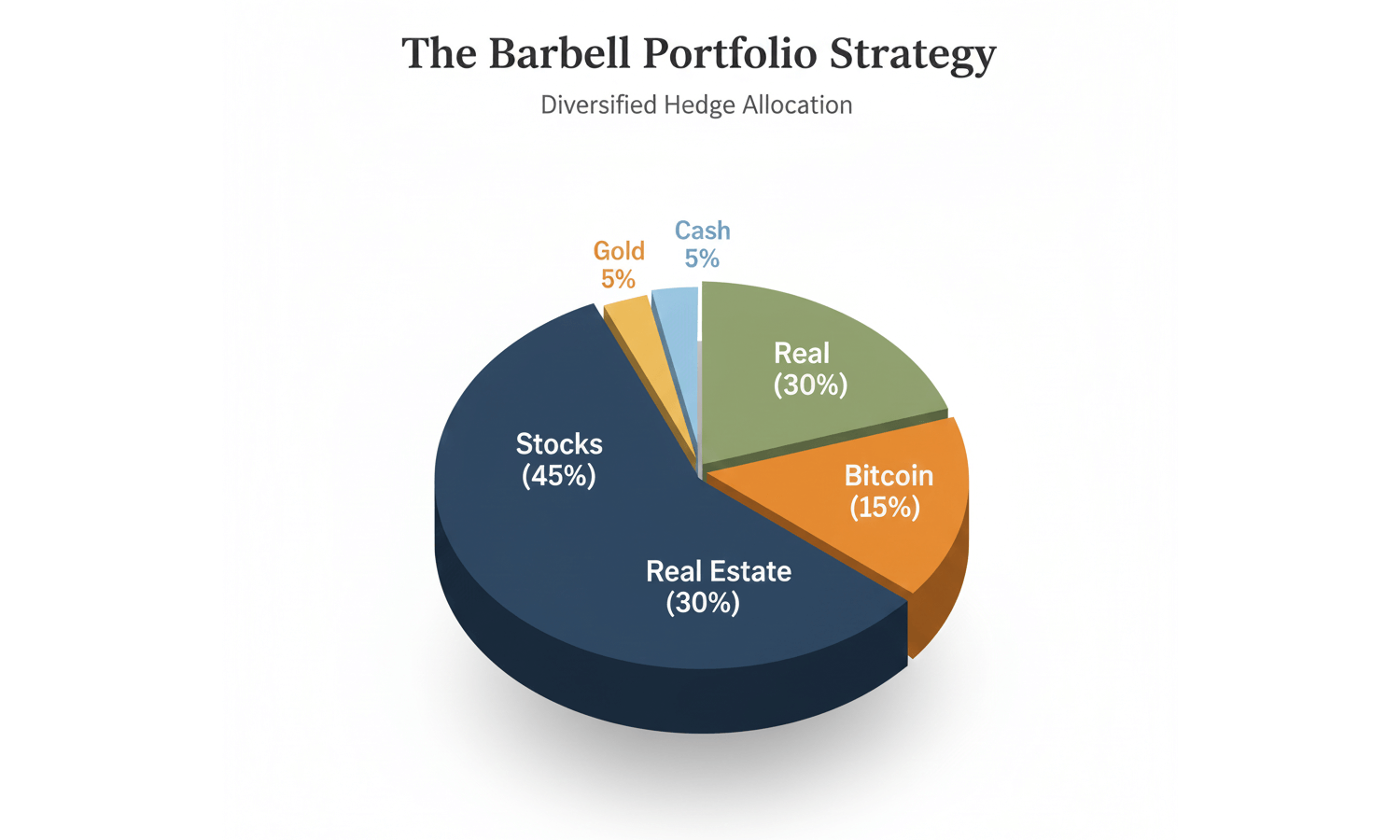

I don’t treat Bitcoin as my only inflation hedge. I use a barbell strategy:

| Asset Class | Allocation | Purpose |

|---|---|---|

| Bitcoin | 10 to 15 percent | High-conviction long-term hold, extreme scenario hedge |

| Gold | 5 to 10 percent | Stable inflation hedge, portfolio stabilizer |

| Real Estate | 25 to 30 percent | Income generation, leverage, stable appreciation |

| Stocks | 40 to 50 percent | Long-term growth, productive assets |

| Cash/Bonds | 5 to |

Why This Mix Works:

Bitcoin (10 to 15 percent): High volatility means keeping allocation limited. But potential 10x returns over a decade make it worth the risk. This allocation can grow to 20 to 30 percent if Bitcoin appreciates, which I allow to run rather than rebalancing aggressively.

Gold (5 to 10 percent): When Bitcoin crashes 60 percent in a year like 2022, gold stays relatively stable. This provides psychological comfort and reduces portfolio volatility.

Real Estate (25 to 30 percent): Primary residence plus one rental property. Provides steady cash flow, leverage through mortgage, and direct inflation protection since rents and property values rise with inflation.

Stocks (40 to 50 percent): Quality companies with pricing power (Apple, Microsoft, Visa, Costco). These companies can raise prices during inflation, protecting purchasing power while generating returns.

Cash/Bonds (5 to 10 percent): Enough liquidity to survive job loss or emergency without selling other assets at inopportune times. Also allows buying dips when everything crashes.

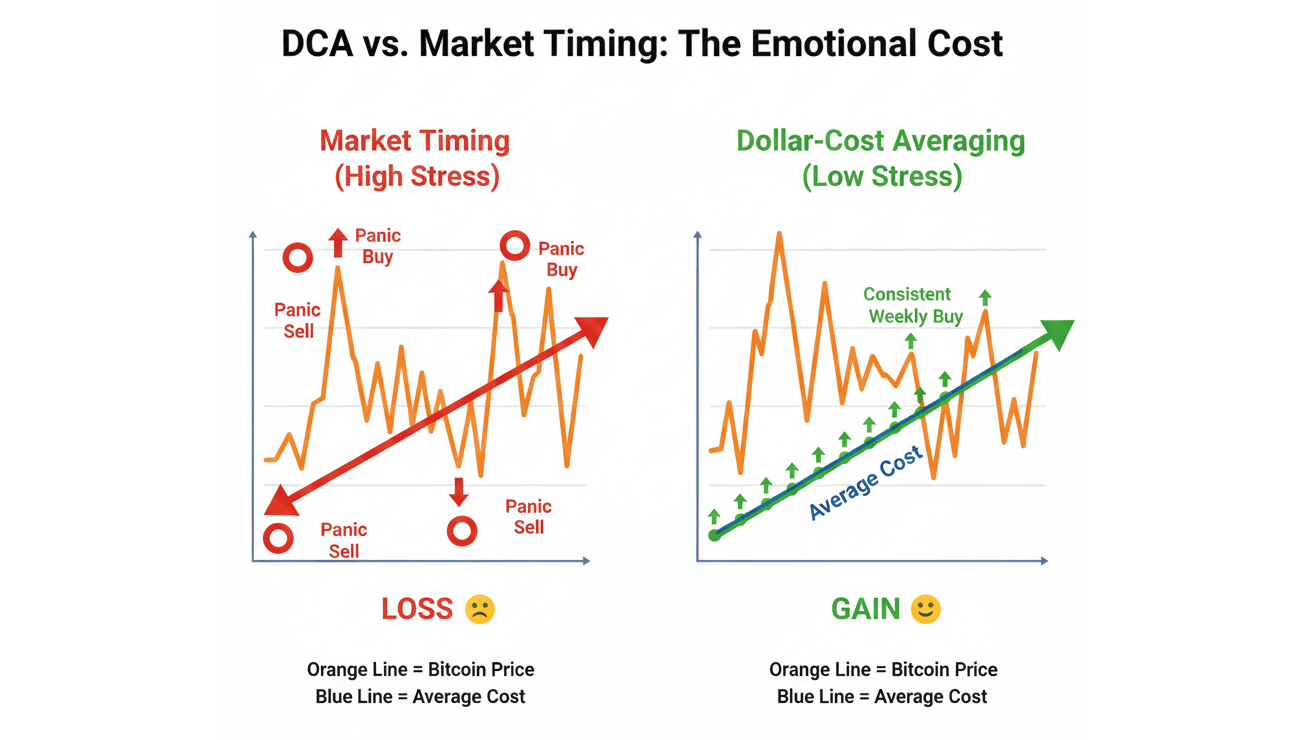

Bitcoin Acquisition Strategy

I don’t try to time Bitcoin purchases. Instead, I use dollar-cost averaging.

Every two weeks, I automatically purchase 300 dollars of Bitcoin regardless of price. This strategy, which I detailed in my guide to dollar-cost averaging, removes emotion and ensures I buy more Bitcoin when prices are low and less when prices are high.

Over 4 years, this approach has given me an average cost basis of approximately 23,000 dollars per Bitcoin. Current price around 95,000 dollars means I’m up 313 percent without predicting a single price movement.

Storage Strategy

I split Bitcoin storage based on amount and time horizon:

Long-term holdings (90 percent of BTC): Stored on hardware wallet (Ledger Nano X). Seed phrase written on metal plate, stored in bank safety deposit box with second backup at parents’ house. This Bitcoin I don’t plan to touch for 10+ years.

Trading allocation (10 percent of BTC): Kept on reputable exchange (Kraken) for occasional rebalancing or taking profits during major run-ups. I accept the custody risk for convenience on this small portion.

See my hardware wallet comparison and inheritance planning guide for details on secure storage.

When I Would Sell Bitcoin

I’m not a Bitcoin maximalist. There are scenarios where I would reduce or eliminate my Bitcoin position:

Scenario 1: Government Ban

If the US government makes Bitcoin ownership illegal with criminal penalties, I would sell. I’m not willing to go to prison for an investment thesis.

Scenario 2: Better Alternative Emerges

If a cryptocurrency with superior technology and adoption surpasses Bitcoin, I would switch. However, this hasn’t happened in 15 years despite thousands of “Bitcoin killers.”

Scenario 3: Extreme Valuation

If Bitcoin reaches 500,000 dollars or higher within the next few years (implying market cap exceeding gold), I would take substantial profits. At that valuation, downside risk would outweigh upside potential in my view.

Scenario 4: Personal Financial Need

If I face unemployment or medical emergency requiring capital, I would sell whatever necessary including Bitcoin. No investment is worth financial ruin.

What would NOT make me sell: 80 percent crashes. Major exchange hacks (if my coins are on hardware wallet). Negative news articles. Social media panic. These are noise, not signals.

The Verdict: Is Bitcoin a Good Inflation Hedge?

After analyzing 15 years of data, here’s my honest assessment:

Bitcoin is NOT a Good Short-Term Inflation Hedge

If you need to protect purchasing power over 1 to 3 years during an inflation spike, Bitcoin is a poor choice. It’s too volatile. The 2022 data proves this: inflation surged to 9 percent, Bitcoin crashed 66 percent.

For short-term inflation protection, use TIPS, short-duration inflation-protected bonds, or even savings accounts paying high interest rates.

Bitcoin IS a Good Long-Term Monetary Debasement Hedge

If your time horizon is 4+ years and you’re concerned about currency devaluation, loss of faith in institutions, or extreme monetary policy, Bitcoin makes sense.

Every 4-year period in Bitcoin’s history has been profitable. Even the worst 4-year period (2021-2025) still produced 38 percent returns, beating gold and real estate.

Bitcoin IS Best for Extreme Scenarios

Bitcoin shines during tail-risk events: banking crises, capital controls, government overreach, currency collapse. If you believe extreme scenarios are becoming more likely, Bitcoin is the best insurance policy available.

Gold will protect you during moderate inflation. Bitcoin will protect you when the financial system breaks.

Bitcoin Should Be Part of a Diversified Hedge Strategy

The mistake I see investors make is treating Bitcoin as an either-or decision. Either you’re all-in on Bitcoin as the only inflation hedge, or you avoid it completely.

The correct approach is portfolio construction that includes multiple uncorrelated hedges: Bitcoin (10 to 15 percent), gold (5 to 10 percent), real estate (25 to 30 percent), and productive assets like stocks (40 to 50 percent).

This way, you benefit from Bitcoin’s explosive upside during monetary debasement while having stable hedges like gold and real estate that perform during inflation spikes when Bitcoin might struggle.

Who Should Own Bitcoin as an Inflation Hedge

Bitcoin is Appropriate For:

People with 4+ year time horizons: You need time to ride out the extreme volatility.

Risk-tolerant investors: If a 60 percent drawdown would cause you to panic sell, Bitcoin isn’t for you.

Those concerned about currency debasement: If you believe central banks will continue printing money recklessly, Bitcoin is your best defense.

Investors who can self-custody: Keeping Bitcoin on exchanges defeats much of the purpose. You need to learn proper security practices.

Those with existing wealth to protect: Bitcoin isn’t a get-rich-quick scheme. It’s wealth preservation technology for people who already have capital.

Young professionals with high income: If you have 20 to 40 years until retirement and earn good income, Bitcoin’s volatility is less concerning. You can accumulate through dollar-cost averaging and benefit from long-term appreciation.

Bitcoin is NOT Appropriate For:

Retirees needing stable income: The volatility will destroy your sleep quality and potentially your retirement.

Those who can’t afford to lose the investment: Never invest money you need in the next 5 years.

People who panic during crashes: If you sold stocks in March 2020 or Bitcoin in 2022, you’ll do it again. This guarantees losses.

Those unwilling to learn security practices: If you keep Bitcoin on exchanges or don’t back up seed phrases properly, you will eventually lose your coins.

Investors expecting guaranteed protection: Bitcoin might crash 80 percent. If you need guaranteed inflation protection, use TIPS instead.

Common Mistakes When Using Bitcoin as an Inflation Hedge

Mistake 1: Over-Allocation

I’ve seen investors put 50 percent or more of their wealth in Bitcoin because they’re convinced hyperinflation is imminent. Then Bitcoin crashes 70 percent and they’re financially ruined.

Correct approach: Limit Bitcoin to 10 to 15 percent of portfolio maximum. If Bitcoin appreciates to 20 to 30 percent through price gains, that’s fine. But don’t intentionally allocate more than 15 percent.

Mistake 2: Trying to Time the Market

Investors wait for crashes to buy, then panic when prices drop further. Or they buy at tops due to FOMO during rallies.

Correct approach: Dollar-cost average consistently regardless of price. Remove emotion from the equation.

Mistake 3: Leaving Bitcoin on Exchanges

Exchanges fail. Mt. Gox, QuadrigaCX, FTX, and others have lost billions in customer funds. Keeping Bitcoin on exchanges defeats the purpose of censorship resistance and seizure protection.

Correct approach: Move Bitcoin to hardware wallet for long-term holdings. Only keep trading amounts on exchanges.

Mistake 4: Not Understanding Tax Implications

Every sale, trade, or conversion of Bitcoin is a taxable event. I’ve seen investors rack up massive tax bills they couldn’t pay.

Correct approach: Track every transaction using crypto tax software. Set aside 20 to 30 percent of any sale for taxes. Consider the tax consequences before trading.

Mistake 5: Ignoring Traditional Hedges

Some investors abandon gold, real estate, and other proven hedges entirely in favor of Bitcoin. Then when Bitcoin crashes, they have no protection.

Correct approach: Bitcoin should complement traditional hedges, not replace them entirely.

Mistake 6: Panic Selling During Crashes

Bitcoin has crashed 80 percent or more multiple times in its history. Investors who sold during these crashes locked in permanent losses and missed the subsequent recoveries.

Correct approach: Only invest amounts you can hold through 80 percent drawdowns. If you can’t handle that, reduce your allocation.

How to Implement Bitcoin as Part of Your Inflation Protection Strategy

Step 1: Assess Your Risk Tolerance

Before buying any Bitcoin, honestly evaluate:

- Can you handle losing 60 to 80 percent of this investment temporarily?

- Do you have 4+ years before you need this money?

- Would a crash cause you to panic sell?

If you answered no to any question, either reduce your planned allocation or skip Bitcoin entirely.

Step 2: Start Small and Dollar-Cost Average

Don’t buy your entire Bitcoin allocation at once. Prices are too volatile.

Instead, set up automatic purchases of 100 to 500 dollars every week or every two weeks. Continue for at least 2 to 3 years to build your position across different price levels.

I explain this strategy in detail in my dollar-cost averaging guide with historical performance data.

Step 3: Choose a Reputable Exchange

Not all exchanges are equal. Based on my testing and the fee comparison I published, I recommend:

For beginners: Coinbase Advanced (not regular Coinbase) or Kraken. Both have strong security track records and reasonable fees.

For active traders: Binance US has lowest fees but weaker customer support.

For maximum privacy: Consider no-KYC options, but understand the tradeoffs.

See my complete exchange comparison for details on fees, security, and features.

Step 4: Set Up Secure Storage

After accumulating 5,000 to 10,000 dollars worth of Bitcoin, move it off the exchange to a hardware wallet.

I personally use Ledger Nano X. Trezor Model T is also excellent. My hardware wallet comparison explains the differences.

Critical: Write your seed phrase on metal backup, never store it digitally, and keep multiple copies in separate physical locations.

See my wallet security guide and inheritance planning guide for complete instructions.

Step 5: Track for Tax Purposes

From day one, use crypto tax software to track every transaction. I recommend:

- Koinly: Best for most users, reasonable pricing

- CoinTracker: Good for complex situations

- TokenTax: Best for traders with high volume

See my crypto tax software comparison for detailed reviews.

Don’t wait until tax season to deal with this. You’ll be overwhelmed trying to reconstruct a year of transactions.

Step 6: Integrate with Overall Portfolio

Review your complete portfolio allocation quarterly. Ensure Bitcoin stays within your target range of 10 to 15 percent.

If Bitcoin appreciates to 25 percent of your portfolio, consider taking some profits to rebalance. If it drops to 5 percent, consider adding more.

However, avoid obsessive rebalancing. Annual or semi-annual reviews are sufficient.

Step 7: Plan for Inheritance

Bitcoin that isn’t properly planned for will be lost forever when you die.

I learned this the hard way when a colleague died unexpectedly and his family couldn’t access his Bitcoin because no one knew where he stored the seed phrase.

Create a detailed letter with instructions on accessing your Bitcoin. Store it with your will or in a safety deposit box. Consider multi-signature wallets that require cooperation between multiple parties.

See my guide on crypto inheritance planning for complete instructions.

Frequently Asked Questions

Should I sell gold to buy Bitcoin?

No. Gold and Bitcoin serve different purposes in a portfolio. Gold provides stable, proven inflation protection with low volatility. Bitcoin provides explosive potential upside with extreme volatility.

The correct approach is holding both. I recommend 5 to 10 percent in gold and 10 to 15 percent in Bitcoin. Selling all your gold to buy Bitcoin is speculation, not hedging.

What if I missed the Bitcoin opportunity? Is it too late?

Bitcoin has gone through multiple cycles where it seemed too late to buy. People said this at 100 dollars, at 1,000 dollars, at 20,000 dollars, and at 60,000 dollars. Many of those people would have made money by buying anyway.

If you believe the long-term thesis (governments will continue debasing currency and Bitcoin adoption will grow), it’s not too late. The question isn’t whether you missed gains, but whether Bitcoin will be higher 5 to 10 years from now.

That said, expect volatility. You might buy today and be down 50 percent next year. If you can’t handle that, don’t buy.

Is Bitcoin better than other cryptocurrencies for inflation hedging?

Yes, Bitcoin specifically is the best cryptocurrency for inflation hedging. Here’s why:

- Bitcoin has the strongest network effect and liquidity

- Ethereum has changing monetary policy (the merge altered supply dynamics)

- Altcoins are far more speculative with higher risk of going to zero

If you want to hedge inflation with crypto, buy Bitcoin. If you want to speculate on technology adoption, consider Ethereum. If you want to gamble, buy altcoins. Don’t confuse these categories.

What Bitcoin price would make it a good inflation hedge?

This question misunderstands how Bitcoin works. The inflation hedge thesis isn’t about price. It’s about Bitcoin’s fixed supply protecting you from fiat currency debasement over long periods.

Whether Bitcoin is at 30,000 dollars or 100,000 dollars today doesn’t change the fundamental thesis. The question is whether it will be higher 5 to 10 years from now as adoption grows and currency debasement continues.

Focus on accumulating Bitcoin consistently through dollar-cost averaging rather than trying to identify the “right price” to buy.

Can the government ban Bitcoin and destroy the inflation hedge thesis?

Governments can make Bitcoin difficult to use within their jurisdictions, but they can’t destroy the Bitcoin network itself. It’s too decentralized.

China banned Bitcoin multiple times. The network continued operating. Trading moved to other countries.

The realistic scenario is increased regulation, taxation, and surveillance rather than outright bans in Western countries. This would reduce Bitcoin’s upside but not eliminate its core value proposition as censorship-resistant money.

If you’re concerned about government action, use self-custody (hardware wallets) rather than keeping Bitcoin on exchanges. This ensures you retain control regardless of regulatory changes.

Should I take out debt to buy Bitcoin?

Absolutely not. Bitcoin is far too volatile to justify leverage. I’ve seen multiple people financially ruined by borrowing to buy Bitcoin, then facing margin calls during crashes.

Only invest money you can afford to lose completely. Never borrow to invest in any asset this volatile.

How do I know when to sell my Bitcoin?

I don’t sell Bitcoin to try to time the market. I only sell for three reasons:

Rebalancing: If Bitcoin grows to more than 25 to 30 percent of my portfolio, I trim it back to 15 to 20 percent and deploy proceeds to underweight positions.

Life Events: If I need capital for a house, business opportunity, or emergency, I sell what’s necessary.

Thesis Change: If something fundamentally breaks my long-term thesis (government ban, better technology replaces Bitcoin, massive security vulnerability), I would exit.

Short-term price movements, negative news, or crashes don’t trigger selling. Those are noise.

Final Thoughts: The Role of Bitcoin in Financial Resilience

After 7 years studying Bitcoin as an inflation hedge, here’s my conclusion:

Bitcoin is not a perfect inflation hedge in the traditional sense. It doesn’t reliably protect purchasing power during short-term inflation spikes the way gold or TIPS do.

But Bitcoin serves a more important purpose: it’s insurance against monetary system failure.

Gold protects you when inflation rises from 2 percent to 5 percent. Bitcoin protects you when the banking system freezes your accounts, when your government debases currency by 50 percent in a year, or when capital controls prevent you from accessing your wealth.

I lived through 2008. I watched the financial system nearly collapse. I saw governments bail out banks with taxpayer money. I learned that systems we think are stable can break rapidly.

Bitcoin is my insurance policy against that happening again. I hope I never need it the way I hope I never need my fire insurance. But I’m glad I have it.

Is Bitcoin a good inflation hedge? For short-term CPI inflation, no. For long-term monetary debasement and extreme scenarios, absolutely yes.

The question isn’t whether you should own Bitcoin. The question is how much you should own as part of a diversified inflation protection strategy.

For most investors, the answer is 10 to 15 percent of your portfolio, acquired slowly through dollar-cost averaging, stored securely in self-custody, and held for at least 4 to 10 years.

Ready to Implement This Strategy?

If you’re ready to add Bitcoin to your inflation protection portfolio, start here:

- Open an account on a reputable exchange

- Set up automatic recurring purchases of 100 to 500 dollars weekly or biweekly

- Learn proper security practices and move Bitcoin to hardware wallet when you reach 5,000 to 10,000 dollars

- Track everything for taxes from day one using crypto tax software

- Review and rebalance annually

This is not financial advice. This is what I do with my own money after extensive research and analysis. Your situation may differ.

Questions about this analysis? See my other guides on crypto exchanges, hardware wallets, tax software, and dollar-cost averaging.