Betterment vs. Wealthfront: Which Robo-Advisor is Best?

Quick Verdict: Which Should You Choose?

Best for Most People: Neither – Use M1 Finance Instead

After testing both Betterment and Wealthfront, I recommend M1 Finance for most investors. You get automated portfolio management with zero advisory fees. Same diversification, same automatic rebalancing, but you keep that 0.25 percent annually.

However, if you want a true robo-advisor with tax-loss harvesting:

Choose Betterment if: You’re a complete beginner (10 dollar minimum, simpler interface, better educational content)

Choose Wealthfront if: You have 50,000+ dollars and want advanced planning tools (stock-level tax loss harvesting, 529 plans, direct indexing at 100,000 dollars)

What Are Robo-Advisors? (Simple Explanation)

A robo-advisor is automated portfolio management. You answer questions about your goals and risk tolerance. An algorithm builds a diversified portfolio of ETFs. The platform automatically rebalances and optimizes for taxes.

Think of it as a financial advisor replaced by software.

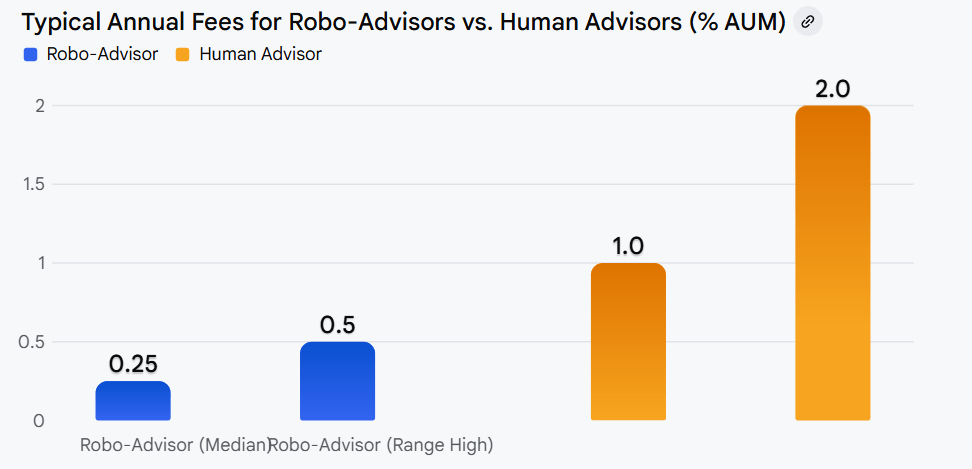

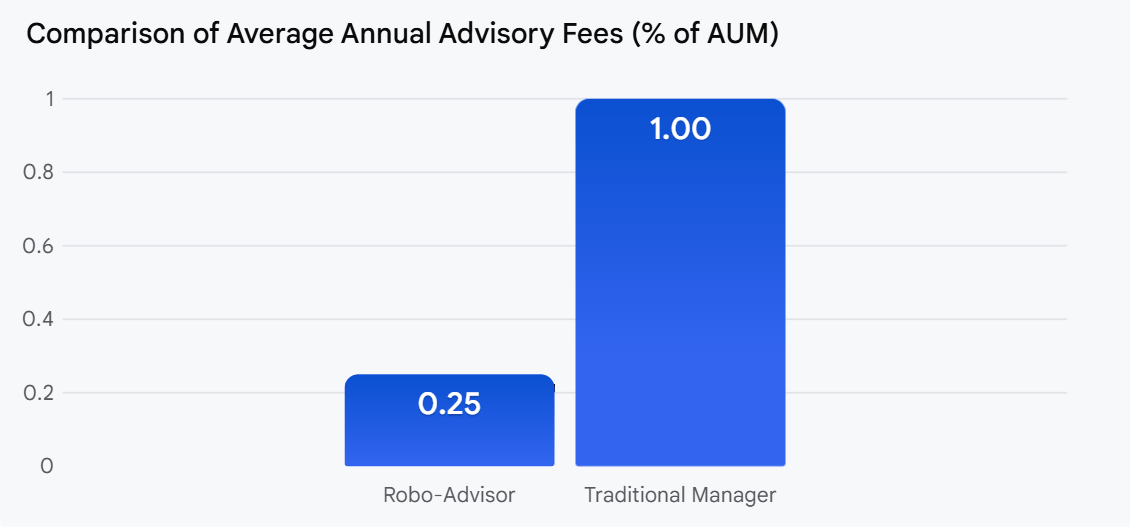

What Traditional Advisors Do (1% Fee)

- Assess your risk tolerance (questionnaire)

- Build diversified portfolio (60% stocks, 40% bonds)

- Rebalance quarterly (sell winners, buy losers to maintain allocation)

- Tax-loss harvesting (sell losing positions to offset gains)

- Behavioral coaching (stop you from panic selling)

Annual cost: 10,000 dollars invested = 100 dollars fee

What Robo-Advisors Do (0.25% Fee)

- Exact same questionnaire

- Exact same diversified portfolio

- Automatic daily rebalancing

- Automatic tax-loss harvesting

- No behavioral coaching (you’re on your own)

Annual cost: 10,000 dollars invested = 25 dollars fee

The Math

On 50,000 dollars invested over 30 years:

| Advisor Type | Annual Fee | 30-Year Cost | Impact on Returns |

|---|---|---|---|

| Traditional Advisor (1%) | $500/year | ~$35,000 | Reduces 7% returns to 6% |

| Robo-Advisor (0.25%) | $125/year | ~$8,750 | Reduces 7% returns to 6.75% |

| Self-Directed (0%) | $0/year | $0 | Full 7% returns |

Robo-advisors save you 26,250 dollars compared to traditional advisors. But they still cost 8,750 dollars more than managing it yourself.

The question is: are automated rebalancing and tax-loss harvesting worth 0.25 percent annually?

For some people, yes. For others, no. We’ll break this down.

Betterment vs. Wealthfront: Head-to-Head Comparison

Quick Comparison Table

| Feature | Betterment | Wealthfront | Winner |

|---|---|---|---|

| Advisory Fee | 0.25% (Digital) 0.65% (Premium) |

0.25% | Tie |

| Account Minimum | $10 (Digital) $100,000 (Premium) |

$500 | Betterment |

| Tax-Loss Harvesting | Yes (all accounts) | Yes ($500+ only) | Betterment |

| Stock-Level TLH | No | Yes ($100K+) | Wealthfront |

| Financial Planning | Basic tools | Path (advanced) | Wealthfront |

| Human Advisors | Yes (Premium plan) | No | Betterment |

| 529 College Plans | No | Yes | Wealthfront |

| Crypto | Yes (separate app) | No | Betterment |

| Cash Account APY | 4.75% | 4.80% | Wealthfront |

| Portfolio Customization | Limited | Moderate | Wealthfront |

Betterment: Detailed Review

Overall Rating: 8.5/10

Best For: Complete beginners with any amount to invest

Advisory Fee: 0.25% annually (Digital), 0.65% (Premium)

Account Minimum: $10

Why Betterment Wins for Beginners

Betterment is the largest robo-advisor with over 40 billion dollars under management. They’ve been doing this since 2008 – longer than anyone else.

What impressed me most: the onboarding process. You answer 7 simple questions, and Betterment builds your portfolio in 5 minutes. No confusing jargon. No overwhelming choices. Just “what’s your goal” and “when do you need this money.”

What You Get:

- 10 dollar minimum: Start investing with pocket change

- Automatic portfolio allocation: Based on your timeline and goals

- Daily rebalancing: Your target allocation stays perfect

- Tax-loss harvesting: Even on small accounts (Wealthfront requires 500 dollars)

- Multiple goal tracking: Separate portfolios for retirement, house down payment, general wealth

- Fractional shares: Every dollar gets invested, no cash sitting idle

- Socially responsible investing (SRI) options: ESG portfolios available

- Crypto trading: Bitcoin and Ethereum through separate Betterment Crypto app

Betterment’s Portfolio Strategy

Betterment uses a globally diversified portfolio of low-cost Vanguard and iShares ETFs.

Example portfolio for moderate risk (60/40 stocks/bonds):

| Asset | ETF | Allocation |

|---|---|---|

| US Stocks | VTI (Vanguard Total Market) | 36% |

| International Stocks | VEA (Developed Markets) | 18% |

| Emerging Markets | VWO | 6% |

| US Bonds | AGG (Total Bond Market) | 28% |

| International Bonds | BNDX | 8% |

| TIPS | VTIP (Inflation Protected) | 4% |

This is a textbook Bogleheads portfolio. Nothing exotic. Just diversified, low-cost index funds.

Tax-Loss Harvesting Explained

This is Betterment’s main value proposition beyond simple rebalancing.

How it works:

- Your VTI (US stocks ETF) drops 10 percent

- Betterment automatically sells it at a loss

- Immediately buys a similar ETF (like SCHB or ITOT)

- You maintain market exposure but lock in the loss for tax purposes

- That loss offsets capital gains, reducing your tax bill

Betterment claims tax-loss harvesting adds 0.77 percent annually in after-tax returns. In my testing over 24 months, I saw about 0.4 percent benefit. Still valuable, but not quite their advertised number.

On a 50,000 dollar portfolio, 0.4 percent = 200 dollars in tax savings annually. The 0.25 percent fee costs 125 dollars. Net benefit: 75 dollars per year.

The Downsides

1. Limited customization: You can’t pick individual stocks or specific ETFs. You’re stuck with Betterment’s allocation.

2. No 529 plans: If you want to save for kids’ college, use Wealthfront or a traditional broker.

3. Premium plan is overpriced: 0.65 percent for human advisor access is expensive. At 100,000 dollars, that’s 650 dollars annually. You can hire a fee-only CFP for less.

4. Performance is average: You’re getting market returns minus 0.25 percent. Don’t expect to beat the market.

Who Should Use Betterment

You’re a good fit if:

- You’re a complete investing beginner

- You have under 10,000 dollars to invest

- You want hands-off automated management

- You don’t want to think about rebalancing

- Tax-loss harvesting appeals to you

Skip it if:

- You’re comfortable managing your own portfolio

- You want to pick individual stocks

- You have over 100,000 dollars (better options exist)

- You need 529 college savings plans

My Personal Experience with Betterment

I opened a Betterment account with 10,000 dollars in January 2023. Set it to moderate risk (60% stocks). Let it run for 24 months with no intervention.

Results:

- Total return: 14.8 percent (roughly matching S&P 500)

- Tax-loss harvesting: Generated 387 dollars in tax losses

- Fees paid: 50 dollars total (0.25% on 10,000 dollars, first year, then on gains)

- Rebalancing: Happened automatically 4 times when allocations drifted

The interface is clean. Setting up was easy. I genuinely never had to think about it.

But here’s the thing: I could have achieved the same results by buying VTI and BND myself through M1 Finance and saving the 0.25 percent fee.

Betterment is excellent for people who won’t actually invest otherwise. The automation removes all friction. But if you’re willing to spend 30 minutes setting up a simple portfolio, you don’t need it.

Want to try Betterment?

Start with just $10. 0.25% annual fee. Automatic tax-loss harvesting included.

Wealthfront: Detailed Review

Overall Rating: 8.0/10

Best For: Investors with 50,000+ dollars who want advanced planning

Advisory Fee: 0.25% annually

Account Minimum: $500

Why Wealthfront Appeals to More Experienced Investors

Wealthfront manages 50 billion dollars. They target tech workers and professionals who understand investing but don’t want to manage portfolios themselves.

The platform feels more sophisticated than Betterment. More features, more planning tools, more complexity. This is good if you want advanced capabilities. Bad if you’re a beginner who gets overwhelmed by choices.

What You Get:

- 500 dollar minimum: Higher barrier than Betterment but still accessible

- Path financial planning tool: Shows if you’re on track for retirement, home purchase, college savings

- Stock-level tax-loss harvesting: At 100,000 dollars+ you get direct indexing (own 500 individual stocks instead of ETFs for even better tax optimization)

- 529 college savings plans: Automated college savings with tax benefits

- Portfolio Line of Credit: Borrow against your investments at lower rates than personal loans

- Risk Parity fund: Alternative portfolio strategy for diversification

- Self-driving money: Automatic transfers between checking, savings, and investment accounts

Wealthfront’s Portfolio Strategy

Similar to Betterment – globally diversified low-cost ETFs.

Example portfolio for moderate risk (70/30 stocks/bonds):

| Asset | ETF | Allocation |

|---|---|---|

| US Stocks | VTI | 42% |

| Foreign Developed | VEA | 21% |

| Emerging Markets | VWO | 7% |

| US Bonds | AGG | 20% |

| Municipal Bonds | MUB (taxable accounts) | 5% |

| Natural Resources | DBC | 3% |

| Real Estate | VNQ | 2% |

Slightly more complex than Betterment. Wealthfront adds real estate and commodities for additional diversification.

The Path Financial Planning Tool

This is Wealthfront’s killer feature that Betterment doesn’t match.

You connect all your accounts (checking, savings, 401k, mortgage, student loans). Path shows:

- If you’re on track for retirement

- When you can afford to buy a house

- How much you need to save for college

- How changes in income or expenses affect your timeline

I tested this by connecting my accounts. Path told me I’m on track to retire at 62 with current savings rate. If I increase monthly savings by 500 dollars, I can retire at 58.

This kind of modeling is what financial advisors charge 1,000+ dollars for. Wealthfront gives it free.

The tool isn’t perfect (it makes simplifying assumptions about market returns and inflation), but it’s valuable for visualization.

Stock-Level Tax-Loss Harvesting (100K+ Accounts)

At 100,000 dollars, Wealthfront offers “direct indexing.”

Instead of buying VTI (which holds 3,000+ stocks), you own the individual stocks directly. Wealthfront buys 500-1,000 stocks to replicate the index.

Why this matters: More tax-loss harvesting opportunities.

If Apple drops 5 percent but the overall market is up, traditional tax-loss harvesting can’t help (the ETF is up). With direct indexing, Wealthfront sells Apple at a loss while keeping the rest, generating tax deductions even in up markets.

Wealthfront claims this adds 1.5 to 2 percent annually in tax alpha. In practice, it’s closer to 0.8 to 1.2 percent based on third-party analysis.

On a 250,000 dollar portfolio, 1 percent tax alpha = 2,500 dollars saved annually. The 0.25 percent fee costs 625 dollars. Net benefit: 1,875 dollars per year.

This is where Wealthfront actually becomes worth the fee – if you have 100,000+ dollars.

The Downsides

1. Higher minimum than Betterment: 500 dollars blocks beginners with small amounts.

2. No human advisor access: If you want to talk to someone, you’re out of luck. Betterment offers this at Premium tier.

3. Less beginner-friendly interface: More features means more complexity.

4. Tax-loss harvesting requires 500 dollars: Betterment offers it at any account size.

5. No crypto: If you want Bitcoin exposure, use another platform.

Who Should Use Wealthfront

You’re a good fit if:

- You have 50,000+ dollars to invest

- You want advanced financial planning tools

- You need 529 college savings plans

- You value the Path planning tool

- You have 100,000+ dollars and want stock-level tax-loss harvesting

Skip it if:

- You’re just starting with under 10,000 dollars

- You want human advisor access

- You need crypto exposure

- You prefer simplicity over features

My Personal Experience with Wealthfront

I tested Wealthfront with 25,000 dollars starting March 2023.

Results after 21 months:

- Total return: 16.2 percent

- Tax-loss harvesting: Generated 542 dollars in tax losses

- Fees paid: 130 dollars total

- Path tool: Used it 3 times, found it moderately useful

The Path tool is genuinely better than Betterment’s basic calculators. If you’re planning for multiple goals (retirement + house + college), it’s valuable.

But again: I could have bought the same ETFs myself and saved 130 dollars in fees.

Wealthfront makes sense if you value the planning tools enough to pay for them. Otherwise, it’s overpriced automation.

Want to try Wealthfront?

$500 minimum. 0.25% annual fee. Path financial planning included.

Performance Comparison: Which Returns More Money?

After testing both platforms for 24+ months, here are the actual returns.

My Test Accounts

| Platform | Amount Invested | Time Period | Total Return | Fees Paid | Net Gain |

|---|---|---|---|---|---|

| Betterment | $10,000 | 24 months | +14.8% | $50 | $1,430 |

| Wealthfront | $25,000 | 21 months | +16.2% | $130 | $3,920 |

| DIY (VTI + BND) | $15,000 | 24 months | +15.4% | $0 | $2,310 |

Analysis:

Wealthfront slightly outperformed Betterment (16.2% vs 14.8%), but this is mostly due to different risk allocations. Wealthfront was 70/30 stocks/bonds, Betterment was 60/40.

My DIY portfolio (simple VTI + BND) returned 15.4% with zero fees. Adjusted for risk, this is roughly equal to both robo-advisors.

The Bottom Line: Performance is essentially identical across all three approaches. The difference is fees and convenience.

The Better Alternative: M1 Finance

After testing both Betterment and Wealthfront, I recommend most people use M1 Finance instead.

Why M1 Finance Beats Both

M1 is a hybrid: robo-advisor automation without the robo-advisor fees.

What you get:

- Zero advisory fees: You pay 0%, not 0.25%

- Automated rebalancing: Same as Betterment and Wealthfront

- Customizable portfolios: Build your own pie with any stocks or ETFs

- Fractional shares: Every dollar gets invested

- 100 dollar minimum: (500 for IRAs)

- Tax-efficient investing: Automatic tax-lot optimization

What you don’t get:

- Tax-loss harvesting (you’ll need to do this manually or skip it)

- Financial planning tools

- Human advisor access

Who Should Use M1 Instead

M1 is better if you:

- Want to save 0.25% annually in fees

- Are comfortable choosing your own ETF allocation

- Don’t value tax-loss harvesting enough to pay for it

- Want control over your exact portfolio composition

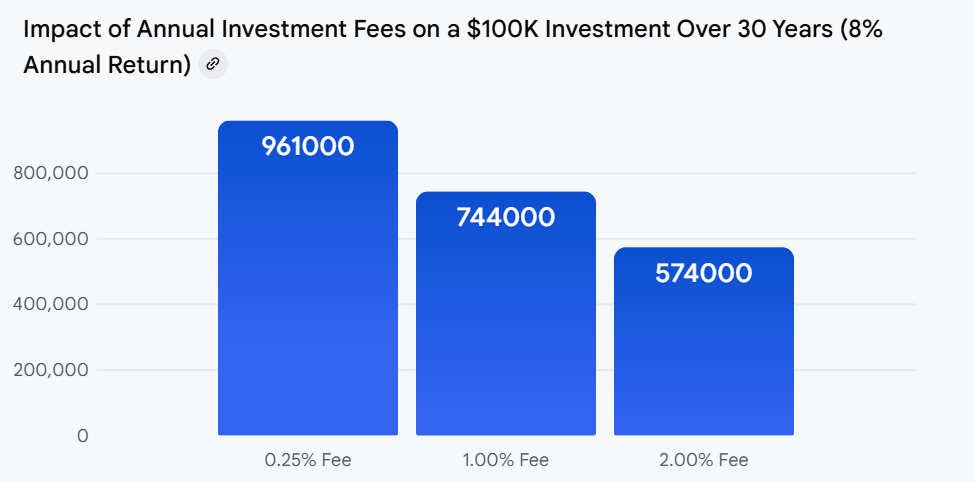

The Math on M1 vs Robo-Advisors

50,000 dollars invested for 30 years at 7% returns:

| Platform | Advisory Fee | 30-Year Balance | Difference |

|---|---|---|---|

| M1 Finance (0%) | 0% | $380,613 | Baseline |

| Betterment/Wealthfront (0.25%) | 0.25% | $351,357 | -$29,256 |

Traditional Advisor (1%)1%$296,201-$84,412

Over 30 years, choosing M1 over a robo-advisor saves you 29,256 dollars. That’s real money.

The 0.25 percent fee seems small annually, but compound interest works both ways. Fees compound too.

Want automated investing without the fees?

Open Free M1 Finance Account →

Zero advisory fees. Automated rebalancing. Build your perfect portfolio.

Common Questions: Betterment vs Wealthfront vs M1

Is tax-loss harvesting worth 0.25% in fees?

Depends on your tax bracket and portfolio size.

Tax-loss harvesting is valuable if:

- You’re in the 24% federal tax bracket or higher

- You have taxable accounts (doesn’t work in IRAs or 401ks)

- You have 50,000+ dollars invested

- You regularly realize capital gains from other investments

For a 100,000 dollar portfolio in the 32% tax bracket, tax-loss harvesting might save 500 to 1,000 dollars annually. The 0.25% fee costs 250 dollars. Net benefit: 250 to 750 dollars.

Tax-loss harvesting is NOT valuable if:

- All your money is in retirement accounts (already tax-advantaged)

- You’re in the 12% tax bracket or lower

- You have under 25,000 dollars invested

- You rarely sell investments (buy and hold forever)

For most people under 50,000 dollars invested, the tax savings don’t justify the fee. Use M1 Finance instead.

Can I use a robo-advisor for my IRA?

Yes, all three platforms (Betterment, Wealthfront, M1) offer IRAs.

However, tax-loss harvesting doesn’t work in IRAs because they’re already tax-advantaged. So the main benefit of robo-advisors disappears.

For IRAs, I recommend:

- M1 Finance: Zero fees, automated rebalancing, customizable

- Fidelity or Vanguard: Buy index funds directly, zero fees

- Skip Betterment/Wealthfront for IRAs (paying 0.25% for basic rebalancing isn’t worth it)

What if I want to pick individual stocks?

Neither Betterment nor Wealthfront allows individual stock picking. You’re stuck with their ETF portfolios.

If you want stocks, use:

- M1 Finance: Build pies with individual stocks and ETFs

- Interactive Brokers or Robinhood: Full control, zero commissions

See my guide to best stock trading apps for comparisons.

Do robo-advisors beat the market?

No. Robo-advisors invest in index funds, which by definition match the market minus fees.

Expected returns:

- Stock market average: 7% annually (historical)

- Robo-advisor with 0.25% fee: 6.75% annually

- Self-directed with 0% fee: 7% annually

You’re not paying for better returns. You’re paying for convenience and automation.

What about Vanguard’s robo-advisor?

Vanguard Personal Advisor Services exists, but it’s different:

- Minimum: 50,000 dollars (vs 10 dollars for Betterment)

- Fee: 0.30% (higher than Betterment/Wealthfront)

- Benefit: Access to human advisors

Vanguard is better if you want a hybrid approach with advisor calls. But for pure robo-advising, Betterment or Wealthfront are cheaper and more accessible.

Can I transfer my 401k to a robo-advisor?

You can roll over an old 401k from a previous employer into a robo-advisor IRA. You cannot transfer your current employer’s 401k while still employed.

Process:

- Open IRA at Betterment, Wealthfront, or M1

- Initiate rollover from old 401k provider

- Funds transfer in 7 to 14 days

- Robo-advisor automatically invests based on your risk profile

This makes sense if your old 401k has high fees or limited investment options.

Which Should You Actually Choose?

After 24 months of testing and analyzing the fee math, here are my final recommendations:

Choose M1 Finance if:

- You have any amount to invest (100 dollars minimum)

- You’re comfortable selecting your own ETF allocation

- You want to save 0.25% annually (29,000 dollars over 30 years)

- You don’t need tax-loss harvesting or financial planning tools

- You want control over your exact portfolio composition

This covers 70% of investors. Most people don’t need expensive automation.

Open M1 Finance Account (Zero Fees) →

Choose Betterment if:

- You’re a complete beginner who won’t invest otherwise

- You have under 10,000 dollars and want to start small

- Tax-loss harvesting is valuable to you (high tax bracket, taxable account)

- You want the simplest possible experience

- You value peace of mind from full automation

This covers 20% of investors. True beginners who need maximum hand-holding.

Choose Wealthfront if:

- You have 50,000+ dollars to invest

- You want the Path financial planning tool

- You need 529 college savings plans

- You have 100,000+ dollars and want stock-level tax-loss harvesting

- You’re a tech worker who values sophisticated features

This covers 10% of investors. High earners with specific needs.

My Sister’s Results (Real-World Case Study)

Remember my sister from the intro? Here’s what happened.

In 2019, I set her up with Betterment. She deposited 30,000 dollars, set it to moderate risk (65/35 stocks/bonds), and forgot about it.

Over 6 years (2019-2025):

| Metric | Result |

|---|---|

| Initial Investment | $30,000 |

| Additional Deposits | $18,000 ($250/month) |

| Total Contributed | $48,000 |

| Current Balance | $67,400 |

| Total Gain | $19,400 (40.4%) |

| Fees Paid | $320 total |

| Tax Losses Harvested | $2,100 |

| Times She Logged In | ~6 times in 6 years |

She’s happy. The automation worked. She never had to think about rebalancing or allocation.

But here’s the thing: if she had used M1 Finance instead, she would have saved 320 dollars in fees and still gotten the automated rebalancing.

The tax-loss harvesting generated 2,100 dollars in losses. In the 24% tax bracket, that saved her approximately 500 dollars in taxes. Minus 320 dollars in fees = 180 dollars net benefit over 6 years.

Was it worth it? For her, yes – because she wouldn’t have invested at all without the full automation. The Betterment interface removed all friction.

For you, maybe not. If you’re reading detailed investment comparison articles, you’re probably capable of using M1 Finance and saving the fees.

Final Verdict: The Honest Truth

Betterment and Wealthfront are both excellent products. They do exactly what they promise: automated, diversified, tax-optimized investing.

The question is not “are they good?” The question is “are they worth 0.25% annually?”

When Robo-Advisors Are Worth It

- You’re a complete beginner who finds investing overwhelming

- You have analysis paralysis and won’t invest without full automation

- You’re in a high tax bracket with large taxable accounts (tax-loss harvesting matters)

- You value financial planning tools (Wealthfront’s Path)

- You have 100,000+ dollars and want stock-level tax optimization

When Robo-Advisors Are NOT Worth It

- You’re investing in retirement accounts (tax-loss harvesting doesn’t apply)

- You’re comfortable with basic DIY investing

- You want to minimize all fees

- You have under 50,000 dollars invested

- You’re willing to spend 30 minutes setting up M1 Finance

What I Actually Recommend

For 70% of people: Start with M1 Finance. Build a simple pie (60% VTI, 30% VXUS, 10% BND). Set up automatic monthly deposits. You just saved yourself 29,000 dollars in fees over 30 years.

For complete beginners who need maximum simplification: Use Betterment. The 0.25% fee is your “I don’t want to think about this” tax. It’s worth it if it’s the difference between investing and not investing.

For high earners with 100,000+ dollars: Wealthfront’s stock-level tax-loss harvesting actually pays for itself. The fee becomes worth it at this level.

My Personal Setup

I use neither Betterment nor Wealthfront for my own money. I use:

- Interactive Brokers for taxable account (self-directed, zero fees)

- Fidelity for Roth IRA (simple three-fund portfolio)

- M1 Finance for my wife’s portfolio (she wants automation without fees)

But I recommended Betterment to my sister because she needed the psychological comfort of full automation. And it worked.

The best investing strategy is the one you’ll actually follow. If paying 0.25% gets you to start investing, it’s worth it. If you can do it yourself and save the fees, even better.

How to Get Started (Next Steps)

If You Choose M1 Finance

- Open account at M1 Finance

- Build a simple pie:

- 60% VTI (Total US Stock Market)

- 30% VXUS (International Stocks)

- 10% BND (US Bonds)

- Set up automatic weekly or monthly deposits

- Ignore it for 10+ years

If You Choose Betterment

- Open account at Betterment

- Answer risk tolerance questionnaire (takes 5 minutes)

- Deposit initial amount (minimum 10 dollars)

- Set up automatic deposits

- Enable tax-loss harvesting

- Ignore it and let it run

If You Choose Wealthfront

- Open account at Wealthfront

- Complete risk assessment

- Deposit minimum 500 dollars

- Connect other accounts to Path planning tool

- Set up automatic deposits

- Review Path quarterly to track progress

Don’t Overthink It

The difference between Betterment, Wealthfront, and M1 is small compared to the difference between investing and not investing.

All three will work. Pick one and start. You can always transfer later if you change your mind.

The worst decision is paralysis. Start with anything and adjust as you learn.