Americans collectively overpay for insurance by an estimated $847 billion annually – a staggering figure derived from research by the Consumer Federation of America and analysis of insurance industry profit margins. That’s roughly $6,500 per household flushed down the drain on unnecessary coverage, inflated premiums, and deliberately confusing policy terms designed to maximize insurer profits.

The insurance industry operates on information asymmetry. They know everything about risk pricing, actuarial tables, and profit optimization. You know what your agent tells you – and agents earn commissions by selling you more coverage, not less.

This investigative analysis exposes the tactics insurance companies use to extract maximum premiums while minimizing payouts, and provides a battle-tested framework to cut your insurance costs by 30-50% without sacrificing essential protection. These strategies are used by insurance industry insiders and financial advisors – but rarely shared with average consumers.

The Insurance Industry’s Dirty Little Secrets

Secret 1: Loyalty Is Financially Punished

Here’s what insurance companies don’t advertise: their most loyal customers subsidize the discounts given to new customers. This practice, called “price optimization,” uses sophisticated algorithms to identify customers unlikely to shop around and systematically raises their premiums year after year.

According to a Consumer Reports investigation, long-term customers pay an average of 21% more than new customers for identical coverage. For auto insurance, this penalty can exceed $500 annually. For homeowners insurance, the loyalty tax averages $290 per year.

State Farm, Allstate, and Progressive have all faced regulatory action over price optimization practices, yet the industry continues these tactics in states where they remain legal.

The fix is brutally simple: shop your insurance every 12-18 months without exception. Data from the National Association of Insurance Commissioners shows that consumers who switch carriers save an average of $356 annually on auto insurance alone.

Secret 2: Your Credit Score Affects Pricing More Than Your Driving Record

In 47 states, insurance companies use credit-based insurance scores to determine your premiums – often weighing credit more heavily than your actual claims history or driving record.

Research from the Federal Trade Commission found that drivers with poor credit pay 91% more for auto insurance than those with excellent credit, even with identical driving records. This practice disproportionately impacts lower-income Americans and minorities, creating a poverty trap where financial hardship leads to higher insurance costs, making financial recovery harder.

California, Hawaii, and Massachusetts have banned the practice, proving it’s not essential for accurate risk assessment. In these states, insurers still profit while charging fairer rates based on actual risk factors.

The workaround: Improving your credit score by 100 points can reduce insurance premiums by $400-700 annually across all policies. Focus on paying down credit card balances below 30% utilization and disputing any credit report errors through AnnualCreditReport.com.

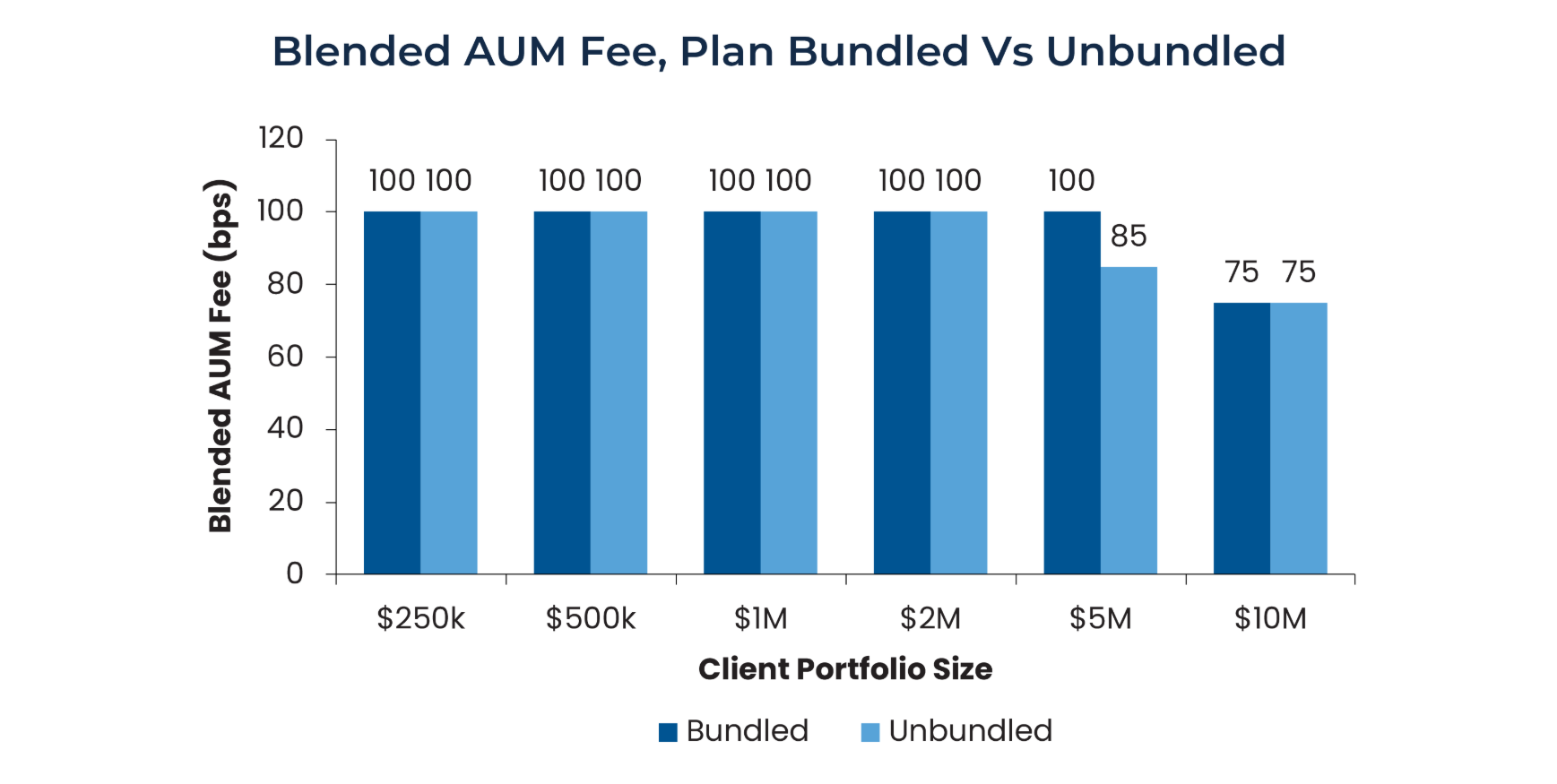

Secret 3: Bundling Isn’t Always the Bargain They Promise

Insurance agents push bundling (combining auto, home, and other policies) as a money-saver. Sometimes it is. Often it’s not.

A 2024 analysis by The Zebra found that 34% of consumers who bundle would save money by separating their policies among different carriers. The multi-policy discount (typically 15-25%) sounds impressive, but means nothing if the underlying premiums are inflated.

Example scenario:

- Bundled with State Farm: Auto $1,800 + Home $1,400 = $3,200 with 20% bundle discount = $2,560 total

- Unbundled best rates: Auto with Geico $1,200 + Home with Amica $1,250 = $2,450 total

The unbundled approach saves $110 annually despite losing the bundle discount.

The strategy: Get quotes both bundled and unbundled from at least 5 carriers. Use independent comparison sites like Policygenius, The Zebra, or Insurify to streamline the process.

Secret 4: Deductibles Are Your Leverage Point

Increasing your deductible from $500 to $1,000 can reduce premiums by 15-30%, according to the Insurance Information Institute. Moving to a $2,500 deductible can cut premiums by 40% or more.

The math is compelling: if raising your deductible saves $300 annually, you recoup the higher deductible in 3.3 years ($1,000 difference / $300 savings = 3.3 years). Since the average driver files a claim only once every 17.9 years (per National Association of Insurance Commissioners data), the higher deductible pays for itself many times over.

This strategy requires maintaining an emergency fund equal to your deductible. If you can’t immediately access $1,000-2,500 without going into debt, keep the lower deductible until you build that safety net.

Pro move: For homeowners insurance, consider a percentage-based deductible (1-2% of home value) instead of a flat dollar amount. On a $300,000 home, a 2% deductible is $6,000 – dramatically higher than most claims below that threshold, resulting in premium savings of 25-35%.

Secret 5: You’re Paying for Coverage You Don’t Need

Insurance policies are loaded with coverage that benefits the insurer more than you:

Rental car coverage on auto insurance ($50-120/year): Unnecessary if your credit card provides this benefit. Most premium credit cards offer primary or secondary rental car coverage at no additional cost.

Towing and roadside assistance ($20-80/year): AAA membership costs $60-120 annually and covers all your vehicles plus better benefits. Alternatively, many credit cards include roadside assistance.

Accidental death and dismemberment (AD&D): Extremely narrow coverage that only pays in specific circumstances. Term life insurance is far superior and more comprehensive.

Life insurance on children: Emotionally appealing but financially illogical. Children aren’t income earners, so there’s no income to replace. The premiums are better allocated to parents’ life insurance or 529 college savings.

Cancer insurance and disease-specific policies: These pay only for specific conditions. A comprehensive health insurance policy with solid critical illness riders provides broader protection at better value.

According to insurance expert analysis from J.D. Power, the average American could eliminate $300-600 in unnecessary coverage without reducing meaningful protection.

The Seven-Step Strategy to Slash Your Insurance Costs by 40%

Step 1: Conduct an Annual Insurance Audit (December Is Optimal)

Block 2-3 hours in early December to comprehensively review all insurance policies. December timing is strategic because:

- You can adjust coverage before January renewals

- Year-end bonuses provide cash flow to increase deductibles

- Insurers offer competitive rates to meet annual sales quotas

Create a spreadsheet documenting:

- Current carrier and policy number

- Coverage limits and deductibles

- Annual premium

- Claims filed in past 5 years

- Discounts currently applied

This baseline enables accurate comparison shopping and identifies coverage gaps or overlaps.

Step 2: Maximize Every Available Discount

Insurance companies offer 20-30 potential discounts, but they don’t automatically apply them – you must ask. According to Insurance.com research, the average policyholder qualifies for 5-7 discounts but receives only 2-3.

Auto insurance discounts to demand:

- Good driver (no accidents/violations for 3-5 years): 15-25%

- Low mileage (under 10,000 miles annually): 10-15%

- Safety features (anti-lock brakes, airbags, anti-theft): 5-20%

- Defensive driving course completion: 5-10%

- Automatic payment enrollment: 5-8%

- Paperless billing: 2-5%

- Multiple vehicles: 10-25%

- Good student (under 25 with 3.0+ GPA): 10-25%

- Military/veteran status: 5-15%

- Professional organization membership (alumni associations, professional groups): 5-10%

Homeowners insurance discounts:

- Security system (monitored): 10-20%

- Fire/smoke detectors: 5-10%

- New home (built within 10 years): 8-15%

- Claims-free history (5+ years): 15-25%

- Roof age and material (impact-resistant): 10-30%

- Sprinkler system: 5-15%

- Gated community: 5-10%

A Consumer Federation study found that proactively requesting all eligible discounts reduces premiums by an average of $423 annually across auto and home policies.

Step 3: Optimize Your Coverage Limits (Not Too Much, Not Too Little)

Auto insurance liability: Minimum state requirements are dangerously insufficient. With average lawsuit settlements ranging from $50,000-$100,000+, minimum coverage ($25,000-$50,000 in many states) exposes you to devastating financial risk.

Recommended coverage levels:

- Bodily injury: $250,000/$500,000 minimum (per person/per accident)

- Property damage: $100,000 minimum

- Uninsured/underinsured motorist: Match your liability limits

The cost difference between minimum coverage and $250,000/$500,000 is typically only $150-300 annually – trivial compared to the financial devastation of being underinsured.

Umbrella liability insurance: Once you have maxed your auto and home liability, add an umbrella policy providing $1-2 million additional coverage. Cost is surprisingly low ($150-300 annually for $1 million) because it only kicks in after underlying policies are exhausted.

Homeowners insurance: Insure your home for replacement cost, not market value. A $400,000 home might cost $500,000+ to rebuild if destroyed. Guaranteed replacement cost endorsements (adding 20-25% to declared value) protect against construction cost inflation and should cost only $50-100 annually extra.

Step 4: Leverage Telematics and Usage-Based Insurance

Progressive’s Snapshot, Allstate’s Drivewise, and State Farm’s Drive Safe & Save use smartphone apps or plug-in devices to monitor driving behavior. Safe drivers can save 30-50% on premiums.

Monitored factors include:

- Hard braking frequency

- Rapid acceleration

- Nighttime driving (midnight-4am)

- Total miles driven

- Phone usage while driving (on some programs)

According to data from Progressive, 54% of Snapshot participants receive discounts averaging 29%, with top performers saving up to 50%.

Privacy concerns are valid – these programs track your location and driving patterns. However, major insurers contractually commit to using data only for pricing, not sharing with third parties or law enforcement.

The verdict: If you’re a safe driver, telematics programs offer substantial savings. Aggressive drivers or those uncomfortable with tracking should skip them.

Step 5: Time Your Policy Changes Strategically

Never cancel a policy before the new one begins. Gaps in coverage can:

- Result in significantly higher premiums (20-30% increase for 30-day gap)

- Create legal liability issues

- Void protection on existing claims

Best practices for switching:

- Secure new policy with start date matching current policy expiration

- Receive written confirmation of new policy before canceling old one

- Cancel old policy in writing, requesting refund of unused premium

- Verify cancellation confirmation within 10 days

Mid-term cancellations: If you find dramatically better rates mid-policy, calculate the cost. Most insurers charge short-rate cancellation penalties (10-25% of unearned premium). If annual savings exceed the penalty, switch immediately rather than waiting for renewal.

Step 6: Appeal Your Property Assessment and Challenge Premium Increases

Homeowners insurance premiums are partially based on your home’s insured value, which insurers often inflate. Request a detailed replacement cost estimate and challenge if it seems excessive.

For property in areas with declining values or after major local events (employer closures, demographic shifts), request reassessment. Reducing insured value from $350,000 to $310,000 can save $200-400 annually while still providing adequate protection.

When premiums increase at renewal, call and ask why. If it’s industry-wide rate increase, you have limited recourse. If it’s risk-based (claims in your area, credit score change), address the underlying issue or shop aggressively.

Document all conversations with insurance company representatives, including names, dates, and reference numbers. State insurance departments investigate complaints about unjustified rate increases – your documentation is essential evidence.

Step 7: Consider Captive vs Independent Agents vs Direct

Three distribution models with different pricing:

Captive agents (State Farm, Allstate): Represent one company. Can provide deep expertise but limited price competition. Best for those valuing relationship continuity over lowest price.

Independent agents: Access multiple carriers (10-30+). Shop your coverage across their portfolio. Generally provide better pricing because they’re motivated to keep your business by finding competitive rates.

Direct writers (Geico, Progressive, Lemonade): No agent commissions means lower overhead. Average savings of 5-15% vs captive agents according to J.D. Power studies. Trade-off is less personalized service.

Optimal strategy: Get quotes from all three channels. Use independent agents to establish your baseline competitive price, then compare against direct writers. Captive agents occasionally beat both when running promotions.

The Insurance Products You Actually Need (And What to Avoid)

Essential Coverage

Health insurance: Non-negotiable. Even healthy individuals face catastrophic risk from accidents or sudden illness. The Affordable Care Act marketplace (Healthcare.gov) provides options for those without employer coverage.

Auto insurance: Required by law in 49 states (New Hampshire exception). Never drive uninsured – lawsuits from accidents can result in wage garnishment, asset seizure, and financial ruin.

Homeowners/renters insurance: Protects your largest asset (homeowners) or belongings (renters). Renters insurance averages just $15-20 monthly but covers $20,000-40,000 in personal property.

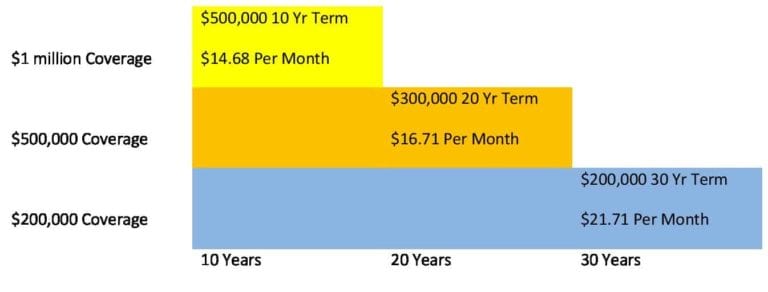

Term life insurance: If anyone depends on your income (spouse, children, elderly parents), you need coverage equal to 10-15x annual income. A healthy 35-year-old can secure $1 million in 20-year term coverage for $40-60 monthly through providers like PolicyGenius or Haven Life.

Disability insurance: You’re far more likely to become disabled than die during working years. 60% of working-age adults would face financial hardship within 6 months of losing income according to Life Happens research. Target coverage of 60-70% of gross income.

Umbrella liability: Once net worth exceeds $500,000 or household income exceeds $150,000, umbrella coverage protects against lawsuits that exceed underlying policy limits.

Usually Unnecessary Coverage

Extended warranties: Consumer Reports analysis found that product failure rates during extended warranty periods average only 5-7%. Warranty costs typically exceed expected claims by 300-400%. Self-insure by setting aside warranty costs in a savings account instead.

Credit card insurance: Pays credit card minimums if you’re unemployed or disabled. Costs 0.5-1.5% of balance monthly (6-18% annually) for limited benefits. Better to maintain emergency fund covering 6 months of expenses.

Mortgage life insurance: Decreasing coverage (as mortgage balance decreases) at level premiums makes this a poor value. Term life insurance provides more flexibility and better pricing.

Flight insurance: Commercial aviation death risk is approximately 1 in 11 million flights. Your comprehensive term life insurance already covers death from any cause – specific flight coverage is redundant and overpriced.

State-by-State Insurance Cost Variations and What They Mean

Geographic location dramatically impacts insurance costs. Auto insurance in Michigan (no-fault state with unlimited medical coverage) averages $2,610 annually, while Maine averages $912 – a 186% difference.

Most expensive states for auto insurance (2024 averages):

- Michigan: $2,610

- Louisiana: $2,546

- Florida: $2,364

- California: $2,190

- Nevada: $2,155

Least expensive states:

- Maine: $912

- Vermont: $991

- New Hampshire: $1,040

- Idaho: $1,098

- Ohio: $1,142

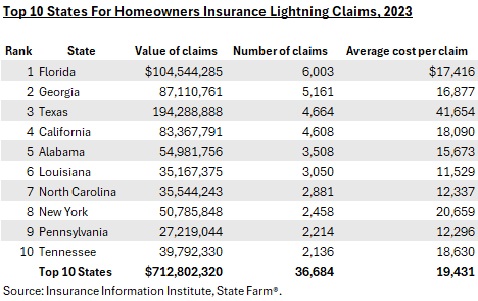

Homeowners insurance shows similar disparity. Oklahoma faces severe tornado and hail risk, averaging $4,228 annually. Oregon’s mild climate results in $946 average premiums.

What this means: If you’re considering relocation, insurance costs should factor into decision-making. Moving from Florida to Ohio could save $2,200 annually on insurance alone – $66,000 over a 30-year period.

Check state-specific rates at the National Association of Insurance Commissioners (NAIC.org) before relocating.

How Insurance Companies Profit From Claim Denials

Insurance operates on a simple formula: collect more in premiums than paid out in claims. The combined ratio (claims + expenses / premiums) for property and casualty insurers averaged 96.8% in 2023, according to AM Best data. That leaves 3.2% profit margin before investment income.

To protect margins, insurers employ sophisticated claim management:

Low-ball initial offers: First settlement offers average 40-60% of fair value, per Insurance Research Council studies. Insurers count on claimants accepting quickly rather than negotiating or hiring attorneys.

Delay tactics: “We need more documentation” and “Your claim is under review” extend resolution timelines. Studies show that 70% of claimants accept reduced settlements after 60+ day delays due to financial pressure.

Policy language complexity: Average insurance policy contains 20,000+ words of legal terminology designed to limit liability. Exclusions and limitations often contradict advertising promises about comprehensive coverage.

How to fight back:

- Document everything with photos, videos, and written descriptions immediately after loss

- Get multiple professional estimates for damages (contractors, appraisers)

- Request written denial explanation citing specific policy language

- File complaints with state insurance departments (insurers hate regulatory scrutiny)

- Consider public adjusters for claims exceeding $10,000 (they work on contingency, typically 10-15%)

- Hire attorneys for claims exceeding $50,000 (many work on contingency for insurance disputes)

The Future of Insurance: How Technology Is Disrupting Pricing

Insurtech companies like Lemonade, Root, and Metromile are leveraging artificial intelligence, behavioral data, and usage-based models to undercut traditional insurers by 20-40%.

Key innovations reshaping insurance:

AI-powered underwriting: Analyzes 1,000+ data points (vs 20-30 for traditional insurers) to more accurately assess risk. This benefits low-risk customers who subsidize high-risk customers in traditional models.

Instant claims processing: Lemonade’s AI bot approves simple claims in 3 seconds vs 10-15 days for traditional insurers. Fast processing improves customer satisfaction and reduces administrative costs.

Peer-to-peer insurance: Groups of customers pool premiums, with unclaimed amounts returned annually. Small groups (50-100 people) create social pressure to minimize fraudulent claims.

Parametric insurance: Pays automatically when triggering events occur (earthquake magnitude, hurricane windspeed, flight delay duration) without adjuster involvement. Eliminates claim disputes and fraud.

The catch: Insurtech companies have limited track records. Lemonade posted a combined ratio of 121% in recent quarters (paying out $1.21 in claims and expenses for every $1.00 in premiums) – financially unsustainable long-term. Only work with insurers rated A- or better by AM Best to ensure they can pay claims.

What to Do Right Now: Your 30-Day Action Plan

Week 1: Gather all current insurance policies and create comparison spreadsheet. Document current coverage, premiums, deductibles, and discounts.

Week 2: Run credit report (AnnualCreditReport.com) and address any errors. Dispute inaccuracies through credit bureaus. Improve credit score if below 700.

Week 3: Get comparison quotes from 5+ insurers using both independent agents and direct comparison sites (Policygenius, The Zebra, Insurify). Include telematics programs if you’re a safe driver.

Week 4: Analyze quotes, optimize coverage levels and deductibles, select best value policies, and switch carriers if savings exceed 15%.

Quarterly: Review bills for automatic premium increases and challenge any unjustified changes.

Annually: Repeat entire process. Insurance is not “set and forget” – market conditions and personal circumstances change constantly.

Take Control or Keep Overpaying

The insurance industry counts on consumer inertia, complexity confusion, and loyalty. They’ve optimized systems to extract maximum premiums from minimum effort customers.

But you’re not powerless. Armed with the strategies in this article, you can reclaim $2,000-4,000 annually that’s currently flowing to insurance company shareholders instead of your savings account, retirement fund, or vacation plans.

The question is simple: will you invest 4-6 hours annually to implement these strategies, or continue overpaying thousands of dollars every year?

Your financial future is built on thousands of small decisions. Insurance optimization might not be exciting, but it’s one of the highest-return activities for the time invested – often yielding 40-50% annual returns through savings.

The insurance companies are betting you won’t take action. Prove them wrong.