The New Crypto Gold Rush: Could the Next “Bitcoin Moment” Happen by 2026?

The crypto market is gearing up for what many analysts call the biggest bull cycle since 2017 and 2021 – potentially even larger.

With Bitcoin hitting new all-time highs in 2025 and institutional adoption accelerating, the question dominating Twitter (X), Reddit, and crypto trading desks is:

Which crypto will be the next to explode – the “Next Bitcoin” with a 10x or even 50x potential by 2026?

According to CoinMarketCap, over 23,000 cryptocurrencies exist today – yet analysts from Messari, CoinGecko, and Ark Invest agree that fewer than 0.5% have a realistic chance of 10x growth.

This article breaks down the 5 most promising cryptos positioned for massive gains by 2026 – based on real utility, adoption trends, financial backing, developer activity, and macro-market catalysts.

Quick Snapshot: Top 5 Cryptos With 10x Potential by 2026

| Rank | Crypto | Sector | Why It Could 10x |

|---|---|---|---|

| #1 | Solana (SOL) | Web3 / DeFi / AI | Fastest ecosystem growth, high institutional adoption |

| #2 | Chainlink (LINK) | Real-World Assets (RWA) + Oracle AI | Infrastructure piece for tokenized global finance |

| #3 | Aptos (APT) | L1 / AI / Gaming | Strong VC backing, scaling for mass consumer apps |

| #4 | Immutable X (IMX) | Gaming & Metaverse | Leading Web3 gaming chain with huge studios on board |

| #5 | Celestia (TIA) | Modular Blockchain | “The Ethereum of modular chains” — explosive dev growth |

Before You Ape In: Crypto Is NOT a Guaranteed 10x Game

Crypto has created millionaires – and wiped out fortunes just as fast.

A realistic rule for 2025–2026:

Expect 1 out of 10 high-risk crypto picks to deliver life-changing returns – the rest will stagnate or die.

But the 5 coins in this list are not meme gambles – they have utility, adoption, and long-term fundamentals.

1 – Solana (SOL): The Most Likely “Next Ethereum”

Category: Layer-1 Smart Contract Network

Market Cap (2025): ~$110B

Growth Potential by 2026: 5x-10x

Analyst Target: $800-$1,100 by end of 2026

Solana’s comeback after the 2022 crash has been one of the most powerful narratives in crypto.

Once dismissed as “dead,” Solana is now the fastest-growing blockchain ecosystem in the world.

Why Analysts Are Bullish

- Fastest Blockchain for Real Users: 65,000+ TPS, near zero fees

- Massive Consumer Adoption: payments, memecoins, Web3 social

- Preferred Chain for AI x Crypto Apps

- Visa, Shopify, Stripe, and PayPal integrations expanding

- Solana Phones driving retail onboarding

According to Visa, Solana is becoming a major payments layer due to speed and cost efficiency.

Key Catalysts for 5x–10x

- Massive inflow of developers from Ethereum ecosystem

- Explosion of AI-enabled crypto apps

- Institutional asset tokenization choosing Solana

- Consumer crypto adoption (phones, Pay apps, gamified wallets)

source: tradingview.com

Risks

- Outages (although improved in 2024–2025)

- Heavy exposure to memecoin volatility

- Competing L1 chains pushing aggressive incentives

“Solana is the most user-ready blockchain today. If crypto goes mainstream, Solana leads the charge.”

— Messari Research, 2025

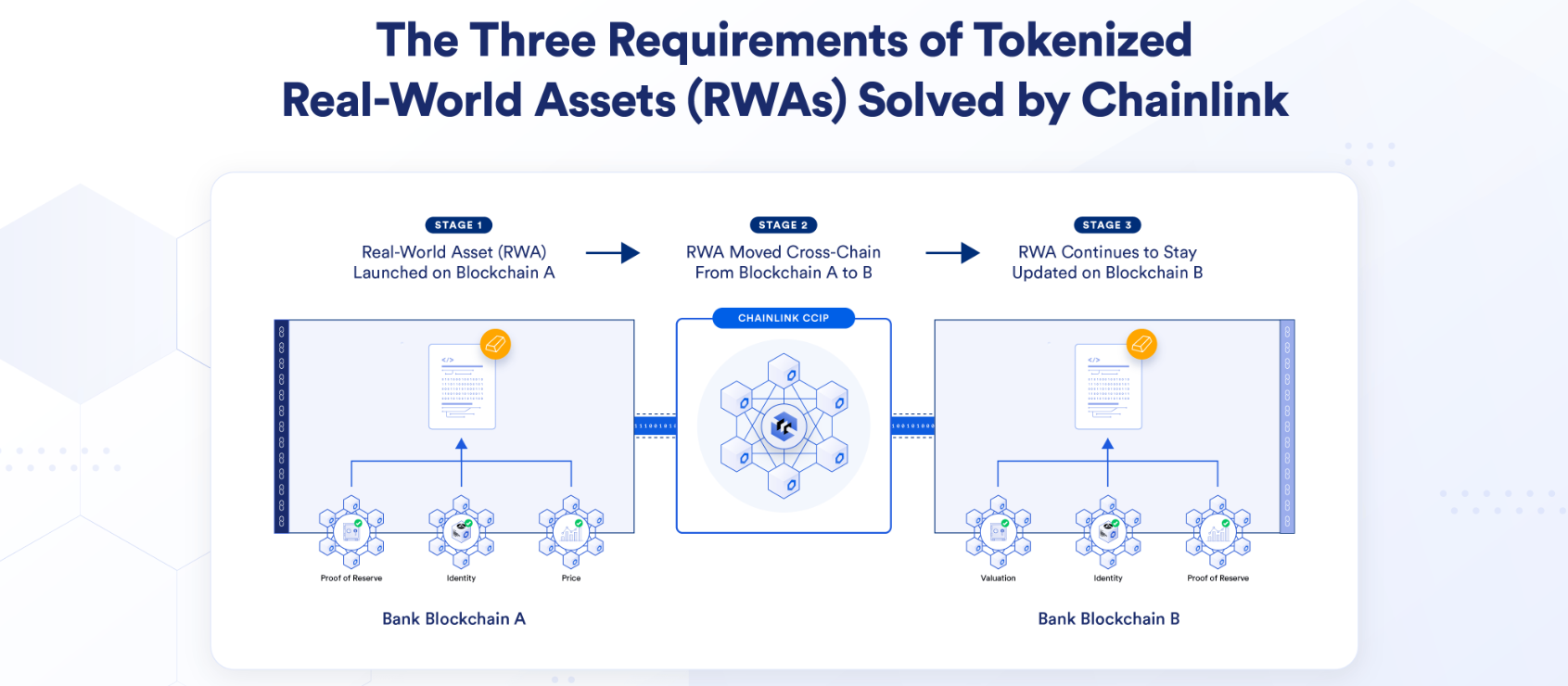

2 – Chainlink (LINK): The Backbone of Tokenized Global Finance

Category: Oracle Network / RWA / AI Data Layer

Market Cap (2025): ~$27B

Growth Potential by 2026: 6x–12x

Analyst Target: $120–$180 by end of 2026

Chainlink is not a “hype coin” – it is infrastructure, quietly integrated into nearly every major blockchain.

Over 85% of all DeFi platforms rely on Chainlink oracles for real-time data.

But the real explosion comes from RWAs (Real-World Assets).

Why LINK Could 10x

- LINK is becoming the data bridge for tokenized real estate, stocks, bonds, and commodities

- BlackRock, SWIFT, Citi, and DTCC are testing or integrating tokenization platforms using Chainlink

- AI x Blockchain data feeds create a new moat

source: Chainlink

Growth Catalysts

- $5 trillion tokenized asset market by 2030 (Boston Consulting Group)

- AI data oracles create enterprise demand

- LINK staking and supply shock

Risks

- Limited public retail hype (LINK grows quieter than memecoins)

- Slow price movement vs hype coins

- Heavy institutional narrative — slower feedback loop

“If crypto becomes global finance, Chainlink becomes the API that connects it all.”

— Bank of America Digital Assets Desk

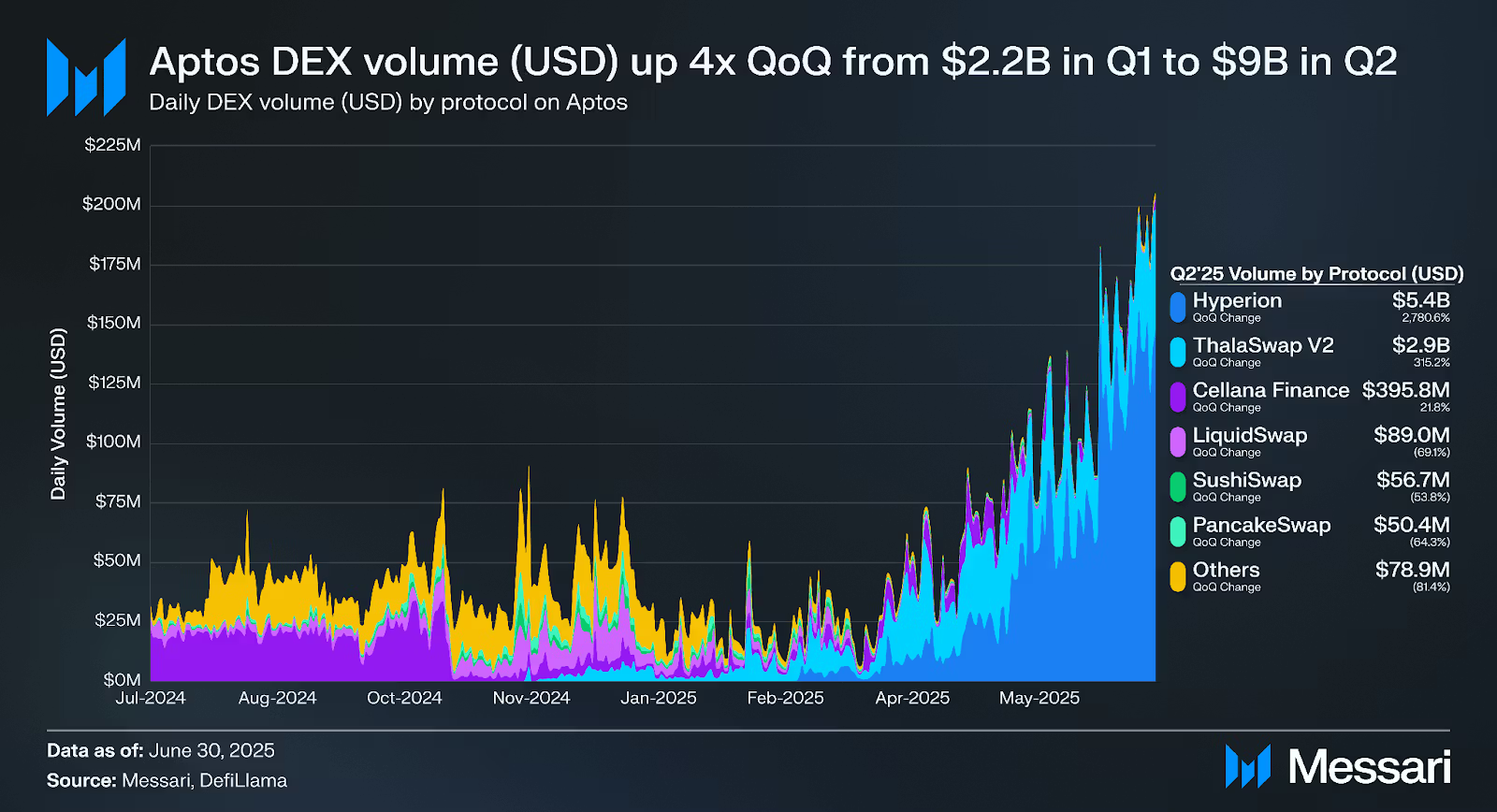

3 – Aptos (APT): The “Web3 + AI + Mobile” Chain With Silicon Valley Backing

Category: Layer-1 Next-Gen Blockchain

Market Cap (2025): ~$6.8B

Growth Potential by 2026: 8x–15x

Analyst Target: $85–$120 by end of 2026

Aptos is one of the most heavily VC-backed L1 blockchains in the world — funded by a16z, Multicoin, Jump Crypto, Binance Labs, and Coinbase Ventures.

Created by former Meta engineers who built the Diem blockchain, Aptos is architected for mass consumer adoption, AI integration, and mobile-first usage.

Why Aptos Is Primed for a Breakout

- Built using the Move programming language (safer & faster than Solidity)

- Strategic partnerships in Asia, gaming, and AI-driven consumer apps

- Aptos x Microsoft partnership for AI + blockchain tools

- TikTok-style Web3 onboarding tools in development

This positions Aptos as the “crypto chain for the next billion users” – especially in emerging markets.

Catalysts That Could Push APT to 10x

- Massive expansion into Asia (Vietnam, Korea, India)

- Web3 mini-apps and Web3 social networks

- AI wallets + Web3 ID + gamified onboarding

- Growth of Move developer ecosystem

source: messari.io

Risks

- VC unlocks can pressure the price

- Needs “killer apps” for mainstream adoption

- Faces competition from Solana, Sui, and TON

“Aptos is playing the long game: Asia, AI, mobile, gaming – and that’s exactly where the next 500M users come from.”

— CoinGecko Research

4 – Immutable X (IMX): The Leading Blockchain for Gaming & Web3 Entertainment

Category: Web3 Gaming & Metaverse Platform

Market Cap (2025): ~$3.9B

Growth Potential by 2026: 10x-20x

Analyst Target: $40-$70 by end of 2026

If one sector is primed for mainstream onboarding into crypto, it’s gaming.

Immutable X is the #1 Web3 gaming chain with the strongest game studio partnerships and the biggest AAA-quality titles preparing for 2025–2026 releases.

Why IMX Can 10x Faster Than Other Altcoins

- 200+ Web3 games building on Immutable

- Partnerships with Ubisoft, GameStop, Polygon, Amazon Web Services

- Zero gas fees for gamers, fast transactions, NFT-native

- Strong creator economy with digital asset ownership

The first AAA Web3 games launching on Immutable in 2025 may spark a “Web3 Gaming Bull Run”, similar to DeFi Summer in 2020.

Growth Catalysts

- One viral game = exponential user onboarding

- Gaming + collectibles + esports integrations

- IMX token utility for gas, staking, and creator economy rewards

Risks

- Web3 gaming may still be early for mass adoption

- Success depends on game quality (not tech alone)

- Competes with Ronin, Avalanche subnets, and Solana Gaming

“Web3 gaming won’t onboard millions with wallets – it will onboard them with fun.”

— Immutable Co-Founder Robbie Ferguson

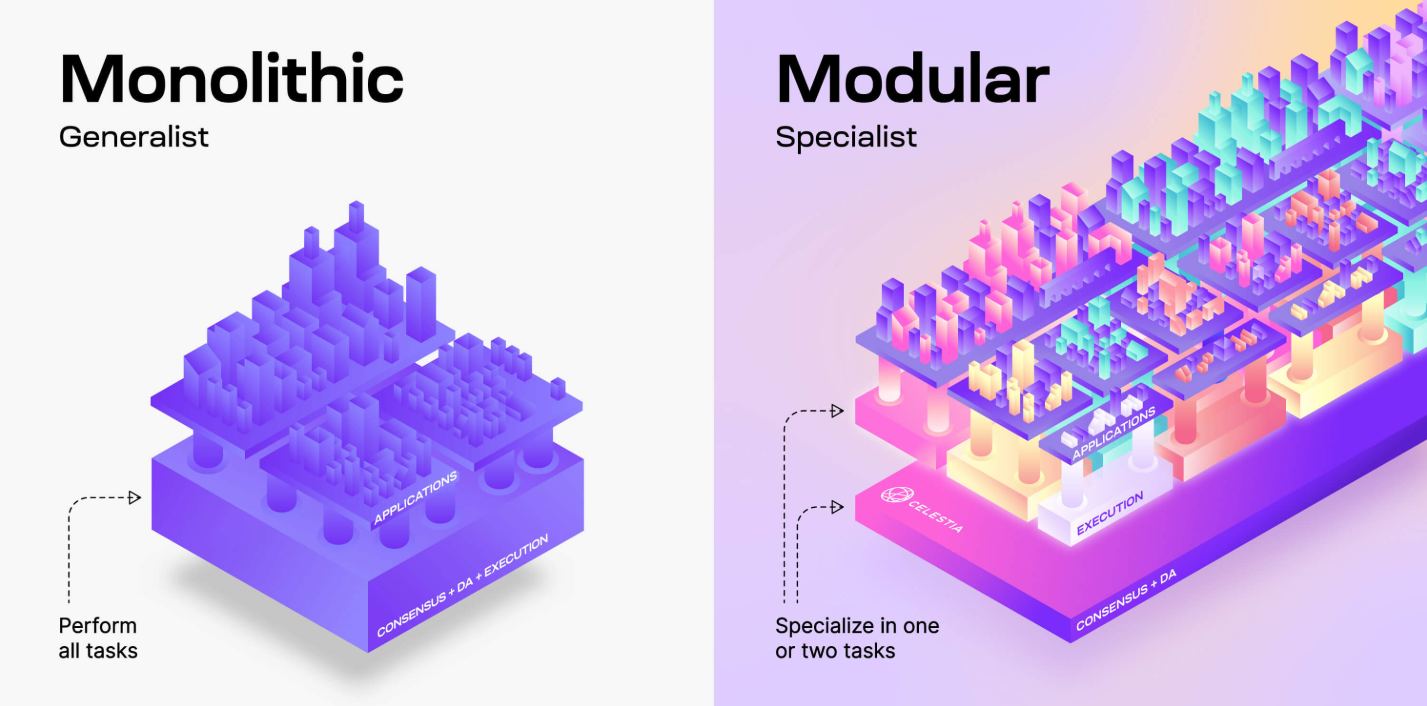

5 – Celestia (TIA): The Modular Blockchain Revolutionizing How Blockchains Are Built

Category: Modular Blockchain / Infrastructure

Market Cap (2025): ~$12B

Growth Potential by 2026: 7x–14x

Analyst Target: $200–$350 by end of 2026

Celestia is one of the most important innovations since Ethereum — and ironically, it is not a competitor to Ethereum, but a scaling amplifier for the entire crypto industry.

Why Celestia Is a 10x Infrastructure Play

Celestia enables modular blockchains, meaning developers can build chains like “app-stores” with plug-and-play components, not from scratch.

Think of Celestia as the AWS of blockchains.

- Makes launching blockchains cheaper, faster, scalable

- Hundreds of modular chains in development

- Preferred by new DeFi, AI, and gaming chains

source: celestia

Catalysts for Growth

- Modular ecosystem explosion (1000+ chains by 2026)

- Developers migrating from monolithic chains

- TIA staking and restaking demand

- AI + modular blockchains synergy

Risks

- Early-stage narrative, could take time

- Complexity barrier for retail understanding

- Competition from Polygon AggLayer and EigenLayer

“If Ethereum was the operating system of crypto, Celestia is becoming the cloud infrastructure.”

— Delphi Digital

Quick Recap Table — The 5 Potential 10x Coins

| Crypto | 2025 MC | 2026 Potential | Strength | Risk Level |

|---|---|---|---|---|

| SOL | $110B | 5x–10x | Fastest adoption & users | Medium |

| LINK | $27B | 6x–12x | RWA + institutional rails | Low-Medium |

| APT | $6.8B | 8x–15x | AI + mobile + Asia expansion | Medium-High |

| IMX | $3.9B | 10x–20x | Web3 gaming leader | High |

| TIA | $12B | 7x–14x | Modular infra revolution | Medium |

How to Build a 10x Crypto Portfolio for 2025–2026

If you simply buy all 5 coins with equal weight, you may still see strong returns — but optimal risk-adjusted allocation matters.

Below are three suggested portfolio strategies depending on risk appetite:

1. Conservative 10x Portfolio (Lower Risk)

Designed for long-term investors prioritizing durability over hype.

| Coin | Allocation | Why |

|---|---|---|

| LINK | 35% | Institutional adoption + RWA backbone |

| SOL | 30% | Retail + institutional growth + scaling narrative |

| TIA | 20% | Infrastructure-level innovation |

| APT | 10% | Early-stage, high upside |

| IMX | 5% | Gaming volatility but strong potential |

Goal: Strong ROI with minimized downside

Expected Drawdown in Bear: -40% to -55%

Potential Bull Return: 4x-7x

2. Balanced 10x Portfolio (Medium Risk)

Best fit for investors looking for a blend of safety + explosive upside.

| Coin | Allocation |

|---|---|

| SOL | 30% |

| LINK | 25% |

| APT | 20% |

| IMX | 15% |

| TIA | 10% |

Sweet spot of risk vs reward

Bear Drawdown: -50% to -65%

Potential Bull Return: 7x-12x

3. High-Growth “Moonshot” Portfolio (High Risk)

For aggressive investors chasing life-changing returns.

| Coin | Allocation |

|---|---|

| IMX | 30% |

| APT | 25% |

| TIA | 20% |

| SOL | 15% |

| LINK | 10% |

Goal: Maximize upside

Bear Drawdown: -65% to -85%

Potential Bull Return: 12x-20x

“One moonshot coin can outperform 20 safe picks. A smart portfolio holds both.”

– Binance Research, 2025

Risk Management Rules (Most Investors Ignore)

If you want to survive crypto winters, print these and tape them above your desk:

- Never go all-in on one coin

- Take profits in layers (25% at 3x, 25% at 5x, 25% at 10x, leave the rest)

- Use cold storage for 70-90% of long-term holds

- If a coin pumps 300% in a month, expect a correction – don’t chase

- Hold for full cycles: 18-36 months, not weeks

Expert Price Forecasts for 2026 (Consensus Range)

| Coin | Low | Base Case | Bull Case |

|---|---|---|---|

| SOL | $450 | $800 | $1,100 |

| LINK | $70 | $140 | $180 |

| APT | $45 | $85 | $120 |

| IMX | $18 | $42 | $70 |

| TIA | $120 | $260 | $350 |

Timeline: When Could the 10x Move Happen?

| Phase | Expected Timeframe | What Triggers It |

|---|---|---|

| Accumulation | Q2-Q4 2025 | Smart money positioning |

| Expansion | Q1-Q3 2026 | Retail FOMO + media flood |

| Euphoria | Q4 2026-Q1 2027 | “Crypto Supercycle” peak |

If you want to find the “Next Bitcoin,” don’t look for a meme coin to turn $100 into $1 million overnight.

Look for the infrastructure, platforms, and data layers that crypto cannot function without.

“Real utility wins every cycle. Hype comes and goes – infrastructure stays.”

– ARK Invest Digital Assets Team

The 5 cryptos in this list – SOL, LINK, APT, IMX, TIA – sit at the intersection of the strongest adoption narratives:

AI, gaming, tokenized finance, modular blockchains, and consumer onboarding.

If the 2026 cycle plays out as expected, these coins won’t just rise – they could reshape the crypto industry altogether.