Top 7 High-Yield Dividend Stocks for Passive Income

Before You Buy Any Dividend Stock: Read This

The Cardinal Rule of Dividend Investing

A high dividend yield is worthless if the stock price collapses.

Example: You buy Stock A with a 10% dividend yield at $100/share. You earn $10 in dividends. Great! But the stock drops to $60. You “earned” $10 but lost $40. Net result: -$30.

Always prioritize dividend safety over dividend yield. A sustainable 4% dividend that grows annually beats an unsustainable 10% dividend that gets cut.

What Makes a Dividend Stock Safe?

After analyzing hundreds of dividend stocks, I look for five critical factors:

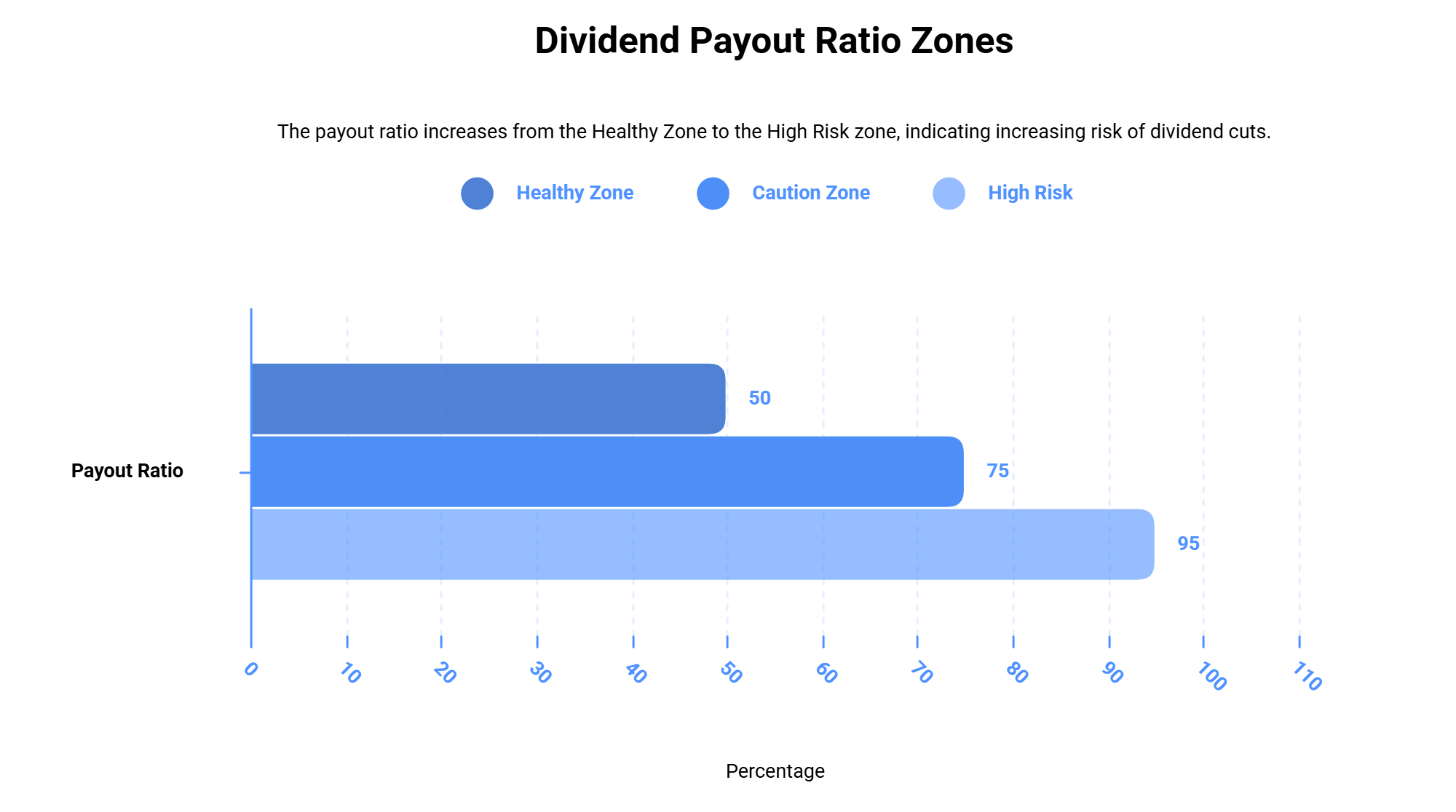

1. Dividend Payout Ratio Under 70%

Payout ratio = (Annual Dividend / Earnings) x 100

If a company earns $4 per share and pays $3 in dividends, the payout ratio is 75%. This is risky – the company is paying out most of its profit, leaving little room for dividend growth or economic downturns.

Safe payout ratios: 30% to 60%. This leaves room for dividend increases and economic cushion.

2. Consistent Dividend History (10+ Years)

Companies that have paid and raised dividends for 10+ consecutive years tend to continue. Management has committed to dividends as a priority.

Best indicator: Dividend Aristocrats (25+ years of consecutive increases) or Dividend Kings (50+ years).

3. Strong Balance Sheet

Check debt-to-equity ratio. High debt during recessions forces companies to cut dividends to preserve cash.

Safe debt-to-equity: Under 1.5 for most industries (under 1.0 is ideal).

4. Recession-Resistant Business

People don’t stop using electricity, water, or toilet paper during recessions. Utility companies and consumer staples tend to maintain dividends even in bad economies.

Avoid cyclical industries (construction, luxury goods) for dividend investing unless you’re very confident in timing.

5. Dividend Growth Track Record

A company paying the same dividend for 10 years is stagnant. Look for companies that increase dividends annually by 3% to 8%.

Dividend growth protects against inflation and compounds your income over time.

The 7 Best Dividend Stocks (Ranked)

Want professional dividend stock research?

These picks are based on my personal analysis, but for comprehensive dividend stock recommendations, I use The Motley Fool Stock Advisor. They’ve beaten the S&P 500 by 4x since inception and provide monthly dividend stock picks with full analysis.

Quick Comparison Table

| Stock | Ticker | Yield | Payout Ratio | Years Raising | Safety |

|---|---|---|---|---|---|

| Realty Income | O | 5.8% | 74% | 29 years | High |

| AT&T | T | 6.2% | 58% | 40 years | Medium |

| Verizon | VZ | 6.5% | 56% | 19 years | Medium-High |

| Coca-Cola | KO | 3.1% | 75% | 62 years | Very High |

| AbbVie | ABBV | 3.6% | 48% | 52 years | Very High |

| Procter & Gamble | PG | 2.4% | 60% | 68 years | Very High |

| Johnson & Johnson | JNJ | 3.0% | 52% | 62 years | Very High |

1. Realty Income (O) – The Monthly Dividend Company

Rating: 9/10

Current Yield: 5.8%

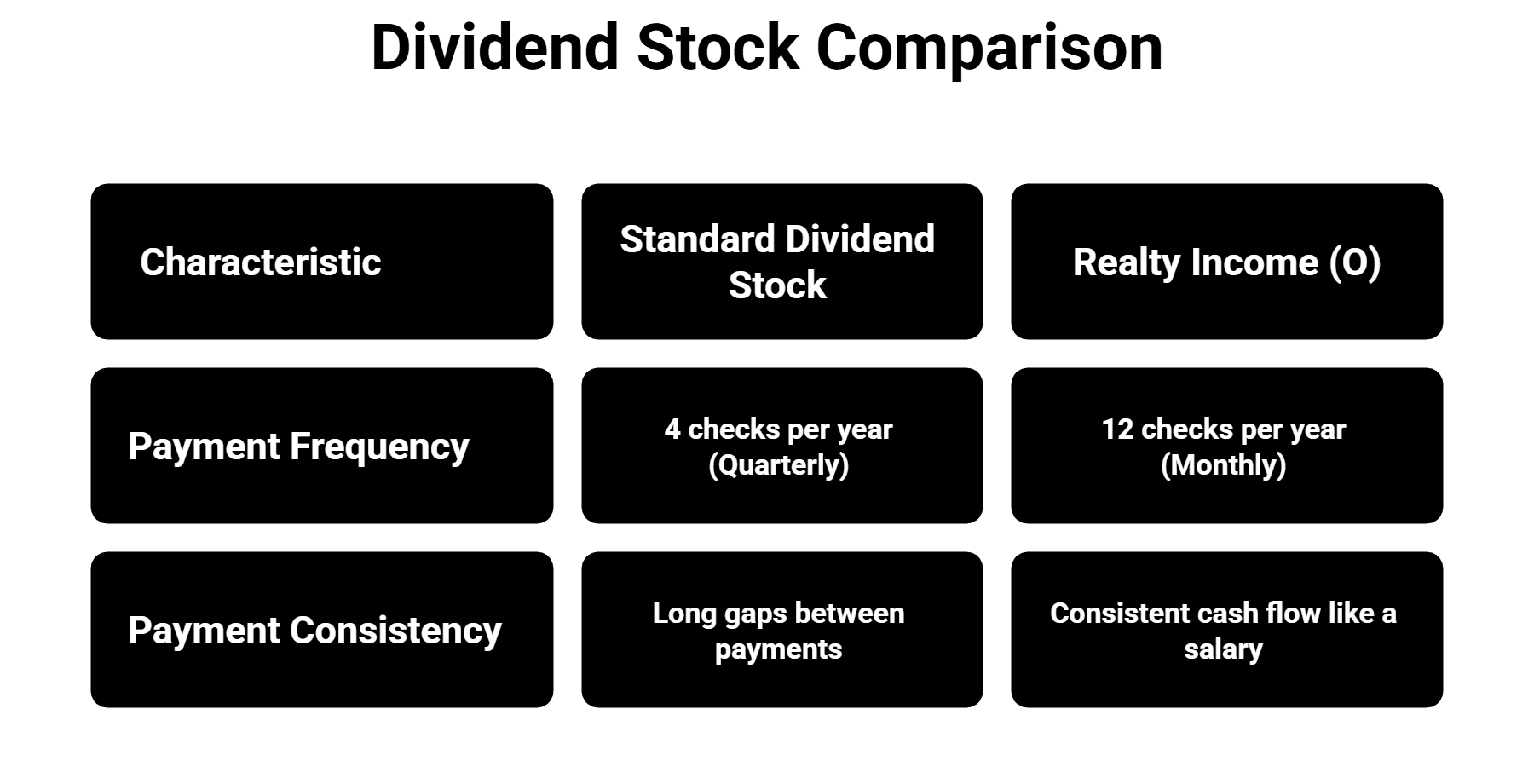

Dividend Frequency: Monthly

Consecutive Years of Increases: 29 years

Market Cap: $47 billion

Why I Own Realty Income

Realty Income is a real estate investment trust (REIT) that owns 15,000+ commercial properties. They lease to Walgreens, Dollar General, FedEx, and other recession-resistant tenants.

The killer feature: monthly dividends. Most stocks pay quarterly. Realty Income pays every month. This is perfect for building passive income that feels like a paycheck.

What You’re Buying:

- 15,000+ properties across retail, industrial, and office sectors

- Long-term leases (average 9+ years remaining)

- 98% occupancy rate

- Tenants in essential businesses (pharmacies, convenience stores, shipping)

The Business Model

Realty Income uses a “triple-net lease” structure. Tenants pay rent plus property taxes, insurance, and maintenance. Realty Income collects rent checks and distributes the cash as dividends.

This is a low-risk, low-growth business. Don’t expect the stock to double. But expect reliable monthly income that grows 3% to 4% annually.

Financial Health

| Metric | Value | Assessment |

|---|---|---|

| Payout Ratio (AFFO) | 74% | Acceptable for REITs |

| Debt-to-EBITDA | 5.2x | Moderate (typical for REITs) |

| Dividend Growth (5yr avg) | 3.2%/year | Beats inflation |

| Occupancy Rate | 98.6% | Excellent |

The Risks

1. Interest rate sensitivity: REITs struggle when interest rates rise. Higher rates make bonds more attractive and increase borrowing costs.

2. Retail exposure: 80% of properties are retail. If e-commerce continues destroying retail, some tenants may struggle.

3. Lower growth potential: This is a mature company. Expect 3% to 5% annual returns plus the dividend, not 15% to 20% growth.

My Position

I own 200 shares of Realty Income (purchased at average price of $54). Current value around $10,800. Annual dividend income: approximately $627.

I like the monthly payments. Every month, $52 appears in my account whether the market is up or down. Over 10 years, I expect this to grow to $75+ per month as they raise the dividend.

Who Should Buy

- Investors wanting monthly income (not quarterly)

- Retirees building cash flow

- Those comfortable with moderate risk for reliable 5% to 6% yields

- Long-term holders (10+ years)

Want to buy Realty Income?

Open an account at Interactive Brokers for best execution and zero commissions on stock trades.

2. Verizon (VZ) – Reliable Telecom Dividend

Rating: 8/10

Current Yield: 6.5%

Dividend Frequency: Quarterly

Consecutive Years of Increases: 19 years

Market Cap: $175 billion

Why Verizon Makes the List

Verizon is a boring business. They provide cell phone service and internet. People pay monthly bills. Verizon distributes the cash as dividends.

This isn’t a growth stock. Subscriber growth is flat. But the dividend is rock solid at 6.5% yield – one of the highest among blue-chip companies.

The Business:

- 143 million wireless subscribers

- Largest 5G network in the US

- Fios fiber internet (growing segment)

- Business services (stable revenue)

Why the Dividend is Safe

Telecom is a utility-like business. People don’t cancel cell phone service during recessions. Verizon has pricing power – they raise prices 2% to 3% annually and customers pay.

Payout ratio: 56% of earnings. This is healthy. Verizon earns $5.50 per share and pays $3.08 in dividends. Plenty of cushion.

The Concerns

1. Heavy debt load: Verizon carries $140 billion in debt from spectrum purchases and 5G buildout. This limits dividend growth.

2. Competitive pressure: T-Mobile is aggressively competing on price. Verizon is losing some market share.

3. Limited growth: US wireless market is saturated. Expect flat subscriber numbers.

But for dividend income, these concerns are manageable. Verizon isn’t going bankrupt. The dividend is safe. Growth will be slow (2% to 3% annually), but the 6.5% yield compensates.

My Take

I don’t personally own Verizon, but I recommended it to my father for his retirement portfolio. He wants high current income, not growth. 6.5% yield on a blue-chip stock fits perfectly.

If you’re retired or near retirement and want reliable income, Verizon works. If you’re young and want growth, skip it.

3. Coca-Cola (KO) – The Ultimate Dividend King

Rating: 9.5/10

Current Yield: 3.1%

Dividend Frequency: Quarterly

Consecutive Years of Increases: 62 years

Market Cap: $285 billion

Why Coca-Cola is the Gold Standard

Coca-Cola has raised its dividend for 62 consecutive years. They paid dividends through the 2008 financial crisis, the dot-com crash, multiple recessions, and COVID-19.

This is what dividend safety looks like.

The yield is moderate at 3.1%, but the power is in dividend growth. If you bought Coca-Cola 30 years ago, your yield-on-cost (dividend divided by your original purchase price) would be 20% to 30% today.

The Business:

- 500+ beverage brands (Coke, Sprite, Fanta, Dasani, Simply, Honest Tea)

- 200+ countries

- 1.9 billion servings consumed daily

- Recession-proof (people buy soda in good times and bad)

Financial Strength

| Metric | Value | Assessment |

|---|---|---|

| Payout Ratio | 75% | High but sustainable |

| Debt-to-Equity | 1.8 | Moderate |

| ROE (Return on Equity) | 41% | Excellent |

| Free Cash Flow | $10.3 billion | Strong |

The Dividend Growth Story

Coca-Cola doesn’t offer a high yield today. But they raise the dividend 3% to 5% every year.

Example: Buy 100 shares at $62 = $6,200 investment. Current dividend: $1.94/share = $194 annually (3.1% yield).

In 10 years with 4% annual increases:

- Dividend grows to $2.87/share

- You’re earning $287 annually

- Your yield-on-cost is now 4.6%

In 20 years:

- Dividend grows to $4.25/share

- You’re earning $425 annually

- Your yield-on-cost is 6.9%

This is the power of dividend growth investing.

My Position

I own 150 shares of Coca-Cola (average purchase price $56). It’s my “sleep well at night” holding. I know the dividend is safe. I know it will grow. I don’t worry about it.

Annual dividend income: approximately $291. Not exciting today, but in 10 years this will be $400+ without buying more shares.

4. AbbVie (ABBV) – Pharmaceutical Powerhouse

Rating: 8.5/10

Current Yield: 3.6%

Dividend Frequency: Quarterly

Consecutive Years of Increases: 52 years

Market Cap: $325 billion

Why AbbVie Stands Out

AbbVie is a pharmaceutical company spun off from Abbott Laboratories. They make Humira (the world’s former best-selling drug) and Skyrizi/Rinvoq (the new blockbusters).

The dividend yield is 3.6%, and the payout ratio is only 48%. This is the lowest payout ratio on this list, meaning AbbVie has massive room for dividend growth.

The Business:

- Humira: $14 billion in annual sales (declining due to biosimilar competition)

- Skyrizi and Rinvoq: $13 billion combined (growing 40%+ annually)

- Botox: $5 billion (aesthetic and therapeutic uses)

- Oncology portfolio: Growing segment

The Humira Problem

Humira lost US patent protection in 2023. Biosimilar competition is eroding sales. This spooked investors and the stock dropped.

But AbbVie anticipated this. They’ve been building Skyrizi and Rinvoq for years. These drugs are growing fast enough to offset Humira declines.

By 2027, management projects Skyrizi and Rinvoq will generate $27 billion annually – double current Humira sales.

Dividend Safety

48% payout ratio is incredibly safe. AbbVie earns $11.50 per share and pays $5.92 in dividends. They could double the dividend and still have a healthy payout ratio.

Expect dividend growth of 6% to 8% annually for the next 5 to 10 years.

The Risks

1. Pipeline risk: Pharmaceutical companies live and die by drug pipelines. If Skyrizi and Rinvoq face unexpected competition or safety issues, growth stalls.

2. Regulatory risk: Government pressure on drug pricing could hurt margins.

3. Patent cliffs: Skyrizi and Rinvoq will eventually lose patent protection (2030s). The cycle repeats.

But for the next 10 years, AbbVie looks strong.

Who Should Buy

- Investors wanting dividend growth (not just high current yield)

- Those comfortable with pharma sector risk

- Long-term holders (10+ years)

5. Procter & Gamble (PG) – Consumer Staples King

Rating: 9/10

Current Yield: 2.4%

Dividend Frequency: Quarterly

Consecutive Years of Increases: 68 years

Market Cap: $405 billion

Why Procter & Gamble is Ultra-Safe

Procter & Gamble makes products people buy regardless of the economy: Tide detergent, Charmin toilet paper, Pampers diapers, Gillette razors, Crest toothpaste.

They’ve raised their dividend for 68 consecutive years. That’s through 10+ recessions, multiple wars, inflation, deflation, and every market condition imaginable.

The yield is low at 2.4%, but the safety is unmatched.

The Business:

- 65+ brands including Tide, Pampers, Gillette, Bounty, Dawn

- 5 billion people use P&G products daily

- Operations in 180+ countries

- $82 billion in annual revenue

The Dividend Growth Story

P&G grows the dividend 4% to 6% annually. Not exciting, but reliable.

If you bought P&G 20 years ago at $50/share:

- Your yield-on-cost today would be approximately 10%

- You’d be earning $5+ per share in annual dividends

- Your original investment would have quadrupled

This is what time and compound dividend growth do.

Why I Don’t Own It (But Respect It)

P&G is too safe for my taste. At 2.4% yield, I prefer higher-yielding alternatives. But for conservative investors who want absolute safety, P&G is perfect.

My parents own P&G in their retirement accounts. They don’t worry about the dividend getting cut. They know it will grow 4% annually forever.

Who Should Buy

- Conservative investors prioritizing safety over yield

- Retirees who can’t afford dividend cuts

- Long-term buy-and-hold investors (20+ years)

- Those building a dividend growth portfolio

6. Johnson & Johnson (JNJ) – Healthcare Giant

Rating: 9/10

Current Yield: 3.0%

Dividend Frequency: Quarterly

Consecutive Years of Increases: 62 years

Market Cap: $380 billion

Why Johnson & Johnson is a Core Holding

Johnson & Johnson is one of only two companies with a AAA credit rating (the other is Microsoft). They’re financially stronger than the US government.

They operate in three segments:

- Pharmaceuticals: 55% of revenue (Stelara, Darzalex, Tremfya)

- MedTech: 45% of revenue (surgical equipment, orthopedics, vision care)

- Consumer Health: Spun off in 2023 (Band-Aid, Tylenol, Listerine now separate company Kenvue)

The Recent Spinoff

J&J spun off their consumer health division (Kenvue) in 2023. Shareholders received Kenvue stock as a special dividend.

This makes J&J a pure-play pharmaceutical and medical device company. Higher margins, better growth potential.

The dividend stayed intact. 62 years of increases continues.

Financial Fortress

| Metric | Value | Assessment |

|---|---|---|

| Payout Ratio | 52% | Very safe |

| Debt-to-Equity | 0.45 | Excellent |

| Credit Rating | AAA | Highest possible |

| Free Cash Flow | $18 billion | Strong |

My Position

I own 100 shares of J&J (purchased around $155). Annual dividend: approximately $300.

This is my “never sell” position. I plan to hold J&J for 30+ years and watch the dividend compound.

Who Should Buy

- Conservative investors wanting blue-chip safety

- Those building a retirement portfolio

- Investors seeking dividend growth with moderate current yield

- Anyone wanting a stock they can hold forever

7. AT&T (T) – Turnaround Dividend Story

Rating: 7/10

Current Yield: 6.2%

Dividend Frequency: Quarterly

Consecutive Years of Increases: 40 years (but cut in 2022)

Market Cap: $155 billion

Why AT&T is Controversial

AT&T cut its dividend by 47% in 2022 after spinning off WarnerMedia. This ended a 40-year streak of dividend increases.

Many dividend investors sold immediately. “Never own a company that cuts the dividend,” they said.

But here’s the contrarian view: AT&T is now a pure-play telecom company. They shed their money-losing media assets (HBO, CNN, Warner Bros). Debt is declining. Free cash flow is improving.

The current 6.2% yield might be sustainable this time.

The New AT&T:

- 240 million wireless subscribers

- Fiber internet (fastest-growing segment)

- Business services

- Debt reduction: Goal to reach $130 billion by 2025 (from $170 billion)

Why the Dividend Might Be Safe Now

After the WarnerMedia spinoff, AT&T’s payout ratio dropped to 58%. This is sustainable for a mature telecom.

Management committed to maintaining the current dividend and potentially growing it

slowly (2% to 3% annually) as debt declines and cash flow improves.

The Risks

1. Trust is broken: AT&T cut the dividend once. They could cut again if the economy worsens.

2. High debt: $140 billion in debt is still significant. Interest payments limit flexibility.

3. Competitive pressure: T-Mobile and Verizon are fierce competitors. AT&T is losing wireless market share.

4. Fiber buildout costs: Expanding fiber internet requires massive capital investment, reducing free cash flow available for dividends.

My Take

I don’t own AT&T, but I’m watching it. If they maintain the dividend for 3+ consecutive years and continue reducing debt, I might add a small position.

For now, it’s a “wait and see.” The 6.2% yield is tempting, but the broken trust concerns me.

If you’re comfortable with higher risk for higher yield, AT&T could work. Just size your position appropriately (no more than 5% of portfolio).

Building Your Dividend Portfolio: Allocation Strategy

Don’t put all your money into one dividend stock. Diversification protects you when individual companies cut dividends or underperform.

Here’s how I would allocate a $50,000 dividend portfolio:

Sample $50,000 Dividend Portfolio

| Stock | Allocation | Investment | Annual Dividend | Purpose |

|---|---|---|---|---|

| Realty Income (O) | 20% | $10,000 | $580 | Monthly income |

| Coca-Cola (KO) | 15% | $7,500 | $233 | Dividend growth |

| Johnson & Johnson (JNJ) | 15% | $7,500 | $225 | Safety + growth |

| AbbVie (ABBV) | 15% | $7,500 | $270 | High growth potential |

| Procter & Gamble (PG) | 10% | $5,000 | $120 | Recession protection |

| Verizon (VZ) | 15% | $7,500 | $488 | High current yield |

| AT&T (T) | 10% | $5,000 | $310 | Speculative high yield |

| Total | 100% | $50,000 | $2,226 | 4.45% yield |

Expected annual income: $2,226

That’s $185 per month in passive income. Not life-changing, but it covers utilities, phone bill, and streaming services.

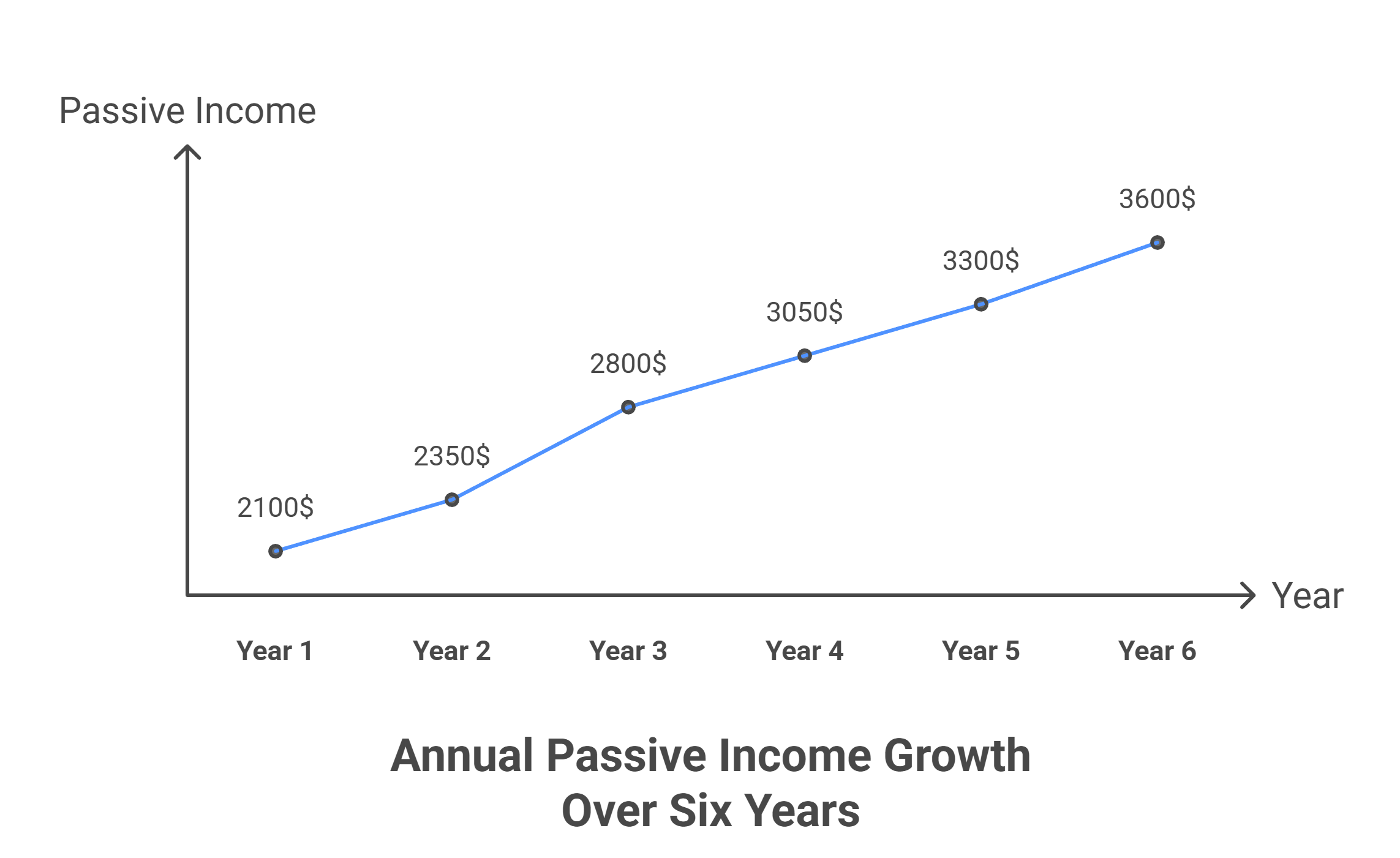

In 10 years with 4% average dividend growth, this portfolio would generate approximately $3,300 annually – without investing another dollar.

Why This Allocation Works

Balance of yield and safety: Portfolio yields 4.45% while maintaining strong dividend safety through blue-chip companies.

Diversification across sectors: REITs (Realty Income), Telecom (Verizon, AT&T), Consumer Staples (Coke, P&G), Pharma (AbbVie, J&J). If one sector struggles, others compensate.

Mix of current income and growth: Verizon and Realty Income provide high current yield. Coca-Cola, J&J, and AbbVie provide dividend growth.

Monthly income component: Realty Income pays monthly, providing consistent cash flow throughout the year.

Common Dividend Investing Mistakes (And How to Avoid Them)

Mistake 1: Chasing the Highest Yield

I see beginners do this constantly. They sort stocks by dividend yield, buy the highest ones (8% to 12% yields), and think they’re geniuses.

Then the dividend gets cut, the stock drops 40%, and they lose money.

Example: In 2020, many investors bought energy stocks yielding 10%+ (Exxon, Chevron, smaller oil companies). When COVID hit and oil crashed, most cut dividends. Investors lost 50%+ of their capital chasing high yields.

Solution: Focus on dividend safety and growth, not just current yield. A sustainable 4% yield that grows 5% annually beats an unsustainable 10% yield that gets cut.

Mistake 2: Not Diversifying Across Sectors

Putting all your dividend money into one sector (like all REITs or all energy stocks) is dangerous.

When that sector struggles, your entire portfolio gets crushed.

Example: Investors who built 100% REIT portfolios in 2022 suffered when interest rates spiked. REITs dropped 25% to 40%. If they had diversified into consumer staples and healthcare, losses would have been smaller.

Solution: Spread across at least 4 to 5 different sectors. No single sector should be more than 30% of your dividend portfolio.

Mistake 3: Ignoring Payout Ratios

Payout ratio tells you what percentage of earnings a company pays as dividends.

If a company earns $4 per share and pays $3.80 in dividends, the payout ratio is 95%. This is unsustainable. One bad quarter and they cut the dividend.

Safe payout ratios:

- Most companies: 30% to 60%

- REITs: 70% to 80% (they must pay 90% of income by law, so higher ratios are normal)

- Utilities: 60% to 75%

Solution: Always check payout ratio before buying. If it’s above 80% (except REITs), be cautious.

Mistake 4: Selling After Short-Term Underperformance

Dividend stocks often underperform growth stocks during bull markets. This frustrates impatient investors who sell.

Example: From 2010 to 2020, tech stocks (Apple, Amazon, Google) crushed dividend stocks. Many dividend investors sold Coca-Cola and J&J to chase tech gains. Then in 2022, tech crashed 40% to 60% while dividend stocks held steady.

Dividend investing requires patience. You’re building income, not chasing capital gains.

Solution: Commit to holding dividend stocks for 10+ years minimum. Ignore short-term price movements. Focus on growing dividend income.

Mistake 5: Not Reinvesting Dividends Early On

When you’re young and building wealth, reinvest dividends to buy more shares. This accelerates compounding.

Example: You buy $10,000 of Coca-Cola. It pays $310 in dividends year one.

Option A: You spend the $310. Next year, you still own $10,000 worth of stock, still earning $310.

Option B: You reinvest the $310 to buy more shares. Next year, you own $10,310 worth of stock, earning $320 in dividends. Over 20 years, this compounds significantly.

Solution: Enable automatic dividend reinvestment (DRIP) in your brokerage account until you need the income.

Mistake 6: Forgetting About Taxes

Dividends are taxed, and tax rates vary depending on your account type and income level.

Qualified dividends: Taxed at 0%, 15%, or 20% (lower rates) if you hold the stock for 60+ days.

Non-qualified dividends: Taxed as ordinary income (up to 37%).

REITs pay non-qualified dividends, which are taxed at your ordinary income rate. This makes them less tax-efficient in taxable accounts.

Solution: Hold REITs and high-yield dividend stocks in tax-advantaged accounts (Roth IRA, Traditional IRA). Hold qualified dividend stocks (J&J, Coke, P&G) in taxable accounts.

How to Start Building Your Dividend Portfolio Today

Here’s the exact step-by-step process I would follow if starting from zero:

Step 1: Open a Brokerage Account

You need a broker with zero commissions on stock trades. Don’t pay $7 to $10 per trade – it eats into your dividend income.

Best options:

- Interactive Brokers – Best for serious investors, best execution quality

- Fidelity – Best for retirement accounts (IRA, Roth IRA)

- Robinhood – Easiest for complete beginners

My recommendation: Interactive Brokers for taxable accounts, Fidelity for retirement accounts.

Step 2: Start With $500 to $1,000

Don’t wait until you have $50,000. Start small and learn.

Buy 1 to 2 shares of 3 to 4 different dividend stocks. This gives you skin in the game and teaches you how dividends work.

Example $1,000 starter portfolio:

- $300 – Realty Income (5 shares)

- $250 – Coca-Cola (4 shares)

- $250 – Johnson & Johnson (1 to 2 shares)

- $200 – Verizon (5 shares)

This generates approximately $40 per year in dividends. Small, but you’ve started.

Step 3: Automate Monthly Contributions

Set up automatic transfers from your checking account to your brokerage account. $100, $200, $500 per month – whatever you can afford.

Then buy more dividend stocks with each contribution. This is dollar-cost averaging applied to dividend investing.

Over time, your positions grow and dividend income compounds.

Step 4: Reinvest Dividends Automatically

Enable DRIP (Dividend Reinvestment Plan) in your brokerage account. This automatically uses dividend payments to buy more shares.

You don’t have to manually reinvest. The broker does it for you, often with fractional shares and zero commissions.

Step 5: Track Your Dividend Income

Create a simple spreadsheet tracking:

- Total invested

- Number of shares owned

- Annual dividend income

- Yield on cost (dividend / original purchase price)

Watching your dividend income grow is motivating. Seeing “$50 per month” become “$75 per month” then “$100 per month” keeps you committed.

Step 6: Review Quarterly, Don’t Trade

Check your portfolio once per quarter when companies report earnings.

Ask:

- Did they maintain or raise the dividend?

- Is the payout ratio still safe?

- Are earnings growing?

If yes to all three, do nothing. Hold.

If a company cuts the dividend, evaluate whether to hold or sell. Usually, it’s best to sell and reinvest in a safer dividend stock.

Step 7: Be Patient

Dividend investing is not exciting. You won’t double your money in 6 months.

But in 10 to 20 years, you’ll have a portfolio generating thousands of dollars in annual passive income. That income will cover your living expenses, giving you financial freedom.

That’s the goal.

Tax Considerations for Dividend Investors

Dividends are taxed, and tax efficiency matters. Here’s what you need to know:

Qualified vs Non-Qualified Dividends

Qualified dividends: Taxed at capital gains rates (0%, 15%, or 20% depending on income). Most US company dividends are qualified if you hold the stock 60+ days.

Non-qualified dividends: Taxed as ordinary income (10% to 37%). REITs, foreign companies, and some MLPs pay non-qualified dividends.

Where to Hold Different Dividend Stocks

| Stock Type | Best Account | Why |

|---|---|---|

| REITs (Realty Income, etc) | Roth IRA or Traditional IRA | Non-qualified dividends taxed as income – avoid in taxable accounts |

| Qualified dividends (J&J, Coke, P&G) | Taxable account OK | Low tax rates (0% to 20%) make them tax-efficient |

| High-yield stocks (Verizon, AT&T) | Roth IRA preferred | High income = more taxes, better to shelter in retirement account |

Example Tax Impact

You earn $2,000 in dividends:

Scenario A (Taxable account, 22% tax bracket):

- Qualified dividends: taxed at 15% = $300 tax

- You keep $1,700

Scenario B (Taxable account with REITs, 22% bracket):

- Non-qualified dividends: taxed at 22% = $440 tax

- You keep $1,560

Scenario C (Roth IRA):

- Tax: $0

- You keep $2,000

Over 30 years, tax efficiency significantly impacts your wealth.

For detailed tax strategies, see our guide on how crypto taxes work in the USA (same principles apply to dividend stocks).

Frequently Asked Questions

Can I live off dividend income?

Yes, but you need a large portfolio. To generate $50,000 annual income with a 4% yield, you need $1.25 million invested.

Most people can’t start with $1.25 million. But you can build toward it over 20 to 30 years through consistent investing and dividend reinvestment.

Realistic timeline: Start with $10,000 to $20,000, contribute $500 to $1,000 monthly, reinvest dividends. In 25 to 30 years, you could have $500,000 to $1 million generating $20,000 to $40,000 annually.

Should I focus on high yield or dividend growth?

It depends on your age and goals.

If you’re young (under 50): Focus on dividend growth. Buy stocks like Coca-Cola, J&J, AbbVie with lower current yields but strong growth. Reinvest dividends. In 20 to 30 years, your yield-on-cost will be 10%+ even though current yield is only 3%.

If you’re retired or near retirement: Focus on current income. Buy higher-yielding stocks like Realty Income, Verizon. You need cash flow now, not growth in 20 years.

What if a company cuts its dividend?

Evaluate why they cut it.

Temporary business problem: Consider holding if the underlying business is strong and the dividend will likely be restored (example: Disney cut dividend during COVID, restored it later).

Structural problem: Sell immediately. If a company cuts the dividend because their business model is failing, the stock will likely continue declining.

Most of the time, it’s best to sell after a dividend cut and reinvest in a safer dividend stock.

How many dividend stocks should I own?

10 to 20 stocks provides good diversification without becoming unmanageable.

Less than 10: You’re too concentrated. One dividend cut hurts significantly.

More than 25: You’re over-diversified. Hard to track, and your best ideas get diluted.

I personally own 15 dividend stocks. This gives me sector diversification while keeping the portfolio manageable.

Are dividend ETFs better than individual stocks?

Dividend ETFs like VYM, SCHD, and DVY offer instant diversification. You own 50 to 400 dividend stocks in one fund.

Pros of ETFs:

- Instant diversification

- Professional management

- Lower risk than individual stocks

- No need to research companies

Cons of ETFs:

- Lower yields (typically 2% to 3%) than handpicked stocks

- You own the bad stocks along with the good

- Less control over tax optimization

My approach: Core portfolio of 10 to 15 individual dividend stocks + one dividend ETF (SCHD) for additional diversification.

Should I reinvest dividends or take the cash?

Reinvest if: You’re still building wealth and don’t need the income. Reinvesting accelerates compounding.

Take the cash if: You’re retired or need passive income to cover expenses.

I reinvested all dividends for the first 5 years. Now I take 50% as cash and reinvest 50%. In 10 years when I’m closer to retirement, I’ll take 100% as cash.

What’s a realistic dividend portfolio return?

Expect 6% to 9% total return (dividends + capital appreciation) long-term.

This is lower than growth stocks (which can return 10% to 15%+), but dividend stocks are more stable and provide income during downturns.

Example: A diversified dividend portfolio might yield 4% with 3% to 5% annual stock price appreciation = 7% to 9% total return.

Do I need a lot of money to start dividend investing?

No. You can start with $100.

Most brokers now offer fractional shares. You can buy 0.25 shares of Johnson & Johnson if that’s all you can afford.

The important thing is starting. Even $50 per month invested consistently becomes significant over time.

Are there better alternatives to dividend stocks for passive income?

Alternatives include:

- Real estate: Rental properties generate income but require active management and large capital. See our REITs vs rental properties comparison.

- Bonds: Lower risk than stocks, but yields are currently low (3% to 5%).

- Crypto staking: Higher yields (4% to 8%) but much riskier. See our best crypto staking platforms guide.

- Business income: Owning a business can generate passive income, but requires significant upfront work.

For most people, dividend stocks offer the best balance of passive income, growth potential, and risk management.

Final Thoughts: Dividend Investing is a Marathon

I’ve been building my dividend portfolio for 8 years. It’s not exciting. Most months, nothing happens. I collect dividends, reinvest them, and go about my life.

But every year, my passive income grows. In 2018, I earned $2,100. In 2025, I’ll earn approximately $4,200 – double the income from the same initial investment.

In another 8 years, I expect to earn $7,000 to $8,000 annually. That’s real money that covers real expenses without selling shares.

This is the power of dividend investing done patiently and correctly.

The stocks I’ve covered in this guide – Realty Income, Coca-Cola, Johnson & Johnson, AbbVie, Procter & Gamble, Verizon, and AT&T – represent my best ideas today. Not every stock will perform well. Some might cut dividends. But as a portfolio, they should generate reliable, growing income over decades.

Start small. Build consistently. Reinvest dividends. Be patient.

In 20 years, you’ll have financial freedom most people only dream about.

Ready to Start Building Your Dividend Portfolio?

Step 1: Get professional dividend stock research from The Motley Fool Stock Advisor (currently 50% off for new members).

Step 2: Open a brokerage account at Interactive Brokers for zero commissions and best execution.

Step 3: Buy your first dividend stock today. Even $100 invested is better than waiting for the “perfect time.”