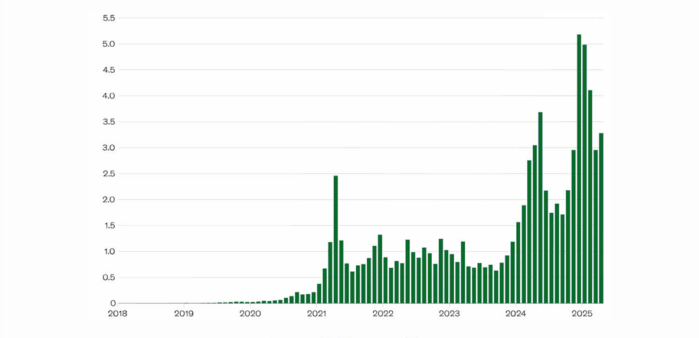

Ethereum spot ETFs launched in July 2024 and quietly accumulated $2.5 billion in assets within the first four months – a figure that shocked analysts who predicted minimal institutional interest. While Bitcoin ETFs dominated headlines, Ethereum’s institutional adoption is creating a fundamentally different investment thesis for 2025.

According to Bloomberg Intelligence, Ethereum ETFs could capture 25-35% of Bitcoin ETF market share by end of 2025, representing $15-20 billion in additional inflows. More importantly, Ethereum’s technology stack positions it as the infrastructure layer for the entire digital economy – something Bitcoin cannot claim.

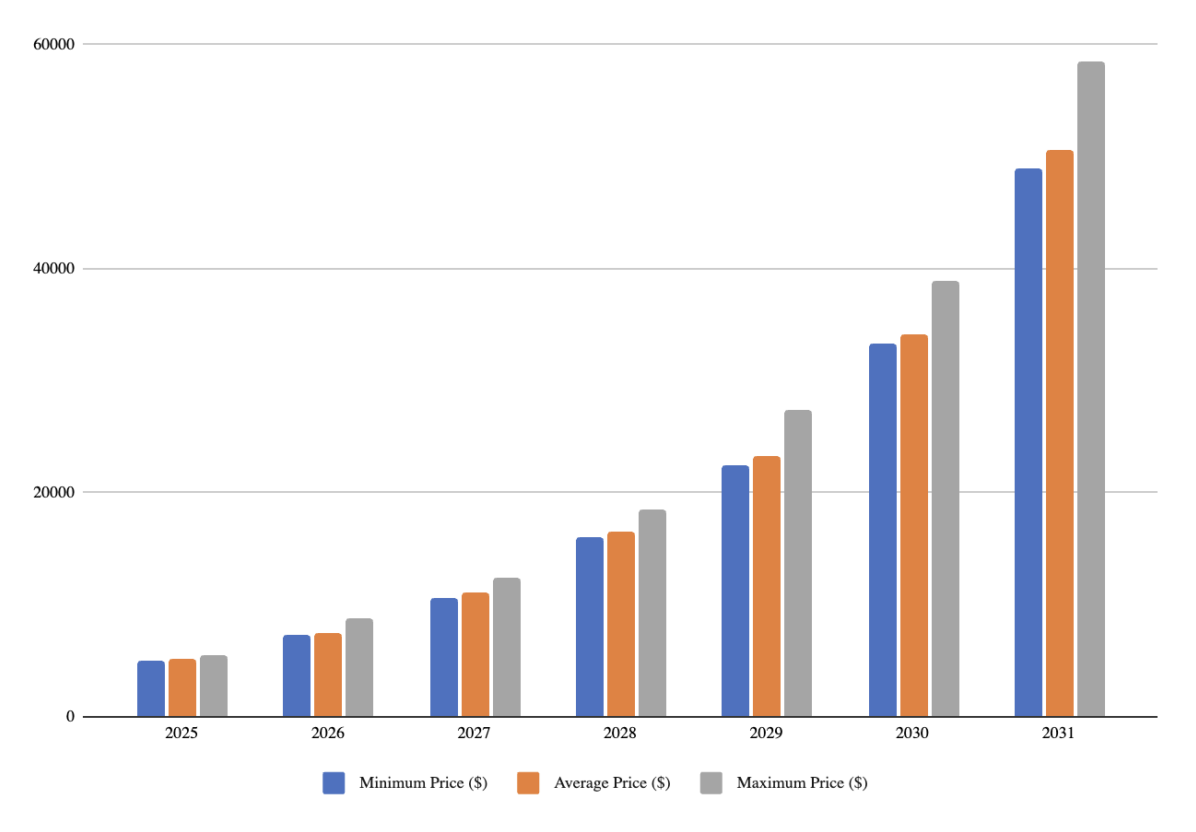

This analysis reveals why sophisticated investors are accumulating Ethereum, what catalysts could drive price to $8,000-12,000 by late 2025, and how to evaluate whether ETH belongs in your portfolio.

Why Ethereum Is Different From Bitcoin

Bitcoin is digital gold – a store of value. Ethereum is a global computer running decentralized applications, processing $4 trillion+ annually in transactions across DeFi, NFTs, stablecoins, and tokenized real-world assets.

Key differentiators:

Smart contract platform: Ethereum hosts 4,000+ decentralized applications. Bitcoin hosts zero. This creates utility beyond speculation.

Staking rewards: ETH holders earn 3-4% annual yield through staking. Bitcoin offers no yield. This makes Ethereum attractive to institutions requiring income generation.

Deflationary economics: Since the 2022 Merge, Ethereum burns more ETH than it creates during high network activity, making it deflationary. Bitcoin remains inflationary until 2140.

Layer 2 scaling: Solutions like Arbitrum, Optimism, and Base process transactions for $0.01-0.10 versus $1-5 on Ethereum mainnet, solving scalability without compromising security.

According to research from VanEck, Ethereum could capture $66 trillion of value from traditional finance sectors including payments, securities settlement, custody, and asset management over the next decade.

The Institutional Adoption Wave Just Starting

BlackRock’s Ethereum ETF (ETHA) attracted $1.2 billion in first 90 days despite launching during summer doldrums when institutional activity typically slows. Fidelity’s FETH added $890 million. Combined institutional Ethereum exposure now exceeds what Bitcoin ETFs achieved in comparable timeframes.

Why institutions are buying Ethereum specifically:

Yield generation: Unlike Bitcoin, staking Ethereum generates passive income. Institutional portfolios require yield – sitting in non-productive assets violates fiduciary duties for many funds.

Regulatory clarity: The SEC’s approval of Ethereum ETFs implicitly acknowledged ETH is not a security, resolving years of uncertainty that prevented institutional participation.

Diversification: Institutions already exposed to Bitcoin need different crypto assets. Ethereum’s low correlation to Bitcoin (0.65 in 2024 vs 0.89 in 2021) provides portfolio diversification benefits.

Real-world utility: CFOs and treasurers understand Ethereum’s role in payments, supply chain, and financial infrastructure better than Bitcoin’s store-of-value narrative.

Tokenization momentum: JPMorgan, Goldman Sachs, and Citibank are building tokenized securities platforms on Ethereum. When $10+ trillion in traditional assets migrate on-chain, they’ll primarily use Ethereum infrastructure.

Price Catalysts for 2025-2026

Pectra upgrade (Q1 2025): Increases validator limits, improves staking experience, and enhances scalability. Could trigger 15-25% price appreciation similar to previous major upgrades.

Staking in ETFs: The SEC currently prohibits ETFs from staking ETH. When this changes (likely 2025), ETFs will generate 3-4% additional yield, making them dramatically more attractive and triggering new inflows.

Ethereum ETF options trading: CFTC approval for options on Ethereum ETFs (expected Q2 2025) will enable sophisticated institutional strategies and increase market depth.

Layer 2 maturation: As Base, Arbitrum, and Optimism grow to millions of daily users, Ethereum mainnet becomes the settlement layer for massive economic activity, increasing ETH demand and burn rate.

Corporate treasury adoption: Following MicroStrategy’s Bitcoin playbook, companies may add Ethereum for yield generation. First major corporate Ethereum purchase could trigger FOMO wave.

According to Standard Chartered Bank analysis, Ethereum could reach $10,000-14,000 by Q4 2025 if institutional adoption maintains current trajectory and staking is enabled in ETFs.

The Risks Nobody Discusses

Regulatory uncertainty persists: While ETFs are approved, the SEC continues enforcement against DeFi protocols and Ethereum-based projects. Aggressive regulation could suppress ecosystem growth.

Competition intensifying: Solana, Avalanche, and newer chains offer faster transactions and lower fees. If developers migrate to competing platforms, Ethereum’s network effects could erode.

Technology risk: Complex upgrades carry execution risk. The 2022 Merge succeeded, but future upgrades could face delays or technical issues affecting confidence.

Staking centralization: Lido controls 29% of staked ETH. Excessive centralization contradicts Ethereum’s decentralization ethos and creates systemic risk.

Market correlation: Despite theoretical independence, Ethereum remains highly correlated to Bitcoin and macro risk assets. Fed policy and recession fears could override fundamental positives.

How to Position for Ethereum’s 2025 Run

Conservative allocation (2-5% portfolio): Purchase through ETFs (ETHA, FETH) for simplicity and tax advantages. Ideal for investors wanting crypto exposure without managing wallets.

Moderate allocation (5-10%): Combine ETF position with self-custodied ETH on hardware wallet, enabling participation in staking and DeFi for enhanced returns.

Aggressive allocation (10-20%): Layer in Ethereum staking, select DeFi protocols for yield farming, and allocate 20-30% to quality Ethereum-based altcoins (Arbitrum, Optimism, Polygon).

Dollar-cost averaging remains optimal: Rather than lump sum, invest fixed amount monthly regardless of price. Vanguard research shows DCA reduces regret and improves adherence to investment plans.

Rebalancing discipline: When Ethereum reaches new highs, take 10-20% profits systematically. Bull markets don’t last forever – disciplined profit-taking protects gains.

Ethereum’s 2025 setup mirrors Bitcoin’s 2024 momentum: fresh institutional access, supply shocks from staking, technology improvements, and growing real-world adoption. The difference is

Ethereum offers utility Bitcoin cannot match – programmability, yield generation, and infrastructure for the digital economy.

Smart money is accumulating quietly. Retail investors will chase after prices double. The question is which group you’ll be in.

Ethereum won’t make you rich overnight. But if institutions continue recognizing its value proposition, current prices may look extremely attractive 12-18 months from now.