What Are NFTs and Are They Worth Investing In?

What Are NFTs? (Simple Explanation)

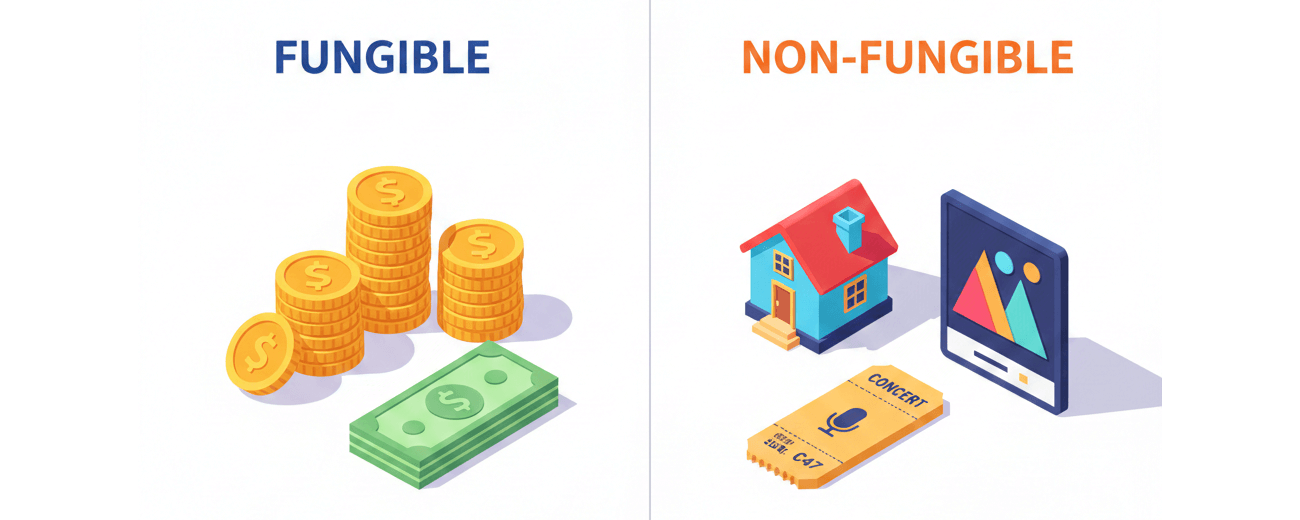

NFT stands for Non-Fungible Token.

That’s a terrible name that confuses everyone. Here’s what it actually means:

Fungible means interchangeable. One dollar bill is fungible with another dollar bill. One Bitcoin is fungible with another Bitcoin. They’re identical and interchangeable.

Non-fungible means unique. Your house is non-fungible. My house might be similar, but it’s not identical. We can’t just swap houses and call it even.

Token means a digital certificate recorded on a blockchain.

So an NFT is a unique digital certificate recorded on a blockchain that proves you own something specific.

What Can NFTs Represent?

NFTs can represent ownership of:

- Digital art: Images, videos, animations

- Profile pictures: Avatars for social media (Bored Apes, CryptoPunks)

- Virtual real estate: Land in metaverse platforms

- Game items: Weapons, skins, characters in blockchain games

- Music and audio: Songs, albums, sound effects

- Domain names: Blockchain-based web addresses

- Event tickets: Proof of attendance, concert access

- Real-world assets: Theoretically houses, cars, anything (not yet common)

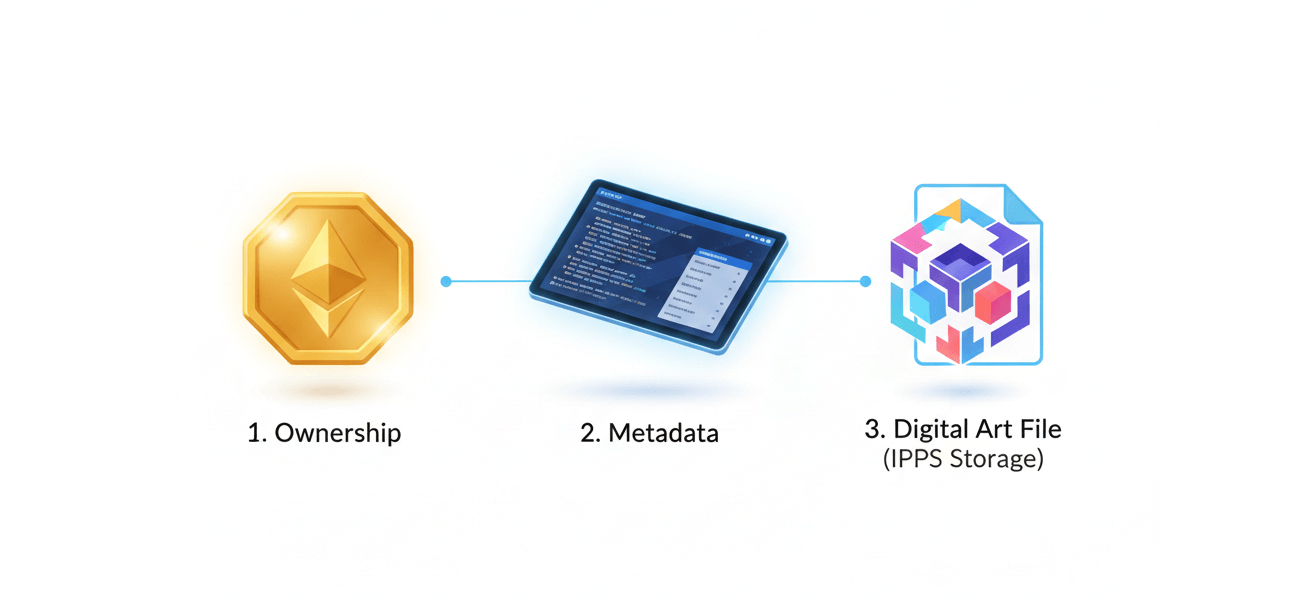

How NFTs Work Technically

When you buy an NFT, you’re buying a token on a blockchain (usually Ethereum) that contains:

- A unique identifier: Proves which specific NFT you own

- Metadata: Description, properties, attributes

- A link to the actual file: Usually hosted on IPFS or a server somewhere

- Smart contract code: Rules about royalties, transferability, etc.

Important: In most cases, you don’t actually own the image file itself. You own a token that points to the image. The image is usually stored on a server that the project controls.

This is critical to understand. If the server goes down or the project shuts down, your NFT might point to nothing. You still own the token, but the thing it represents is gone.

The Confusing Part: Can’t I Just Copy the Image?

Yes. Anyone can right-click and save an NFT image. This confuses people.

The NFT doesn’t prevent copying. It proves authenticity and ownership.

Think of it like this: Anyone can print a copy of the Mona Lisa. But there’s only one original in the Louvre. That original is worth hundreds of millions. The copies are worth nothing.

NFTs create digital scarcity and provable ownership in a world where everything can be copied perfectly.

Whether that’s valuable or stupid depends on what you believe about digital ownership. We’ll get to that.

The History of NFTs: How We Got Here

Early Days (2017-2020)

CryptoKitties (2017): Digital cats you could breed and trade. This was the first mainstream NFT project. It was so popular it crashed the Ethereum network. People paid thousands of dollars for cartoon cats.

At the time, I thought this was idiotic. Looking back, it proved there was demand for digital collectibles with provable scarcity.

CryptoPunks (2017): 10,000 unique 24×24 pixel avatars given away for free. By 2021, some sold for millions of dollars each. The cheapest CryptoPunk today costs approximately 40 ETH (around 150,000 dollars).

I could have claimed a free CryptoPunk in 2017. I didn’t because I thought it was stupid. This was a 150,000 dollar mistake.

The Explosion (2021)

In 2021, NFTs went mainstream:

- Beeple’s “Everydays” sold for 69 million dollars at Christie’s auction

- Bored Ape Yacht Club launched and became the most valuable NFT collection (floor price peaked at 150 ETH = approximately 450,000 dollars)

- Total NFT sales volume: 25 billion dollars in 2021

- Celebrities bought NFTs: Snoop Dogg, Paris Hilton, Jimmy Fallon, Steph Curry

This is when I entered the market. I paid 8 ETH (approximately 24,000 dollars at the time) for a Bored Ape. It felt insane, but the market was going crazy. FOMO took over.

The Crash (2022-2023)

NFT market collapsed alongside crypto:

| Metric | Peak (2021-2022) | Bottom (2023) | Change |

|---|---|---|---|

| Total NFT Trading Volume | 25 billion dollars (2021) | 8 billion dollars (2023) | -68 percent |

| Bored Ape Floor Price | 150 ETH (~450,000 dollars) | 11 ETH (~20,000 dollars) | -95 percent |

| Average NFT Collection Value | Varies widely | -90 percent typical | Most went to zero |

My Bored Ape, which I bought for 24,000 dollars, is now worth approximately 20,000 dollars. Not a total disaster, but I’m basically flat after 3 years (terrible for a high-risk investment).

My other NFT purchases (smaller collections, metaverse land, game items) are down 90 to 100 percent. Most are completely worthless.

Current State (2024-2025)

The NFT market has stabilized at much lower levels:

- Total trading volume: approximately 8 to 10 billion dollars annually

- Most projects from 2021-2022 are dead

- Blue-chip collections (CryptoPunks, Bored Apes) retained some value

- New use cases emerging: event tickets, identity, game items

- Speculation decreased, utility increasing slowly

The hype is gone. What remains is a much smaller market focused on specific use cases rather than pure speculation.

Why Do NFTs Have Any Value at All?

This is the question that matters. After losing money, I had to understand what I was actually buying.

Reason 1: Digital Status and Identity

Humans care about status. We buy expensive watches, cars, and clothes to signal wealth and taste. NFTs are digital status symbols.

A Rolex costs 15,000 dollars. It tells time no better than a 50 dollar Casio. But owning a Rolex signals something about you. Same logic applies to expensive NFTs.

In digital spaces (Twitter, Discord, virtual worlds), your avatar is your identity. A CryptoPunk or Bored Ape avatar signals you’re part of an exclusive group. You paid the price to join.

Is this valuable? Depends on whether you believe digital identity matters. If you spend significant time online, it probably does.

Reason 2: Provable Scarcity in Digital World

Before NFTs, digital items had no scarcity. You could copy anything infinitely at zero cost.

NFTs introduced scarcity to the digital realm. Only 10,000 CryptoPunks exist. The blockchain proves this. No one can create more.

Scarcity + demand = value. This is basic economics.

The question is whether artificial digital scarcity is valuable or just a clever trick. I’m still not entirely sure.

Reason 3: Community and Access

Some NFTs grant access to exclusive communities, events, or benefits.

Bored Ape Yacht Club holders get:

- Access to private Discord and events

- Commercial rights to their ape (can use it for merchandise)

- Future airdrops of related projects

- Networking with other wealthy NFT holders

I’ve attended one Bored Ape event. It was essentially a networking event for people with too much money. But I did make one business connection that led to a client. So there was some utility.

Reason 4: Speculation on Future Value

Most NFT buyers aren’t buying for utility. They’re buying hoping someone will pay more later.

This is the greater fool theory. You’re not buying because the item is valuable. You’re buying because you think a greater fool will pay more.

This works until it doesn’t. When the music stops, whoever is holding the NFT loses.

I lost money on 80 percent of my NFT purchases because I was playing the greater fool game. Don’t make my mistake.

Reason 5: Potential Future Utility

Some NFTs promise future utility that hasn’t materialized yet:

- Game items: Weapons, skins, characters you truly own and can trade

- Event tickets: Provably authentic, resellable, with built-in royalties to artists

- Digital identity: Portable reputation and credentials across platforms

- Real-world asset ownership: NFTs representing houses, cars, stocks

These use cases make sense theoretically. But most haven’t been built yet. Buying NFTs for future utility that might never come is extremely risky.

Why Most NFTs Are Worthless

After losing 79 percent of my NFT investment, here’s what I learned about why most NFTs fail:

Problem 1: No Intrinsic Value

A stock represents ownership in a company that generates cash flow. A bond pays interest. Real estate generates rent. These assets have intrinsic value independent of what someone will pay for them.

Most NFTs have zero intrinsic value. They’re only worth what someone else will pay. When demand disappears, value goes to zero.

My metaverse land purchases are perfect examples. I bought “land” in virtual worlds that never attracted users. The land produces nothing. No one wants to buy it. It’s worthless.

Problem 2: Infinite Competition

Anyone can create an NFT collection. There’s no barrier to entry.

In 2021-2022, thousands of NFT projects launched monthly. Most copied successful formulas (10,000 supply, animal theme, roadmap promising metaverse integration).

Supply exploded. Demand couldn’t keep up. 99 percent of projects died.

I bought into 15 different NFT projects. Only 2 have any value today. The rest are dead.

Problem 3: Rug Pulls and Scams

The NFT space is full of scams:

- Rug pulls: Team launches project, takes money, disappears

- Wash trading: Team creates fake volume by trading with themselves

- Fake roadmaps: Promises of game development, metaverse integration, token airdrops that never happen

- Celebrity pumps: Influencers paid to promote projects they immediately sell

I fell for one rug pull. Project promised a play-to-earn game. Raised 2 million dollars through NFT sales. Team disappeared. Lost 1,200 dollars.

See my guide on spotting crypto scams for red flags that apply to NFTs as well.

Problem 4: Technical Risks

NFTs have technical vulnerabilities most buyers don’t understand:

Metadata isn’t on the blockchain: The actual image/file is usually hosted on a server. If the server goes down, your NFT points to nothing.

Smart contract bugs: Coding errors can make NFTs untradeable or allow theft.

Platform risk: If OpenSea or other marketplaces shut down, liquidity disappears.

Wallet hacks: If someone gets your MetaMask wallet credentials, they can steal all your NFTs instantly.

I nearly lost all my NFTs to a phishing attack. Someone created a fake OpenSea popup. I almost signed a transaction that would have transferred everything. Caught it at the last second.

Problem 5: Tax Complexity

Every NFT sale is a taxable event. The IRS treats NFTs as collectibles, which have a higher capital gains tax rate (28 percent) than stocks or crypto (15 to 20 percent for long-term gains).

Tracking cost basis across dozens of NFT purchases and sales is a nightmare. I use crypto tax software to handle this, but it’s still complicated.

Many NFT traders don’t realize they owe taxes until they get an IRS notice. This can be financially devastating.

The Current State of NFTs: What Actually Survived

Blue-Chip Collections That Retained Value

| Collection | Launch Date | Peak Floor Price | Current Floor Price | Status |

|---|---|---|---|---|

| CryptoPunks | 2017 | ~120 ETH | ~40 ETH (150,000 dollars) | Still valuable |

| Bored Ape Yacht Club | 2021 | ~150 ETH | ~11 ETH (40,000 dollars) | Down but alive |

| Azuki | 2022 | ~30 ETH | ~3 ETH (11,000 dollars) | Struggling |

| Doodles | 2021 | ~23 ETH | ~1.5 ETH (5,500 dollars) | Barely alive |

Even “blue-chip” NFTs lost 70 to 90 percent of their value. Only the absolute top tier (CryptoPunks) maintained significant value.

Emerging Utility-Focused Use Cases

Some NFT applications are showing promise beyond speculation:

Event Ticketing: Companies like Ticketmaster are exploring NFT tickets that prevent counterfeiting and allow resale with artist royalties built in.

Gaming Items: Games where you truly own items that can be traded across platforms. Still early, but some traction in web3 games.

Music NFTs: Artists selling limited edition songs or albums directly to fans, bypassing record labels. Small but growing market.

Domain Names: Blockchain domains (like .eth names) that you own permanently without renewal fees.

These have actual utility. I’m cautiously optimistic about these categories. But it’s still very early.

Should You Invest in NFTs? My Honest Assessment

You Should NOT Invest in NFTs If:

You need the money in the next 5 years: NFTs are illiquid and volatile. You might not be able to sell when you need to.

You can’t afford to lose 100 percent: Most NFTs will go to zero. Only invest money you can lose completely.

You don’t understand crypto fundamentals: If you don’t know how to use MetaMask, understand gas fees, or secure a wallet, don’t buy NFTs yet. Learn the basics first.

You’re buying because of FOMO: Chasing hype is how you lose money. I learned this the hard way.

You believe NFTs will make you rich quick: That ship sailed in 2021. Anyone telling you otherwise is trying to sell you something.

You MIGHT Consider NFTs If:

You want exposure to digital culture and web3: Small allocation (1 to 3 percent of portfolio) to experiment and learn.

You value digital status and community: If you’re active in crypto/web3 spaces, certain NFTs provide genuine social utility.

You’re buying specific utility: Event tickets, game items, music from artists you support. Buy for use, not speculation.

You have high risk tolerance: Comfortable with 80 to 100 percent losses in exchange for potential 10x gains.

You can identify quality projects: Strong team, real utility, sustainable business model, actual community (not just Discord hype).

My Personal NFT Strategy Going Forward

After losing 79 percent of my NFT investment, here’s what I do now:

- Hold blue-chips only: I keep my Bored Ape and one CryptoPunk-adjacent NFT. Everything else I either sold or wrote off as lost.

- No more speculation: I don’t buy NFTs hoping to flip them. That game is over.

- Utility-focused purchases only: If I buy an NFT now, it must provide immediate utility (event access, game item, music I want to own).

- Maximum 2 percent of portfolio: Never again will I put significant capital into NFTs. Small experimental allocation only.

- Assume zero recovery: I mentally write off any NFT purchase as money spent, not invested. If it appreciates, bonus. If not, expected.

How to Buy NFTs Safely (If You Decide To)

Step 1: Set Up Proper Wallet Security

Most NFT theft happens through wallet compromise, not blockchain hacks.

- Create a dedicated wallet for NFTs (separate from your main crypto holdings)

- Use MetaMask or a hardware wallet (Ledger supports NFTs)

- Write down seed phrase on paper, store securely

- Never share seed phrase or sign transactions you don’t understand

- Use a separate browser profile or device for NFT transactions

See my wallet security guide for detailed instructions.

Step 2: Buy Ethereum on a Reputable Exchange

Most NFTs are on Ethereum. You need ETH to buy them.

Use established exchanges: Coinbase, Kraken, or Binance US. Avoid sketchy platforms.

See my exchange comparison for fees and security details.

Step 3: Research the Project Thoroughly

Before buying any NFT, check:

- Team identity: Are they doxxed (publicly known) or anonymous? Anonymous teams = higher rug pull risk

- Smart contract: Is it verified on Etherscan? Any red flags in the code?

- Community: Is Discord/Twitter active with real engagement or bot-driven hype?

- Utility: What does this NFT actually do besides exist?

- Trading volume: Is volume real or artificially inflated through wash trading?

- Roadmap: Realistic or filled with vague promises?

If you can’t verify these things, don’t buy. See my crypto scam detection guide for red flags.

Step 4: Understand Gas Fees

Minting or buying NFTs on Ethereum can cost 50 to 200 dollars in gas fees during peak times.

Check current gas prices before transacting. Wait for low-traffic periods (weekends, late night US time) to save money.

For small NFT purchases, gas fees can exceed the NFT price. This makes small transactions uneconomical.

Step 5: Start Very Small

Your first NFT purchase should be under 500 dollars total.

Use it as a learning experience. How does minting work? How do marketplaces function? What are the tax implications?

Don’t commit serious capital until you understand the entire process.

Step 6: Plan for Taxes Immediately

Every NFT purchase and sale is a taxable event.

Track:

- Purchase price (including gas fees)

- Sale price

- Date of each transaction

- ETH price at time of transaction (for USD cost basis)

Use crypto tax software from day one. Retroactive tax reporting for NFTs is a nightmare.

Frequently Asked Questions

Can I make money with NFTs in 2025?

Possible but unlikely. The easy money phase (2021-2022) is over. Most people who bought NFTs during the hype lost 80 to 100 percent.

If you’re buying for speculation, you’re competing against sophisticated traders and insiders. Retail investors generally lose in this environment.

Your best bet: Buy NFTs for utility or personal enjoyment, not profit. If they appreciate, great. If not, you got what you paid for.

What’s the minimum investment to get started with NFTs?

Minimum purchase: 0.01 ETH (approximately 35 to 40 dollars) plus gas fees (50 to 200 dollars).

Realistic minimum to make it worthwhile: 500 to 1,000 dollars total. Below that, gas fees eat too much of your investment.

Blue-chip NFTs (CryptoPunks, Bored Apes) require 40,000 to 150,000 dollars minimum.

Are NFTs a good long-term investment like stocks or real estate?

No. NFTs don’t generate cash flow like stocks (dividends) or real estate (rent). They’re purely speculative assets.

Compare:

- Stocks: Represent ownership in productive businesses

- Real estate: Produces rental income, appreciates with inflation

- NFTs: Worth only what someone else will pay, no income, high risk of going to zero

NFTs should be a tiny experimental allocation (1 to 3 percent max), not a core holding.

What happens if the NFT marketplace shuts down?

Your NFT still exists on the blockchain. The token is yours regardless of marketplace status.

However, liquidity disappears. If OpenSea (largest marketplace) shut down, selling NFTs would become much harder.

Also, if the project’s server hosting the image goes down, your NFT token might point to a broken link. You own the token, but the image is gone.

How do I know if an NFT is a scam?

Red flags:

- Anonymous team with no track record

- Promises of guaranteed returns or “revolutionary” technology

- Aggressive marketing and celebrity endorsements

- Unrealistic roadmap (metaverse game, token launch, physical merchandise all in 6 months)

- Low liquidity or suspicious trading patterns

- Website full of buzzwords but light on details

- Team asking you to connect wallet to suspicious sites

See my full crypto scam detection guide for more details.

Do I need to report NFT sales to the IRS?

Yes, absolutely. The IRS treats NFTs as collectibles.

Every sale triggers capital gains tax (28 percent for collectibles vs 15 to 20 percent for stocks held long-term).

Failure to report can result in audits, penalties, and interest charges.

See my crypto tax guide for complete details on reporting requirements.

Are NFTs better than owning cryptocurrency?

For most people, no. Cryptocurrency (Bitcoin, Ethereum) has much deeper liquidity, less scam risk, and clearer use cases.

NFTs are higher risk, lower liquidity, and require more expertise to navigate safely.

If you’re new to crypto, start with Bitcoin or Ethereum. Learn the basics. Then consider NFTs as a small experimental allocation if you’re interested in digital collectibles.

Final Thoughts: What I Learned From Losing Money on NFTs

After spending 20,000 dollars and getting back 4,200 dollars, here’s what I learned:

Lesson 1: Hype Is Not a Strategy

I bought most of my NFTs during peak FOMO in 2021-2022. Everyone was talking about them. Celebrities were buying them. Twitter was full of people showing off their new profile pictures.

I convinced myself I was early to a revolution. In reality, I was late to a speculative bubble.

The same pattern repeats in every market cycle: tulips in the 1600s, dot-com stocks in 2000, housing in 2008, NFTs in 2021. When taxi drivers are giving you investment advice, you’re not early.

Takeaway: If you only hear about an investment opportunity when it’s everywhere, you’re probably buying near the top.

Lesson 2: Utility Beats Speculation Every Time

The NFTs that retained any value had actual utility beyond speculation:

- CryptoPunks and Bored Apes became genuine status symbols in crypto circles

- ENS domains (.eth addresses) provide actual naming functionality

- Event ticket NFTs solve real problems (counterfeiting, resale markets)

The NFTs that went to zero promised future utility that never arrived. Metaverse land in platforms nobody uses. Game items for games that were never built. Tokens that would unlock future benefits that never materialized.

Takeaway: Buy things that have value today, not promises of value tomorrow.

Lesson 3: Liquidity Matters More Than You Think

When I wanted to sell my losing NFT positions, I discovered a harsh truth: there are no buyers.

I own NFTs I literally cannot sell at any price. The bid is zero. The collection is dead. The marketplace shows my listing, but nobody is browsing that collection anymore.

With stocks or Bitcoin, there’s always a buyer. The price might be terrible, but you can exit. With NFTs, you can be completely stuck.

Takeaway: Only buy assets with deep, established liquidity. If you can’t sell easily, you don’t really own an investment – you own a liability.

Lesson 4: Communities Are Cults Until They’re Not

NFT project Discords felt like exclusive clubs. Everyone was excited. Everyone believed in the vision. Everyone was making money (on paper).

Then prices crashed. The Discord went quiet. The team stopped updating. The community disappeared.

Strong communities are built on shared values and sustained engagement, not shared financial speculation. When the only thing binding people together is price appreciation, the community dies when prices fall.

Takeaway: Don’t confuse a group of speculators with a genuine community. Real communities survive bear markets.

Lesson 5: Most Innovation Looks Stupid at First

I dismissed CryptoPunks in 2017 as stupid pixel art. That was a 150,000 dollar mistake.

I was wrong because I judged the technology by my personal taste rather than by what the market valued. I didn’t need to like pixel art. I needed to recognize that others did.

At the same time, I bought metaverse land in 2021 thinking I was early to the next big thing. That was a 5,000 dollar mistake.

The difference: CryptoPunks had demonstrated demand and cultural significance. Metaverse platforms had neither.

Takeaway: Being contrarian means buying what others dismiss but has proven value, not buying random speculative projects just because they sound innovative.

The Bottom Line

NFTs are not a scam. They’re a technology that enables digital ownership and scarcity. That technology has legitimate use cases.

But 95 percent of NFT projects are garbage. They’re cash grabs by teams who know the market is full of people with FOMO and no understanding of what they’re buying.

My mistake wasn’t buying NFTs. My mistake was treating them like investments when they were really bets on cultural trends and speculation.

If I could go back, I would:

- Skip the metaverse land, random collections, and unproven game items entirely

- Buy one blue-chip NFT (CryptoPunk or Bored Ape) as a small experimental allocation

- Wait for utility-focused NFTs (tickets, domains, real game items) to mature before buying

- Assume a 100 percent loss on any NFT purchase and be pleasantly surprised if wrong

- Never allocate more than 2 percent of my portfolio to NFTs

I paid 20,000 dollars for this education. You can get it for free by reading this article and learning from my mistakes.

My Current View: Where NFTs Fit in 2025

Three years after the hype cycle, here’s where I think NFTs actually have value:

Legitimate Use Cases (Worth Watching)

1. Event Ticketing and Access Control

NFT tickets solve real problems: counterfeiting, scalping control, resale transparency, artist royalties on secondary sales. Several major venues and artists are experimenting with this.

Investment potential: Low. But if you’re buying tickets anyway, NFT tickets have advantages over traditional ones.

2. Gaming Items (When Games Actually Exist)

If blockchain games with real player bases emerge, in-game items as NFTs make sense. True ownership, cross-game portability, real markets.

Investment potential: Medium, but extremely high risk. 99 percent of “play-to-earn” games failed. Wait for proven games with sustainable economics.

3. Digital Identity and Credentials

NFTs representing professional credentials, educational degrees, membership status. Early stages but logical application.

Investment potential: Probably zero. These are utility items, not appreciating assets.

4. Music and Creator Economy

Artists selling limited edition releases directly to fans. Cuts out middlemen, enables new revenue models.

Investment potential: Low. Buy to support artists, not for profit.

Still Speculative (High Risk)

1. Blue-Chip Profile Pictures

CryptoPunks and maybe Bored Apes retain cultural significance and status value. Everything else is questionable.

Investment potential: Medium. Proven to survive one bear market. But could still go to zero in next cycle.

2. Digital Art by Established Artists

Work by artists with traditional art world credibility might retain value. Most won’t.

Investment potential: Low. Buy because you like the art, not for returns.

Avoid Completely

1. Metaverse Land

Most metaverse platforms have no users. Land in empty virtual worlds is worthless. I learned this expensive lesson so you don’t have to.

2. New Profile Picture Collections

Unless you’re extremely early (which you won’t be), these go to zero. The market is saturated. Demand is dead.

3. Anything Promising Future Utility

Roadmaps full of vague promises about games, tokens, metaverse integration, and partnerships that will “be announced soon” are red flags.

4. Celebrity or Influencer NFT Projects

These are usually cash grabs. The celebrity gets paid to promote, then never mentions it again. You’re left holding worthless tokens.

Final Recommendations: Should You Buy NFTs in 2025?

For Most People: No

If you’re asking whether NFTs should be part of your investment portfolio, the answer is almost certainly no.

Better alternatives exist:

- Want crypto exposure? Buy Bitcoin or Ethereum through a reputable exchange. More liquid, less scam risk, clearer value proposition.

- Want high-risk, high-reward investments? Small-cap growth stocks, venture capital funds, or even concentrated positions in individual stocks are better risk-adjusted bets.

- Want digital collectibles? Buy them because you enjoy owning them, not as investments.

For Crypto Enthusiasts: Maybe, But Small

If you’re already deep in crypto and want exposure to NFTs:

- Limit to 1 to 3 percent of your crypto holdings (which should itself be limited to 10 to 20 percent of your overall portfolio)

- Focus on blue-chips only: CryptoPunks if you can afford them, maybe Bored Apes, nothing else

- Buy utility, not speculation: ENS domains you’ll actually use, event tickets you want, game items in games you play

- Assume total loss: Don’t buy anything you can’t afford to lose completely

- Secure properly: Use hardware wallet, never sign suspicious transactions

For Collectors and Digital Culture Enthusiasts: Yes, But Carefully

If you genuinely value digital art, culture, and community:

- Buy what you like and would want to own even if it goes to zero

- Support artists and creators directly

- Engage with communities around the NFTs you own

- Don’t expect financial returns – any appreciation is a bonus

This is the healthiest way to engage with NFTs. You’re a collector, not an investor.

For Everyone: Educate Yourself First

Before buying any NFT:

- Learn how to use MetaMask safely

- Understand Ethereum gas fees

- Study crypto scam patterns

- Learn the tax implications

- Practice with small amounts first

The NFT space punishes ignorance harshly. I lost thousands learning lessons I could have avoided with basic research.