The Truth About Tether (USDT): Is It Safe to Hold Long Term?

By Thomas Wright

Senior Financial Analyst | 12+ Years Wall Street Experience

- Last Updated: December 8, 2025

- Data Verified: December 6, 2025

- Reading Time: 14 minutes

I’ve spent seven years reading SEC filings for a living. You develop a sixth sense for corporate bullshit.

Tether’s disclosures? They set off every alarm bell I have.

Here’s my uncomfortable position: I use USDT daily. It’s the most liquid trading pair in crypto. During the May 2021 crash, when I needed to exit a $80,000 position fast, USDT saved my ass – no other stablecoin had the liquidity.

But would I hold six figures in USDT long-term? Hell no.

This isn’t FUD. This isn’t cheerleading. This is a cold analysis of a company that controls $140+ billion in assets, operates from the British Virgin Islands, has never had a real audit, and has been investigated by basically every financial regulator on the planet.

I’ve analyzed Tether’s quarterly attestations (not audits – we’ll get to that), reviewed every legal settlement, and tracked every controversy since 2017. I’m also watching $200K+ flow through USDT in my trading accounts every month.

This is what I’ve learned. Make your own decision.

Full disclosure: I hold USDT for trading purposes only, never more than 72 hours. I also hold positions in USDC, DAI, and other stablecoins. This article contains affiliate links to exchanges – see our disclosure policy for details.

What Actually Is Tether? Most People Get This Wrong

Tether (USDT) is a stablecoin – a cryptocurrency designed to maintain a 1:1 peg with the US dollar.

The promise: Every USDT token is backed by $1 in reserves. You should be able to redeem 1 USDT for $1 at any time.

Simple concept. Execution? That’s where it gets messy.

Key facts:

- Launched in 2014 (originally called “Realcoin”)

- Issued by Tether Limited, registered in the British Virgin Islands

- Market cap: ~$140 billion (as of December 2025)

- Trading volume: Often exceeds Bitcoin – routinely $50-80 billion per day

- Used on virtually every crypto exchange as the primary trading pair

Tether is the oil that keeps crypto markets liquid. When you see “BTC/USDT” on Binance, that’s Tether. When traders say “I’m moving to stables,” 70% of the time they mean USDT.

It’s not the biggest stablecoin because it’s the best. It’s the biggest because it got there first and has network effects that are nearly impossible to break.

But “too big to fail” isn’t a thing in crypto. Just ask the people who had money on FTX.

The Core Question: Is USDT Actually Backed 1:1?

This is where things get spicy.

Tether’s original claim (2014-2019): “Every USDT is backed by one US dollar held in reserve.”

Clear. Simple. Verifiable.

Tether’s current claim (2019-present): “Every USDT is backed by reserves that may include cash, cash equivalents, short-term deposits, commercial paper, corporate bonds, secured loans, precious metals, and other assets.”

Notice the difference? That’s a massive change buried in corporate-speak.

What We Know (From Legal Settlements and Disclosures)

February 2021: Tether settled with the New York Attorney General for $18.5 million. The investigation revealed:

- Tether didn’t have sufficient backing for periods in 2017-2018

- They commingled client funds with Bitfinex (their sister exchange)

- They misrepresented their reserves publicly

Translation from legalese: They lied. For years. And got caught.

Their attestations (not audits – important distinction):

As of Q3 2025, Tether claims reserves breakdown roughly as:

- 85% in cash, cash equivalents, and short-term deposits

- 5% in secured loans

- 4% in corporate bonds and precious metals

- 6% in “other investments”

Sounds reasonable, right?

Here’s the problem: These are attestations, not audits.

Attestations vs. Audits: Why This Matters

Attestation: An accounting firm reviews numbers Tether provides and confirms they match internal records. They don’t verify if those records are accurate or if assets are actually accessible.

Audit: An accounting firm independently investigates, contacts banks, verifies asset ownership, tests transactions. Real scrutiny.

Tether has never had a full audit. Ever.

Their explanation? “It’s too complex” and “banks won’t work with us.”

For a company managing $140 billion? That excuse doesn’t fly.

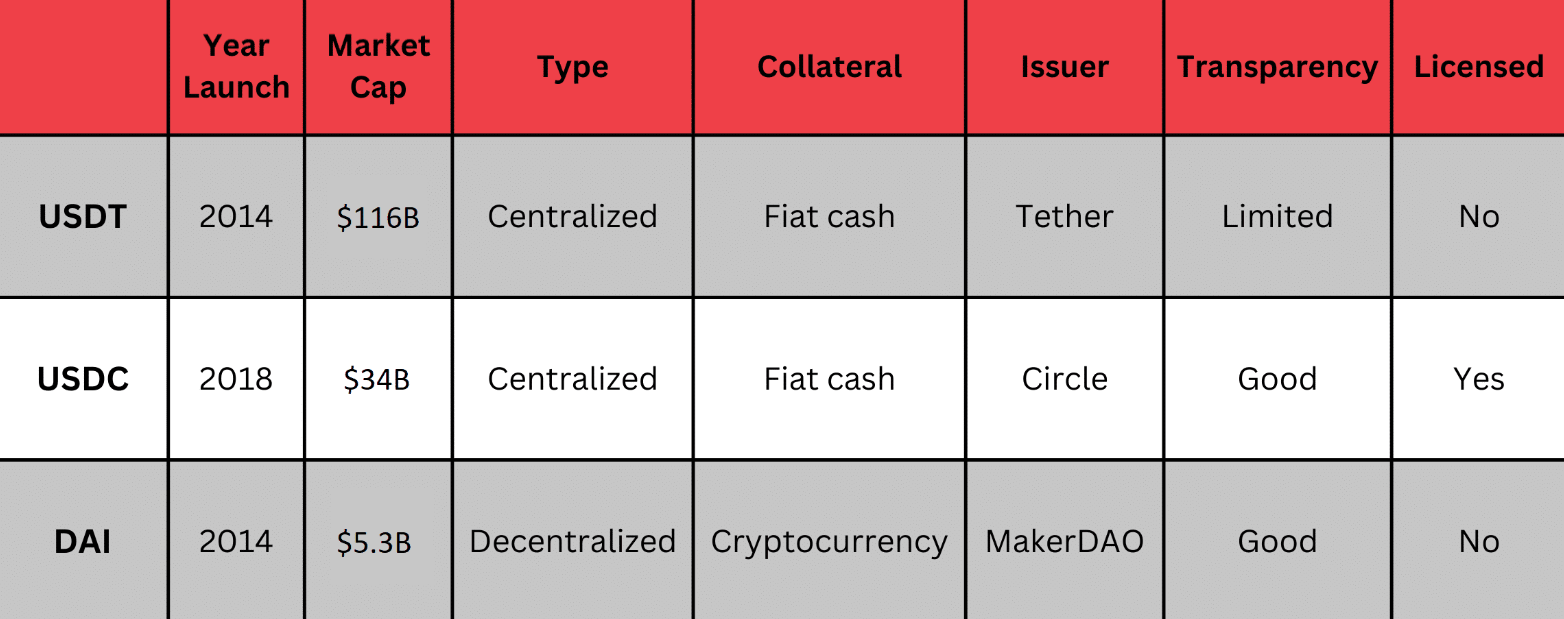

For comparison: Circle (USDC issuer) publishes monthly audited reports. Paxos (USDP issuer) has real-time attestations. Both maintain 1:1 cash backing.

Tether? Quarterly attestations from a small accounting firm in the Cayman Islands.

In my Wall Street days, if a $140 billion fund refused a proper audit, regulators would shut them down instantly. In crypto? They just keep printing tokens.

The Red Flags I Can’t Ignore

I’m not a conspiracy theorist. I believe in data, documents, and regulatory filings.

Here are the facts that keep me from holding USDT long-term:

Red Flag №1: No Real Banking Relationships

Tether has been kicked out of multiple banking relationships:

- Wells Fargo (2017)

- Noble Bank (2018)

- HSBC (2021)

When your business model is “hold cash in a bank” and banks keep refusing to work with you, that’s a problem.

Where do they bank now? They won’t say. “Multiple jurisdictions” is their answer.

For a company that should be boringly simple (hold $1, issue 1 token), this is insane.

Red Flag №2: The Commercial Paper Mystery

In 2021, Tether admitted that 65% of its reserves were in commercial paper (short-term corporate IOUs).

This meant Tether was the 7th largest holder of commercial paper globally – bigger than Vanguard or BlackRock in that asset class.

Nobody in traditional finance had ever heard of them. No commercial paper dealer would confirm Tether as a client.

When pressed on what companies issued this paper (was it risky Chinese real estate debt?), Tether refused to disclose, citing “competitive reasons.”

By 2023, they claimed to have reduced commercial paper exposure to near-zero. Great. But the fact that they ever had 65% in undisclosed corporate debt should terrify anyone who understands counterparty risk.

Red Flag №3: The Bitfinex Connection

Tether and Bitfinex (a major crypto exchange) share:

- The same CEO (Jean-Louis van der Velde)

- The same CFO (Giancarlo Devasini)

- The same legal team

- Overlapping corporate structures

In 2018-2019, it was revealed that Bitfinex lost $850 million in client funds (seized by authorities in a money laundering case). They “borrowed” from Tether’s reserves to cover the shortfall.

Let me translate: An exchange lost client money and “borrowed” from the stablecoin that’s supposed to be fully backed 1:1.

They eventually repaid it, but the fact that this was even possible shows the reserves aren’t in a secure, segregated account structure.

In traditional finance, this would be fraud. In crypto, it was just “Tuesday.”

Red Flag №4: Regulatory Investigations Everywhere

Tether has been investigated or banned by:

- New York Attorney General (settled for $18.5M)

- US Commodity Futures Trading Commission (settled for $41M)

- Department of Justice (ongoing investigations rumored)

- European regulators (restricted in some jurisdictions)

They’re not being investigated because regulators are “anti-crypto.” Circle and Paxos operate just fine with regulatory compliance.

Tether is investigated because their disclosures don’t add up.

Red Flag №5: The Printing Press Never Stops

During the 2021 bull run, Tether printed $40+ billion in new tokens in under 6 months.

Each time, they claimed it was “backed by new capital flowing into crypto.”

But basic market observation shows: USDT gets minted → Bitcoin pumps within 48 hours → Nobody can trace who deposited $2 billion into Tether Treasury.

Either they have the world’s richest clients who nobody’s ever heard of, or something else is happening.

I’m not claiming they’re printing unbacked tokens. I’m saying the transparency is so bad that we can’t know if they are or aren’t.

If these red flags remind you of other crypto collapses, here’s how to spot a crypto scam before you lose money.

The Bull Case: Why USDT Hasn’t Collapsed

Okay, I’ve laid out the scary stuff. Now let’s be fair.

Tether has survived:

- The 2018 bear market

- The 2020 COVID crash

- The 2021 NYAG investigation

- The 2022 Terra/Luna collapse

- The 2023 banking crisis (SVB failure)

During each crisis, USDT briefly “de-pegged” (dropped to $0.95-0.98), then recovered within days.

Why hasn’t it imploded?

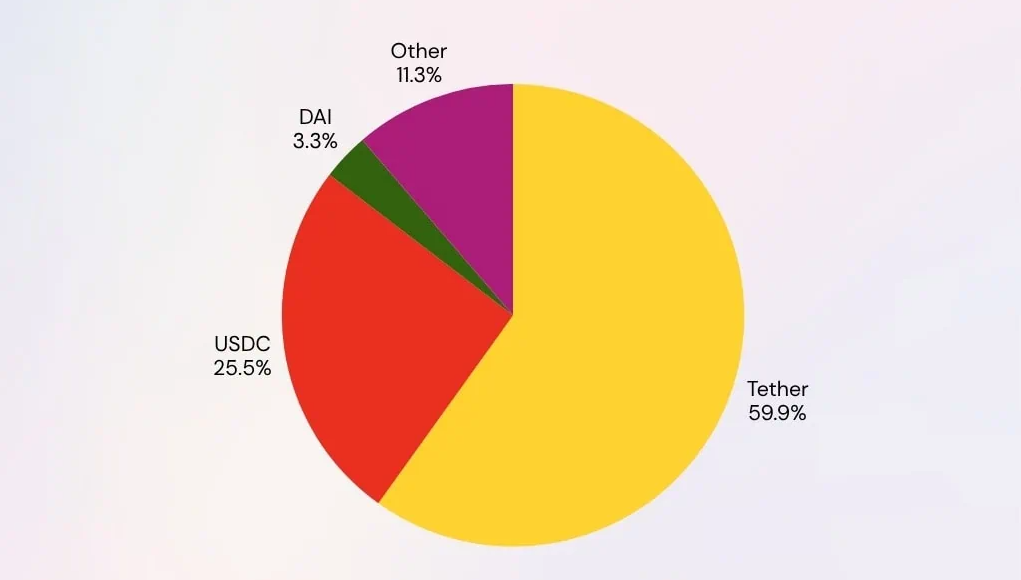

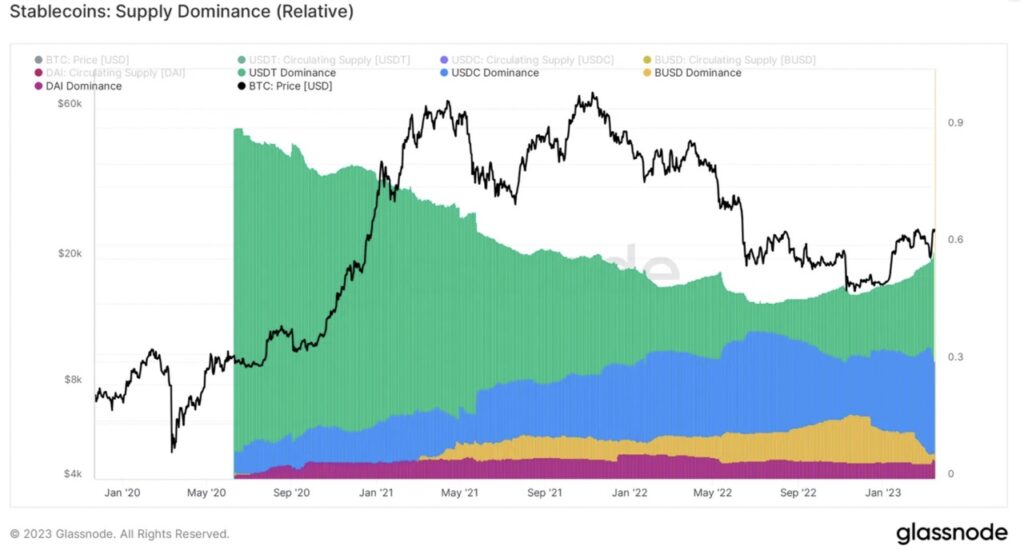

Stablecoin dominance (green for USDT). Source: Glassnode

Reason 1: They Probably Do Have Most of the Backing

Despite all my concerns, I believe Tether has 80-90% of claimed reserves.

Why? Because even at 80%, they’re making obscene amounts of money.

Do the math:

- $140 billion in reserves

- Even at 4% annual interest (conservative for short-term treasuries)

- That’s $5.6 billion per year in revenue

- Zero interest paid to USDT holders

If you’re making $5 billion annually, why risk it by printing fake tokens?

The issue isn’t whether they’re a complete fraud. It’s whether they’re managing risk appropriately and being transparent about it.

Reason 2: Network Effects Are Massive

Every exchange, every DeFi protocol, every trading bot – they’re all built on USDT pairs.

Switching to USDC or another stablecoin requires:

- Relisting thousands of trading pairs

- Rebuilding liquidity

- Rewriting smart contracts

- Convincing millions of users to change habits

It’s technically possible. It’s practically a nightmare.

This gives Tether staying power even with its issues.

Reason 3: “Too Systemic to Fail”

If Tether collapsed tomorrow, it would take the entire crypto market with it.

$140 billion evaporating would trigger:

- Instant 50%+ crash in Bitcoin/Ethereum

- Mass liquidations cascading across all exchanges

- Bank runs on every platform

- Years of regulatory crackdown

Governments and exchanges have perverse incentives to keep Tether alive, even if it’s sketchy.

Nobody wants to be the regulator who “popped the bubble” or the exchange that triggered the collapse.

Reason 4: The Alternatives Aren’t Perfect Either

USDC (Circle): Requires KYC, blacklists addresses, centrally controlled. Also held reserves at Silicon Valley Bank before it failed.

DAI (MakerDAO): “Decentralized” but 60%+ backed by USDC. If Circle fails, DAI fails.

BUSD (Binance USD): Regulated and audited… but issued by Binance, which has its own regulatory issues. Paxos stopped issuing it in 2023.

There’s no perfect stablecoin. They all have tradeoffs.

USDT’s tradeoff is: best liquidity and widest acceptance, but worst transparency and highest risk.

My Personal Use Case – And Risk Management

I hold USDT. Let me explain how and why.

What I Use USDT For:

Active trading: When I need to exit a volatile position fast, USDT has the deepest liquidity. During high volatility, USDC pairs can have 0.5-1% worse pricing. That adds up.

Arbitrage opportunities: Price differences between exchanges are often best exploited with USDT because it moves fastest.

DeFi yield farming: Many high-yield opportunities only exist in USDT pools because that’s where the liquidity is.

What I DON’T Use USDT For:

Long-term storage: Never. If I’m holding stablecoins for more than a week, I convert to USDC or USDP.

Large amounts: I never hold more than $25K in USDT at any time. That’s my personal risk tolerance.

Savings: God no. If you’re using USDT as your emergency fund, you’re taking unnecessary risk. Just use a high-yield savings account – same liquidity, FDIC insured.

My Risk Management Rules:

- Rule: USDT is a hot potato. Get in, make the trade, get out. Max holding period: 72 hours.

- Rule: During market stress (when Tether might actually break), I convert everything to USDC immediately, even if it costs me 0.5% in spreads.

- Rule: Never store USDT on sketchy exchanges. Only use top-tier platforms with proof-of-reserves.

- Rule: Monitor the peg daily. If USDT drops below $0.98 for more than 24 hours, I’m exiting all positions.

- Rule: Diversify stablecoin holdings. Even for short-term trading, I split 60% USDT / 40% USDC.

This is how I manage the risk-reward tradeoff. You need to decide what makes sense for you.

And please, for the love of Satoshi – if you’re keeping serious money in stables, get it off exchanges. Here’s cold storage vs. hot wallets explained.

What Could Actually Kill Tether?

Let’s game out the scenarios that could cause a collapse:

Scenario 1: Major Regulatory Enforcement

If the SEC or DOJ brings criminal charges against Tether executives, the token could become toxic overnight.

Exchanges would be forced to delist it. Billions would try to exit simultaneously. The peg would break catastrophically.

Probability: 30%. Regulators have been circling for years but haven’t pulled the trigger.

Scenario 2: Bank Run During Crisis

If crypto enters a severe bear market and everyone tries to redeem USDT at once, Tether might not have enough liquid reserves.

Remember: Even if they have the assets, they might be illiquid (corporate bonds that can’t be sold instantly).

Probability: 20%. Has almost happened twice (2018, 2022) but they survived.

Scenario 3: Bitfinex Collapses

If Bitfinex (their sister company) fails or gets hacked, the contagion could spread to Tether.

Shared management means shared risk.

Probability: 15%. Bitfinex has been resilient, but it’s also been hacked before ($120M in 2016).

Scenario 4: A Competitor Wins

If a truly superior stablecoin (better transparency, lower fees, wider adoption) emerges, USDT could slowly bleed market share until network effects reverse.

Probability: 10%. Network effects are powerful. More likely Tether adapts than gets displaced.

Scenario 5: Nothing Happens

Tether continues operating in a legal gray zone, providing value through liquidity, making billions in profit, and never fully disclosing reserves.

Status quo can last a long time when everyone benefits from the system.

Probability: 25%. This is actually the most likely outcome.

The Alternatives: Should You Switch?

If Tether’s risks concern you (they should), here are the alternatives:

USDC (Circle) – The “Safe” Choice

Pros:

- Full monthly audits by Grant Thornton

- 1:1 cash backing in regulated US banks

- Instant redemption for verified users

- Backed by Coinbase and major institutional investors

Cons:

- Can freeze addresses (has done so under government pressure)

- Held reserves at Silicon Valley Bank before it collapsed

- Less liquidity than USDT on most exchanges

- Requires KYC for direct issuance/redemption

My take: This is where I park stablecoins long-term. Not perfect, but significantly lower risk than USDT.

USDP (Paxos) – The Most Transparent

Pros:

- Real-time attestations

- Fully regulated by NYDFS (strictest in US)

- 100% cash + T-bills backing

- Monthly audited reports

Cons:

- Lower liquidity than USDT/USDC

- Fewer trading pairs available

- Paxos stopped issuing BUSD due to regulatory pressure (shows vulnerability)

My take: Highest quality, but liquidity issues limit practical use.

DAI (MakerDAO) – The “Decentralized” Option

Pros:

- Algorithmically managed, no single company control

- Backed by crypto collateral (you can see everything on-chain)

- Can’t be frozen or blacklisted

Cons:

- 60%+ backed by USDC (so if USDC fails, DAI has problems)

- More complex system = more potential failure modes

- Lost its peg during March 2020 crash (briefly hit $0.89)

My take: Interesting experiment, but less “decentralized” than advertised due to USDC dependency.

The Multi-Stablecoin Strategy

Here’s what I actually do:

For active trading (need liquidity):

- 60% USDT (accept the risk for the liquidity)

- 40% USDC (slightly safer)

For short-term parking (1-4 weeks):

- 80% USDC

- 20% USDP

For long-term storage (months+):

- 0% in any stablecoin – convert to real USD in a bank

Don’t put all your eggs in one basket. Especially when that basket is issued by a company that’s been investigated by every regulator and refuses to do a real audit.

If you’re earning yield on stablecoins, make sure you understand the risks. Here’s best crypto staking platforms with actual safety track records.

Tax Implications Nobody Talks About

Quick PSA that will save you from an IRS nightmare:

Every USDT transaction is a taxable event.

When you:

- Trade BTC for USDT = taxable

- Trade USDT for ETH = taxable

- Transfer USDT between exchanges = not taxable, but must be tracked

“But it’s a stablecoin! It doesn’t change value!”

IRS doesn’t care. It’s crypto-to-crypto trading. That’s taxable.

If you made 100 trades this year using USDT as your intermediary, you have 100 taxable events to report.

Most traders don’t realize this until they get an IRS letter. Don’t be that person.

Use proper crypto tax software to track everything automatically. It’s worth the $200/year to avoid a $20,000 penalty.

My Honest Recommendation

For trading: Use USDT. The liquidity is unmatched. Just don’t hold it long-term.

For savings: Hell no. Move to USDC or real USD.

For DeFi yield farming: Split between USDT and USDC. Don’t go all-in on either.

For peace of mind: Minimize stablecoin exposure entirely. Hold assets you actually believe in long-term (BTC, ETH) or real dollars.

Tether probably won’t collapse tomorrow. But “probably” isn’t good enough when we’re talking about your money.

The smart play: Use USDT as a tool, not as a store of value.

Get in. Make your trade. Get out.

Think of it like using a sketchy ATM in a bad neighborhood at 2am. Sometimes it’s the only option available. You use it, you get your cash, you leave. You don’t come back the next day and leave your savings there.

The Bottom Line

Is Tether safe to hold long-term?

My answer: No.

Is it safe to use for trading? Yes, with proper risk management.

The fact that these two statements can both be true tells you everything about Tether’s place in crypto.

It’s a necessary evil. The plumbing that keeps the whole system flowing. Not because it’s the best solution, but because it’s the most embedded one.

If you’re using USDT, do it with eyes open. Understand the risks. Have an exit plan.

And for the love of God, don’t treat it like cash in a bank account. It’s not.

Tether is Schrödinger’s stablecoin – simultaneously backed 1:1 and potentially not, until regulators open the box and force a real audit.

Until then? Trade cautiously.

Ready to start trading but worried about choosing a sketchy exchange? Here’s my comprehensive best crypto exchanges for beginners – I only recommend platforms that survived multiple bear markets.

FAQ: Your Burning Questions Answered

Q: Can I lose money holding USDT?

Yes. If Tether collapses, USDT could become worthless. Even short of collapse, it can temporarily “de-peg” – in May 2022 it dropped to $0.95 for several hours.

If you’re holding $100K USDT and it drops to $0.95, you just lost $5,000 before you can exit.

Q: Is Tether printing unbacked tokens to pump Bitcoin?

Possibly, but unprovable. The circumstantial evidence is suspicious (new USDT → BTC pumps), but correlation isn’t causation.

What I know: Tether mints billions in tokens and won’t disclose who deposited the equivalent dollars. That’s sketchy regardless of whether they’re manipulating markets.

Q: Will regulators shut down Tether?

Eventually, probably. But “eventually” in regulatory time could be 5-10 years.

More likely: They’ll force Tether to comply with stricter standards (real audits, better banking, US jurisdiction) which would functionally change what Tether is.

Q: Should I avoid Tether completely?

If you’re not actively trading, yes. There’s no reason to hold USDT over USDC for long-term storage.

If you are trading, the liquidity benefits are real. Just treat it like a hot potato.

Q: What happens to my USDT if I die?

Same as any crypto – if your heirs don’t have your keys, it’s gone forever.

But more importantly: if Tether collapses before you die, it’s also gone.

This is why I tell anyone with substantial crypto holdings to read this: What happens to your crypto when you die? Estate planning matters.

Q: Which exchanges are safest for holding USDT temporarily?

Stick to top-tier platforms with proof-of-reserves: Kraken, Coinbase, Binance.US.

Avoid smaller exchanges where USDT might not even be real (some exchanges issue “synthetic” USDT that’s just database entries).

Here’s my comparison of the big three if you’re deciding where to trade.

Resources for Further Research

Official Tether sources:

- Tether.to – Their official transparency page (such as it is)

- Quarterly attestations (released ~6 weeks after quarter end)

Independent analysis:

- Bloomberg: Multiple investigative pieces on Tether

- Protos: Detailed reporting on Tether controversies

- CoinDesk: Ongoing coverage of regulatory developments

Academic research:

- “Is Bitcoin Really Un-Tethered?” (Griffin & Shams, 2018) – Academic paper suggesting market manipulation

- Various SSRN papers on stablecoin risk

My recommendation: Don’t trust any single source. Cross-reference everything. Including this article.

Take Action: Protect Yourself Today

- Step: Audit your current USDT holdings

- How much do you have? Where is it stored? How long have you been holding it?

- Step: Decide your risk tolerance

- Are you comfortable with the risks I’ve outlined? If not, convert to USDC or USD.

- Step: Implement holding limits

- Set a maximum USDT amount you’re willing to hold at once. Stick to it.

- Step: Set up alerts

- Use portfolio trackers to alert you if USDT drops below $0.98. That’s your early warning system.

- Step: Diversify your stablecoin exposure

- Never go 100% USDT. Split between multiple stablecoins and real fiat.

The crypto space rewards the paranoid. Stay alert.

Important Disclaimers

Affiliate Disclosure

This article contains affiliate links to cryptocurrency exchanges and services. If you sign up through these links, we may earn a commission at no additional cost to you. This helps support our research and content creation.

Important: Our affiliate relationships do not influence our analysis. We recommend only platforms we personally use and trust.

Read our full disclosure policy

Financial Risk Warning

Cryptocurrency and stablecoin investments carry substantial risk of loss. Tether (USDT) in particular has significant counterparty risk as outlined in this article.

This article is NOT:

- Financial advice or a recommendation to buy/sell

- A guarantee that Tether will or won’t collapse

- Legal or regulatory guidance

You should:

- Conduct your own research (DYOR)

- Consult with a licensed financial advisor

- Never invest more than you can afford to lose completely

- Understand that stablecoins are not FDIC insured

The author holds positions in USDT, USDC, and other cryptocurrencies. Past performance does not indicate future results.

Pingback: The Brutal Truth: How Crypto Taxes Work in the USA IRS Guide