Over 31 million Americans are enrolled in Medicare Advantage plans, representing 54% of all Medicare beneficiaries – yet research from the Commonwealth Fund reveals that 40% don’t understand what they purchased. More alarming, Kaiser Family Foundation data shows Medicare Advantage enrollees pay $2,000-5,000 more out-of-pocket annually than Original Medicare beneficiaries with Medigap coverage.

Insurance companies spend billions marketing Medicare Advantage with promises of $0 premiums, dental coverage, and gym memberships. What they don’t advertise: network restrictions, prior authorization requirements, and out-of-pocket maximums that devastate retirees facing serious illness.

This analysis exposes the critical differences between Medicare Advantage and Original Medicare, reveals which option saves money based on your health status, and provides a decision framework preventing costly mistakes during the 2025 Annual Enrollment Period (October 15 – December 7).

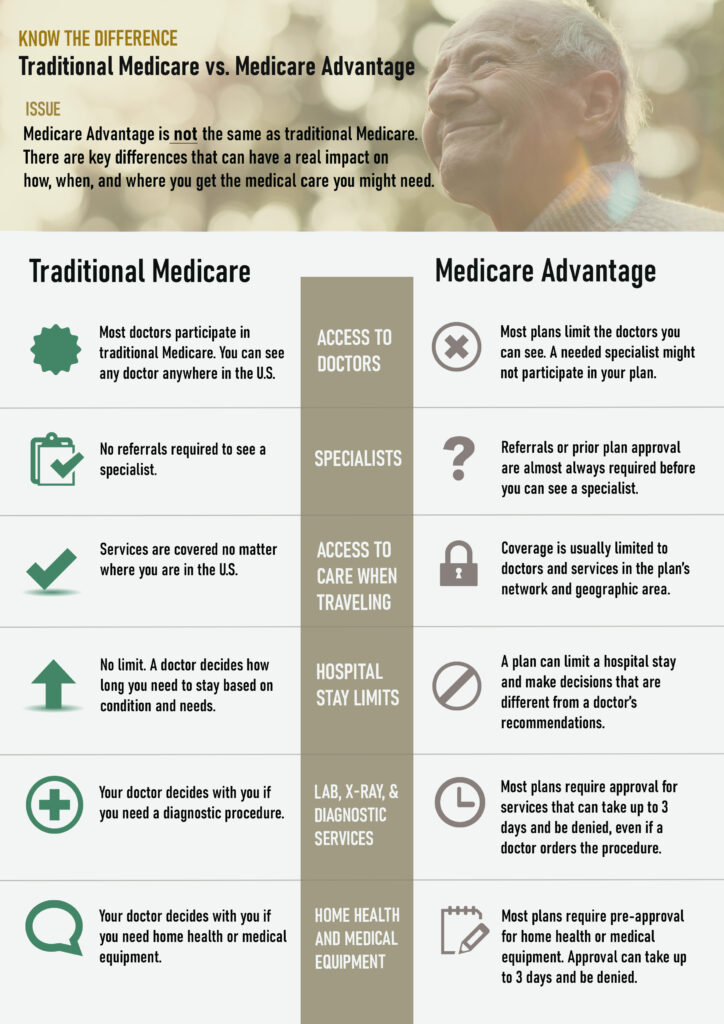

Understanding Original Medicare vs Medicare Advantage

Original Medicare (Parts A & B):

- Part A covers hospital stays (most pay $0 premium)

- Part B covers doctor visits ($174.70 monthly premium in 2024)

- No network restrictions – see any doctor accepting Medicare nationwide

- No prior authorization for specialist visits or procedures

- Requires separate Part D (prescription drug) coverage

- No out-of-pocket maximum – costs continue indefinitely without Medigap

Medicare Advantage (Part C):

- Private insurance replacing Original Medicare

- Often $0 monthly premium (beyond Part B premium)

- Combines medical and usually prescription coverage

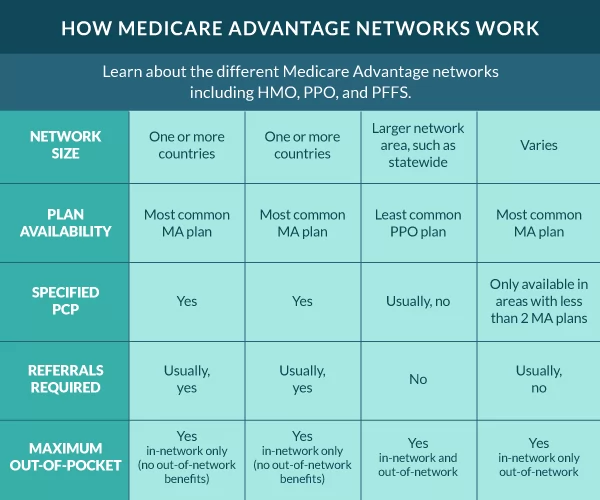

- Restrictive provider networks – HMO/PPO limitations apply

- Prior authorization required for many services

- Out-of-pocket maximum ($8,850 in 2025)

- Additional benefits: dental, vision, hearing, gym memberships

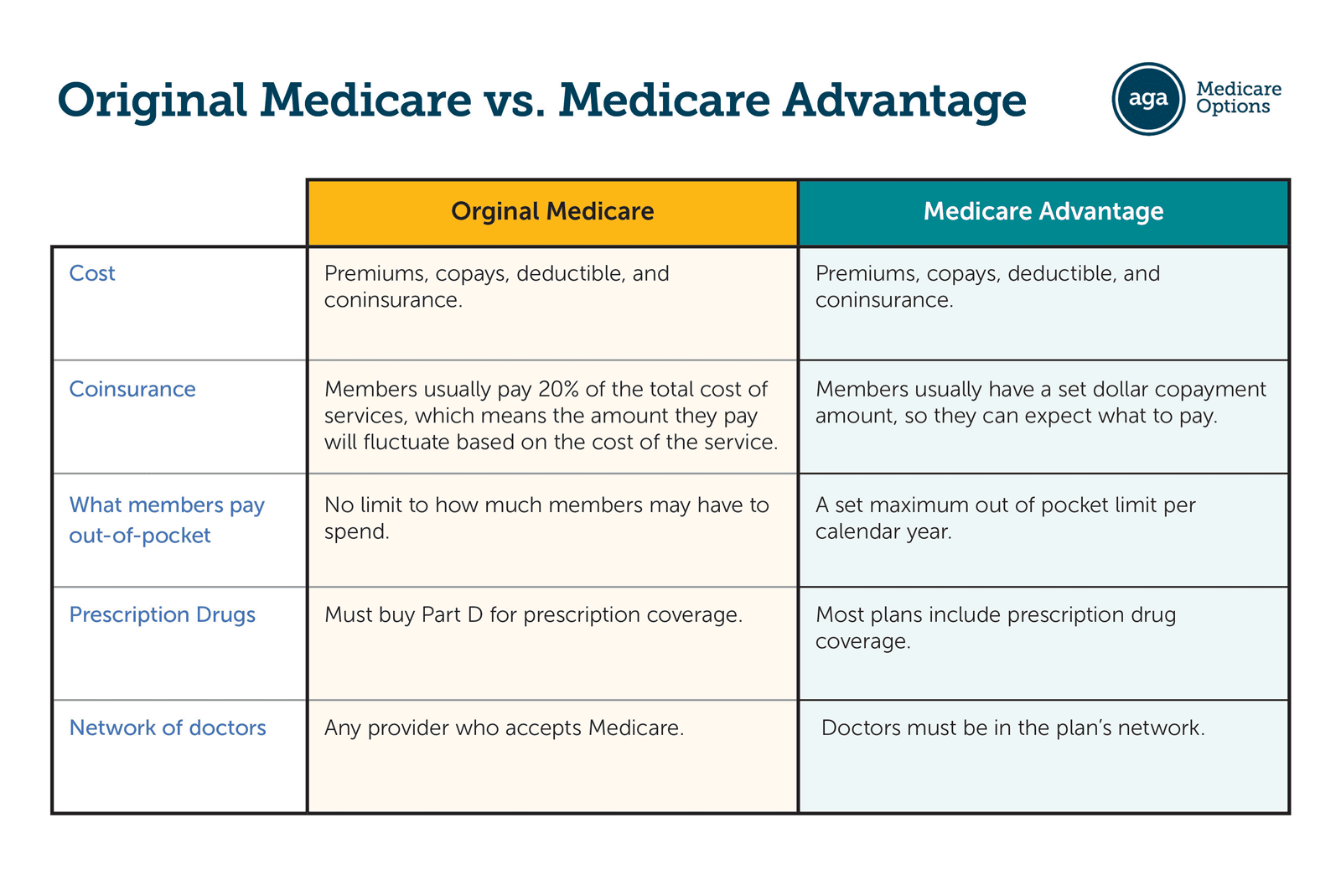

The fundamental trade-off: Original Medicare offers unlimited provider choice and predictable costs with Medigap. Medicare Advantage offers lower premiums but restricted networks and higher potential out-of-pocket costs.

The Hidden Costs of Medicare Advantage

Network restrictions create financial traps. According to Kaiser Family Foundation analysis, 32% of Medicare Advantage enrollees faced surprise out-of-network bills averaging $2,100 annually. Emergency situations, specialist referrals, and travel complications frequently result in out-of-network care.

Prior authorization delays and denials: The Medicare Payment Advisory Commission found that 18% of prior authorization requests are initially denied, requiring appeals and delaying necessary care. Some denials prevent treatment that Original Medicare would have covered immediately.

Maximum out-of-pocket expenses: While the $8,850 cap sounds protective, reaching it requires paying $8,850 from your own funds. For seniors on fixed incomes averaging $50,000 annually, this represents 18% of annual income. Original Medicare with Medigap Plan G typically caps annual costs at $2,500-3,500.

Drug formulary changes: Medicare Advantage plans can change covered medications mid-year, forcing expensive alternatives or higher copays. Original Medicare Part D plans cannot make mid-year formulary changes except in specific circumstances.

Geographic limitations: Moving to a different state or spending winters elsewhere creates coverage gaps. Original Medicare works identically nationwide. Medicare Advantage requires changing plans or paying out-of-network costs.

When Medicare Advantage Actually Makes Sense

Healthy seniors with low healthcare utilization: If you visit doctors 2-3 times yearly, take few medications, and face no chronic conditions, Medicare Advantage’s $0 premiums save $1,500-2,500 annually compared to Original Medicare plus Medigap plus Part D.

Budget-constrained seniors: Monthly premiums for Medigap Plan G run $150-300 depending on location and age. Medicare Advantage eliminates this fixed cost, replacing it with variable costs only when using healthcare.

Those comfortable with managed care: HMO-style care coordination suits some people. If you prefer having a primary care physician coordinate all care and don’t mind referral requirements, Medicare Advantage provides this structure.

Seniors rarely traveling: If you live year-round in one location and have no plans for extended travel, network restrictions become less problematic. Local network adequacy matters more than national flexibility.

When Original Medicare Is Superior

Chronic health conditions or cancer history: Frequent specialist visits, ongoing treatments, and potential hospitalizations make Original Medicare’s unlimited access and predictable costs far superior. Prior authorization delays can be dangerous with serious conditions.

High prescription drug costs: Part D plans under Original Medicare often have better formularies and lower costs for expensive medications. Medicare Advantage drug coverage frequently has higher copays for specialty drugs.

Snowbirds and travelers: Spending time in multiple states or traveling extensively requires Original Medicare’s nationwide coverage without network restrictions. Medicare Advantage creates complications and potential coverage gaps.

Preference for provider choice: Seeing specific specialists or continuing relationships with existing doctors requires verifying they accept your Medicare Advantage plan. Original Medicare is accepted by 93% of doctors versus 70% accepting specific Medicare Advantage plans.

Peace of mind over premium savings: Medigap coverage eliminates surprise bills almost entirely. For seniors valuing financial predictability over monthly premium savings, Original Medicare with Medigap provides superior protection.

The Medigap Factor

Medigap (Medicare Supplement Insurance) fills Original Medicare’s coverage gaps, paying most or all of the 20% coinsurance and deductibles. Plan G is most popular, covering everything except the Part B deductible ($240 in 2025).

Medigap Plan G costs:

- Age 65: $125-180 monthly

- Age 75: $180-250 monthly

- Age 85: $220-320 monthly

Total annual costs (Original Medicare + Medigap Plan G + Part D):

- Monthly: $174.70 (Part B) + $200 (Plan G) + $40 (Part D) = $415

- Annual: $4,980

This seems expensive compared to $0 premium Medicare Advantage, but consider: Medigap eliminates nearly all out-of-pocket costs. A single hospital stay under Medicare Advantage could cost $5,000-8,000 out-of-pocket, exceeding an entire year of Medigap premiums.

Medigap enrollment is time-sensitive. The six-month Open Enrollment Period starting when you turn 65 guarantees acceptance regardless of health. Missing this window means medical underwriting – insurers can deny coverage or charge higher premiums based on health conditions.

Real-World Cost Comparison Scenarios

Scenario 1: Healthy senior, minimal care

- Medicare Advantage: $0 premium + $500 annual out-of-pocket = $500 total

- Original Medicare + Medigap: $4,980 premiums + $240 deductible = $5,220 total

- Winner: Medicare Advantage saves $4,720

Scenario 2: Cancer diagnosis requiring treatment

- Medicare Advantage: $0 premium + $8,850 max out-of-pocket = $8,850 total

- Original Medicare + Medigap: $4,980 premiums + $240 deductible = $5,220 total

- Winner: Original Medicare saves $3,630

Scenario 3: Multiple chronic conditions

- Medicare Advantage: $0 premium + $6,500 estimated out-of-pocket = $6,500 total

- Original Medicare + Medigap: $4,980 premiums + $500 additional costs = $5,480 total

- Winner: Original Medicare saves $1,020

The pattern is clear: Medicare Advantage favors healthy individuals. Original Medicare with Medigap protects against catastrophic costs.

How to Decide During Annual Enrollment

Step 1: Assess your health trajectory

- Excellent health, no conditions: Medicare Advantage viable

- Chronic conditions or recent diagnoses: Original Medicare safer

- Family history of serious illness: Consider long-term protection

Step 2: Calculate total potential costs

- Medicare Advantage: Premium + maximum out-of-pocket + drug costs

- Original Medicare: Part B + Medigap + Part D premiums + deductibles

Step 3: Evaluate your priorities

- Network flexibility vs lower premiums

- Provider relationships vs additional benefits

- Financial predictability vs variable costs

Step 4: Review prescription drug coverage

- Check formularies on medicare.gov

- Calculate annual drug costs under each option

- Verify preferred pharmacies are in-network

Step 5: Consider future changes

- Switching FROM Medicare Advantage to Original Medicare after initial enrollment requires medical underwriting for Medigap in most states

- Going TO Medicare Advantage is always possible

- This asymmetry favors starting with Original Medicare if uncertain

State-Specific Considerations

Six states (CA, CT, ME, MA, NY, VT) have stronger Medigap protections, allowing annual guaranteed issue enrollment regardless of health status. Residents of these states have more flexibility to switch between options.

Florida, Texas, and Arizona have highest Medicare Advantage enrollment (65-70% of beneficiaries) due to aggressive marketing and large retiree populations. This doesn’t mean it’s the best choice – just the most marketed.

Rural areas face limited Medicare Advantage networks. According to CMS data, 23% of rural counties have only one Medicare Advantage plan option versus 40+ options in major metropolitan areas. Original Medicare’s universal acceptance matters more in rural settings.

Decision Framework

Choose Medicare Advantage if:

- You’re healthy with minimal healthcare needs

- Budget constraints make Medigap premiums prohibitive

- You’re comfortable with managed care and network restrictions

- You live in one location year-round

- Dental/vision/gym benefits have significant value to you

Choose Original Medicare with Medigap if:

- You have chronic conditions or serious illness history

- You want unlimited provider choice nationwide

- You travel frequently or live in multiple states

- You value financial predictability over premium savings

- You can afford the higher monthly premiums

The $5,000 mistake: Choosing based on premium alone without considering potential out-of-pocket costs. Insurance exists to protect against large unexpected expenses, not to minimize monthly payments.

Your health status matters more than marketing promises. Be honest about your situation and choose the option providing best total value and protection for your specific circumstances.