A portfolio requiring just 15 minutes of annual maintenance outperforms 89% of actively managed funds over 15-year periods according to S&P Dow Jones Indices research. This isn’t luck – it’s mathematics, cost efficiency, and behavioral discipline combined into the simplest wealth-building strategy ever created.

The three-fund portfolio consists of total US stocks, total international stocks, and total bonds. That’s it. No stock picking, no market timing, no expensive advisors charging 1% annually. Vanguard founder John Bogle proved this approach builds more wealth than complex strategies used by Wall Street professionals.

This guide reveals exact fund allocations by age, the rebalancing system preventing emotional mistakes, and why this boring strategy consistently outperforms exciting alternatives. If you want to get rich slowly but surely, this is your blueprint.

Why Simple Beats Complex in Investing

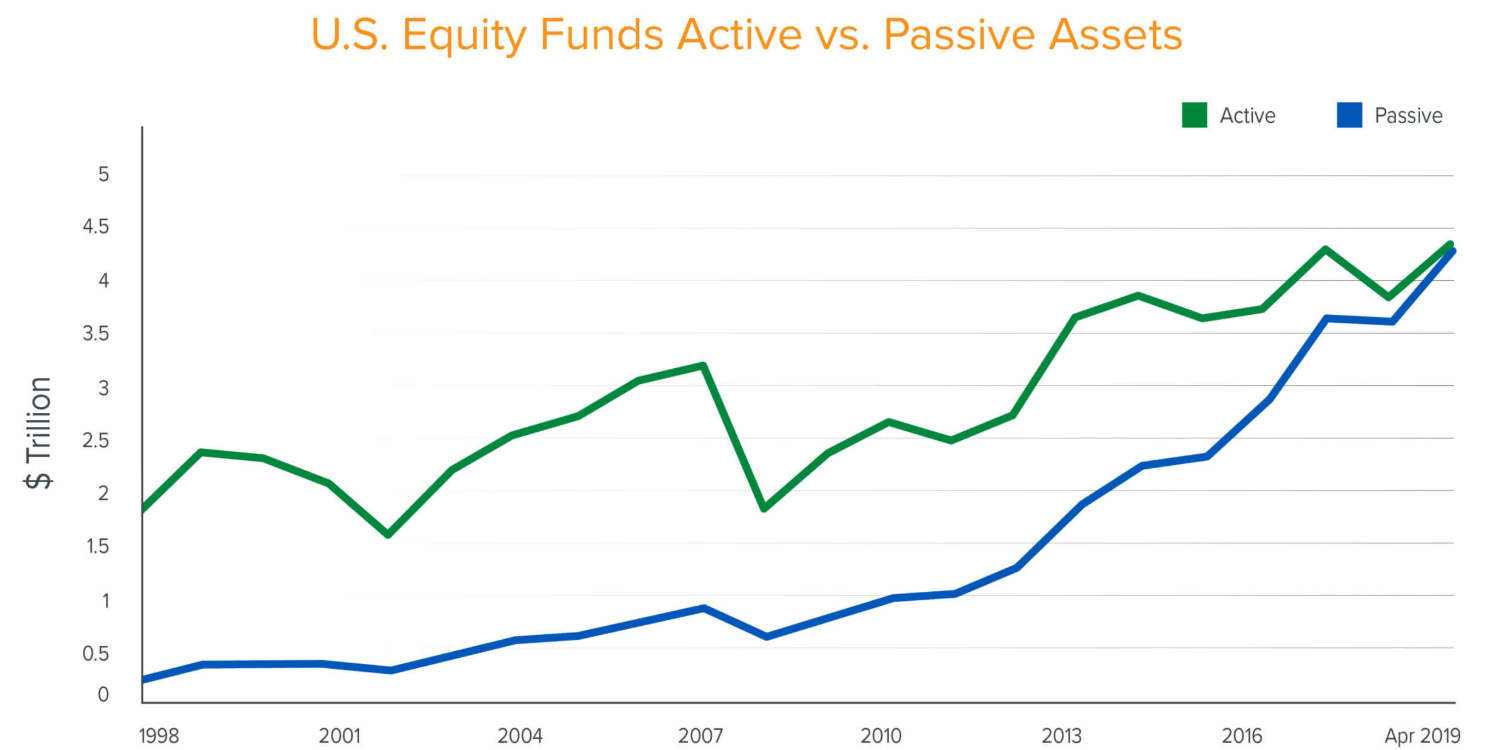

Wall Street profits from complexity. The more confused you are, the more likely you’ll pay for advice, trade frequently (generating commissions), and buy expensive actively managed funds.

The data destroys this narrative:

- 89% of large-cap fund managers underperform the S&P 500 over 15 years (SPIVA Scorecard)

- Average expense ratio for active funds: 0.66% vs index funds: 0.05% (Morningstar)

- On $500,000 portfolio over 30 years, fees difference costs $187,000 in lost returns

Warren Buffett’s famous bet: In 2008, he wagered $1 million that an S&P 500 index fund would beat a basket of hedge funds over 10 years. The index fund won by massive margin – returning 125.8% versus 36.3% for hedge funds.

Why index funds dominate:

- Zero stock picking risk – you own the entire market

- Minimal costs – fees below 0.10% annually

- Tax efficiency – low turnover reduces capital gains

- No manager risk – no genius required, no potential fraud

- Behavioral simplicity – nothing to tinker with prevents mistakes

The Three-Fund Portfolio Explained

Total US Stock Market

- Vanguard: VTSAX (mutual fund) or VTI (ETF)

- Fidelity: FSKAX or ITOT (ETF)

- Schwab: SWTSX or SCHB (ETF)

- Expense ratio: 0.03-0.04%

Provides exposure to 3,700+ US companies across all market caps and sectors. This is your growth engine – US stocks historically return 10% annually over long periods.

Total International Stock Market

- Vanguard: VTIAX or VXUS (ETF)

- Fidelity: FTIHX or IXUS (ETF)

- Schwab: SWISX or SCHF (ETF)

- Expense ratio: 0.06-0.08%

Covers 7,900+ companies in 50+ countries outside the US. Provides geographic diversification – when US markets lag, international markets often lead and vice versa.

Total Bond Market

- Vanguard: VBTLX or BND (ETF)

- Fidelity: FXNAX or AGG (ETF)

- Schwab: SWAGX or SCHZ (ETF)

- Expense ratio: 0.03-0.05%

Holds 10,000+ US government and corporate bonds. Provides stability and income – bonds typically decline less than stocks during market crashes, preserving capital.

Total annual costs: $30-50 per $100,000 invested versus $660+ for average active funds. The savings compound to hundreds of thousands over decades.

Age-Based Asset Allocation That Actually Works

The classic rule “110 minus your age in stocks” is outdated. People live longer and need more growth. Modern allocation strategies maintain higher stock exposure throughout life.

Age 20-35 (Aggressive Growth):

- 85% Total US Stock

- 15% Total International Stock

- 0% Bonds

Maximum growth potential. Young investors have 30-40 years to recover from market crashes. Time is your edge – volatility doesn’t matter when you’re not withdrawing for decades.

Age 35-50 (Growth with Modest Stability):

- 60% Total US Stock

- 25% Total International Stock

- 15% Bonds

Balances growth with early risk management. As assets grow and retirement approaches, modest bond allocation reduces portfolio swings while maintaining strong returns.

Age 50-60 (Pre-Retirement Balance):

- 50% Total US Stock

- 20% Total International Stock

- 30% Bonds

Protects accumulated wealth while continuing growth. Bonds cushion against major market crashes in the critical decade before retirement when portfolio is largest.

Age 60-75 (Early Retirement):

- 40% Total US Stock

- 15% Total International Stock

- 45% Bonds

Emphasizes capital preservation with continued growth. Need to fund 20-30 year retirement, so complete defensive positioning is premature. Stocks remain majority during early retirement years.

Age 75+ (Late Retirement):

- 30% Total US Stock

- 10% Total International Stock

- 60% Bonds

Prioritizes stability and income. Shorter time horizon and required minimum distributions justify conservative positioning, though stocks remain important for inflation protection.

The Rebalancing System That Prevents Emotional Mistakes

Rebalancing is critical yet simple: selling assets that grew and buying assets that declined to maintain target allocation. This forces “buy low, sell high” behavior that most investors fail at emotionally.

Annual rebalancing rules:

Once yearly (same date annually, e.g., January 15):

- Check current allocation percentages

- If any fund is 5%+ from target, rebalance

- If all funds within 5% of target, do nothing

Example: Target is 60/25/15 (US/International/Bonds). Current is 68/22/10 after strong US stock year.

- US stocks 8% over target – sell 8% to rebalance

- International 3% under – within threshold, no action

- Bonds 5% under – buy to restore to 15%

During accumulation phase (contributing new money):

- Direct new contributions to underweight funds

- This achieves rebalancing without triggering taxable events

Tax-loss harvesting bonus:

- If fund is down, sell for tax loss and immediately buy similar fund

- Example: Sell VTI, buy ITOT (both total market but different enough for IRS)

- Capture tax deduction while maintaining market exposure

Behavioral benefit: Annual rebalancing provides discipline. You won’t panic sell during crashes because you follow a system, not emotions. In 2022 when stocks dropped 18%, disciplined investors rebalanced into stocks at discounts.

Where to Hold Each Fund for Maximum Tax Efficiency

Tax-advantaged accounts (401k, IRA, Roth IRA):

- Prioritize bonds and international stocks – these generate most taxable income

- REIT funds if added – produce ordinary income taxed at highest rates

- No annual tax reporting required regardless of trading

Taxable brokerage accounts:

- Prioritize US total stock market – generates qualified dividends taxed at 0-20%

- Tax-loss harvesting opportunities available to offset gains

- Hold long-term (12+ months) for favorable capital gains treatment

According to Vanguard research, proper tax-location adds 0.35% annual return – equivalent to $35,000 on $1 million over 30 years through compound growth.

Performance Expectations and Reality Check

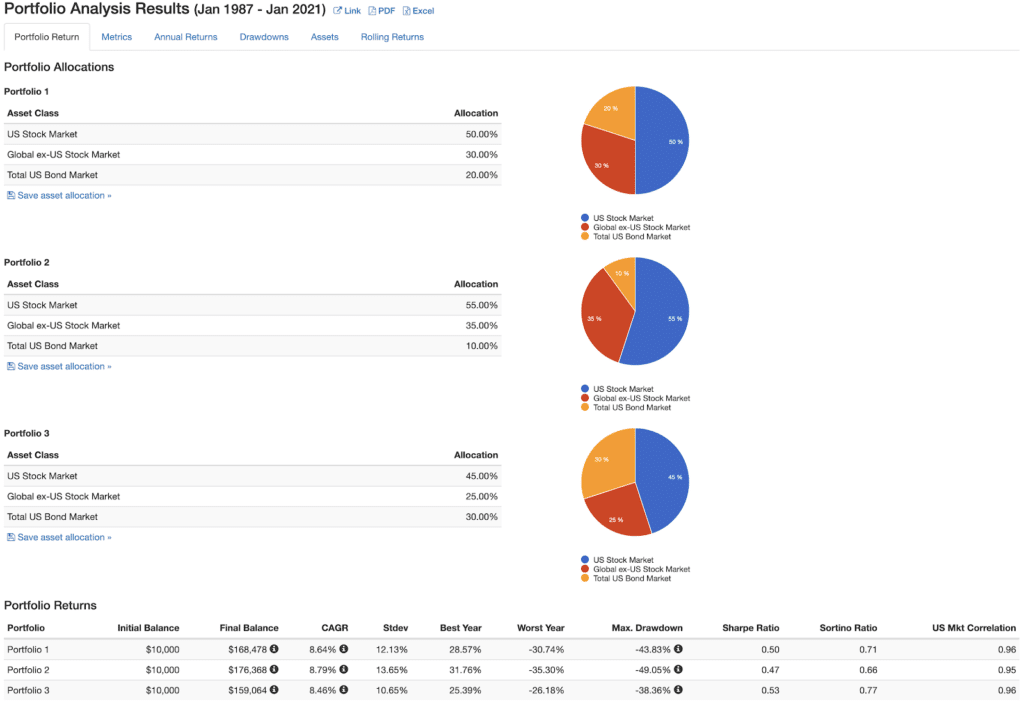

Historical three-fund portfolio returns (60/30/10 allocation):

- Average annual return: 8.1% (1970-2024)

- Best year: +31.4% (1995)

- Worst year: -22.8% (2008)

- Positive years: 78% (39 of 50 years)

$10,000 invested in 1974 grew to $780,000 by 2024 with dividends reinvested. Monthly contributions of $500 starting 1974 would have grown to $3.2 million.

Important reality checks:

This isn’t get-rich-quick. Wealth builds through decades of consistent contributions and compound growth. Anyone promising faster returns is selling something or taking excessive risk.

Volatility is guaranteed. Your portfolio will decline 20-40% multiple times. This is normal and expected. The key is not panicking and selling at bottoms.

Discipline matters more than intelligence. Following the plan during crashes separates successful investors from failures. Behavioral mistakes destroy more wealth than bad investment choices.

Common Mistakes That Sabotage Simple Strategies

Mistake: Abandoning the plan during crashes

2008-2009 saw 50% market decline. Investors who sold in panic locked in losses. Those who stayed invested recovered completely by 2012 and went on to massive gains through 2021.

Mistake: Chasing performance

Bitcoin, meme stocks, and hot sectors tempt investors away from boring index funds. Studies show performance-chasing reduces returns by 1-2% annually. Stay the course.

Mistake: Over-complicating

Adding sector funds, emerging markets, REITs, commodities, and alternatives reduces returns and increases costs. Three funds are sufficient. More funds do not equal better diversification.

Mistake: Timing the market

“I’ll invest after the next crash” mentees miss years of gains waiting. Research from Charles Schwab shows staying invested beats timing attempts 75% of the time.

Mistake: Insufficient contributions

Portfolio allocation doesn’t matter if you’re only investing $50 monthly. Focus first on increasing savings rate to 15-20% of income, then optimize allocation.

Getting Started This Week

- Monday: Open account at Vanguard, Fidelity, or Schwab (takes 15 minutes online)

- Tuesday: Fund account via bank transfer

- Wednesday: Purchase three funds based on your age allocation

- Thursday: Set up automatic monthly contributions (most important step)

- Friday: Calendar annual rebalancing date (e.g., first Monday of January)

That’s it. You now have a portfolio that will likely outperform most professional investors over your lifetime. The hard part isn’t setup – it’s resisting the urge to tinker.

Boring Wins

Finance industry thrives on making investing seem complex, mysterious, and requiring professional management. The truth is simpler and more profitable for investors.

Three index funds, age-appropriate allocation, annual rebalancing, and behavioral discipline build more wealth than exotic strategies, hedge funds, and active stock picking. The evidence is overwhelming and the logic is simple.

Your choice: Pay 1% annually for active management that underperforms 89% of the time, or spend 15 minutes yearly maintaining a portfolio that consistently wins. The difference compounds to hundreds of thousands of dollars.

Wealth building isn’t exciting. It’s boring, systematic, and incredibly effective. Start today.