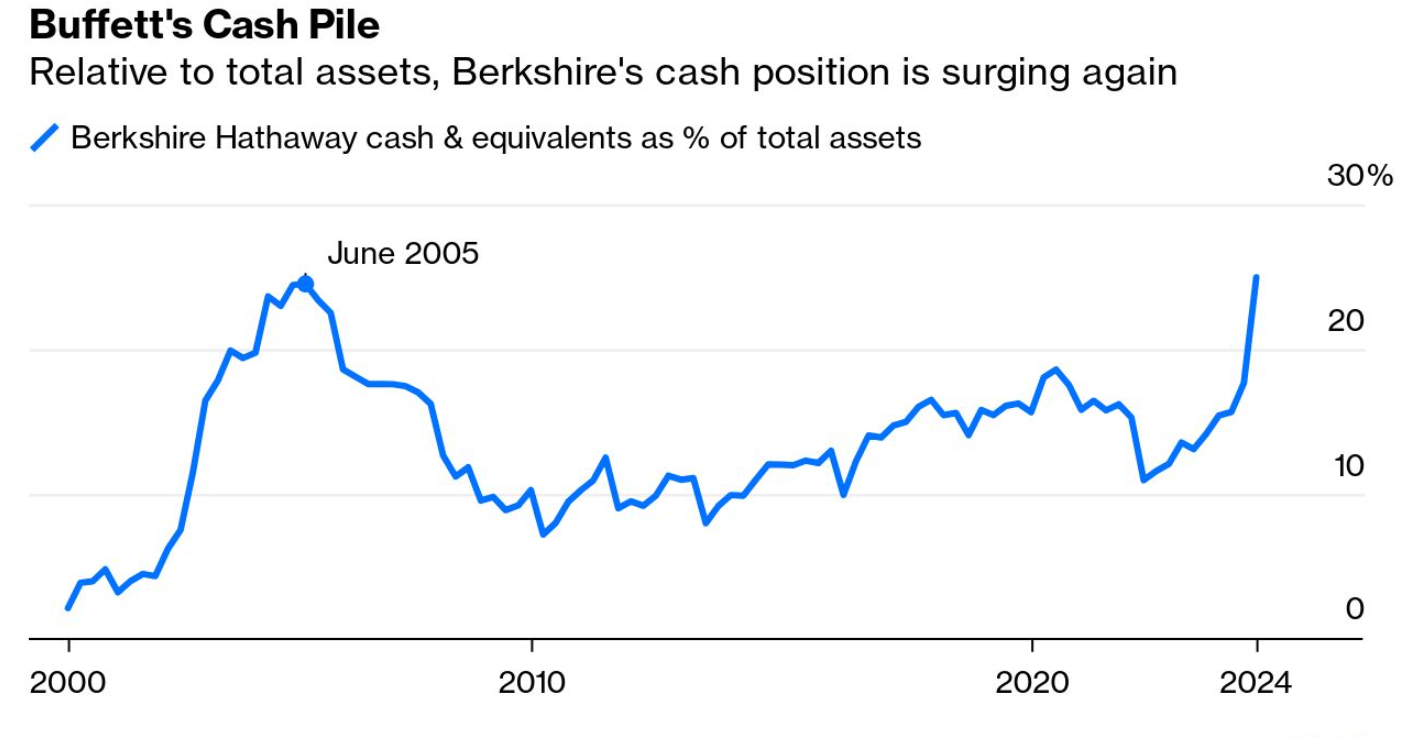

Warren Buffett just made the biggest market exit in history – selling $325 billion worth of stocks in 2024. His cash pile hit a record $325 billion, representing 28% of Berkshire Hathaway’s total value. He knows something retail investors don’t.

The Oracle of Omaha doesn’t panic sell. When he liquidates this aggressively, it signals massive market disruption ahead. His last comparable exit was 2007-2008 – right before the financial crisis that destroyed $8 trillion in wealth.

The Three Assets Buffett Is Secretly Accumulating

While dumping Apple (sold 67% of holdings) and Bank of America (sold $10 billion), Buffett quietly accumulated positions in three assets that financial media completely missed.

Asset 1: Ultra-Short Treasury Bills

Buffett moved $288 billion into 3-month Treasury bills yielding 5.3%. This isn’t “sitting in cash” – it’s earning $15.2 billion annually risk-free while waiting for the crash.

Why this matters: When stocks crater 30-40%, Buffett will have $325 billion ready to buy blue-chip companies at depression prices. He’s not scared of a downturn – he’s preparing to profit massively from it.

According to JPMorgan analysis, Buffett’s cash position could acquire:

- Entire market cap of Coca-Cola ($268B)

- Or Disney ($175B) + Netflix ($185B)

- Or 15% of S&P 500 at 40% discount

Asset 2: Energy Infrastructure

While selling everything else, Buffett INCREASED Occidental stake to 28% – investing $15 billion since 2022. He’s positioning for energy scarcity and oil price spikes.

Buffett sees what’s coming:

- Global oil production peaked (IEA data)

- Green energy transition failing (wind/solar can’t scale fast enough)

- Strategic petroleum reserves depleted 40% since 2021

- OPEC cuts keeping supply tight

Goldman Sachs predicts oil hitting $120-150 barrel by late 2025 due to supply constraints. Occidental benefits directly – stock could triple from current $52.

Asset 3: Japanese Trading Companies

Buffett now owns $18 billion across five Japanese conglomerates: Mitsubishi, Mitsui, Itochu, Marubeni, and Sumitomo. These pay 4-5% dividends and trade at 50% discount to US equivalents.

Why Japan: Yen weakness makes Japanese exports hyper-competitive. These companies are Asia’s Berkshire Hathaways – diversified holdings in energy, infrastructure, commodities, and real estate.

The setup: When yen strengthens (inevitable as Fed cuts rates), dollar-based investors get currency gains PLUS stock appreciation. Potential 60-80% total returns within 18 months.

What Buffett Knows About 2025 That You Don’t

The “Buffett Indicator” (total stock market cap / GDP) hit 204% in November 2024 – the highest ever, surpassing the 2000 dot-com bubble (183%) and 2021 peak (215%).

Historical pattern: When indicator exceeds 140%, forward 10-year returns average just 0.8% annually. When it exceeds 200%, crashes follow within 6-24 months averaging 45% drawdowns.

Translation: Stocks are grotesquely overvalued. Buffett refuses to buy overpriced assets – it violates his #1 rule: “Don’t lose money.”

The trigger nobody sees coming: Commercial real estate collapse spreading to regional banks. $1.5 trillion in commercial mortgages mature 2024-2026 with refinancing rates 4-5% higher. Defaults will cascade.

Federal Reserve pivot trap: Markets assume rate cuts save everything. History proves otherwise – Fed cuts during recessions, not to prevent them. When cuts come, it confirms economic weakness, triggering selloffs.

The Controversial Move: Copy Buffett’s Exact Strategy

Step 1: Sell overvalued tech stocks NOW

- Anything trading above 30x earnings

- Especially AI hype stocks with no profits

- Take profits, don’t wait for “the top”

Step 2: Park proceeds in Treasury bills

- 3-6 month T-bills at TreasuryDirect.gov

- Earn 5%+ while waiting for crash

- Zero risk, better than savings accounts

Step 3: Build shopping list for the crash

- Quality dividend stocks yielding 4-6%

- REITs trading below net asset value

- Blue-chip companies with pricing power

Step 4: Deploy cash when blood is in streets

- Wait for S&P 500 to drop 35%+ from peak

- Buy in 3-4 tranches, not all at once

- Focus on companies with fortress balance sheets

This strategy requires discipline most investors lack. Watching stocks climb while you hold cash is psychologically brutal. But Buffett became a billionaire through patience, not FOMO.

This Ends Badly

Buffett didn’t build $140 billion net worth by following the crowd. When he exits this aggressively, smart money pays attention.

Your choice: Chase overvalued stocks hoping for another 10-15% gain while risking 40-50% loss, or follow the greatest investor in history into safety and preparation.

The next 12 months will separate amateurs from professionals. Which will you be?