How Crypto Taxes Work in the USA: A Simple Guide

By Thomas Wright

Senior Financial Analyst | 12+ Years Wall Street Experience

- Last Updated: December 8, 2025

- Tax Year Covered: 2025 (filing in 2026)

- Reading Time: 16 minutes

In 2017, I made $43,000 trading crypto. I thought I was brilliant.

Then April 2018 arrived. My accountant handed me a tax bill for $18,000. I nearly had a stroke.

Why? Because I didn’t understand that every single trade – Bitcoin to Ethereum, Ethereum to Litecoin, Litecoin back to Bitcoin – was a taxable event. I had made 247 trades that year. Each one generated a gain or loss that needed to be calculated and reported.

I learned the expensive way: The IRS doesn’t care that crypto feels like a game. They don’t care that you’re “just trading.” They don’t care that Coinbase doesn’t send you a proper tax form.

They want their cut. And if you don’t give it to them voluntarily, they will come after you with penalties, interest, and potentially criminal charges.

I’ve now filed seven years of crypto taxes. I’ve been through two IRS audits (passed both). I’ve helped dozens of traders unfuck their tax situations after years of non-compliance.

This guide will save you thousands of dollars and countless hours of stress. I wish someone had written it for me in 2017.

Full disclosure: I am not a CPA or tax attorney. This is educational content based on my experience and research, not legal tax advice. Consult a licensed tax professional for your specific situation. This article contains affiliate links – see our disclosure policy for details.

The Brutal Truth: You Owe Taxes – Yes, Even You

Let’s clear up the most dangerous myth in crypto:

“The IRS doesn’t know about my crypto, so I don’t have to report it.”

Wrong. Catastrophically wrong.

Here’s what the IRS knows:

Since 2016: Coinbase has been required to report your transactions via Form 1099-K (if you exceed $20K in transactions).

Since 2020: The IRS added a question to Form 1040 (the main tax return): “At any time during 2024, did you receive, sell, exchange, or otherwise dispose of any financial interest in virtual currency?”

That question appears on page 1. Before your name and address. They’re not subtle.

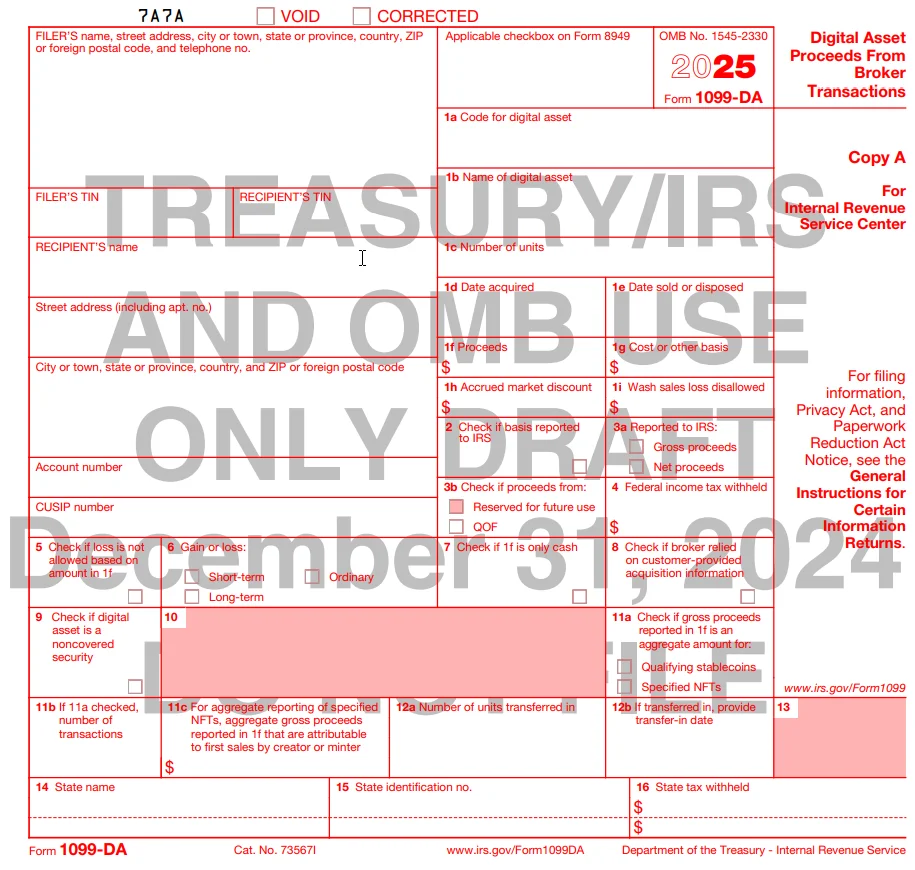

Since 2021: The Infrastructure Bill requires exchanges to report all transactions via Form 1099-B starting in 2026 (for 2025 tax year).

Since 2023: Enhanced IRS enforcement with $80 billion in new funding specifically targeting tax evasion, including crypto.

Translation: The “they’ll never find out” era is over.

I personally know three people who got IRS letters in 2024 for unreported 2021 crypto gains. One owed $45,000 in back taxes plus penalties. Another is in criminal proceedings.

Don’t be that person.

How the IRS Classifies Crypto – This Changes Everything

The IRS treats cryptocurrency as property, not currency.

This matters because:

Currency: If you trade euros for yen, that’s typically not taxable.

Property: If you trade your car for a boat, that’s taxable. You calculate the gain/loss based on the fair market value of what you received.

Crypto is property. Which means:

- Trading Bitcoin for Ethereum = taxable event (like trading a car for a boat)

- Buying coffee with Bitcoin = taxable event (like paying with gold)

- Converting BTC to USDT = taxable event (shocking but true)

Every. Single. Transaction.

This is why active traders who make 500+ trades per year often have absolute nightmares at tax time. Each trade needs to be calculated, tracked, and reported.

The 7 Taxable Events

Not everything you do with crypto triggers taxes. Here’s what does:

Event 1: Selling Crypto for Fiat (USD, EUR, etc.)

Example: You sell 0.5 BTC for $30,000.

This is straightforward. You calculate your gain/loss:

- Sale price: $30,000

- Cost basis (what you paid): $20,000

- Capital gain: $10,000 (taxable)

If you held the Bitcoin for more than one year, it’s a long-term capital gain (lower tax rate). Less than one year? Short-term capital gain (taxed as ordinary income).

Event 2: Trading Crypto for Crypto

Example: You trade 1 ETH for 50 SOL.

This is where most people screw up. They think “I didn’t cash out, so no taxes.”

Wrong. The IRS sees this as:

- You sold 1 ETH for its current market value

- You used that money to buy 50 SOL

Calculation:

- 1 ETH = $2,500 at time of trade

- Your cost basis for that ETH = $1,800

- Capital gain: $700 (taxable)

It doesn’t matter that you never touched dollars. The IRS treats the market value of what you received as taxable income.

This is why holding stablecoins during volatility has tax implications – every conversion is a taxable event.

Event 3: Spending Crypto on Goods/Services

Example: You buy a $5,000 laptop with Bitcoin.

Same logic as crypto-to-crypto trades. You “sold” Bitcoin for its fair market value ($5,000) and must calculate your gain/loss.

If your cost basis was $3,000, you have a $2,000 capital gain. Yes, even though you just bought a laptop.

This is why Bitcoin will never be used for daily purchases. Nobody wants to calculate taxes every time they buy coffee.

Event 4: Earning Crypto – Mining, Staking, Airdrops

Income event first, then capital gains later:

When you receive crypto, it’s ordinary income at fair market value on the day you receive it.

Example: You stake ETH and earn 0.1 ETH in rewards.

- On the day you receive it, 0.1 ETH = $250

- That’s $250 of ordinary income (taxed like your salary)

- Your cost basis for that 0.1 ETH is now $250

Later, if you sell that 0.1 ETH for $300:

- Capital gain: $50 (taxed separately)

So you’re taxed twice: once on receiving it, once on selling it.

This hits staking platforms users hard. If you earned $10,000 in staking rewards but never sold, you still owe taxes on that $10,000 as income.

Event 5: Receiving Crypto as Payment

Example: You’re a freelancer paid 0.05 BTC for a project.

This is ordinary income at the market value when you receive it.

- 0.05 BTC = $3,500 on payment day

- Report $3,500 as income

- Your cost basis is now $3,500

Same double-taxation as staking/mining.

Event 6: Gifts and Donations (Special Rules)

Giving crypto as a gift:

- No immediate tax for you (the giver)

- Recipient inherits your cost basis and holding period

- Subject to gift tax rules if over $18,000 per person per year (2024)

Donating crypto to charity:

- No capital gains tax (huge benefit!)

- You can deduct the fair market value

- Must hold for more than 1 year to deduct full value

- Must be a qualified 501(c)(3) charity

This is actually a smart tax strategy: If you have highly appreciated crypto, donate it directly instead of selling and donating cash.

Event 7: Lost or Stolen Crypto (You’re Screwed)

Lost your private keys? Got hacked? Exchange went bankrupt?

Bad news: You can’t just write it off as a loss.

The IRS requires proof of a “identifiable event” where your property became worthless. Simply losing access doesn’t qualify.

There’s a narrow exception for theft, but you need:

- Police report filed

- Evidence the theft occurred

- Proof you had ownership

Just “I lost my keys” won’t cut it. The IRS assumes you still have access unless proven otherwise.

This is why securing your crypto properly isn’t optional. One mistake can cost you taxes on coins you no longer have.

What’s NOT Taxable (The Few Exceptions)

Buying crypto with fiat:

- Purchase 1 BTC for $40,000 = not taxable (you’re just investing)

Transferring between your own wallets:

- Moving BTC from Coinbase to your Ledger = not taxable (just changing location)

Holding crypto:

- Your Bitcoin went from $30K to $60K = not taxable until you sell (unrealized gains)

Like-kind exchanges (mostly eliminated):

- Before 2018, some argued crypto-to-crypto was “like-kind exchange” (tax-deferred)

- The 2017 Tax Cuts and Jobs Act eliminated this for everything except real estate

- Don’t try this. The IRS will crush you.

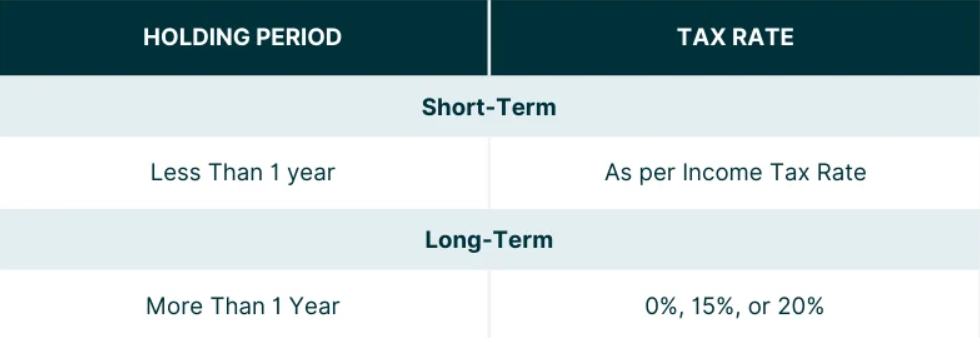

Capital Gains Tax Rates – Short-Term vs. Long-Term

The tax rate you pay depends on how long you held the asset.

Short-Term Capital Gains (Held < 1 Year)

Taxed as ordinary income at your regular income tax bracket:

| Income (2025) | Tax Rate |

|---|---|

| $0 – $11,600 | 10% |

| $11,600 – $47,150 | 12% |

| $47,150 – $100,525 | 22% |

| $100,525 – $191,950 | 24% |

| $191,950 – $243,725 | 32% |

| $243,725 – $609,350 | 35% |

| $609,350+ | 37% |

Rates for single filers; married filing jointly has different brackets

Translation: If you’re day trading, you could be paying up to 37% federal tax + state tax (California adds another 13.3%!).

That’s 50% of your gains gone. This is why frequent trading strategies often underperform after taxes.

Long-Term Capital Gains (Held ≥ 1 Year)

Taxed at preferential rates:

| Income (2025) | Tax Rate |

| $0 – $47,025 | 0% |

| $47,025 – $518,900 | 15% |

| $518,900+ | 20% |

Massive difference. Hold for 366 days instead of 364 days and your tax rate can drop from 37% to 15%.

This is why long-term DCA strategies are so tax-efficient. You’re automatically qualifying for long-term rates.

Pro tip: If you bought Bitcoin on January 1, 2024, you must wait until January 2, 2025 to sell for long-term treatment. Not December 31, 2024. One extra day matters.

Cost Basis Methods – This Will Save You Thousands

When you sell crypto, you need to know which specific units you’re selling to calculate your gain/loss correctly.

Problem: You bought Bitcoin 10 different times at 10 different prices. You sell 0.5 BTC. Which purchase are you selling?

The IRS allows several methods:

FIFO (First In, First Out) – The Default

You sell the oldest units first.

Example:

- January 2023: Bought 1 BTC at $20,000

- June 2024: Bought 1 BTC at $35,000

- December 2025: Sell 1 BTC at $50,000

Using FIFO, you sold the January 2023 purchase:

- Gain: $50,000 – $20,000 = $30,000 (long-term)

LIFO (Last In, First Out)

You sell the newest units first.

Same example, LIFO:

- You sold the June 2024 purchase

- Gain: $50,000 – $35,000 = $15,000 (short-term if sold before June 2025)

HIFO (Highest In, First Out)

You sell the highest cost basis units first (minimizes taxable gain).

Same example, HIFO:

- You sold the June 2024 purchase (higher basis)

- Gain: $50,000 – $35,000 = $15,000

Specific Identification

You manually specify which exact units you’re selling.

This is the most powerful method if you have proper documentation.

Requirements:

- You must identify the specific units at the time of sale

- You must have contemporaneous written records

- The exchange/wallet must support specific lot tracking

Most exchanges don’t support this well. You need specialized tax software to track properly.

My recommendation: Use HIFO if your platform supports it. It typically minimizes taxes. But whatever you choose, be consistent – you can’t switch methods mid-year.

Tax Forms You’ll Actually Use

Form 8949: Capital Gains and Losses

This is where you report every single crypto transaction.

For each sale, you report:

- Description (0.5 BTC)

- Date acquired

- Date sold

- Sales price

- Cost basis

- Gain or loss

If you made 500 trades, you have 500 lines to fill out. Fun times.

Pro tip: The IRS allows you to summarize if you have many transactions. You can submit a summary on Form 8949 and attach a detailed statement separately. Just make sure your tax software generates IRS-compliant reports.

Schedule D: Summary of Capital Gains

This summarizes your Form 8949 totals:

- Short-term gains/losses

- Long-term gains/losses

- Net capital gain/loss

The final number flows to your Form 1040 main tax return.

Schedule 1: Additional Income

If you earned crypto (mining, staking, airdrops), report it here as “Other Income.”

This gets taxed as ordinary income, not capital gains.

Schedule C: Business Income (For Professional Traders)

If crypto trading is your full-time business, you might qualify to report on Schedule C.

Benefits:

- Deduct business expenses (software, hardware, home office)

- Qualify for certain deductions

Downside:

- Subject to self-employment tax (15.3%)

- Much higher audit risk

- Requires proof it’s a bona fide business

Most retail traders should NOT use Schedule C. The IRS scrutinizes this heavily.

Common Deductions and Write-Offs

What you CAN deduct:

Capital losses (up to $3,000 per year):

- If your losses exceed gains, you can deduct $3,000 against ordinary income

- Remaining losses carry forward indefinitely

Example:

- Gains: $5,000

- Losses: $12,000

- Net loss: $7,000

- You can deduct $3,000 this year, carry forward $4,000 to next year

Transaction fees:

- Exchange fees and gas fees are added to your cost basis

- Example: Buy 1 ETH for $2,000 + $50 gas fee = $2,050 cost basis

What you CANNOT deduct – common mistakes:

Investment education:

- Courses, books, subscriptions – not deductible for most taxpayers (eliminated in 2017 tax reform)

Hardware wallets:

- Ledger or Trezor purchases – not deductible (considered personal property)

Trading platform subscriptions:

- TradingView Pro, Glassnode, etc. – not deductible unless you’re a professional trader (Schedule C)

Home office:

- Not deductible unless crypto trading is your documented business

The 2017 Tax Cuts and Jobs Act eliminated most miscellaneous itemized deductions. Don’t try to get creative.

The Wash Sale Rule Loophole

In traditional stocks, the wash sale rule prevents tax loss harvesting:

If you sell a stock at a loss and buy it back within 30 days, you can’t claim the loss.

The loophole: This rule doesn’t currently apply to crypto.

Tax loss harvesting strategy:

- Bitcoin drops from $50K to $40K

- You sell at $40K (realize $10K loss)

- Immediately buy back at $40K

- You still own the same amount of BTC

- You locked in a $10K loss for tax purposes

This is 100% legal right now. I use it every year.

The catch: Congress is trying to close this loophole. It might be eliminated in 2026 or 2027. Use it while you can.

How to execute:

- Near year-end, review your portfolio

- Identify positions with losses

- Sell and immediately rebuy

- Offset your gains with harvested losses

Just be careful with trading fees – if you’re paying 0.5% roundtrip, a small tax benefit might not be worth it.

State Taxes – Often Forgotten, Always Expensive

Federal taxes are just the beginning. Most states tax capital gains too.

States with NO income tax (crypto-friendly):

- Texas, Florida, Nevada, Wyoming, Washington, Tennessee, South Dakota, Alaska, New Hampshire (limited)

If you live here, you only pay federal taxes. Lucky you.

States with HIGH taxes on crypto:

- California: 13.3% top rate (yes, on top of federal 37%)

- New York: 10.9%

- New Jersey: 10.75%

- Oregon: 9.9%

Combined federal + state can hit 50%+ for short-term gains in California.

Some states have special rules:

- Pennsylvania: Doesn’t allow capital loss deductions (brutal)

- New Jersey: Treats crypto trading income as business income for high-frequency traders

Always check your state’s specific rules. Don’t assume it mirrors federal treatment.

How to Actually Track Everything

If you made less than 10 trades, you can track manually in a spreadsheet.

If you made more than 10 trades, use software. Seriously.

The Manual Method Not Recommended

Create a spreadsheet with columns:

- Date

- Transaction type (buy/sell/trade)

- Amount

- Cost basis

- Sale price

- Gain/loss

- Short vs. long-term

Track every single transaction. Calculate every gain/loss. Generate Form 8949.

Time required: 5-10 hours for 100 transactions.

Error rate: High. Miss one transaction and your entire return is wrong.

The Smart Method: Crypto Tax Software

These tools connect to your exchanges via API, import all transactions, calculate gains/losses automatically, and generate IRS forms.

Top options:

- CoinTracker

- Koinly

- CoinLedger (formerly CryptoTrader.Tax)

- ZenLedger

- TaxBit

I’ve tested all five. Here’s my detailed comparison of the best crypto tax software – features, pricing, accuracy.

Cost: $50-300/year depending on transaction volume.

Time saved: Literally 20+ hours.

Peace of mind: Priceless when the IRS comes knocking.

What these tools do:

- Import transactions from 500+ exchanges

- Handle complex scenarios (staking, DeFi, NFTs)

- Calculate cost basis using your chosen method

- Generate Form 8949 and Schedule D

- Track wash sales

- Support amended returns

Don’t try to outsmart this with a spreadsheet. Pay for the software.

What If You Didn’t Report in Previous Years?

Okay, you fucked up. You made crypto gains in 2020, 2021, 2022 and never reported them.

Option 1: File Amended Returns (Before They Find You)

If it’s been less than 3 years, you can file amended returns (Form 1040-X) for each year.

Penalties:

- Failure to file: 5% per month (max 25%)

- Failure to pay: 0.5% per month

- Interest: ~7% annually (compounded)

Example:

- You owed $10,000 in 2021

- It’s now 2025 (4 years)

- Penalties: ~$2,500

- Interest: ~$2,800

- Total: $15,300

Painful, but better than the alternative.

Option 2: Wait and Hope They Don’t Notice (Terrible Idea)

The IRS has up to 6 years to audit if you underreported income by 25%+.

Criminal tax evasion has no statute of limitations.

If they find you first:

- All the above penalties

- Potential fraud penalties (75%)

- Criminal prosecution for large amounts

I know someone who owed $30K and ignored it. The IRS added $40K in penalties. Then they garnished his wages and seized his bank accounts.

Don’t gamble with the IRS. They always win.

Option 3: Voluntary Disclosure Program (For Serious Cases)

If you owe substantial amounts and are genuinely worried about criminal charges, consult a tax attorney about the IRS Voluntary Disclosure Program.

This is for six-figure+ situations. Not relevant for most people.

Record Keeping Requirements (The Boring But Critical Part)

The IRS requires you to keep records for at least 3 years (6 years if large income omissions).

What to save:

Exchange records:

- Complete transaction history (CSV exports)

- Deposit/withdrawal records

- Historical price data

- Fee statements

Wallet records:

- All incoming/outgoing transactions

- Wallet addresses used

- Private key backups (encrypted)

Form 8949 and Schedule D:

- Your filed tax returns

- All supporting calculations

Correspondence:

- Any letters from the IRS

- Responses from your CPA/tax software

Pro tip: At end of each tax year, export everything from your exchanges. They might not maintain records forever (especially if they go bankrupt like FTX).

Store in multiple locations: cloud backup, external drive, printed copies for big years.

Red Flags That Trigger IRS Audits

The IRS uses algorithms to flag suspicious returns. Here’s what increases your risk:

Flag 1: Not reporting when they have data

If Coinbase sent you a 1099-K and you don’t report anything, you’re getting a letter. Guaranteed.

Flag 2: Reporting losses every single year

If you claim $5K-10K in crypto losses year after year after year, they’ll wonder if you’re actually trading or just creating fake losses.

Flag 3: Inconsistent cost basis

If your reported cost basis is suspiciously high (minimizing gains), they might ask for documentation.

Without records, they’ll assume your cost basis is $0. You’ll owe taxes on the full sale amount.

Flag 4: Round numbers

If every transaction is exactly $5,000 or $10,000, it looks fabricated.

Real transaction histories are messy with weird amounts like $4,847.23.

Flag 5: NFT or DeFi with no reporting

If they see you received NFTs or DeFi tokens (they’re watching OpenSea, Uniswap), but you report zero income, that’s a problem.

Every airdrop, every NFT mint, every DeFi yield – it’s all supposed to be reported.

My advice: Report everything accurately. The small amount you “save” by fudging numbers isn’t worth the audit risk.

Special Situations That Confuse Everyone

NFTs

Tax treatment: Same as crypto. Property subject to capital gains.

Creating/minting:

- If you’re the creator, sale proceeds = ordinary income

- If you’re a buyer/flipper, profit = capital gains

Royalties:

- If you’re the original creator receiving royalties on resales = ordinary income

DeFi (Yield Farming, Liquidity Pools)

This is the wild west. The IRS hasn’t issued clear guidance.

Conservative approach (what I do):

Providing liquidity:

- Depositing crypto into a pool = not taxable (like depositing into a bank)

Earning yield:

- Rewards received = ordinary income at fair market value

Withdrawing:

- Calculate gain/loss based on value deposited vs. value withdrawn

- Includes impermanent loss

Trading on DEXs:

- Same as centralized exchanges – every trade is taxable

Some tax professionals argue different methods. Until the IRS clarifies, stay conservative.

Crypto Loans

Taking a loan (using crypto as collateral):

- Not taxable (you didn’t sell, just borrowed against it)

If the loan gets liquidated:

- That’s a sale = taxable event

Paying back the loan:

- If you pay back in the same crypto, no additional tax

- If you pay back in different crypto, that’s a trade = taxable

Hard Forks and Airdrops

IRS Revenue Ruling 2019-24:

If you receive new crypto from a hard fork or airdrop, it’s ordinary income at fair market value when you gain “dominion and control” (i.e., when you can actually access and sell it).

Example:

- Bitcoin Cash forked from Bitcoin in 2017

- If you held 1 BTC, you received 1 BCH

- BCH was worth ~$300 when accessible

- You report $300 ordinary income

Even if you never claimed it, sold it, or even knew about it – technically you owe taxes.

In practice, most people ignore small airdrops. But for large ones (like the Uniswap UNI airdrop worth $1,200+), you should report it.

IRS Enforcement: What’s Actually Happening

2024-2025 reality check:

The IRS hired thousands of new auditors with the $80B funding from the Inflation Reduction Act. Crypto is a priority target.

What they’re doing:

1. Matching 1099 forms:

- They’re cross-referencing exchange reports with tax returns

- If Coinbase says you had $50K in proceeds and you report $0, you’re getting a letter

2. Blockchain analysis:

- The IRS contracts with Chainalysis and other firms

- They can trace Bitcoin and Ethereum transactions

- They know which wallets belong to exchanges vs. individuals

3. Subpoenas:

- They’re subpoenaing exchanges for user data

- Coinbase already turned over 13,000+ accounts in 2021

4. International cooperation:

- Foreign exchange data is being shared under tax treaties

- Even if you traded on Binance International, they’re starting to get that data

The message: The “crypto is anonymous” era is dead. Assume they’ll eventually find out about everything.

FAQs: Your Desperate Questions Answered

Q: What if I only made $500 in profit? Do I still report it?

Yes. There’s no minimum threshold. All capital gains must be reported.

You might not owe tax (if your total income is low), but you still need to report the transaction.

Q: Can I just say I lost my crypto in a boating accident?

The IRS has heard every excuse. This one is so common it’s become a meme.

Unless you have a police report proving theft, you can’t write it off as a loss. And you still owe taxes on any prior gains before the “accident.”

Q: What if I used a DEX? The IRS can’t track that, right?

Wrong. If you moved funds from Coinbase → MetaMask → Uniswap, they can trace that entire chain.

DeFi isn’t anonymous. It’s pseudonymous. And once they link your wallet to your identity (via an exchange), they see everything.

Q: Can I move to Puerto Rico to avoid taxes?

Maybe. Puerto Rico has Act 60 which offers 0% capital gains tax for new residents.

Requirements:

- Become a bona fide PR resident (live there 183+ days/year)

- The gains must occur AFTER you become a resident

- Complex reporting requirements

This works for future gains, not past gains. And the IRS audits these aggressively. Don’t try it without a tax attorney.

Q: What about moving crypto to a cold wallet? Is that taxable?

No. Transferring between your own wallets is not taxable.

You’re just moving property from one pocket to another.

But when you eventually sell, you’ll need to track the cost basis correctly. Proper wallet security is essential for record-keeping.

Q: If I mine crypto as a hobby, is that different from business mining?

Yes, but neither is favorable:

Hobby mining:

- Income is still taxable (ordinary income)

- Expenses are NOT deductible (after 2017 tax reform)

- You basically pay tax on gross income

Business mining:

- Income taxable as ordinary income

- Expenses are deductible

- But subject to self-employment tax (15.3%)

There’s no good option. Mining is tax-inefficient unless you’re doing it at scale.

Q: Can I deduct my Ledger hardware wallet?

No. The 2017 Tax Cuts and Jobs Act eliminated miscellaneous itemized deductions.

Unless you’re a professional trader filing Schedule C, personal investment expenses aren’t deductible.

Your Tax Action Plan – Do This Today

Step 1: Gather all your transaction data

Log into every exchange, wallet, DeFi protocol you’ve used. Export complete transaction histories.

Do this before year-end while the data is fresh.

Step 2: Choose and set up tax software

Pick one of the top crypto tax platforms and connect your accounts.

Let it import everything and calculate your gains/losses.

Review for errors (software isn’t perfect).

Step 3: Calculate your estimated tax liability

If you owe more than $1,000, you might need to make quarterly estimated payments (even for crypto gains).

Failure to pay quarterly can trigger penalties.

Step 4: Optimize before year-end

December 31 is the cutoff. Before then:

- Tax loss harvest any losers

- Hold winners until they qualify for long-term rates

- Consider gift strategies for high-net-worth situations

Step 5: File on time (by April 15)

Extension requests (Form 4868) give you until October 15 to file.

But they don’t extend your payment deadline. If you owe taxes, pay by April 15 to avoid penalties.

Step 6: Keep records for 7 years

Store your filed returns, Form 8949, and all supporting documentation.

If you get audited in 2030 for your 2024 return, you’ll need proof.

When to Hire a Professional

DIY is fine if:

- You made <50 transactions

- Only bought/sold on 1-2 exchanges

- No complex scenarios (mining, DeFi, NFTs)

- Total gains <$10,000

Hire a crypto-savvy CPA if:

- You made 100+ transactions

- You have DeFi, NFT, staking, or mining income

- You’re being au